Rich Investor,

Poor Investor Rich Investor,

Poor Investor

David Morgan

Editor: The

Silver Investor

July

30, 2007

One of the

most widely read books on money and investing has to be Robert

Kiyosaki's Rich

Dad, Poor Dad,

which is a unique economic perspective developed by Kiyosaki's

exposure to two "dads," his own highly educated father,

and the multi-millionaire eighth-grade dropout father of his

closest friend.

Kiyosaki has made a fortune in real estate and was able to retire

at 47. Rich Dad, Poor Dad lays out the philosophy behind

Kiyosaki's relationship with money. Most reviews of the book

stress that the book advocates "financial literacy,"

which has never been taught in schools. The main principle is

to acquire income-generating assets, always providing better

results than even the best of traditional jobs. One of the main

points is that assets must be acquired so that the jobs can eventually

be shed.

What most investors hear time and time again is that "timing

is everything." This is an important factor for any investor

and especially those who aspire to become truly financially independent.

If investors knew that real estate had peaked in most places

in the United States, would those investors be willing to use

that timing to their advantage? It is something that is certainly

worth considering very strongly, as Mr. Kiyosaki himself states

quite simply: the real estate market is due to come down. It

must be pointed out that this statement was made when real estate

was peaking in most areas of the United States.

Mr. Kiyosaki, like all successful investors, knows there is a

time to sow and a time to reap. Mr. Kiyosaki sowed when real

estate was not the preferred investment class and has cautioned

real estate investors against risky strategies such as "flipping,"

or relying solely on the appreciation of the property, and properties

with low, or no "cash flow."

What does Mr. Kiyosaki like now? He is looking at the commodity

markets, specifically oil an - sit down for this one - the precious

metals. That is correct - yet gold and silver are investments

that are still out of favor with most of the investing public.

Lately, at his live appearances, Mr. Kiyosaki has been inviting

an increasing number of advisors and other guests on stage to

speak on a wide variety of investment topics, including the precious

metals industries. One of these guests is Mike Maloney of GoldSilver.com.

Mr. Maloney's mission has been to introduce real estate investors

to an extremely undervalued asset sector, the precious metals.

It is Mr. Maloney's belief that all things run in cycles and

everything repeats. He believes that the bear market in precious

metals, which ended in 2001, took gold and silver into such undervalued

extremes, that even at today's prices, gold and silver are still

an incredible bargain.

He also claims that the new bull market in the metals has just

barely begun and that this new bull will take the precious metals

to price levels considered unimaginable by most. Mr. Maloney

estimated a price target of $6,000.00 for both gold AND silver

. . . and he follows that statement up with "and that's

only IF the dollar survives, and history gives that a very low

probability." When you consider the amount of paper currency

that the governments of the world have printed since the last

precious metals bull ended in 1980, could Mike Maloney possibly

be right?

The point of this essay, however, is how well a real estate investor

might do if a little proper timing is used during the investment

process. Let us look back into history and see just what took

place the last time we had a real estate boom, followed by an

era of high inflation.

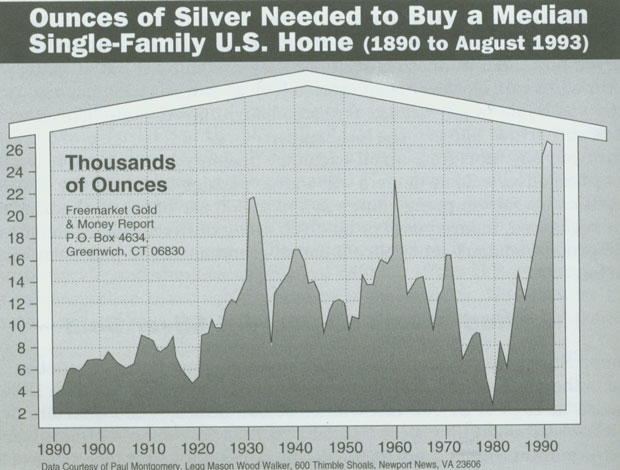

Look at the charts below:

Chart

1 - Average House Price 1890 to 1990

Data

from Paul Montgomery, Legg Mason, published in Silver Bonanza,

1993

Data

from Paul Montgomery, Legg Mason, published in Silver Bonanza,

1993

What we see

in this chart is a real estate investor who would have been well

served to move some of those profits (diversify) in the precious

metals. Since the chart depicts silver, and real estate peaked

prior to the metals (many investors were using real estate as

a hedge against inflation in the 1970s), an astute real estate

investor might have sold some real estate holdings and moved

into the precious metals in, perhaps, 1978 for example. At that

time, the median single-family home in the United States might

have cost 9,000 troy ounces of silver.

