|

|

|

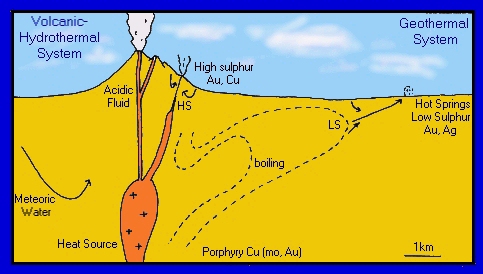

Different epithermal gold assemblages related to fluid type and location |

|

|

|

Diagram from Colley. H, Module 8346, Mineral Resource geology |

Here's how Gallery says the same thing:

Copyright

©2002 Gallery Resources

That's a little more complicated than most of us want to know and I'm going to try to simplify what they said. Please forgive me in advance if I am not totally correct on any aspect from a geology point of view. I am not a geologist.

Basically Newfoundland (which used to be connected to South West England 350 million years ago) is at the edge of a massive tectonic plate. Superheated lava formed deep within the earth's crust and found its way to the surface. Heat from the lava formed hydrothermal (hot water) convective systems containing minerals. Yellowstone is nothing more than the same thing today.

These superheated water and minerals systems cause most of the richest gold deposits we know about today. As early as 20 years ago, major mining companies were actively prospecting this area looking for a repeat of the Buchan's Mine located some 40 miles west. Between 1928 and 1984 this mine produced 16.2 million tons of ore grading an incredible 14.5% zinc, 1.3% copper, over 4 ounces of silver and 1.37 grams of gold per ton.

BHP Minerals held what is now known as the Katie Black Bart Project in 1993 when they dug a single trench which uncovered felsic volcanic rocks. They drilled a short hole which intersected a 6 inch section of 10% zinc, 1.68% lead and 2.4 ounce silver. Which is exactly what a VMS system looks like. But bigger. BHP geologists dismissed the mineral rich boulders and outcrop as a granite rather than felsic volcanic rock with little chance of a large deposit.

But others have since then come to the conclusion the Botwood Basin further to the north-east is home to another potential Carlin Trend. Actually, the Katie Black Bart property also has many of the aspects of the Carlin Trend and while others are finding significant indications of gold in the Botwood Basin, at Katie, Gallery is going for the motherlode.

In March of 2000, Lady Luck spread her wings and smiled on Newfoundland. By sheer random chance, a D-8 Bulldozer on a logging road project uncovered a number of large (greater than 1 meter) polymetallic boulders near where BHP dug the 1993 trench. Prospectors, Gary Lewis and Cyril Reid, of Black Bart Prospecting recognized the nature of the rock and wisely staked the property. They took samples of the boulders to the Prospectors and Developers Association convention held in Toronto in mid-March of 2000 where Bruce Costerd, President and CEO of Gallery Resources saw the rocks and immediately cut a deal to acquire the property.

One of the boulders assayed a remarkable total of 32.6% combined zinc-lead-copper. Another showed silver at 4.4 ounces per ton and also gold at .10 ounce per ton.

When Gallery Resources employees did a preliminary survey of their new property, they uncovered more polymetallic boulders in the area around the initial discovery site and identified a widespread distribution of the favorable felsic volcanic rocks. Based on this highly-favorable discovery, Gallery increased the size of their claims from 4,500 acres to 45,600 acres making it one of the largest mineral properties in Newfoundland covering 27 kilometers (18 miles) of strike length.

At the same time Gallery was conducting an initial survey of their property, a pair of young geologists from a tiny company called Altius convinced mining giant Barrick to enter into a joint venture with them to explore part of the Botwood Basin. When word spread of Barrick's interest, a staking war took place in Newfoundland with dozens of small exploration companies eager to enter the fray.

So far the Botwood Basin has been like the a stripper at a cheap carnival show. Everyone knows there is something there, they just have to sort through too many veils to find it. Botwood Basin has gold. But has yet to prove any major deposit.

