..

Gold Stock

Alert:

Caution, Caution, Caution

Bob Moriarty

May 19, 2003

How many times

have you read prognostications where the analyst would say something

to the effect "If it goes up past 140 it will go up more

and if it goes down past 125, it will go down more."

I mean, aren't those the only alternatives? Everything either

goes up or down. Things rarely remain exactly the same. And after

the fact, you can count on the fact the person making the claim

will insist they called it correctly. "Well, I said it was

going up." Well, they almost always say it's going down

as well and one of them almost has to be true.

Basically,

people try to cover all the bases because no one has a crystal

ball, we are all just guessing. But some guess better than others.

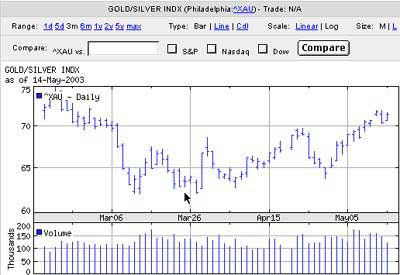

In late March, I said, "Buy,

buy, buy"

in a Gold Stock Alert. I do not claim to have a crystal ball

but I am close to the market and try to get a feel for the overall

status of things. It felt like a good time to be buying gold

shares. At the time, the HUI was about 115, now it's 135 and

change. I've put in a chart of the XAU with an arrow showing

where I made the call.

So it's about

time I come up with a nice ambiguous call because I'm not liking

what I see in gold stocks. Bear with me and realize I could be

totally wrong. But follow along.

In December, starting about the 10th or so, gold began a long

rise from about $320 to just over $390 in early February. And

the gold stocks wouldn't wake up. That's not true of all of them,

I bought a bunch in early December, for a friend, which went

up about 50%. But a 20% move in gold should mean about a 120%

move in the small gold stocks and we saw barely half that. Gold

was moving but the gold stocks weren't. Sentiment towards gold

futures turned overly bullish in January and it should have been

clear that gold was getting dangerous.

Sure enough,

both physical gold and gold shares got clobbered in the January-March

period with many juniors down 50% from their yearly highs as

gold retraced all the way back to the low $320 range. We did

hit a bottom and have come up from there. As luck would have

it, my call in late March was not bad.

Chart

courtesy of Yahoo! Finance

But with another

$35 move higher in gold, the gold shares as measured by both

the HUI and XAU have barely budged higher. They are higher but

not by much. And that's with the dollar doing a swan dive and

Iraq waking up and not particularly liking the American definition

of freedom. Gold's up but don't get carried away thinking this

is all there is.

I think we

are a lot weaker than we ought to be. And if gold shares don't

want to move on a $35 move, the dollar falling out of bed, bonds

busting through the rafters and the Canadian peso acting like

it's on Viagra, you might want to show some caution.

The US dollar will rebound and when it does, both the Canadian

peso and gold will get hammered. The dollar is years from a bottom

but even in a brutal bear market, there are violent bull rallies.

I suspect we are in for 2-3 months of weak gold share prices.

So I am urging caution on the part of our readers.

Richard Russell

says about gold, "Buy and hold." And he's right; if

you have bought gold or gold shares in the past two years, you

probably haven't done badly and can count on doing far better

in the future. We are a lot closer to the bottom in gold than

to the top. I firmly believe the actions of the Bush administration

and the Federal Reserve have pretty much destroyed the future

of the dollar as an international reserve currency. When the

rest of the world realizes there is nothing supporting the dollar

but hot air, look for the dollar to go a lot lower and gold a

lot higher. For all purposes, the neo-cons have declared war

against both China and Saudi Arabia in public. By dumping their

dollar holdings, either country could turn the US into a 2nd

World nation in six months. And they might just bite the bullet

and do it.

Harry Schultz

on the other hand suggests you trade gold shares and gold. Actually,

he almost insists on it. So if you believe him and my warning

makes sense to you, you might want to lighten up on the gold

shares. But within the next 2-3 months, there will be an extraordinary

opportunity to buy gold shares cheap. So keep your powder dry.

If you don't agree with me, you need do nothing. But I am seeing

warning signs and I want to point it out. I could be dead wrong.

While I suspect gold shares are going down a bit, I also suspect

the Dow and S&P are on the verge of doing a nose dive. May

through October is traditionally the worst period of the year

for holding common shares. The VIX is screaming complacency and

the sheeple are about to get sheared again. October would make

a real good time for a stock market low before the market begins

a nice 150% advance.

Bob Moriarty

May 17, 2003

_______________

321gold Inc Miami USA 321gold Inc Miami USA

|