Move forward to the peak in silver prices in early 1980, and

that same median home would cost one-third as much in terms of

silver. Quite a move in just a few years, don't you think? This

of course will bring many questions to mind, because most real

estate investors are partial to the investment class that they

understand and have experienced for some time. Real estate opportunities

still exist, but the overall trend has shifted. In plain words,

it will be far easier to make money in the precious metals over

the next several years than in real estate.

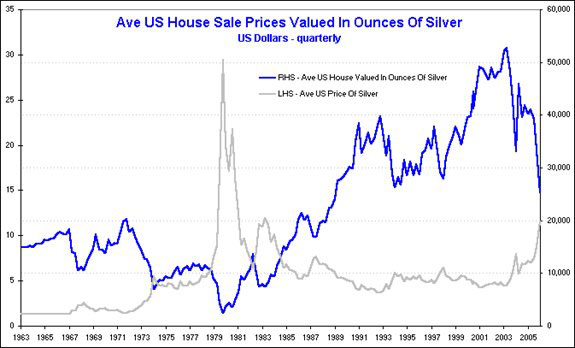

Chart

2 - Average House Price 1963 to 2005

Chart 2 will

give a real estate investor something to ponder. At the top of

the precious metals market last time (January 1980), it took

a mere three thousand ounces of silver valued at $150,000 to

purchase a median-priced single-family home. Today, three thousand

ounces of silver is valued at about $40,000. Who wouldn't be

willing to pick up the median-priced house for $40,000? We are

not talking the foreclosure market here; we are valuing houses

in terms of silver bullion.

The ability

of most investors to profit from differing sectors is key to

really becoming a seasoned investor. However, it is human nature

to stick with the winners, and most real estate investors, once

successful, seldom look to other investment opportunities. This

is not to say that a very astute real estate investor cannot

do well as the housing market declines, but why swim against

the tide?

If the same

principals that made you a successful real estate investor were

applied to the precious metals markets, you could reap huge rewards

by selling silver when it was dear and buying back into the real

estate market when it again is fairly valued.

In conclusion,

most of life's biggest lessons are learned by experience. History

does repeat, but it never repeats exactly. The last time inflation

really took off in a big way, the real estate sector was vibrant

as a "tangible asset" but eventually became overvalued;

as this was occurring, the precious metals were in the mid stages

of being accepted by many individual investors, not only as a

method of preserving wealth, but as a potential means of making

large capital gains.

Today the world

has changed significantly from the 1980s. We have instant communications

from almost anywhere, stocks can be traded by the click of a

mouse, the Internet is providing society with information overload,

and the world economy is showing signs of large changes ahead.

The future will favor those who can see ahead and take the appropriate

action now. With the real estate market having a surplus in some

of the major boom areas, and aboveground silver supplies dwindling

dangerously low, having lost approximately 1.5 billion ounces

of the 2-billion-ounce inventory since 1980, don't you think

chance favors taking profits on some of the more marginal real

estate holdings and moving some of your assets into the precious

metals sector?

Correction

to my last public domain article, "The Silver Millionaire":

The correct amount of paper millionaires in the U.S. is about

nine million. A silver millionaire requires 715,000 troy ounces

of silver.

July 27, 2007

-David Morgan

email:

silverguru22@hotmail.com email:

silverguru22@hotmail.com

website:

www.silver-investor.com

Mr. Morgan

has been published in The Herald Tribune, Futures magazine, The

Gold Newsletter, Resource Consultants, Resource World, Investment

Rarities, The Idaho Observer, Barron's, and The Wall Street Journal.

Mr. Morgan does weekly Money, Metals and Mining Review for Kitco. He is hosted monthly

on Financial

Sense

with Jim Puplava.

Mr. Morgan

was published in the Global Investor regarding Ten

Rules of Silver Investing, which you can receive for free. His book Get

the Skinny on Silver Investing is available

on Amazon.

His private Internet-only newsletter, The

Morgan Report,

is $129.99 annually.

321gold Ltd

|