News From Vangold's

Papua New Guinea Properties

Paul the Benjaminite

February 21, 2004

It has taken a quite a bit

longer than expected, but the news of the surveys on Vangold's

(75%) and New Guinea Golds (25%) Feni Island properties is finally

out. The incredible potential of the Feni Islands (Ambitle Island)

was previously reported on in The

Bluest of Blue Sky Potential and in More

Blue Skies Over Feni. These reports explained the combination

of geological circumstances which could mean that Ambitle Island

will turn out to be one of the largest gold deposits in the world,

like its sister island, Lihir. But the news is not limited to

Vangolds Feni Islands Property! The recent acquisition of Kanon

Resources means that Vangold and New Guinea Gold now have a share

in seven exciting and prospective land packages in Papua New

Guinea. Three drilling programs will be in the news within the

next few months on three of these properties with the drills

turning first, on the Ambitle Island and Mt. Penck properties,

both scheduled to begin within weeks!

Ambitle Island

Exploration Results

As expected, the results from

the exploration of the central and southern portions of Ambitle

Island have yielded impressive results. Both the biogeochemical

survey and the stream panned concentrate surveys were conducted

in portions of the Central Caldera and the Old Caldera Zone on

Ambitle Island. (Both calderas are actually volcanic craters.)

The biogeochemical survey started

near the mouth of the Nanum River and the scientists worked their

way up the hill close to the river toward the Central Caldera

sampling along the way. The first priority was the Kabang area

north of the large and intense I.P. anomaly, where drilling and

soil sampling was previously done. Unfortunately, the geologist

heading up the survey fell ill with malaria, and, as a result,

the survey was cut short, and many prospective areas have yet

to be tested. Even the area of the I.P. anomaly was largely untested.

However, the program is likely to be continued sometime within

the next couple of months. Still, enough work was done on the

panned concentrate survey, along with previous evidence collected,

to provide some excellent drill targets.

Dr. David Lindley, Vangold's

lead consulting geologist overseeing the Feni project, reported

the following on the stream panned concentrate survey:

81 panned

concentrate samples were collected. Panned concentrate sampling

was conducted along the Nanum River and its major tributaries.

72% of all panned samples had visible gold.

This must mean

there are numerous sources of gold throughout the approximately

14 square kilometers of the Nanum River Valley. Large areas are

yet to be surveyed.

