The Best Kept Secret in Mexico The Best Kept Secret in Mexico

Bob Moriarty

Archives

December 1, 2005

I recently

came back from a three day trip to the best kept secret in Mexico.

I also took a look at a billion ounce silver mine.

The most popular

business model in the gold/silver juniors is that of raising

some seed money, picking up a property or two, do some drilling

and surface exploration until you run out of money, raise money,

drill holes: All in the hope of someone coming along one day

and buying the company out at great profit to the investors.

Unfortunately, it only makes profit for the insiders and those

raising capital for the company. When is the last time you heard

of a junior being bought out for any reason? It's pretty much

a variation of the greater fool theory so common among home buyers

at present. Surely there must be a greater fool than me.

Barbara

and I used to run a small computer company selling CPU upgrades

for Macintosh computers. We were good at it and made money. Actually

we used to outsell MacMall and MacConnection by a bunch so you

could safely say we were real good at it.

When we

began selling these CPU upgrades on the web, the web was still

taking baby steps. Our closest direct competitor was Cyberian

Outpost in CT. When we were doing $3 million in sales and clearing

a nice fat profit, they were doing $21 million in sales and losing

$7 million. This was in the days of the dotcom magic. Cyberian

went public and soon had a market cap of $500 million. I did

some math and if my numbers were right, our little two man (sorta)

company should have been worth about $71 million. Except for

the minor fact that they were losing money hand over fist and

we were making money. I told Barbara about our new found wealth

and she told me I was daft.

As long

as we ran the company, we made money. That seemed to make sense

to me. As long as Cyberian Outpost existed, they lost money.

Eventually they went teats up and destroyed $500 million dollars

of shareholder value. But we weren't much better off, Steve Jobs

hates the idea of anyone making money off of Apple computers

so he killed the CPU business. We kept going until we couldn't

make a reasonable profit and then we simply shut down and went

on our way. We had a good business model but it didn't call for

us to lose money.

When you invest

in a junior, you are not only getting into bed with the company,

you are getting into bed with their business model. Make sure

that (1) you understand how they intend for you to make money

and (2) it makes sense. As far as I am concerned I get very nervous

when a junior doesn't have a plan for making a profit somehow,

someday. That makes me fairly unusual, the standard business

model accepted by almost everyone is to drill and spend and pray

until you have a zillion shares, then do a rollback and start

over. Make sure that at least in theory you have some way of

possibly making money some day. If you don't, you won't.

The Best Kept Secret

in Mexico

In early November

I went to Mexico to visit a new property of Great Panther

Resources in a town called Guanajuato. Located in Central

Mexico at an elevation of about 6,000 feet, it is hot during

the day and chilly at night. Designated a UN World Heritage Zone

in 1988 because of its ancient buildings and deep sense of history,

it attracts visitors from all over the world. The city is the

best kept secret in Mexico, it's so beautiful and still pretty

much off the beaten path.

Guanajuato

is Mexico's foremost mining state. In the south fertile plains

support a variety of livestock and the cultivation of corn, wheat

and beans.

The Spanish

first visited the area around 1541. By 1546 the Viceroy of New

Spain granted Don Rodrigo de Vazquez a license for a cattle ranch

in return for his services to the King of Spain. Two short years

later. in 1548, a mule driver with the name of Juan Rayas changed

the course of history by discovering the richest silver vein

in history. Rayas was driving a team of mules on his way to the

newly discovered ore deposits at Zacatecas when he stopped over

night near the Cerro del Cubilete in Guanajuato. The next day

he found streaks of melted silver in the rocks surrounding his

camp fire and the rush was on.

The primary

silver structure is called the Veta Madre vein and it extends

an incredible 25 kilometers. At one point, the richest mine in

the district: the La Valenciana, still in production today, produced

over one third of the silver in the world. It was said that Count

of Valenciana, Antonio Obregon y Alcocer, was the second richest

man in the world. Second only to the king of Spain. Over the

course of 450 years, the mines of Guanajuato have produced somewhere

between 1.2 and 1.5 billion ounces of silver.

