Silver

Companies - Year in Review Silver

Companies - Year in Review

Sean Rakhimov

Editor: Silver Strategies

January 11, 2006

We own shares in most companies

mentioned herein; if that is a problem for you, please read no

further.

In our last article we looked

at the performance of silver. Today we are going to look at how

silver stocks faired in 2005. It has been a busy year for silver

stocks and there is a lot to cover. This has been perhaps a break-through

year for silver stocks. A number of silver juniors made their

mark by acquiring properties of merit, making discoveries, expanding

resources, spinning off assets, etc. We will look at some of

them as space permits.

But first we'd like to get

this notion off our chest. In the last several months we have

been itching to write an essay titled "I am changing my

tune" and it has nothing to do with music. The fact of the

matter is that over the past year or so a whole batch of silver

companies secured a rather substantial amount of silver resources

in the ground. If we tallied them all up we'd probably get a

number north of a billion ounces and those are ounces the companies

can talk about. Our research suggests that we can probably see

another billion ounces of silver the companies cannot talk about

yet.

We would like to credit Peter

Megaw, who is a top notch geologist with tons of experience in

silver exploration in Mexico and is the technical force on the

ground behind such companies as Mag Silver and Excellon Resources.

Over the years Peter was generous in sharing his knowledge and

emphasized the importance of ore grade for the economics of the

project which in itself is not a novel concept, but the significance

of it is often overlooked by investors. It was Peter who drove

the point home for us in that grade is more important than

price of silver.

So don't rush to sell your

silver investments chances are a good part of those billions

of ounces will never see the light of day. We are not saying

that to take away from some of the spectacular stories in the

silver sector, but it is something to bear in mind.

The following table comes straight

from our Stock

Performance Report. It pretty much tells the story of who

the winners and losers were. But we would like to look under

the hood and highlight what made some of those results possible.

We also want to remind investors that yesterday's losers can

turn into winners on a single drill hole, so don't judge the

companies momentarily at the bottom of the table too harshly.

There could be any number of reasons why a particular stock performed

poorly during a given stretch of time. This table is nothing

more than a snapshot of a very dynamic industry.

In the last bit of housekeeping,

we'd like to apologize to our readership that this table does

not include some of the brighter stars of 2005, such as

Fortuna Silver, Great Panther and others. This is simply because

the process of collecting this data is very laborious, perhaps

why no one else does it, and we are working to add them to our

database. Others, such as Excellon, Oremex, Orko, Revett,

Tumi, etc. do not yet see the value in our service and expressed

no interest to collaborate with us. We don't hold it against

them and only bring it up to address a steady flow of emails

inquiring about these companies. We make every effort to build

our website into the best source of information on silver

on the web. If you don't see your favorite silver company below,

contact the company.

Back in May of 2005 we penned

an article titled Silver

Stocks on Sale and immediately received several disgruntled

emails expressing all sorts of dismay about silver stocks - tell-tell sign of a cyclical bottom. The majority

of companies previously highlighted on these pages did very well

in 2005. In no particular order they include: Esperanza Silver,

Avino Silver, Minera Andes (contrary to what the table shows,

we consider Minera Andes a big winner in 2005 and continue to

like it), Palmarejo Silver, Silvercorp, Silver Wheaton, Endeavour

Silver, First Majestic, Macmin Silver, Genco Resources, Western

Silver and others. We will return to our discussion of these

and other silver companies in the future, but for this edition

we'll limit ourselves to "new comers".

Sabina Silver (TSX.V:

SBB)

Sabina Silver just recently

changed its name and announced a renewed focus on silver. This

company has the potential to make some waves the silver sector.

Sabina has several properties in its portfolio throughout Canada,

including gold properties JV-ed with Wolfden Resources and Placer

Dome and 100 ounce silver values at the Del Norte option in the

Eskay Creek area. Sabina owns 4 million shares of Wolfden Resources

which gives the company additional exposure to gold. As of this

writing Sabina's 6.5% stake in Wolfden is worth about C$15 MM.

The Hacket-River project was

originally acquired from Teck Cominco by spending CA$ 7 million

on the property for 100% ownership. The terms of the deal signed

in February, 2004 provided for 4 year period but Sabina completed

it in 10 months. As part of the deal Teck Cominco owns 300,000

shares of SBB. Sabina spent an additional C$5 million at Hackett

River in 2005 forcing Teck's second and final earn-back decision.

Teck Cominco has passed up on that option and is now limited

to a 2% NSR in the project.

Drilling to date on the company's

flagship Hacket-River Property outlined 154 million ounces of

silver in measured & indicated category and 50+ million ounces

in inferred and that's just the beginning. It also contains over

1.8 million tons of zinc with some lead, copper and gold which

at today's metal prices could give the project a significant

boost. A recently completed 32,000 ft drill program allowed Sabina

to upgrade quality of its resources and raise the potentially

mineable cut-off grade to 15 oz/ton silver equivalent. That is

a significant boost to the economics of this project. Current

work is focused on the metallurgy and is aimed to upgrade recovery

grades from a previous study by completed by Cominco in 1981.

