Chart In Focus

Doctor Copper Has A Message on Inflation

McClellan Financial Publications, Inc

Posted Apr 19, 2024

Apr 11, 2024

One trite Wall Street saying is that copper is the only metal with a PhD in economics. This is because copper is an industrial metal, the demand for which waxes and wanes with economic growth and shrinkage. So falling copper prices can be a sign that economic trouble lies ahead, and the converse is also true.

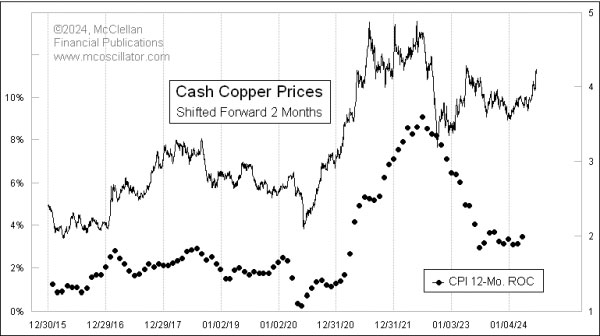

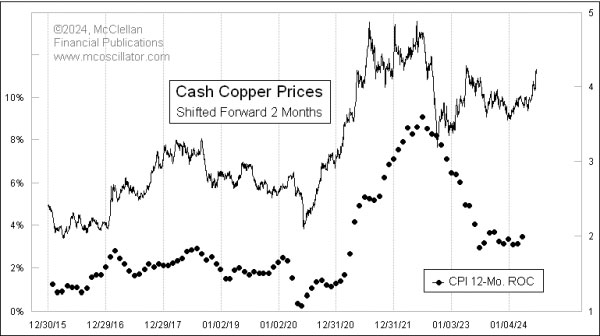

I would argue that copper's more reliable role is as a leading indicator of inflation, as illustrated in this week's chart. It shows the price of copper, shifted forward by 2 months to reveal how the growth rate of the Consumer Price Index (CPI) tends to echo copper's movements. The plot of copper prices uses daily data, whereas the CPI is monthly, and so naturally there is going to be more noise in the copper data.

Generally speaking the correlation has been good, although the first couple of years after Covid strained the correlation a bit. The copper market was arguably not functioning properly then, like so many other markets, with industrial demand and copper mining production both seeing turbulence from labor availability. But that seems to have settled down now.

The latest posting for CPI just out on April 10 caught many by surprise, but it reflects an up move which already started in copper from its December 2023 low. And the most recent jump to above $4/pound says that inflation is not yet done rising.

There is room to question the legitimacy of that message, since part of the rise in copper prices may have come from speculative trading in China. The Shanghai Stock Exchange just recently imposed trading limits on futures contracts for both gold and copper, in an effort to tamp down on that trading. So if this spike disappears rapidly, then one may be able to put a thumb over that point on the chart and disregard it. For now, though, the message is that inflation is going to be rising for at least the next 2 months.

***

Related Charts

###

Tom McClellan

Editor,

The

McClellan Market Report

email:

tom@mcoscillator.com

website:

www.mcoscillator.com

(253) 581-4889

Subscribe

to Tom McClellan's free weekly Chart In Focus email.

Copyright ©1996-2024, McClellan Financial Publications. All Rights Reserved.

321gold

Ltd

|