| |||

Gold: Ready, Set, Go! Were You Really Ready?Przemyslaw Radomski The previous week is over and even though we haven’t seen any significant volatility in its final part, it doesn’t mean that we haven’t seen any meaningful signals. We did and one of them has important implications for the short-term and a few others have much more important implications of the medium-term nature. Based on today’s sizable decline in gold and silver, it seems that the short-term signal has already worked. The general stock market declined visibly in the last two trading days of the previous week and if the stocks are about to slide, it may be a good idea to prepare for such a decline. That’s what we’ll discuss in the following part of today’s analysis. For now, let’s start with the short-term charts and short-term signals (charts courtesy of http://stockcharts.com). Gold’s and Silver’s Tiny Rally (Click on images to enlarge) In Friday’s Alert, we wrote the following about gold’s inability to move above the previous highs:

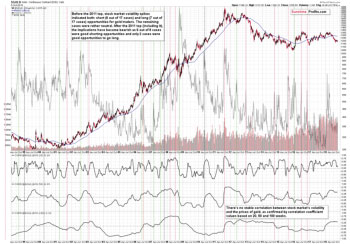

There was yet another attempt of gold to move higher and while gold ended the session higher, the intraday low was once again lower than in the previous days. Overall the tendency for gold to move back and forth but lower overall remains in place. We saw the same thing in silver. The intraday high was once again lower than on the preceding day. And once again, there was only an intraday attempt to move above the 50-day moving average that was invalidated before the session’s closing bell. The above, plus silver’s recent short-term outperformance continue to support lower prices in the upcoming days and weeks. The outperformance can be seen even more clearly on the SLV ETF chart. The situation now is very similar to what we saw at the previous tops, right before the significant declines, just as we described it last week. And we have just seen an important short-term confirmation from the mining stocks. Mining Stocks’ Short-term Signal Gold and silver moved a bit lower yesterday. It’s not odd because the USD Index declined a bit on Friday. What is odd and significant, however, is the fact that despite this situation the gold stocks declined. They should have moved higher, but they didn’t which is a bearish sign. The same goes for mining stocks’ inability to complete the inverse head-and-shoulders pattern that we discussed previously. The general stock market declined on Friday, but the move was not significant enough to really justify this extent of mining stocks’ weakness. Preparing for the Stock Market Volatility Speaking of the general stock market and its decline, the last two trading days were declines and while we are not yet seeing any dramatic decline, it may be a good time to prepare for such. And by preparing for it, we mean considering what might happen to the gold price if we see a significant increase in the volatility of the main stock indices. If we see the latter, we’ll also – almost certainly – see articles and interviews where people will say that gold could rally because of this increase. By preparing for it, we mean recalling that an increased volatility in the general stock market is not likely to trigger a rally in the precious metals. That’s just an easy thing to say when being asked during an interview. Gold is often treated as a safe haven, so when investors become nervous, they will turn to the yellow metal, seeing safety. Right? As long as you don’t check the facts, it seems perfectly understandable. But we did check the facts when the above was a popular trigger that was supposed to launch gold above $1,500. On January 31st, 2018, right after the initial decline in the S&P 500, we wrote that, for gold, the implications are not bullish and that gold can even decline along with the S&P. Moreover, in April, we discussed the link between gold and the volatility index – VIX. We wrote the following:

What happened shortly thereafter? Gold declined, thus further increasing the bearish statistics. The current reading is that since 2011, 77.8% of cases (7 out of 9) when VIX spiked were good shorting opportunities. The above doesn’t change anything at the moment, but please keep it in mind, if the S&P declines and you read that another decline and/or volatility is going to send gold to the moon. Quick fact-check suggests the opposite. Now, since we are already discussing the long-term charts, let’s take a look at the current situation in the PMs from the long-term point of view. Summary Summing up, the outlook for the precious metals sector remains extremely bearish even though not much seems to have happened in the final part of the previous week. It’s important to keep in mind the fact that it was precisely “nothing” that directly preceded the two-day $200+ decline in gold in April, 2013. Consequently, just because nothing changed in the last two trading days, it doesn’t mean that nothing is about to. All in all, it seems that the huge profits on our short positions will soon become enormous. And Friday’s underperformance of mining stocks seems to indicate that the waiting for decline’s continuation may be over. The full version of the above analysis (today’s Gold & Silver Trading Alert) includes also short-, and long-term targets for gold and silver in terms of both: price and time. We encourage you to subscribe and read the details today. Thank you. ### Oct 8, 2018 Disclaimer: All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's essays or reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. |