But slightly to the south and west of Botwood, Gallery has a commanding land position called the Katie property and they believe it's about to pay off in a big way. Since the initial discovery and Gallery's deal with the original claim holder in March of 2000, Gallery has been conducting soil samples and geophysical surveys. (They literally scoop up soil samples on a regular basis and test for trace elements. They really aren't looking just for gold, they are looking for all the precursor elements which are found in all epithermal gold systems).

Gallery raised money for a drill program of 30 holes in early summer and began to drill in late July. By August they hit what they were looking for, positive signs of an epithermal system identical in texture to a epithermal system discovered by Altius at Rolling Pond further north in the Botwood Basin.

What they refer to as hole KP-32 intersected a 190 foot thick section of what is called a boiling zone. Remember, the minerals are transported through the rock in a hot water fluid which gets its heat from the hot magma. This "boiling zone" of hydrothermal action is exactly that, where the temperatures are so hot that the fluid boils. And the key is that the boiling zone will contain very specific chemicals and minerals in a true epithermal system. Gold is rarely present in the boiling portion of an epithermal system but does increase with depth. There is only sporadic gold in the 60 some meter section of KP-32 (.15 gram per ton) but ten times as much silver. Which is to be expected, silver is a lighter material.

In a epithermal system the "boiling zone" covers a potential zone of high-grade gold mineralization which can contain values up to 1 ounce per ton called "bonanza gold." This high grade mineralization is what Gallery believes they will find once they drill the new 30 hole program. Typically the high grade zone will start below 350 meters (1150 feet) and continue to a maximum depth of about 1000 meters, (3300 feet).

So far, the story of Gallery and their epithermal system at Bruce Pond is a fairly straightforward and ordinary tale. They located a high potential claim... did the low cost ground studies and research... drilled a highly successful hole which confirmed their original theory. But you or I can go to any mining company on the planet and they will tell a similar if not identical story.

What's different with Gallery?

Actually, it's who is willing to bet on them. You can believe the President and CEO of Gallery Resources, Bruce Costerd, believes in his own company. He owns or controls almost 10% of the outstanding 93 million shares. While it's edifying to know he thinks highly of his company and has put his personal fortune on the block, it's more interesting to see who else believes Gallery is on the right track and about to make mining news in a big way.

I can't emphasize how significant that is. Face it, there are a lot of sharks in the mining business, and while Bre-X ran most of them out I realized at the New York mining show a month ago that they sense blood and are returning in numbers. There are two kinds of exploration companies, those who seek gold and those who seek investment. There are dozens of companies who couldn't find gold if you locked them in the basement of the New York Fed sitting outside a cage of 400 ounce bars. There are lots of companies who want nothing more than to raise money and drill useless holes in the ground. And there are companies such as NovaGold who find gold, and then more gold, and then more gold. You can look at the stock and see how the market treats companies who actually find gold in economic quantities.

But there is also another expert in knowing about drill holes and what is found in them. And that's the drilling company. Much or most drilling is done on a contract basis. You have to be a pretty big company to afford to have drill rigs and highly trained crews sitting still on a regular basis. When small exploration companies drill, they almost always contract out the work.

I'll state for the record what should be obvious. If you went and talked to the drill crew on any mining project, you could stake your fortune safely on what they have to say. They know the stinkers, they watch the drill cores come out day after day after day. You can't kid a driller, they have seen and heard every trick in the book.

(There's one trick I really like hearing about. It's called twinning. An exploration company will come up with a likely drill target, raise money by selling shares and sink a hole which shows good values. Then they sink another hole right next to the first. Which shows almost identical values. Then they go out and raise more money, and more money and more money). They get rich selling shares. You want to deal with people who plan on making money by finding gold.

So if there was such a thing as an unbiased expert in the mining business, it would have to be the drilling contractor. They get paid on a per foot basis. They don't care if a company finds minerals or not. Actually they probably prefer to not find an economic deposit, then the company keeps drilling and and drilling. And the driller gets paid and paid.

