HUI vs Gold: Back to Fundamentals

PMtrader

Jun 7, 2006

This paper builds upon several

prior editorials; an index of these editorials may be found here.

First, let's revisit the work presented in a 2001 paper entitled

"Looking for Leverage in the HUI" - where the fundamental

relationship between the HUI and Gold was explored and where

the original "rule of 200" was developed. Basically,

small price ranges of gold and their associated HUI values were

each averaged to produce a single data point - the results then

plotted over the entire range of these "bin" points.

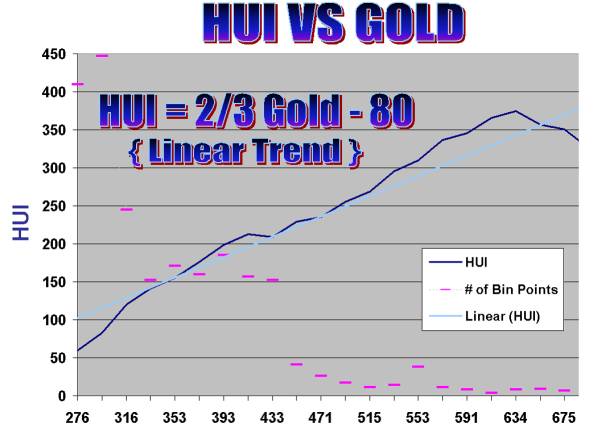

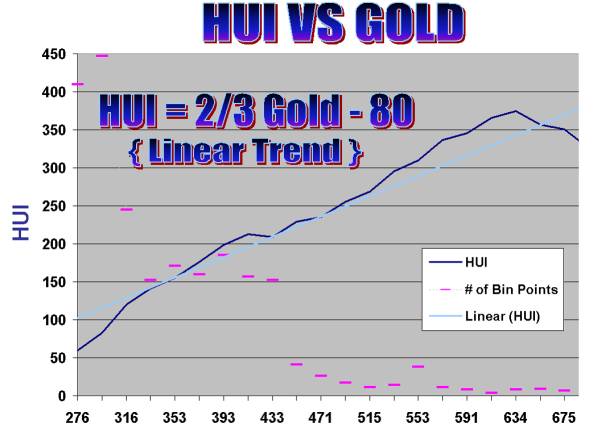

The figure below shows the results of this updated analysis.

The purple dashes show the

number of times the price of gold fell within a price bin...

data ranges between June of 1996 until the present time.

There are relatively few data points when the price of gold traded

higher than $450. As such, the strength of the conclusions should

be tempered by this sparse data. The dark blue line is a plot

of the process described above, and the light blue line is its

linear trend. This trend line is well approximated by the formula

shown: HUI = 2/3 Gold - 80. As an example, when gold is

$600/oz, HUI's average historical performance values it at 320.

Note the inverse relation as well: Gold = 3 (HUI + 80 ) /

2.

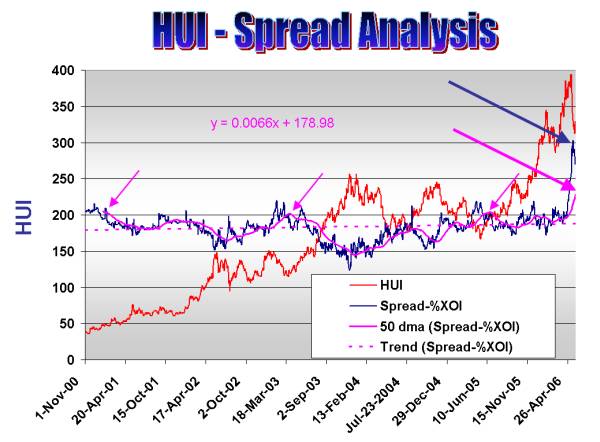

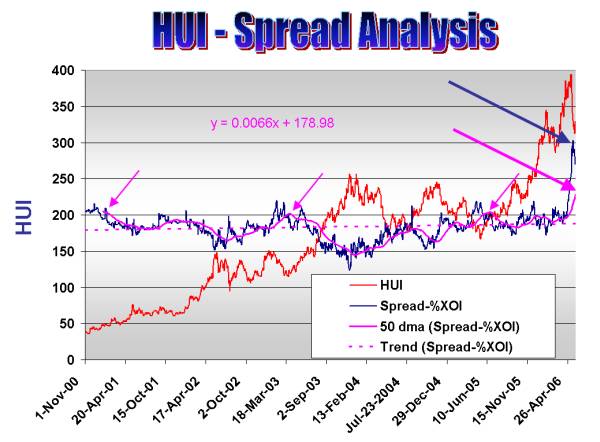

Now, let's consider the updated spread analysis shown in the

plot below - previous readers should note that the standard spread

has been removed; only the oil adjusted spread is shown to make

the plot less cluttered.