Pending its results a scoping study is earmarked for the fall

of 2006.

With C$8.5 MM in the bank Sabina

Silver is well financed and looking for acquisitions with special

emphasis on projects that are close to or already producing silver.

The company is yet to register on the radar of your average silver

bug, let alone mainstream investors. That may change in the coming

months as Sabina steps up its marketing efforts and continues

to advance its projects towards production.

Apogee Minerals (TSX.V:

APE)

Apogee Minerals is a junior

silver exploration company focused on Bolivia. Historically,

Bolivia was a prominent silver country (Potosi). Today

Pan American, Apex and Coeur have producing or development stage

properties in Bolivia. While thoroughly outsized by the seniors,

Apogee has the ambition to grow into an 800-pound gorilla and

is in position to do so. Here's why:

- APE is the symbol for the

company's stock on TSX Venture Exchange, not the chief reason

by far, but we thought we'd mention it

- Apogee is focused on production,

has no debt and offers attractive capital structure

- Local expertise of operating

in Bolivia; Two of the top managers live in the country

- Large scale projects with

past/present production, including the Pulacayo mine which in

Bolivian history is only second to the world-famous Potosi Silver

District

- Joint-Venture with Apex Silver;

Apex itself is in the business of developing elephant projects

- Strong support from both the

local mining cooperatives and state-owned mining company COMIBOL.

In less than a year Apogee

has assembled a portfolio of properties each of which meets these

criteria:

- Past/present production or

near term production potential

- Economic deposit at current

metal prices

- Large size ore-body

- Great blue-sky potential

All properties offer significant

exposure to silver with some mix of zinc, lead and gold. Apogee

has no shortage of high quality projects; in fact each one of

its properties could easily justify the company's present market

valuation and then some. This is a results oriented company that

means business. Six weeks ago we visited the properties of Apogee

Minerals and prepared a full report about the company available

from Silver-Investor.com.

Impact Silver (TSX.V:

IPT)

Impact Silver has recently

closed the deal that had an immediate and dramatic impact on

its share price. The company purchased a silver district called

the Royal Mines of Zacualpan. In fact it did one better - Impact

acquired the private Mexican holding company that owns this 125

sq. km property with all corresponding licenses, permits and

rights. That is an important distinction because:

a) The property has 3-4 producing

mines (the 4th has been on and off line) and Impact can pretty

much take over the operations (scheduled for January 16, 2006)

without having to jump through extra bureaucratic hoops in Mexico.

TSX has approved the deal.

b) The mine is profitable now but was losing money for several

years through 2003 (tax credits).

c) Existing contracts with local businesses and service providers

will remain in tact.

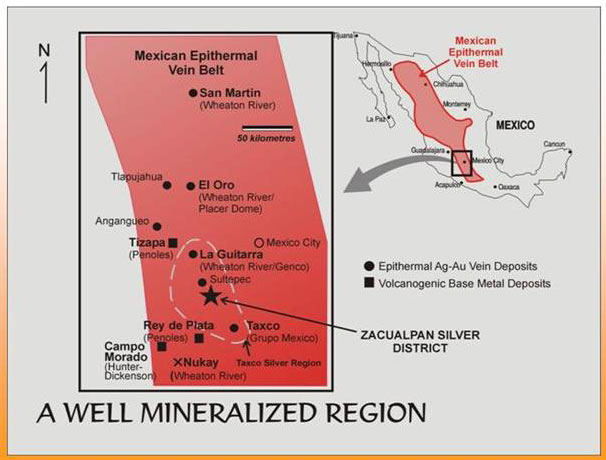

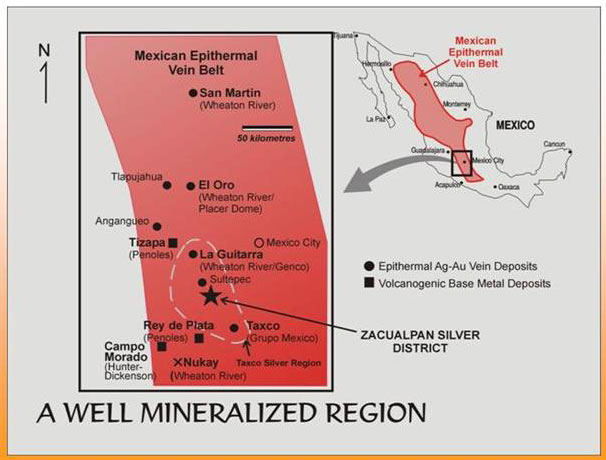

The location of the property

speaks for itself and tells volumes to anyone remotely interested

in the silver sector. All in all Impact paid US$1.7 + 300,000

shares of common stock.

