| .. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Company |

Symbol |

Resources

at |

Shares |

Ounce |

Price $C |

Mkt

Cap $C |

Net

Cash |

Cap oz |

| NovaGold | NRI-TO |

11.7 moz |

29.7 |

.39 |

$3.15 |

$93.6 |

$2.5 |

$7.78 |

| Gabriel | GBU-TO |

11.4 moz |

93.5 |

.12 |

$3.34 |

$312.3 |

$30.0 |

$24.69 |

| Miramar | MAE-TO |

6.9 moz |

60.2 |

.11 |

$1.40 |

$84.3 |

$11.6 |

$10.53 |

| MindFinders | MFL-TO |

3.2 moz |

21.9 |

.15 |

$2.57 |

$56.3 |

$1.6 |

$17.09 |

| Francisco | FGX-V |

2.4 moz |

16.4 |

.15 |

$7.15 |

$117.3 |

$32.9 |

$34.86 |

.

Everything is fairly simple up to this point. I have showed that

Novagold is underpriced based on assets, PE and in comparison

to other similar companies. But what should stick out in the

above table and what I have tried to make clear in my previous

articles is the rich nature of Donlin Creek. In my view it is

indeed another Carlin Trend and that's what an investor should

be thinking. They have almost half an ounce of gold per share

at $250 gold but look at what happens if and when gold goes up.

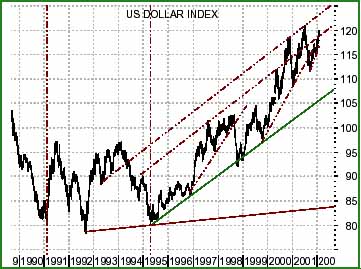

There is no conspiracy holding down the price of gold. I know there are some big names who support the conspiracy/manipulation mantra but it's nonsense and fairly easy to see in the two charts below.

In 1995, Robert Rubin became the Secretary of the Treasury under Clinton. Robert Rubin is the ultimate Wall Street insider and a former Harvard professor. He brought to Washington his theory of a strong US dollar policy. His strong dollar policies weren't done behind closed doors, they were out in the open for everyone to see. And if you look at a chart of the US dollar, you can almost pinpoint when he arrived in Washington.

chart courtesy of Kevin

Klombies IMRA

Whenever we talk about the price of gold (POG) it's easy to forget we are actually talking about two different commodities. One, of course, is gold. But the other is the dollar. And since the value of an ounce of gold is an ounce of gold, and an ounce of gold is quoted in US dollars, when we quote the POG, what we are really doing is quoting the value of the dollar based on ounces of gold.

If you change that only a little bit and quote in currency units other than the dollar, it is obvious that the POG in all currencies other than the dollar has been climbing since September of 1999.

chart courtesy of Kevin

Klombies IMRA

Since the basis of the conspiracy claim is that some mysterious CABAL is holding gold down and the price hasn't gone up since the conspiracy began in 1995, all we have to do is look at the chart.

And we see gold has been going up in every currency but the dollar since 1999 and it's actually the strong dollar policy of Robert Rubin which has caused the appearance of a weak POG. What has really happened is that the dollar has gone up rather than gold going down.

I hold a strong opinion that the price of gold will soon change. I believe gold bottomed in September of 1999. I have said so, and here it is for the record. Gold is in a bull market. The bottom is behind us. Also I believe there are two different scenarios either of which is possible.

One is to recognize how dangerous the strong dollar position of Robert Rubin has been to not only our economy but to the rest of the world. While Americans enjoyed rapid growth and low inflation, we exported our deflation to the rest of the world while they eventually shipped up to $450 billion dollars of their money a year to the US to finance our balance of payment deficit.

We only have to look at the stock market bubble of 1999 and 2000 to realize what a giant mistake the strong dollar policy has been. We created the biggest asset bubble in history and are only beginning to enjoy the pain as the chickens slowly come home to roost. The bankruptcy of Argentina is the direct result of our strong dollar policy since they tied their currency to ours. But they lacked the ability to continue printing dollars in a credit bubble which most Americans still deny.

