Chart In Focus

The Gold Move that ETF Traders Were Not Betting On McClellan Financial Publications, Inc

Posted Dec 9, 2022

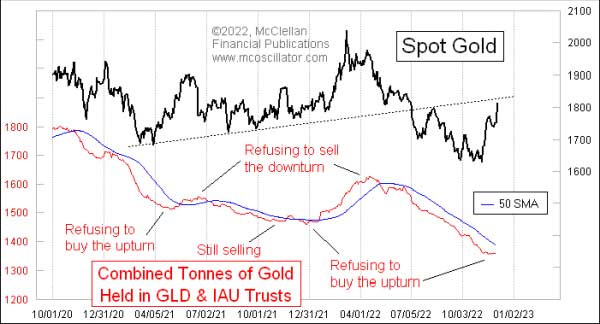

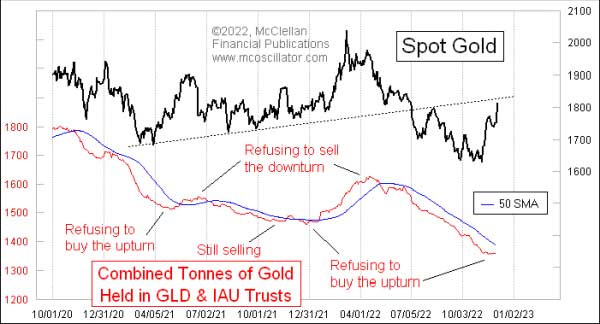

Dec 1, 2022 Gold prices have moved up by almost $200 off of the October lows. Ordinarily that would bring a response by investors to start buying into GLD and IAU, the big gold bullion ETFs. But they are not doing that (yet), and that is really interesting. The normal behavior by investors is to buy into these ETFs when gold is rising, and sell out of them when gold prices fall. Extremes of either buying or selling can be useful indications of a sentiment extreme, worthy of a top or bottom for prices. That is how things normally work. What is happening now is not normal. Gold prices have been rising, and they jumped a whole lot on Dec. 1, 2022 thanks to a little bit of dollar weakness. But up through Nov. 30 (the most recent data available), there has not been any response by investors trying to reposition themselves into these ETFs. Both GLD and IAU hold gold bullion to back their shares. If the shares trade at a price significantly different from the net asset value (NAV), then these funds will issue or redeem shares as needed to get the trading price back close to the NAV. When the funds do that, the total asset levels will change. The sponsors report these data after the close each day at the following links: https://www.ishares.com/us/products/239561/ishares-gold-trust-fund http://www.spdrgoldshares.com/assets/dynamic/GLD/GLD_US_archive_EN.csv Given the big jump in gold prices since October, we should expect that public sentiment toward gold should be turning more bullish, but it is not. Investors are still avoiding these ETFs, which means that their bearishness is more firmly rooted. That is actually bullish for gold prices, because to get a top for gold prices we would expect to see investors clamoring to get into gold. They are not at that point yet, which conveys the message that gold is going to have to trend higher for a lot longer to get sentiment to change. *** Related Charts Aug 31, 2022

Sprott Physical

Gold Trust As A

Sentiment Tool | Aug 04, 2022

Gold ETFs Being

Shunned During

Price Upturn

| Nov 12, 2021

Borrowing a Sentiment Tool From the Yen

To Use With Gold | ### Tom McClellan

Editor, The McClellan Market Report

email: tom@mcoscillator.com

website: www.mcoscillator.com

(253) 581-4889 Subscribe to Tom McClellan's free weekly Chart In Focus email. Copyright ©1996-2022, McClellan Financial Publications. All Rights Reserved. 321gold Ltd

|