.

The money-go-roundWarren E. Pollock In hindsight its easy to see

that money rotates between widely held asset classes. As this

rotation occurs investors seam to be accepting less and less

return for more and more risk. Its possible (probable) that all

widely-held assets could deteriorate concurrently (at the same

time). Even though gold has a following it has very little mainstream

support, its not widely held. I believe that diversification

towards physical gold and liquidity may be the only way to withstand

the next mass flight to safety. With the recent stock market

decline a rotation has started which also can be identified.

I want to draw your attention

to the DOW chart here. As illustrated

on the chart; This generalized publication seeks to discuss macroeconomics, technical analysis, investing theory, politics, news, and markets. This newsletter does not provide specific advice to any individual. Its our recommendation and opinion that individuals should seek the counsel of a licensed financial ad visor who can design a plan appropriate to specific financial conditions, objectives, and risk tolerance. The publishers of this letter may purchase, hold, and dispose of positions in financial instruments discussed herein at will. The newsletter is published to its subscribers on a regular basis. With the recent decline in the stock market the rate on Treasuries have dropped dramatically. Part of this action can be attributed to Japan buying dollars but some of it represents money trapped in mutual funds and stocks that are going to "cash." Many of these funds are not really going to cash they going indirectly through managed funds into treasury bills, strips, and notes. We are seeing a second flight occur between stocks and bonds.

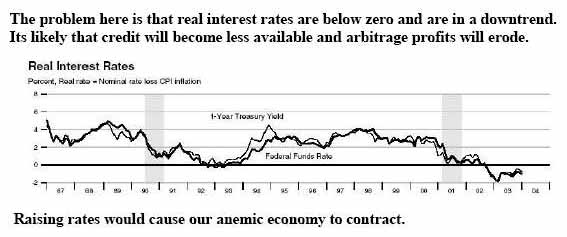

Theoretically the concern arises

that, A stock market crash could cause people to rush into bonds

thereby lowering yields even further. Should yields then need

to reverse upwards tremendous amounts of capital will be lost

because the market value of bonds are at inverse to the prevailing

interest rate. Imagine retirees losing money in stocks shifting

into negative interest rate bonds and then losing not only the

yield but also their capital savings. The Nation's Stock Brokerage System

Must Fortify Itself Against Future Attacks by Warren Pollock. |