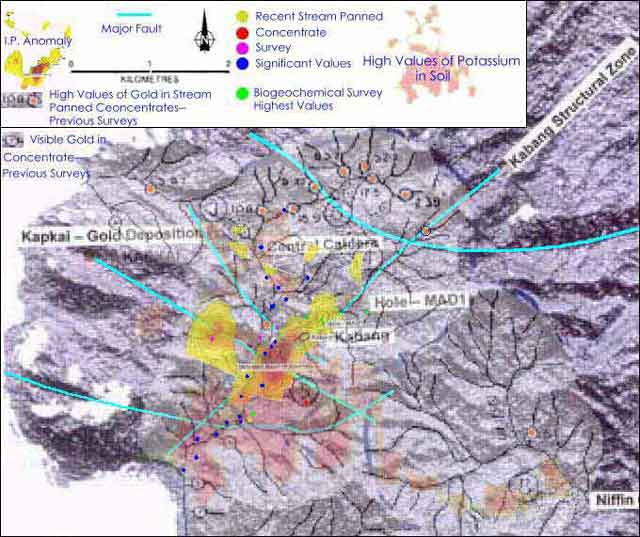

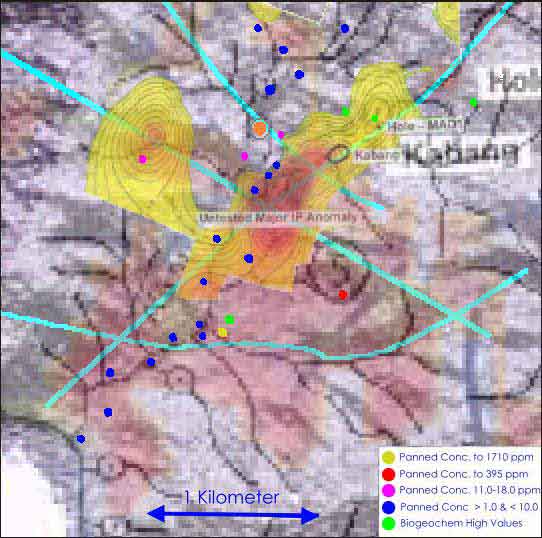

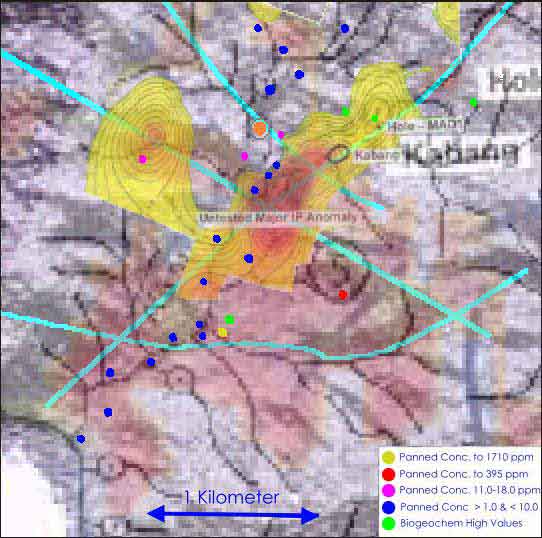

The radar

image below

has been modified to show the results of the stream panned concentrate

survey, the four highest values found in the biogeochemical survey

and their relationship to the I.P. anomaly, major faults on the

island, and the potassic alteration (displayed in my previous

report).

There are several important

points to be made about the results so far:

The major I.P. anomaly, showing

a major conducting body underground, overlies the junctions of

the major NE-SW trending fault with two NW-SE faults. Previous

stream panned concentrate surveys in the northern part of the

central crater with high values are shown as orange dots. The

I.P. anomaly is also open to the north in the same general area.

However, this map strongly suggests that the greatest prospects

are in the southern crater, where the I.P. anomaly is open to

the south, southeast and southwest, and is highly correlated

with the highest values of the intense potassic alteration.

This high potassium in the soil is often associated with gold

ore as it is in the area of the Louise Caldera of Lihir Island

where some 50 million ounces in reserves have been proven up.

Judging from the size of this alteration, the potential exists

to find a huge gold deposit. The other colored dots indicate

significant values in the recent surveys. The following picture

gives a closer look at the southern crater in the Nanum River

Valley.

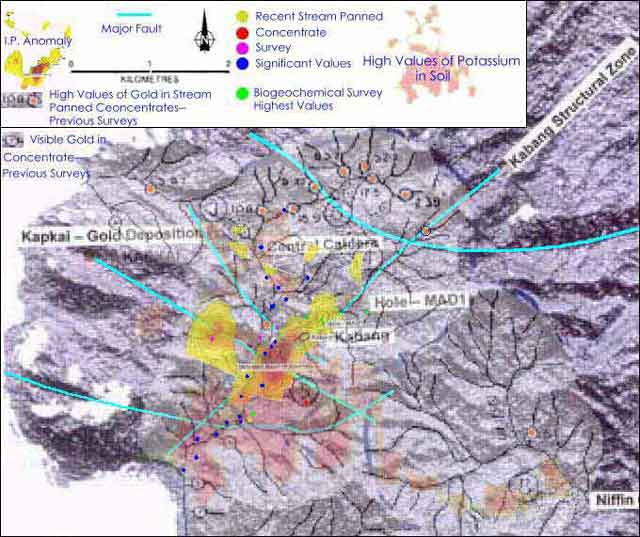

The golden yellow, red, magenta

and blue dots show the relative amounts of gold, from highest

to lowest respectively, found in the steam panned concentrate

survey. (Values below 1 ppm are not shown, though anything above

0.1 ppm (ppm = g/t) is considered to be anomalous.) Most of the

blue dots are along the main river and show the widespread occurrence

of gold. It is more significant when high levels of gold are

associated with a spring rather than a main river or a large

creek, because it shows that the gold is coming up from the ground

below rather than having come from upstream. Highly significant,

therefore, is the spring found in the area indicated by the golden

yellow dot. Gold values in that area ranged to as high as 1,710

ppm! The nearby green dot from the biogeochemical survey

confirms the presence of high values of gold there. It is within

the area of the high potassic alteration, too. Although the I.P.

survey did not go that far south, the graph shows that the I.P.

anomaly was intensifying in that direction. High gold in pan

values also occurred in the area indicated by the red dot with

values up to 395 ppm.

