Finding a fair market price

for the US ten-yr bond

Warren Pollock

The Macroeconomic Newsletter

eMail pollock.warren@verizon.net

Jun 30, 2004

To an individual investor, what yield would a 10-year fixed rate

Treasury bond need to provide in order to justify a purchase

held to maturity?

As an investor, I would evaluate if the yield were sufficient

to provide a risk-adjusted return on investment. In world of

fiat paper money, this calculation is never made.

Were the reserve currency gold, which has finite supply, return

on investment calculations would need to be considered much more

carefully.

The Treasury won't ask this question while foreign governments

and central banks are buying US paper. Vested political and economic

interests have temporarily trumped the business sense of foreign

buyers. At what point, however, does return on investment become

an issue for a portfolio of holdings measured in hundreds of

billions or trillions of dollars?

Government Service Entities (GSEs) never ask this question because

their job was to facilitate the social objective of providing

everyone with a primary home. This objective was met and replaced

with a tax-subsidized form of leveraged speculation. As things

are becoming more desperate, the GSEs are lobbying congress to

extend zero down payment credit to the living dead and the financially

destitute. The GSEs are a formidable political lobby. Additionally,

a poisonous financial condition provides ample political leverage.

Thus, these institutions are looking to the government to bail

them out even though the implied guarantee has been removed.

Retail financial institutions never ask this question because

they profit from fees, product turnover, and differentials. You

would think that customer satisfaction in providing a quality

product would be a consideration. Unfortunately the lack of customer

turnover and new business will expose yet another breach of fiduciary

responsibility.

The news out from Washington Mutual and GM on June 28th confirms

that product turnover has been slowing while profit margin on

interest rate differentials has narrowed. Now that insiders have

sold their stock, the layoffs can begin.

These companies are ending the practice of lending long at fixed

rates, borrowing short, and hedging with derivatives. The system

has become unsustainable.

Relative to the broad stock market, the price-to-earnings ratios

of financial companies are relatively low. As index components

these stocks are used to artificially understate total market

P/E.

What happens when everyone realizes the market has been overvalued?

US brokerage accounts are structured in a binary fashion that

forces a choice to be made between domestic stocks and bonds.

Individuals invested in treasuries don't question the yield they

are getting because they mistakenly believe that treasuries held

to maturity are risk free. After stocks go bad they move to bonds.

After they lose money in bonds, they switch to stocks. The small

investor loses in both directions. This leads me to believe that

in the initial stages of dislocation savers are going to pay

as debtors walk away.

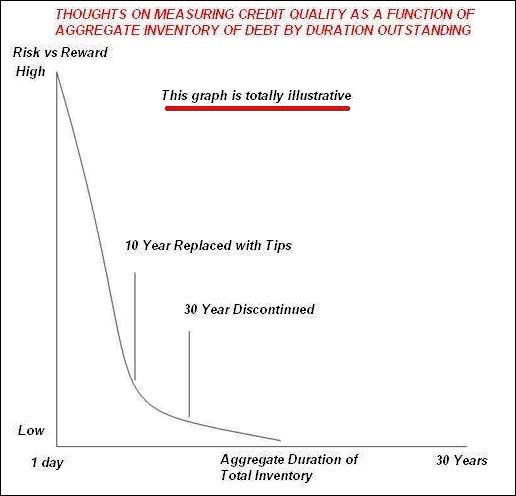

Systemic instability exists when a desirable yield cannot be

found to compensate for long duration risk. To temporarily forestall

a credit crisis the aggregate duration of treasury and private

debt will be moved to shorter and shorter duration. The mismatch

between risk and yield causes a convex trend to develop (see

graph). The trend towards ever-shorter maturity provides an indicator

of creeping insolvency.

If the ratio between credit

quality and risk were appropriate, all government debt issued

could be long-dated.

June 29, 2004

Warren Pollock

The Macroeconomic Newsletter

eMail pollock.warren@verizon.net

This generalized

publication seeks to discuss macroeconomics, technical analysis,

investing theory, politics, news and markets. This newsletter

does not provide specific advice to any individual. It's our

recommendation and opinion that individuals should seek the counsel

of a licensed financial adviser who can design a plan appropriate

to specific financial conditions, objectives, and risk tolerance.

The publishers of this letter may purchase, hold, and dispose

of positions in financial instruments discussed herein at will.

The newsletter is published to its subscribers on a regular basis.

________________

321gold Inc

|