Gallery's drill company wants to take shares in lieu of partial payment. They will take enough in cash to pay the crews and for the equipment but they want shares in the company before the current drill program starts. Now what does that tell you about what the drill company thinks of the prospects at Bruce Pond?

Investing in gold mining shares is gambling. Forget whatever anyone tells you about reasonable and prudent. Buying stock is always a gamble, a crap shoot. The game is rigged, you have less information than anyone else in the game and most gold exploration never pays back the original investment. But those who do pay off in a big way.

I've been trying to understand for years why gold would be a good investment. It's a business which sucks in a lot of ways, you are constantly eating your young and when it's bad, it's really really bad. And then I start thinking about our debt-based financial system and how every dollar created is created out of thin air as a loan. And I start realizing that a debt based system can only end in one way. And gold, as bad as it is, starts looking better and better.

The race is not always to the swiftest; nor the battle to the brave. But that's the way to bet.

I paid my way through Marine Corps boot camp shooting dice made out of two pieces of chalk. I knew the odds on each roll and I don't think any of the other boots did. And I did the same thing all the way though flight training during the 1960s. The idea of gambling may shock you but I still pick up the dice in Nevada and win on a regular basis.

It's easy, even when the odds are against you. The trick is in money management. If you set the money you are willing to lose at a maximum of $750 and make the best odds bets on craps, the odds are about .75% against you. But over the course of an evening $100,000 will cross the table back and forth between you and the house. Wait until you have more money than you walked in with and then leave the table a winner.

The only other alternative is to walk away a loser and that's what everyone else will do. Let them.

Gallery Resources is selling at between $.09 and $.11 as I write this. That's all Canadian, you almost have to buy the Canadian shares trading under the symbol "GYR" on the TSX Venture Exchange (TSX.V). There are 93,000,000 shares outstanding which is a lot. But the market cap is about $9 million which isn't much considering this isn't their only project. I would be happier with fewer shares but the last few years have been a disaster in the mining business for everyone. Gallery Resources isn't the only company with poor liquidity, a lot of shares and a lot of dry holes. But that was then and this is now.

Our debt based financial system is going to end in a bad way. I can only think of one way. I have put most of my money in gold and silver shares and physical metal. I am always willing to take a risk if the return is right.

Gallery Resources has been a $2 stock twice before, in 1990 and 1996. During the preceding year before discovery of the epithermal system at Bruce Pond, the low on the stock was $.06. I have no reason to believe that represents anything but a floor. The stock can go down from $.09 where it is now to $.06 if Gallery discovers a lot of rocks at the bottom of 30 holes in their current drill program. The risk is 33%. The reward is a lot higher.

The claim holder is betting on the success of this drill program. The drill company is betting on the success of this drill program. The president of Gallery Resources is betting on the success of this drill program. It's a bet, but it's not a bad bet.

Do not chase the stock. It's not very liquid and that's not good. Hopefully as the word gets out the liquidity will improve. Buy the Canadian shares, the US OTC is far too illiquid and the market maker will make salami out of you. If your broker cannot buy the Canadian shares, change brokers. Penntrade, (founded by Alex Pennaluna in 1926, is one of our favorite companies and we think you will find them your favorite as well), is where we recommend to buy the Canadian shares, they are reasonable in price and tremendous in service.

The drilling program of 30 holes has commenced. Results will be announced over the next 2-3 months as they home in on the best holes. One of these days I think the stock is going to shoot up like a squirrel running up a tree with its tail on fire. Make sure you are invested before that day. When it has gone up a lot, sell.

-Bob Moriarty

October 18, 2002

Nothing we write is

intended to be anything more than our opinion about the merits

of a stock. Before buying or selling any stock, the investor

should do his own due diligence.

We are investors for our own benefit. At any one time we may own 25-30 different mining stocks. It follows that often we will own stocks which we have written about.

Copyright ©2001-2026 321gold Ltd. All Rights Reserved