The McClellan

Market Report (snippet)

Gold

McClellan Financial Publications,

Inc

Posted Sep 11, 2008

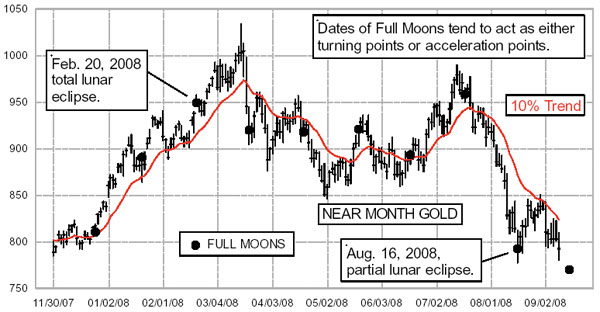

Monday saw the Dollar Index up strongly, and gold moving up in spite of that dollar strength. That was a strange development, because dollar strength usually hurts gold prices. Well, gold made up for that anomaly on Tuesday by falling sharply even though the Dollar Index was down. The drop takes December gold futures back down to retest the Aug. 15 low. In after-hours trading, gold is down even further this evening, even though the dollar is not helping or hurting things. I suspect that there may be some hedge funds out there which had exposure to both financial stocks and long gold positions, and they are having to liquidate one to cover the other.

Understand, though, that gold prices have already dropped 20% in just 2 months, which is an unsustainable rate of decline. Eventually the bungee cords will snap taut, and bring at least a temporary rebound.

Next Monday, Sep. 15, is the date of the next full moon, and so we should expect some kind of turning point behavior from that event if nothing else intervenes before then. But as I mentioned on Monday, the holding still of gold prices for four trading days is an unnatural behavior which tends to occur just before big rallies, as if someone is holding prices in place until everything is ready for the rally to commence. Tuesday looks to me like a fakeout dip.

Written Sep 9, 2008

McClellan Financial Publications, Inc

email: tom@mcoscillator.com

website: www.mcoscillator.com

You can learn

more about the work of Tom McClellan and Sherman McClellan by

visiting www.mcoscillator.com.

They publish

a twice monthly newsletter, The McClellan Market Report ($195/year),

and a companion Daily Edition ($600/year or $160/quarter). You

can see samples and get information about subscribing by visiting

their website.

©1996-2008,

McClellan Financial Publications, Inc., P.O. Box 39779, Lakewood,

WA 98496-3779. www.mcoscillator.com, tel: 253 581-4889,

800 872-3737, fax: 253 584 8194.

321gold Ltd

|