THE MICIK MARKET LETTER

Bell Bottoms, Gold & the Goldies

Alan Micik snippet

Posted Dec 26, 2013

In a prior Update, MML observed:

“Sometimes, there is a news item that contrarily “shouts out” bottom, or top. This 28 month Goldie Bear Market has

discredited many who own physical gold as well as some prominent Gold Stock Bugs. The U.S. media shills and

Establishment just love bashing gold or anyone related to the Goldies.”

Gold Drop Is Blow to Prominent Hedge-Fund Manager Sprott - December 11, 2013-WSJ

Just when we thought the U.S. Media had reached its nadir in unbalanced and omission journalism in that WSJ article, CNBC exceeded the WSJ standards with its own version of yellow journalism in this “interview” with Frank Holmes (U.S. Global Investors) on December 23rd.

Readers are encouraged to listen to this 3 minute interview as the CNBC interviewers work overtime to discredit Holmes and gold in an “interview” which coincidentally appeared just as gold broke $1,200 in the background. Holmes is blasted for being bullish on gold (down about 30% in 2013) whereas U.S. stocks were up about as much. One interviewer (Simon) stated that Holmes showed no “compassion” for Investors by remaining bullish with a long-term 10% allocation to gold and the Goldies.

The gem quote of this “interview” was when CNBC interviewer (Simon) concludes, “The difference between you and I is that I’m not trying to sell a product.” Readers can draw their own conclusions from the CNBC 1 year yardstick for gold vs. U.S. Stocks, and whether or not Simon (and CNBC) is selling a product.

Our MML view is that this was an Establishment Media Editorial, not an interview. MML never observed CNBC contrasting the poor U.S. Stock performance during the Dow’s declines of 2009, 2010, or 2011 against the rallies which simultaneously occurred in gold. Nor did we ever observe CNBC blast any of those bullish U.S. stock analysts for showing no “compassion” for Investors by maintaining their allocations in U.S. stocks during those U.S. stock declines.

The other omission here (as with the WSJ article) is that since 2000, gold is up 340% from its low, whereas U.S. stocks are up 55% for the same time period. From 2008’s gold low, gold is up 74% and U.S. stocks are up 96% for a 4.4% difference per year in spite of gold’s dismal 2013 performance.

In December, MML has observed multiple media gold and Goldie tax-selling articles, the bashing of a prominent Goldie Hedge Fund Manager, and an Establishment TV Editorial masquerading as an “interview” of a Goldie Mutual Fund Manager. This is a sign of the times as gold and the Goldies are at or near lows, and we certainly understand that it’s normal for the Media to be bearish in here.

But, the Media only follows trends…they almost never anticipate a change of trend in any market. This is why Investors and Traders often do not buy bottoms because almost nothing one currently reads in the mainstream U.S. Media provides a catalyst for Bullish action in gold or the Goldies (GDX) by Investors or Traders.

Yet, investment fashions are never static. With this December’s Sentiment readings at 5 year Bullish highs for U.S. Stocks, and multiple Zero % Bullish short-term trading readings throughout December for the Goldies (yes, that is not a typo), readers may soon want to fashion a contrarian approach for the Goldies and gold.

Our experience has been that these types of extreme media gold articles and Sentiments most often occur at:

MML thinks the bell just got rung for a bottom now, or in the not too

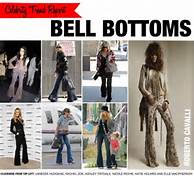

distant future for gold and the Goldies. It may not be stylish to buy Bell Bottoms anymore, but each to their own fashion regarding investments.

Our next Subscriber Update will be on 12/29/13 and we will Update Subscribers on the improving technical trends we are now observing. In the meantime, we’re rushing out to the store to get some Bell Bottoms before they get “sold out” like the Goldies.

Our closed Investor “hedging” profits remain at $160 per ounce, and our Trader’s profits are $91 per ounce. Total MML Trading and “hedging” gains are now $252 per ounce. Our Major Miner’s losses are negligible, < 2% for 2 years (break-even

in 2013), and we have had no trades in the Jr. Mining sector for 2 years. We remain long in

our physical gold allocation which

each Subscriber determines according to their specific investment objectives and needs.

If you would like to review our current MML forecasts for gold and other markets, consider a subscription (details are listed below). In deference to our Subscribers, we have a 4 day calendar “Quiet Period” from all Subscriber Updates before any Posts.

###

Al Micik

email: atmmail@sbcglobal.net

The Micik Market Letter (MML) covers opportunities in any market sector (U.S. Stocks, silver, etc.) when low-risk opportunities are identified for the

investor and/or trader. Ongoing coverage is provided for gold and physical gold hedging strategies. Individual shares in any sector are generally not covered,

but nor are they excluded. Unlike other market reports, we do not have regular “publication dates,” as the markets create the dates of action, and thus the

communication to our subscribers. MML uses proprietary indicators (combined with technical analysis and contrary opinion) while applying 38+ years of

market experience in stocks, options, and futures.

SUBSCRIPTIONS: US $155 per year. No refunds, so consider the trial service. Trial subscriptions (one-time/non-refundable): US $40 for 8 weeks which includes the prior 2 Month’s of Updates previously sent to subscribers enabling you to fully evaluate MML on a 16 week basis. If you elect an annual subscription without a trial subscription (this includes our prior 2 months of Updates) our pricing is US $135 for the first year. This is an email service. Email us at atmmail@sbcglobal.net and we will send you a Pay Pal Invoice for the subscription you elect (credit cards are accepted).

For those that would like to review previous MML articles, we are archived here, at 321Gold.

DISCLAIMERS: Market opinions and recommendations detailed in this letter, while expressed in good faith, are not guaranteed, and losses will occur with any investment strategy, including this service. Each investor/trader/hedger must carefully manage to their individual risk tolerance and use “stops” to control their risks. At no time should the subscriber infer that opinions or recommendations are customized actionable advice, or be construed as an inducement or suggestion to trade or invest. The editor, publisher, associates, directors, consultants, employees, and accounts under management may, or may not, have positions in securities or derivatives described herein. Actions taken as a result of reading MML is the sole responsibility of each reader. MML is not and does not profess to be a professional investment advisor. Readers are advised to consult with their own professional advisers, attorneys, and accountants before making any investment decisions. By your reading MML (an independent market research letter) you fully and explicitly agree that MML will not be held liable or responsible for any decisions you make regarding any information discussed herein.

321gold Ltd

|