The most intense portion of

the I.P. anomaly, which shows up as the orangish-red area is

some 650 meters long by 280 m wide at its largest dimensions..

How deep is the mineralization at the I.P. anomaly? The manner

in which the I.P. survey was performed on Ambitle (150 m spaced

dipole array) allows a conducting body to be detected at a maximum

of about seventy five meters in depth. Considering the combined

evidence, it appears that there is a large gold deposit 75 meters

deep or less. Of course, it could go much deeper than that. Deep

drilling through this area might be able to reach all the way

down to the much larger area detected as the aeromagnetic

anomaly, which may be a lower grade pyrite and gold deposit.

Clearly there are widespread

gold occurrences on the island. The aeromagnetic anomaly and

potassic alteration show that a extensive mineralization exists

in the southern portion of the Nanum River valley, but it is

not known if it is near enough to the surface and or if it is

high enough grade to be mined. The I.P. anomaly and high values

in the stream panned concentrate and biogeochemical surveys indicate

areas where hydrothermal enrichment, or feeder zones, from a

deeper deposit exists. Deep drilling will determine if these

zones are economical to mine. It will also determine if the large

underlying deposit can be mined, and, in a word, if Ambitle Island

really is another Lihir!

Preparations are underway to

begin drilling several of the many drill targets. A camp has

already been completed which will house the drill crews, geological

staff and other workers. The drill contract has been awarded,

and drilling is scheduled to begin by the end of this month.

At the same time, additional survey work will take place. The next few months

will be exciting times for Vangold and its shareholders!

The Kanon

Properties

During the precious metals

bear market, the less savvy mining companies found themselves

out of business. The smarter managers found ways to survive even

if it meant becoming a dot-com business for a while. The most

able management teams, however, knew that the bear market was

merely a cyclical bottom and that precious metals would be back

in vogue in a few years. So they spent the time acquiring cheap

or abandoned precious metal properties with inherent value. This

is exactly what the managers of Kanon Resources Ltd did. They

went cherry picking throughout Papua New Guinea grabbing up the

best and most prospective properties available. Papau New Guinea,

with its unique geology, having two fracture zones going through

it, has had quite a lot of geological activity past and present.

It hosts some of the largest gold deposits in the world. All

of the Kanon properties were selected for their potential to

be multimillion ounce resources. Vangold and New Guinea Gold,

through Kanon Resources, have a share in the "crème

de la crème" of Papua New Guineas exploration

properties!

At the time that Kanon was

acquired by Vangold and New Guinea Gold, Kanons huge properties

totaled to 1399 square kilometers (139,900 hectares) which is

just over 0.3% of the entire land area of Papua New Guinea

or the equivalent of about 52% of the land area of the state

of Rhode Island in the United States or almost 25% of the land

area of Prince Edward Island in Canada!

There were five properties

in the original package. However, since that time, the management

of Kanon has agreed to a 50:50 joint venture with NGG in one

of the previously held NGG properties, Mt. Nakru. Since Vangold

has a 50% interest in Kanon, that gives Vangold an effective

25% in Mt. Nakru. So, including the Feni Islands, Vangold has

an interest in seven properties in Papua New Guinea now!

Both VAN and NGG had the right

to increase their interest in one of the initial Kanon properties

to 60% by funding the first $300,000 worth of exploration, which

NGG opted to do with regards to the Mt. Penck property. As it

currently stands then, here is the interest each company holds

in the seven projects:

| |

VAN |

NGG |

| Feni Islands |

75% |

25% |

| Bismarck |

50% |

50% |

| Mt. Penck |

40% |

60% |

| Allemata |

50% |

50% |

| Fergusson |

50% |

50% |

| Yup River |

50% |

50% |

| Mt. Nakru |

25% |

75% |

An estimated $15 to $17 million

dollars (Australian or Canadian) has been spent on exploring

these properties. Based on the amazing widespread results obtained

so far, it can be truly said that all of these properties have

the potential to host rich sources of gold, while especially

Mt. Penck, Yup River and Bismarck have the potential to

be another Porgera-like find!

