GEAB N°36 - June 17, 2009

- snippet

Perspective

LEAP2020

Jun 30, 2009

Below is an

excerpt from the Jun 17, 2009 issue of GEAB

(Global European Anticipation

Bulletin)

Global systemic crisis in summer 2009:

The cumulative impact of three "rogue waves"

As anticipated by LEAP/E2020

as early as October 2008, on the eve of summer 2009, the question

of the US and UK capacity to finance their unbridled public deficits

has become the central question of international debates, thus

paving the way for these two countries to default on their debt

by the end of this summer.

At this stage of the global

systemic crisis' process of development, contrary to the dominant

political and media stance today, the LEAP/E2020 team does not

foresee any economic upsurge after summer 2009 (nor in the following

12 months).1

On the contrary, because

the origins of the crisis remain unaddressed, we estimate that

the summer 2009 will be marked by the converging of three very

destructive "rogue waves"2 illustrating

the aggravation of the crisis and entailing major upheaval by

September/October 2009. As always since this crisis started,

each region of the world will be affected neither at the same

moment, nor in the same way.3 However,

according to our researchers, all of them will be concerned by

a significant deterioration in their situation by the end of

summer 2009.4

This evolution is likely to

catch large numbers of economic and financial players on the

wrong foot who decided to believe in today's mainstream media

operation of "euphorisation".

In this special "Summer

2009" edition, our team describes in detail these three

converging "rogue waves" and their impact, and gives

a number of strategic recommendations (currencies, gold, real

estate, bonds, stocks, currencies) to avoid being swept away

in this deadly summer.

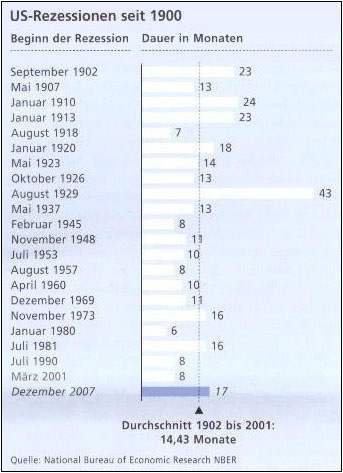

Duration (in months)

of US recessions since 1900

(average duration: 14,43 months)

Duration (in months)

of US recessions since 1900

(average duration: 14,43 months)

Sources: US National Bureau of Economic Research / Trends

der Zukunft

LEAP/E2020 believes that, instead

of "green shoots" (those which international media,

experts and the politicians who listen to them5 kept

perceiving in every statistical chart6

in the past two months),

what will appear on the horizon is a group of three destructive

waves of the social and economic fabric expected to converge

in the course of summer 2009, illustrating the aggravation of

the crisis and entailing major changes by the end of summer 2009

more specifically, debt default events in the US and UK, both

countries at the centre of the global system in crisis. These

waves appear as follows:

1. Wave of massive unemployment:

Three different dates of impact according to the countries in

America, Europe, Asia, the Middle East and Africa

2. Wave of serial corporate bankruptcies: companies, banks, housing,

states, counties, towns

3. Wave of terminal crisis for the US Dollar, US T-Bond and GBP,

and the return of inflation

__________________

1

Not even the « jobless recovery » many experts are

trying to make us believe in. In the United States, United Kingdom,

Eurozone and Japan, it is a « recoveryless recovery »

we must expect, i.e. a pure invention aimed at convincing US

and UK insolvent consumers to start buying again and keeping

US T-Bonds' and UK Gilts' country purchasers waiting as long

as possible (until they decide that there is really no future

selling their products to the lands of the US Dollar and British

Pound.

2

Rogue waves

are very large and sudden ocean surface waves which used to be

considered as rare, though we now know that they appear in almost

every storm above a certain strength. « Rogue waves »

can reach heights of 30 meters (98 ft) and exert tremendous pressure.

For instance, a normal 3 meter-high wave exerts a pressure of

6 tons/m2. A 10 meter-high tempest wave exerts a pressure of

12 tons/m2. A 30 meter-high rogue wave can exert pressure

of up to 100 tons/m2. No ship yet built is able to resist such

pressures. One specific kind of rogue wave is called the "three

sisters", i.e. a group of three rogue waves all the more

dangerous in that, even if a ship had time to react properly

to the first two waves, there is no way she could be in the right

position to brave the third one. According to LEAP/E2020, it

is a similar phenomenon that the world is about to encounter

this summer; and no country (ship) is in a favourable position

to face them, even if some countries are more at risk than others,

as explained in this GEAB (N°36).

3

LEAP/E2020 estimate that their anticipations of social and economic

trends in the various regions of the world - published in GEAB

N°28 (10/16/2008) are still relevant.

4

More precisely, in every region, media and stock markets will

no longer be able to hide the deterioration.

5

Our readers have not failed to notice that the same people, media

and institutions, considered everything was for the best in the

best of worlds 3 years ago, that there was no risk of a severe

crisis 2 years ago, and that the crisis was under control a year

ago. Their opinion is therefore highly reliable!

6

As regards US economic statistics, it will be interesting to

follow the consequences of the revision of the indexing formula

by the Bureau of Economic Analysis due to take place on 07/31/2009.

Usually, this type of revision results in further complexity

of historical comparisons and favourable modification of important

figures. For example, some previous revisions enabled the division

of the average level of measured inflation by three. Source:

MWHodges,

04/2008.

###

ISSN 1951-6177

- All rights reserved

Lots more follows for subscribers.

You can subscribe

here.

LEAP2020

contact email

website: English LEAP2020

Subscription

200 euros for one year (10 + 6 issues)

Subscribe for 1 year (10 issues including

present issue) and get the 6 previous issues free (6 archive

issues) €200

© Copyright

Europe 2020 / LEAP - 2009 All rights reserved.

321gold Ltd

|