That money must return home one day. It's the nature of the international system. When it does, the dollar will drop. And even President Bush has begun to recognize the damage done to our manufacturing sector. Our "leaders" in Washington are still in denial but the effects of the strong dollar have brought down Argentina, may well bring down the Japanese banking system and cause more bankruptcies in the US than in our entire history. let there be no question in your mind as to how I stand, the strong dollar policy was a mistake and will ultimately be blamed for the depression we are so swiftly approaching.

At a minimum, I expect the US dollar to begin falling within the next two months. There is a lot of "hot' money from both Japan and Europe chasing assets right now. The Japanese banking regulations decreasing government protection of bank accounts takes effect on March 31st which is also the last day the Europeans have to place their bets in the "legacy" currencies. Right now both the Europeans and Japanese are betting on the dollar and gold in about equal numbers so we have the bizarre experience of watching gold and the dollar get stronger daily.

One day soon the dollar will weaken. My guess is 30-40% which would result in the POG climbing 45-60% in dollar terms. So I believe $400 to $450 gold is quite possible. For all the nay sayers out there who are so quick to criticize any opinion of others, just look at what the price of copper did last week. In one day it climbed 5%. Gold and silver can easily do the same and I believe they will.

I could go back and redo the table comparing Novagold with the other four stocks but the key is that Novagold has so much more gold resources per share. If gold goes up and the resources of the other stocks increase at a similar rate to Novagold, NRI still gains the most because they have is 2-3 times the amount of gold resources per share of stock. So no matter how much gold goes up, NRI gains the most benefit.

If you accept the value of existing Novagold assets at about C$4.84 and wanted to figure out how much Donlin would increase in value to achieve the $10, $20 and $30 figures for scoping, pre-feasibility and feasibility study benchmarks, I have worked up the numbers with gold at $275. If you add C$4.02 to the C$4.84 figure, NRI should be worth C$8.86 with the release of the scoping study.

It would go up another C$3.94 to C$12.80 in October with the release of the pre-feasibility study and up to C$16.74 with the completion of the feasibility study.

My SWAG for Novagold with $450 gold is C$20 to C$50 and I suspect I might be quite conservative. You are dealing with a company whose management owns a lot of the stock. Novagold will go into production far faster under their current management than under any other situation. They all own stock and you may rest assured they have the interests of the shareholders at heart. If you profit, they profit.

And I also have a doomsday scenario for the price of gold. In my doomsday scenario, gold and silver will regain their historic use as the basis for the monetary system just as they did for most of the last 3,000 years.

JP Morgan/Chase has a derivatives book of about $30 trillion dollars. The GNP of America is about $9 trillion. Someone last week did a story, which we posted, about the Fed stepping in to save JPM because they are too big to fail.

Pardon me for being especially stupid but I fail to see how an economy of $9 trillion can possible bail out a single company which might have losses well into the trillions. The real question should be "Is JPM too big to save?" or "Is JPM too big not to fail?"

I know a variety of writers, some of whom I really respect, have bandied about a POG well into the four figures. That's my scenario, if and when the banks close here, (if it can happen in Argentina and Japan, you think it won't happen here?) the limit on the POG could be $2,000 or $5,000. It almost won't matter what mining stock you buy, all of them will be wildly profitable, remember there is about a 400-800% leverage. If gold doubles, your stock should be up 4-8 fold.

In that case, I would love Novagold even though all gold stocks will have a performance most of us only dream of. At $250 gold, NRI has about 10 million ounces which can be mined economically at Donlin, at $350 gold it goes up to maybe 16 million ounces and at $450 gold it goes up to 21 million ounces. You may rest assured the price of the stock will reflect the incredible resources behind each share.

I like all gold/silver shares at the present time but I love Novagold shares. They may have already gone up 2500% but they are still underpriced. The stock has wonderful liquidity so you could trade them if you wished or you can buy and hold. In any situation from $250 gold to $2,500 gold, Novagold will be both a leader and a winner.

Bob Moriarty

February 5th, 2002