The McClellan Market Report

Daily Edition (snippet)

Stalled Gold Price Fueling Disinterest McClellan Financial Publications, Inc

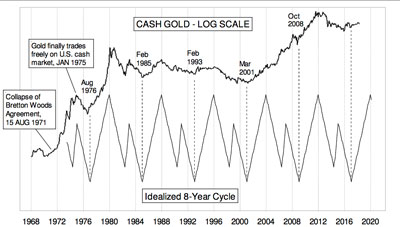

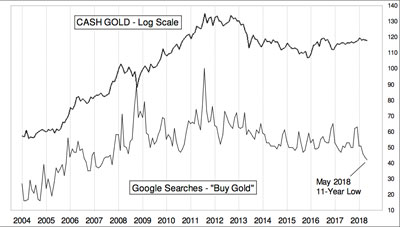

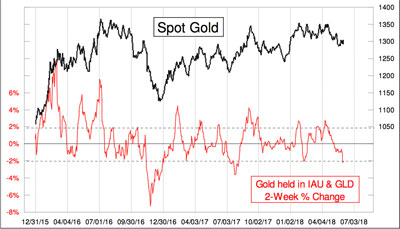

Posted Jun 10, 2018  Gold is supposed to be in a 3-year bull market right now. That is the message from gold’s 8-year cycle shown in the top chart. This cycle typically manifests itself in a pattern of 3 years up, and then a 5-year zigzag decline. Thus far, the new up phase has been under whelming in terms of the returns it has brought for gold owners. This is rather reminiscent of the mid-1990s, seen near the middle of the top chart. There was a really fun rally from $330 to $390 back in 1993, and then gold went dead flat for 2-1/2 years. So the worry now is that we are seeing another one of those periods, which would make owning gold just not worth the bother. The one saving grace for the remaining gold bulls is that this view of gold not being worth the bother seems to be getting more widespread. Forbes recently posted an article, noting that Google searches on the term “buy gold” are now at an 11-year low, as shown in the chart below.  This data comes from an interesting site which Google runs, at www.trends.google.com. You can enter any search word or phrase, and see how its popularity varies over time. You can even do comparisons, to see for example whether Taylor Swift or Ariana Grande is more popular, according to this method of comparison (spoiler: it’s Taylor). Seeing a low reading like this means that “buy gold” is not a search term that is garnering much interest lately. And the presumption is that buying gold is also not an action that people have much interest in at the moment. As every card-carrying contrarian knows, that is a sign of a bottom for prices. We should note, however, that there is no such thing as a card-carrying contrarian, because a real contrarian would eschew crowd psychology so much that he would never join an organization of like-minded others. That chart gives us a message about the public not being interested in gold on a rather long-term basis. The last chart shows a much more immediate view of the public’s disinterest in owning gold.  Over the past couple of weeks, there has been a pretty big flight out of both GLD and IAU, the two biggest ETNs that are backed (so they claim) by gold bullion. When a lot of traders are selling, the funds have to redeem shares, selling off the bullion holdings to fund those redemptions, and thereby keep the share price close to the net asset value. Big 2-week drops of 2% or more tend to be associated with important price bottoms. The day when this indicator crosses below -2% is not necessarily the exact bottom day, but a meaningful bottom is the expectation when it happens. Bottom Line: On both a short-term and a long-term basis, there is a great disinterest in owning gold. That is a condition associated with meaningful price bottoms for gold. ### Written Jun 5, 2018

Tom McClellan

Editor, The McClellan Market Report

email: tom@mcoscillator.com

website: www.mcoscillator.com

(253) 581-4889 Subscribe to Tom McClellan's Market Reports. Copyright ©1996-2018, McClellan Financial Publications. All Rights Reserved. 321gold Ltd

|