The small purple arrows show

good buy points for the raging gold bull that started in late-2000

/ early-2001. Any time the 50 day moving average (dma) of the

spread popped above the 200 mark, significant gains were soon

to follow. Now notice the large arrows at the right of the figure.

The dark blue arrow corresponds to a huge spike in the absolute

spread, and the large purple one corresponds to a similar historical

spike in the 50 dma of the spread.

Previously, this type of spike has signaled a great buying opportunity.

However, because it stands out so dramatically, some additional

consideration is warranted. As I said earlier, there have been

relatively few days where gold and the HUI have traded in these

higher ranges. As such, the spread behavior could be misleading

- without the sparse data caveat, it signals the "mother

of all buying opportunities".

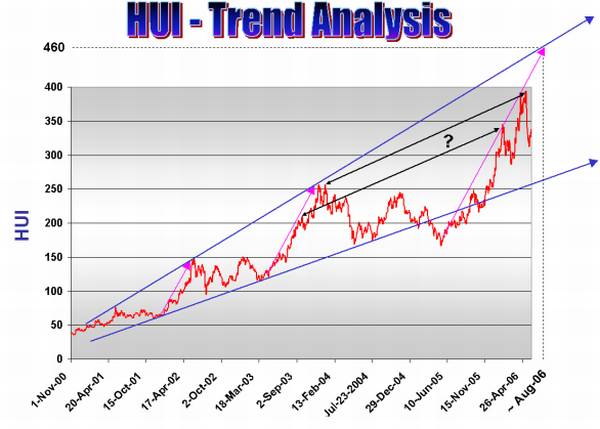

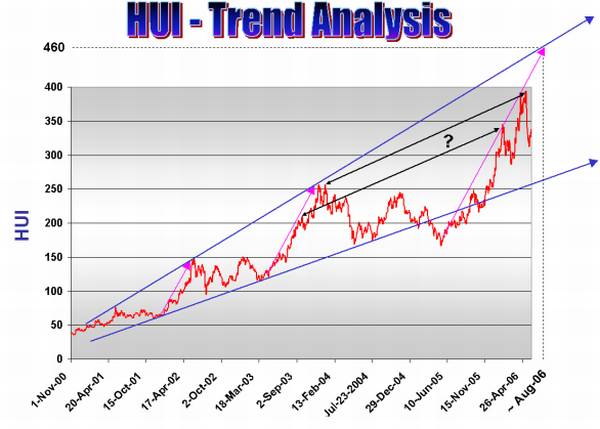

Finally, let's revisit the trend analysis given in the last few

referenced editorials. There is something new to consider.

First, the blue lines show

the cone-channel previously introduced. The purple arrows are

parallel and show the major price moves in the HUI over the last

five and a half years. Now look at the black double-arrows and

the "?" mark. Here's the idea; if these lines are meaningful,

then we may have reached a prolonged period of consolidation

(on the order of a year). However, according to the cone-channel,

we have not yet completed the move in the HUI.

In conclusion, it appears that we are in a period of uncertainty.

Breaking 400 on the HUI should confirm the idea of filling the

channel and bring the 460 target back into play. (Note that with

the formula provided at the beginning of this paper, the 460

target corresponds to a gold price of about $810/oz.) Barring

the setting a new high in the HUI, we may have entered into a

period of consolidation.

All the best,

Jun 6, 2006

Terry L. Krohn

PMtrader

email: PMtrader

A

Personal Note

Jun 2006 A

Personal Note

Jun 2006

Many thanks to readers of Eye of the Pyramid!

Axiom House is running a great special starting June 6 and running

all day June 7. You can check it out at the link below. GATA will

receive a $2 donation for every book purchased by a member.

http://www.axiomhouse.com/offers/bonuspage.htm

Eye of the Pyramid can also be purchased at Amazon.

About Terry L. Krohn About Terry L. Krohn

Mr. Krohn is a research scientist living in the Washington D.C.

area.

His field of expertise is scattering physics - the analysis of

interactions between electro-magnetic waves and matter.

Copyright

© 2006 by Author - Reproduced with Permission.

321gold

Inc

|

About Terry L. Krohn

About Terry L. Krohn