The storyline is painfully

similar to other high profile deals in the area. - There is an

old mine / property / camp / district with a history of production

and existing infrastructure, etc, etc. The universal quality

of such projects is UNDERINVESTMENT. Primarily private Mexican

owners uniformly refused or were unable to invest in their mines

during the years when metal prices hit the dust and slowly run

them into the ground (how's that for a play on words?). When

selling, they usually prefer cash and sniff at shares of potential

buyers. Whatever shares they get as part of the sale, they usually

unload as soon as possible in favor of greenbacks.

A long term lease on a 500

tonne per day (tpd) mill was included in the transaction. The

mill is owned by a major Mexican mining company. We believe Impact

chose to avoid additional share dilution to raise funds in order

to buy this mill at then prevalent stock price of C$0.40. The

stock since has run up to about C$1.00 and most likely the company

will do another financing in the near future.

Now that the property is secured,

Impact can go to work and unlock its potential value by applying

modern exploration and mining technology. It may take a few months

to sort things out and a few more months and millions on equipment,

infrastructure, exploration and so on. These are all guesstimates

on our part but some time in the spring we would expect the company

to have a detailed plan for the future of this project. If things

go well, that 500 tpd mill could be running at full capacity

in 2007. We'll have to wait and see if these projections are

anywhere in the ball park of what will actually take place. So

far so good, the market seems to like the story, so do we.

In Brief

- A number of new and not so

new silver companies are now public. Among them Minco Silver

(TSX: MSV), Au Martinique Silver (TSX.V: AUU), Klondike Silver

(no symbol yet). As far as we can tell Capstone

Gold will be spinning off its silver assets into a separate

entity.

- Silver Wheaton (TSX: SLW,

AMEX: SLW) raised C$100

MM at the end of December, 2005. It took about 6 months for the

market to understand the Business

Model of Silver Wheaton. If history is any guide Ian Telfer

is going to put it to use any day now and it is reasonable to

expect some big news from the company. For those gasping for

a silver ETF this is the next best thing.

- Aspiring ETF investors may

also look at Central Fund of Canada (TSX: CEF, AMEX: CEF).

- Kimber Resources (TSX:

KBR, AMEX: KBX) got

listed on American Stock Exchange and its shares were on a tear

since. With a great management team and backing from Jim Puplava,

who is a director, this one is going places.

- Palmarejo Silver and Gold

(TSX.V: PJO) changed

its name from Palmarejo Gold to better reflect the mix of its

mineral assets. This darling of Canadian fund managers has put

in an impressive performance in 2005.

- Coeur d'Alene Mines (NYSE:

CDE) has ventured into

new territory, both in geographic and financial sense. It acquired

future silver production at two operating mines in Australia:

- Endeavor mine, paid in

full US$38.5 MM for 17.7 MM oz total, 1.3 MM oz annual

- Broken Hill, paid US$36 MM,

future cost approximately US$2.75/oz, 15 MM oz total, 2.3 MM

oz annual.

In total they should add 3.6

MM oz of annual silver production for CDE. The company also expressed

its intent to embrace the retail investor, but despite our repeated

calls, we're yet to hear from Coeur.

- Bear Creek Mining (TSX.V:

BCM) has undoubtedly

been among the biggest winners in the silver sector in 2005.

The cat is out of the bag on this one but we'll try to cover

this and other stories as they develop.

A wave of consolidation is

rocking the gold sector the most visible manifestation of which

was recent acquisition of Placer Dome by Barrick. It stands to

reason that 2006 will bring M & A activity to the silver

sector as well. That would be a welcome development as it would

help the scattered silver sector gain visibility with institutional

investors. With only about 30 or so active primary silver companies

in the world, it is a far cry from 3,000 gold companies, 150

uranium companies and countless oil & gas companies, to this

end silver investors have nothing to worry about.

January 9, 2006

Sean Rakhimov

editor: Silver

Strategies

send feedback

to author

Information

contained herein is obtained from sources believed to be reliable,

but its accuracy cannot be guaranteed. It is not intended to constitute

individual investment advice and is not designed to meet your

personal financial situation. The opinions expressed herein are

those of the author and are subject to change without notice.

The information herein may become outdated and there is no obligation

to update any such information. The author, entities in which

he has an interest, family and associates may from time to time

have positions in the securities or commodities discussed. No

part of this publication can be reproduced without the written

consent of the author. ©Copyright 2004-2010 by Sean Rakhimov.

All Rights Reserved.

Recent Gold/Silver/$$$ essays at 321gold:

Dec 09 A 700 Horsepower Gold Stocks Car Stewart Thomson 321gold

Dec 08 A Global Currency Crisis in 2026? Nagasundaram 321gold

Dec 07 USD, Oil, & Gold: Key Wave Counts captainewave 321gold

Dec 05 If you want a Silver Home Run, Think of Dolly Varden Silver Bob Moriarty 321gold

Dec 05 Red Hot Juniors Lead A Golden Parade Morris Hubbartt 321gold

Dec 05 L@@K Amazon Kindle and Paperback Books by... Bob Moriarty 321gold

|

321gold Inc

|

Silver

Companies - Year in Review

Silver

Companies - Year in Review