|

|||

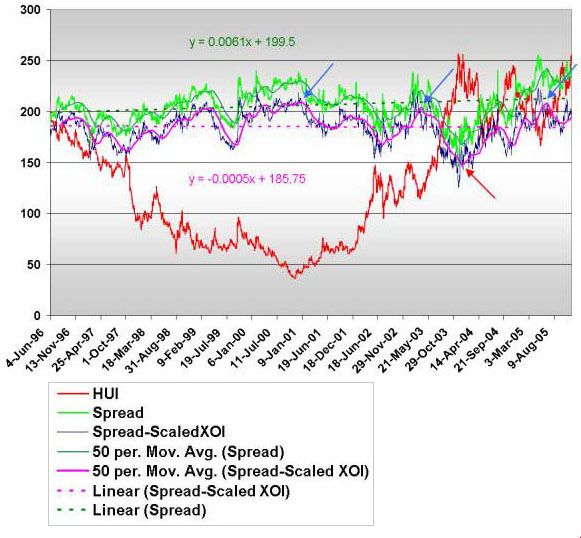

Spreading the Gold and OilPMtrader On the one year anniversary of the release of my novel, Eye of the Pyramid, I'm pleased to be able to tell you about two new developments. Axiom House is running a one-day only offer (today, Dec 1st) with special gifts, which you can read about at the bottom of this editorial. But first, I wanted to tell you about an idea I've had for some time about the spread analysis... and to offer some preliminary results in this regard. This editorial builds upon several prior essays, the most recent of which was titled, "Spreading the Wealth." We've all probably noticed that the gold and silver mining shares have been underperforming the price of the underlying metals for quite some time. In fact, based on the "Rule of 200" introduced in earlier essays, this underperformance has been quite dramatic. There is of course a preliminary caveat. The Rule of 200 analysis was predicated on a gold price ranging from roughly $250 to $400 per ounce. As such, we've been in uncharted waters for some time. But there is something more. Over the past many months, we've had dramatically increasing oil prices. Since the profits from gold mining are significantly reduced by higher energy costs, it is reasonable to suppose that the price of oil would have a noticeable impact on the prior spread analysis. This brings us to the subject of this editorial. In this essay and for the first time, the oil price is considered in the standard spread analysis (Price of Gold minus the HUI Index). In particular, a scaled value for the XOI is used as a proxy for the oil effect, and this proxy is subtracted from the standard spread. One might credibly argue that a more pure proxy for the oil price would be better. However, we must keep in mind that the HUI appears in the formula as well - implying that an index such as the XOI may provide reasonable or even superior results. I will leave it to the reader to judge the efficacy of this proxy based on the results shown below.  The key above explains the differing functions plotted. Notice first a linear trend line (dotted) has been added for the standard spread as well as the "new spread" (standard spread - scaled XOI). Ideally, for spread analysis these linear trends should be flat (the x-coefficient should be zero). Looking at the two algebraic formulas shown in the figure, it is clear that the new trend is an order of magnitude more "efficient" in achieving the flat-line performance - implying we could well be on the right track! So let's focus on the 50 day moving average of the new spread as indicated by the purple line in the plot. Notice the three places this purple line peaked above the 200 mark as indicated by the three blue arrows. These occurred approximately in January of 2001, April of 2003, and July of 2005. There are a few things to notice: They are equally spaced and 27 (3 cubed for the algebraists) months apart; they arguably coincide with the best buy points in the bull market in gold, which started in December of 2000; and the most recent one just occurred in July of this year! Also notice the red arrow. When the purple line crossed beneath the 150 mark in January of 2004, it coincides rather precisely with what many medium-term investors would consider the only sell point in the "run of this golden bull". In summation and according to the above technical analysis - granting that the market will always have the final say - the estimates for a price of gold of $550 and an HUI value of 350 over the next six-twelve months may be quite conservative... as the markets keep Spreading the Golden Oil! With best wishes for everyone over the holidays! November 30, 2005 |

About Terry L. Krohn

About Terry L. Krohn