I asked Peter McNeil, Managing

Director of Kanon, to send me more information about the properties

owned by Kanon. These properties contain over 60 areas

of proven anomalous mineralization! The vast majority are gold

properties but some also contain silver, platinum group metals,

copper, and/or other base metals. They range from findings with

high grade veins to large lower grade prospects with bulk tonnage

potential. Some have had only minimal work done on them, but

have already produced promising results with discoveries of gold

in veins, soil or streams. Others have had enough work done on

them to begin diamond drilling. Some already have inferred resources.

The detailed data that Mr. McNeil sent me pertaining to these

properties and the discoveries and work already done on them,

excluding the numerous maps, filled some 22 pages of A-4 size

(standard letter size) paper! There is no way that a 3000 word

report like this one can do justice to the discoveries already

made and catalogued. Considering in more detail the vast extent

of past work performed and the results obtained on just 1 of

6 Kanon properties, should aptly illustrate the excellent potential

of all of the properties

Of the five original properties

of Kanon, three are not rectangular blocks of land, but are irregularly

shaped to include only known mineralized areas. All have been

selected to cover highly prospective land areas.

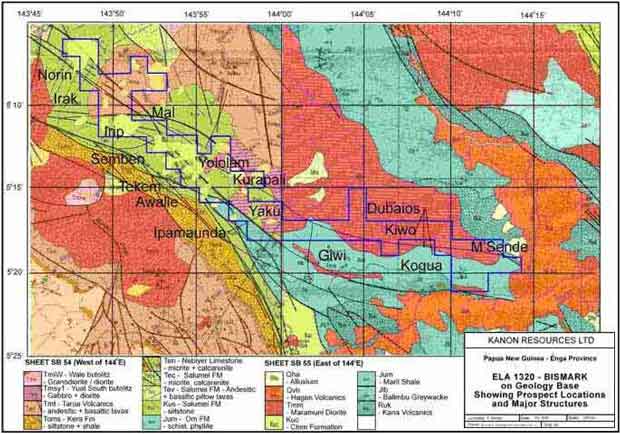

The Bismarck

Property (Vangold 50%)

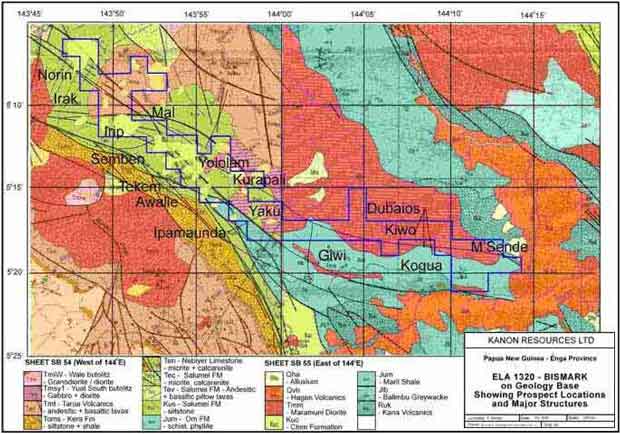

Consider the map of the 206.2

square kilometer Bismarck property below:

The entire licensed area stretches

for approximately 55 km from its SE to NW corner. Why

does it have this unusual boundary shape and the sixteen names

of locations within it? It is because the property has been carefully

selected for known gold occurrences and to cover the entire Bismarck

Fault Zone. There are sixteen areas with known gold anomalies

and a total of some A$6 million has already been spent on exploring

this property. The most advanced work within this property has

been done at the Tekim and Semben Projects. The Bismarck property

is about 100 km NE of the 25 million ounce Porgera Mine and the

Tekim project is geologically similar. Access is by air only.

Here are some highlights:

Tekim

- A 1400 meter long gold in

soil zone

- A large magnetic anomaly

- Trenching of 20 m of 6.99

g/t Au, 90 m of 1.42 g/t, 75 m of 1.0 g/t and 25 m of 4.8 g/t

- Five shallow diamond drill

holes revealed wide zones of low-grade mineralization including

80 m of 1.5 g/t, within which is a gold oxide zone of 29 m of

2.1 g/t and a high grade area of 0.75 m of 23 g/t Au

- Gold in soil up to 18.8 g/t

and in rocks up to 5.8 g/t

- Ready for drilling

Semben

- Quartz dike with high grade

gold veining

- Within a 700 meter long structure

that appears to be about 3 km long in aerial photographs

- Trenching revealed 3 m of

156 g/t, 4.5 m of 23.5 g/t and 2.0 m of 17.0 g/t with coarse

gold

- Four diamond drill holes showed

gold in quartz veins with 0.75 m at 23.5 g/t containing 8.2 m

of 3.4 g/t Au

- Ready for further drilling

M'Sende

- Rich amounts of gold in streams

in 23 of 26 samples draining an area of roughly 4 square kilometers

- Panned concentrates to 30.9

g/t and 76.1 g/t Au

Kurapali

- Trenching showed 17 m of 1.2

g/t Au including 5 m of 2.1 g/t 3.8 g/t in an outcrop

Awale

- Anomalous gold in soil over

a large 1 km by 0.4 km area

- Rock samples up to 10.7 g/t

Au

- A channel sample of chalcedonic

quartz showed 3.33 g/t Au over 5 meters

- No trenching done on soil

anomalies yet

Yorolam

- Rock chip samples up to 43.2

g/t of gold

Giwi

- An area of roughly 600 m by

500 m with 500 ppm copper with low grade gold (max. 0.94 g/t)

- Rock chip samples average

0.15% copper with a maximum of double that

Irak

- Rock samples up to 9.6 g/t

gold and 2.8% copper

- Average of copper in rock

samples was 0.3%

Irib

- Rock chip samples up to 6.7

g/t Au

- Copper in significant grades

Norin

- Rock chip samples up to 1.5%

copper and 1.1 g/t gold

These are only 10 of the 16

prospects within the Bismarck Property.

See Bismarck

Gold Property for additional details.

Space does

not permit this kind of detail to be given about all of Kanon's

Papua New Guinea properties. But each of them has produced similarly

excellent and widespread results. Drilling on

Bismarck is to begin the second quarter of 2004.

Following is a brief discussion

of the other five Kanon properties.

The Mt. Penck

Property (Vangold 40%)

- 101.4 square kilometers

- 6 major prospects

- Major prospects within an

area 1.5 km by 0.8 km

- Near the sea coast (1.5 km

away) making sea transport possible

- New Guinea Gold to begin drilling

first quarter 2004

The Kavola East Prospect

has produced tremendous results in the June 2003 trenching program

showing extensive gold mineralization right on the surface..

Highlights include the following:

Trench # 1 - 97 meters at 3.39 g/t Au

Trench # 4 - 131 meters at 2.36 g/t Au

Trench # 11 - 88 meters at 2.5 g/t Au

Drilling highlights at Kavola

East thus far:

- 55 m at 2.75 g/t gold

- 15 m at 11.73 g/t gold

- 40 m of 8.89 g/t gold

Early results: minimum inferred

resources at 50 m in depth or less: 100,000 oz. of gold at 2.1

g/t Au.

Excellent results from the

other five prospects within the Mt. Penck Property. Drilling

to begin this quarter.

See The

Mt. Penck Gold Property

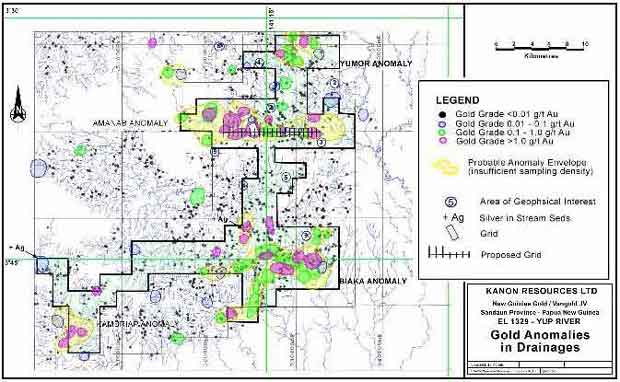

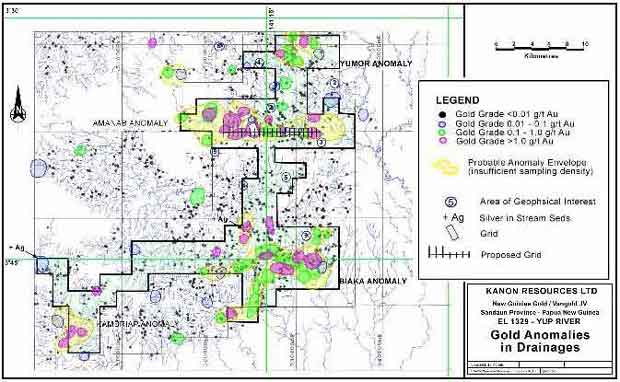

The Yup River

Property (Vangold 50%)

- 378.6 square kilometers

- Exploration is still at the

basic stage, but promising results have been produced

- Extensive reconnaissance sampling

has defined three large and one smaller, coherent high-grade

anomalies, plus numerous smaller ones.Peter McNeils report

- Three large anomalies named

Yumor, Amanab and Biaka

- Amanab anomaly is 20 km long

by an average of 3 km wide

- Biaka anomaly is 15 km long

by an average of 4 km wide

- Yumor anomaly is over 6 km

long

For these three properties,

stream sediment measured at up to 107 g/t, 91 g/t, and 77.5 g/t

respectively.

