China Gold Report update April

2005

China has emerged as the world's 4th largest gold producing country

Marino Pieterse

Goldletter I N T E R N A T I O N A L

Apr 5, 2005

China has been a producer of gold for centuries and

also has a history of usage that stretches back to antiquity.

The gold industry has depended entirely on State investment since

1949, when the People's Republic of China was founded. Domestic

private and foreign investors were excluded from the industry. China has been a producer of gold for centuries and

also has a history of usage that stretches back to antiquity.

The gold industry has depended entirely on State investment since

1949, when the People's Republic of China was founded. Domestic

private and foreign investors were excluded from the industry.

Driven by domestic demand the government invested heavily in

the mining industry in the 1990's and as a result Chinese gold

production has risen significantly to a level where it has overtaken

Canada as the world's fourth largest producer since 1998. Official

gold production in 2004 was 212.3 tonnes, up 11.75 tonnes or

5.9% year-on-year, although non-official and mostly informal

mining, probably means that the total production figure was higher.

About 160 tonnes comes from primary gold mines and the remainder

from various nonferrous smelting entities.

According to GFMS, consumption of gold in 2003 was 207 tonnes,

making China the fourth-largest gold consumer in the world. Per

capita consumption of gold is only 0.16 grams, much lower than

the world's average of 0.7 grams. Gold jewellery is the most

promising sector in the gold industry. About 250 tonnes of gold

was used to make jewellery in China in each of the recent years,

which number is expected to soar to 500 tonnes in three to five

years.

In the past little has been known about the workings of the Chinese

gold industry. Production (and consumption) figures have been

shrouded in secrecy. However, with the largely successful change

in government policy in switching its planned economic system

to a market economy, China's entry in the World Trade organisation

and the recent deregulation and reformation on the mining and

miners laws in China, foreign investment can be viewed as having

less political risk. China has maintained a double-digit economic

growth for the last few years and is considered the fastest growing

economy in the world.

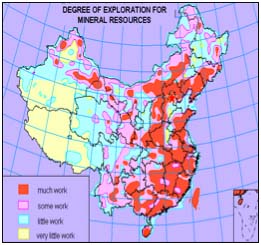

Gold occurrence

Advanced stage precious metals and base metals projects exist

in China. Large areas of mineral lands with potential exist and,

as a result, there has been a steady growth in the number of

foreign mining companies doing business in China. Despite the

recent surge, the gold industry in China remains fragmented,

archaic and undercapitalised. The China Geological and Mineral

Survey Bureau estimates the gold resources of Chinese ten major

provinces to be over 11,000 tonnes and the country's prospective

gold resources at around 15,000 tonnes.

According to statistics of the China Mining Association, Shandong

Province in east China is the richest area (approximately 40%

of total proven reserves), followed by Shaanxi, Sichuan, Gansu,

Yunnan and Guizhou.

Production today is centred on the eastern provinces of Shaanxi,

Shandong, Henan, Hebei, and Liaoning where 70% of known gold

deposits are located. However, since 1994 Fujian Province has

become a major producer with the opening of the country's largest

mine, Zhijinshan, working an epithermal copper-gold deposit.

About 50% of gold in China occurs in quartz-gold vein structures,

with another 17% occurring in placer deposits and the remainder

is found in polymetallic deposits, often in association with

copper.

Most of China's production comes from small, underground mines

with little mechanisation. There are thought to be over 1,200

small to medium sized mines in operation throughout the country,

equal to approximately 70% of total gold deposits and representing

25-30% of total proven reserves, with the largest mine producing

in the region of 100,000 oz annually, although the annual average

is closer to 16,000 oz.

Under a 5-year industry plan, the government hopes to form 12

internationally competitive gold conglomerates by 2005.

A joint study by the United States Geological Survey and the

Tianjin Geological Academy from 1997 to 2002 identified and reviewed

over 160 gold occurrences in China. Within the category of sedimentary

hosted gold deposits (a broad category including Carlin style),

over 20 million ounces of resources have been identified in China

versus over 70 million ounces in Nevada.

Most of the Nevadan ounces were discovered in the 1970's and

1980's post the recognition of this style of mineralization where

as the major exploration push in China began even later in the

1980's.

The largest deposits of this style discovered to date in China

include Lannigou (> 3.2 million ounces) and Baguamiao (>

2.5 million ounces) but exploration has generally been neither

well funded nor extensive. Most reserve definition programs are

limited.

China's national gold industry

Control and ownership of many of China's largest mines is vested

in the State and administrated through the China National Gold

Group Corporation (CNGC). First established in 1979 and then

reorganised in 1993, GNGC, operating under China Gold Group,

controls the major gold mines in seven out of eight main producing

provinces. The GNGC officially controls 450 mines. CNGC's assets

total 9 billion yuan (US$ 1.1 billion) with 61 affiliates across

China.

In 2004, CNGC produced 42 tonnes, a year-on-year increase of

25%.

The one exception to GNGC's jurisdiction is the most important

producing province of Shandong, which accounts for 20-25% of

Chinese gold production. In Shandong, the largest gold mine Zhaoyuan

has an annual production of approximately 75,000-oz. The Zhaoyuan

group consists of nine mines with a total annual output at about

500,000-oz.

In Shandong and elsewhere, all other production is under the

control of provincial, regional or local mining companies. Many

operations are collective run by townships or villages.

China refines its own gold and many mines have refineries

attached to them.

The buying and selling of gold in China has been centralised

since 1983 at ministerial level. All gold production in the country

had to be sold to the People's Bank of China (PBC), which as

the only official institute technically controlled mine purchases

and sale of gold to retailers.

As well as being the repository of all Chinese miner gold, the

PBC was responsible for setting the price paid to the local miners.

From 1995, the Chinese domestic gold price was floated at a discount

of 10% below the international price, although since 1999 it

has more closely tracked the world price.

The move to bring the local gold price in line with the international

price, occurred from recommendations by the World Gold Council

(WGC) in 1998 as part of a timetable for deregulation of the

market, there motivated by China's acceptance into the World

Trade Organisation at the end of 2001.

The official opening of the Shanghai Gold Exchange (SGE) on 30

October 2002 heralded the start of a new era in the gold market

in China, and is further evidence of the intention of the Chinese

government to deregulate the precious metals markets. Gold trade

volume on the Shanghai Gold Exchange amounted to 665.3 tons last

year, up 41% from 2003. Its gold trade volume surged by 59% year-on-year

to US$ 8.83 billion. China Gold Association was formally founded

in November 2001, with 70 enterprises as standing directors,

and 256 enterprises as directors. ...

-> to read the rest of this long article, please click here (pdf)

Marino

G. Pieterse

Goldletter I N T E R N A T I O N A L

Goldletter International is published monthly

by Marino G. Pieterse, Gold Research Centre, Castricum, the Netherlands.

Information and investment comments are independently and thoroughly

researched and believed correct. No guaranty of absolute accuracy

can be given however. Investment decisions are fully made for

own risk. Editorial address: P.O. Box 200, 1900 AE Castricum,

the Netherlands tel.:+31-251-320735 fax: +31-251-321110 e-mail:

info@goldresearchcentre.com

321gold Inc

|