The Best Kept Secret

in Guanajuato

In 1939, after

much labor unrest, a number of the mines were turned over to

the Cooperativa Santa Fe de Guanajuato. And it was all downhill

from there. I don't think much of governments, history books

are filled with tales of the stupidity and blunders committed

by those in government. It seems to me governments can't do much

right. Cooperatives may as well be the same thing, they are true

democracy at work; mob rule.

In 1939 the

cooperative took over the richest 4.2 kilometers of silver in

Mexico. It only took them 65 years to run it into the ground.

The mangers should be complemented, all of the other similar

cooperatives in Mexico failed long before the Cooperativa Sante

Fe de Guanajuato. But when you run a mine based on a democracy,

it can only come to a bad end. Everyone wants to vote benefits

to themselves and their friends. By August of this year, it got

so bad the government turned off the power and they were forced

to mine by hand, the same way as they did 450 years ago.

Bob Archer

of Great Panther had his ear to the ground and when he heard

about the power being turned off, he hustled his way down to

Guanajuato. While it may not seem fair to qualify the sale as

outright theft on the part of Great Panther, it's close. While

everyone else in the business was snoozing or out at the airport,

Bob realized his ship had come to port. The cooperative didn't

want to sell, they had to sell. Each day made the apparent value

of the mines lower. Archer came in with a rock bottom price of

US $7.2 million, most of which is going to pay pension obligations

of the cooperative.

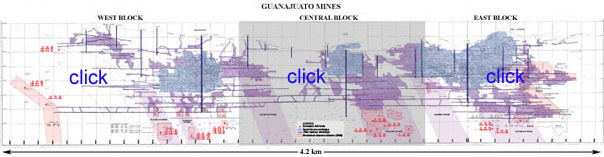

The purchase

price includes 1107 hectares in the two main properties, a 1,200

ton per day mill, workshops and administration facilities and

all the mining equipment. They own 4.2 kilometers, the richest

4.2 kilometers of the Veta Madre vein, most of which has been

barely explored.

click

on image to see the various blocks

Great Panther

has paid $1.45 million already and has 13 months to pay off the

remaining $5.8 million. They do have to stretch but after all,

they own a barely explored series of mines with 25 shafts, 4

winzes (internal shafts) with a past production of about a billion

ounces of silver.

When I visited

in early November Great Panther had barely closed the deal. Even

in the midst of the richest silver district in Mexico it was

possible to hear the gnashing of teeth from all the other Mexican

silver companies who missed the boat.

There

is a meaningless 43-101 resource but I won't even go into it.

When you are looking at a project of this size, you have to look

at the past production and try to guess just how much they took

out in a percentage. Believe me, the past production isn't much

compared to what is left. Let it be said that Great Panther really

doesn't have to explore for silver, you don't explore this kind

of deposit. When you are exploring, you are guessing. At Guanajuato

they don't have to guess, all they have to do is locate. And

just looking at the side view of past production shows a lot

of gaping holes where no one has ever put a drill. So Great Panther

isn't exploring, they are just locating the silver they already

know is there. There

is a meaningless 43-101 resource but I won't even go into it.

When you are looking at a project of this size, you have to look

at the past production and try to guess just how much they took

out in a percentage. Believe me, the past production isn't much

compared to what is left. Let it be said that Great Panther really

doesn't have to explore for silver, you don't explore this kind

of deposit. When you are exploring, you are guessing. At Guanajuato

they don't have to guess, all they have to do is locate. And

just looking at the side view of past production shows a lot

of gaping holes where no one has ever put a drill. So Great Panther

isn't exploring, they are just locating the silver they already

know is there.

Actually buying

a 1,200 ton per day mill for $7.25 million wouldn't be all that

bad of a deal all by itself but this mill was the saddest mill

I have ever seen. The cooperative didn't do a lick of maintenance

or upgrading. 90% of the mill would make better scrap iron than

a mill. But there isn't an issue with Great Panther, Bob Archer

knows half his job is rationalizing the mine and mill, not finding

silver. He has a giant resource, it's up to him to make it make

some sort of sense. I suggested to him that he could pretty much

make it anything he wanted to make it. He could try to optimize

a mill to match the production capability.