Property selected to include

only areas of known mineralization.

Road access is limited. Access

by plane to three government airstrips within the property.

See The

Yup River Gold Prospect

The Mt. Allemata

Property (Vangold 50%)

- 243.4 square kilometers

- 15 prospective areas with

good results so far

- Historically, 14,000 oz. gold

mined from high grade veins

- Trenching in many areas produced

medium to high grade results over significant distances: Such

as 30 meters at 9 g/t Au; 3.5 m of 61.5 g/t; 20 m of 5.58 g/t

Twelve drill holes showed medium

grade mineralization from the surface.

- Gold vein rock sample: 1 m

of 70 g/t

- Pan concentrates up to 91.3

g/t

- Good access by road, air and

sea

See The

Mt. Allemata Gold Project

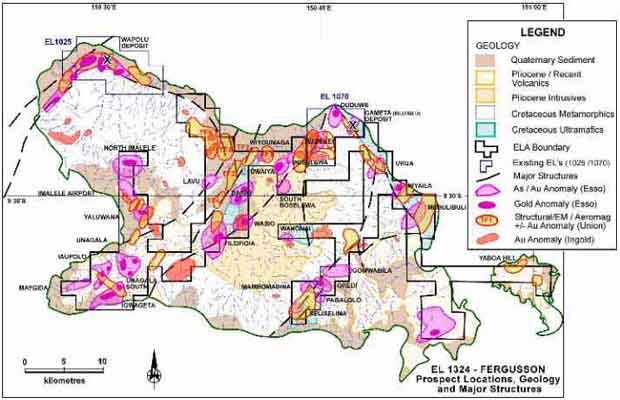

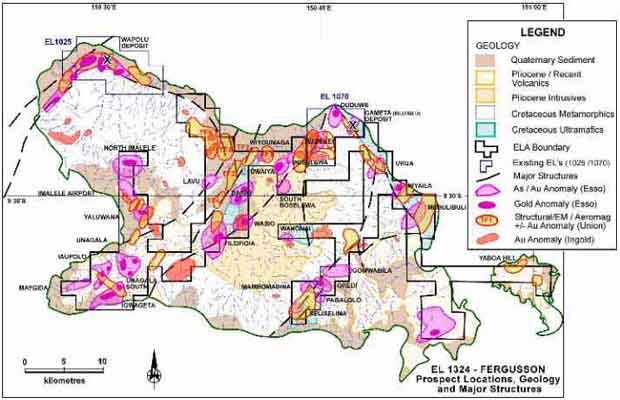

The Fergusson

Property (Vangold 50%)

- 469.8 square kilometers

- More than 32 prospective areas

- Access by boat

- Wide spread low to high grade

near surface mineralization

- Property carefully selected

to include only known mineral occurrences

See The

Fergusson Property

The Mt. Nakru

Property (Vangold 25%)

- 47 square kilometers

- Mt. Nakru has widespread medium

to low grade copper accompanied by low grade gold with potential

for higher grade finds

Vangolds market capitalization,

fully diluted, at C$0.65 per share is a mere C$19.4 million (US$14.7

million) and, with its share in these seven PNG properties it

is obviously considerably undervalued. Vangold also derives significant

income from its interest in an oil and gas project, and has important

high grade gold properties in Canada and the United States.

Disclosure:

We own shares

of Vangold. I was compensated by Vangold for my time in preparing

this report. The opinions expressed in this report are my own.

Paul the

Benjaminite

February 21, 2004

Paul the Benjaminite, B.S., A.S., completed seven years of university

studies including such diverse subjects as chemistry and business.

He is a teacher whose professional experience includes eight

years as a secondary school teacher of sciences including chemistry,

physics and basic geology.

321gold Inc

|