Sell Gold, Then Buy It Sell Gold, Then Buy It

Many of the World's Great

Investors Are Doing Exactly That

Ian Mathias

Provided as a courtesy of Agora

Financial

Jul 8, 2009

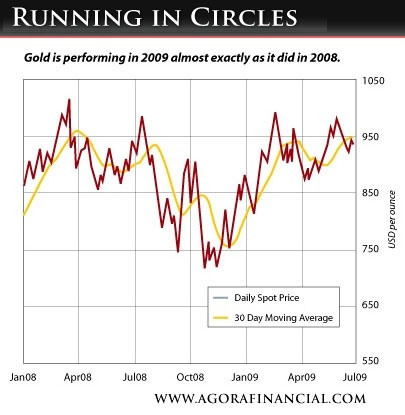

From a technical standpoint,

gold looks set for some short-term pain. Just like stocks, the

gold chart is taking a page from 2008. Check it out:

When it hit the fan last year,

gold failed to deliver the righteous moonshot many had forecast.

It certainly was a better place to be than stocks, but gold still

suffered. Until further notice, the same playbook appears to

be in use today... gold may be the once and future money, but

the dollar and U.S. Treasuries remain the ultimate flight to

quality when the going gets tough.

After sticking to a tight range

the last few weeks, gold fell today along with stocks. The spot

price shed $10, to $925 an ounce.

"I see everything coming

up roses for gold and those who mine it," says Chris Mayer,

armed with proof he's not the only value hound with his eye on

gold.

"For the first time in

a couple of decades, some of America's most successful, big-name

investors are buying gold. David Einhorn, the hedge fund manager

who predicted the downfall of Lehman Bros., recently bought gold

for the first time.

"And then there is John

Paulson, the guy who made billions of dollars by correctly anticipating

the housing bust and credit crisis. Paulson just plunked down

$1.3 billion for an 11% stake in AngloGold. He's also got a big

position in Kinross Gold.

"Peter Munk, the 81-year-old

chairman and founder of Barrick Gold, also offers up his own

anecdote about gold's broadening appeal. 'I have had more phone

calls in the past six months than ever before - from people who

have $120,000 inherited from grandmother, and from hedge fund

managers with millions,' he says. 'I am not saying George Soros,

but people of that caliber have told me they are buying gold.'

"You no longer have to

be a gold bug to think gold will rise in price. In fact, this

buying by some of the world's greatest investors may be the leading

indicator for a quick 116% climb - to $2,000 per ounce or higher.

Give gold the cold stare of a professional handicapper and the

odds look very good, indeed."

Ian Mathias

Copyright ©2009 Agora Financial

LLC. All Rights Reserved.

Ian Mathias is managing editor of The

5 Min. Forecast

and Agora

Financial.

We discovered Ian working as a full time rock climbing guide and

writing on the side. Ian Mathias is managing editor of The

5 Min. Forecast

and Agora

Financial.

We discovered Ian working as a full time rock climbing guide and

writing on the side.

As it turns

out, markets and global economics can be extreme too... at least

enough to keep him around.

Since working

for Agora Financial, respected media outlets including Forbes.com,

the Associated Press, Yahoo, and MSN Money have syndicated his

writing. He received his BA from Loyola College in Maryland and

is currently studying writing at the graduate level.

321gold Ltd

|