The lack of

maintenance was so bad that when we went down to the 300 foot

level in a truck, the clutch was so worn out that we almost had

to walk back to surface. Bob Archer tells a story about how he

saw a pile of beat up iron balls next to the one working ball

mill and he asked what they were doing there. He was told that

they were too out of shape and worn to be used so the miners

used block of granite to replace them. So as they were crushing

the ore, they were also diluting it. By the time the mine was

closed in August, the miners were being forced to carry 50 kilo

sacks of hand-picked ore to the surface. It was a sad tale.

click

on images for large photos

Bob already has a drill rig hard at work.

We viewed some of the core from the current hole, the mineralization

is easy to see and he has located an entirely new section of

the vein. I would be very interested in learning his cost of

locating new ounces. I've always felt the Vancouver brokers get

carried away with 43-101 ounces but his cost of locating ounces

should be among the lowest in the industry. With companies around

like Silver Standard getting $.90 an ounce for ounces in the

ground with no mines or mills, Great Panther is going to get

a hell of a premium for their ounces, these are real ounces of

silver which are going to be produced, not hatched some day.

Endeavour Silver began this

model of buying assets cheap and adding ounces of silver to increase

shareholder value. I really like the model and Brad Cooke deserves

full credit for being the early riser. And in my visits to Fortuna

in Peru and now Great Panther in Guanajuato, I've seen the model

expanded and increased. In my view, the entire silver industry

is due for a major shakeup and shakeout. I cannot understand

the absurd valuations of the few silver companies around. I like

Pan American, they have good mines and great management. I cannot

understand Coeur D'Alene, what makes the CEO worth $880,000 a

year when profit is as rare as hen's teeth. And just how long

does Silver Standard intend to play the "sit on silver until

it hatches" trick? Their model made some sense at $3.50

silver but times change and for all their puffed up egos, prices

change, too. It's time for those silver companies who want to

think of themselves as leaders to start leading.

While I was

in Mexico I didn't have time to visit Great Panther's Topia property

but details can be found on their

website. They intend mining some high grade ore and it seems

their goal is to produce about 1.5 million ounces of silver a

year at a cost of about $3. Their deal there brought with it

a 200 TPD mill and they are in the process of reconditioning

it at this time as they conduct exploration drilling.

We have been owners of Great Panther shares for almost 2 years.

I bought into their story a long time ago when it was just a

great idea. Well, they have the goods now and are going to be

competing to get into the top five silver producers. They have

the mines and the silver and I believe the management team. The

market is not giving them any credit for the ounces which they

obviously have. The entire market cap of Great Panther is under

$20 million Canadian and that isn't going to last long. They

have a lot of silver, should be one of the lowest cost producers

in the business and will be producing in 2006. Look for them

to be leading the pack in under three years.

Great Panther is an advertiser. They have not paid for this article

and it is my opinion and only my opinion. As always, we want

to remind investors they are responsible for their own investment

decisions. I do own shares. I am biased.

Great Panther

Resources, Ltd

GPR-V $.62 Canadian 35 million shares outstanding.

Great Panther website.

Bob Moriarty

President: 321gold

Archives

321gold Inc

|

There

is a meaningless 43-101 resource but I won't even go into it.

When you are looking at a project of this size, you have to look

at the past production and try to guess just how much they took

out in a percentage. Believe me, the past production isn't much

compared to what is left. Let it be said that Great Panther really

doesn't have to explore for silver, you don't explore this kind

of deposit. When you are exploring, you are guessing. At Guanajuato

they don't have to guess, all they have to do is locate. And

just looking at the side view of past production shows a lot

of gaping holes where no one has ever put a drill. So Great Panther

isn't exploring, they are just locating the silver they already

know is there.

There

is a meaningless 43-101 resource but I won't even go into it.

When you are looking at a project of this size, you have to look

at the past production and try to guess just how much they took

out in a percentage. Believe me, the past production isn't much

compared to what is left. Let it be said that Great Panther really

doesn't have to explore for silver, you don't explore this kind

of deposit. When you are exploring, you are guessing. At Guanajuato

they don't have to guess, all they have to do is locate. And

just looking at the side view of past production shows a lot

of gaping holes where no one has ever put a drill. So Great Panther

isn't exploring, they are just locating the silver they already

know is there.