| |||

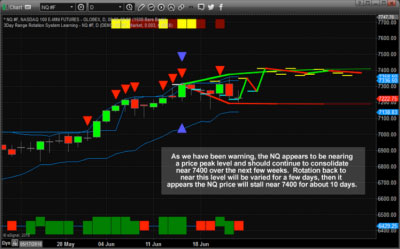

US Equities Maybe Set To Rebound To New HighsKal Kotecha Over the last few weeks, traders and investors have been dealing with multiple news items and external factors that have driven the US Indexes lower overall. This move is related to a fear component that comes with the uncertainty of these news events: Elections in Mexico. Uncertainty in the European Union. Debt and Market issues in China. Corruption and nepotism in Malaysia. Currency issues in Canada related to the USD. Elections in Turkey. All of this has played into the general weakness of the US major indexes and has many traders worried about a deeper price drop. This analysis I share today is vastly different from many of others and what I typically cover in my articles. This predictive price modeling system and predictive price cycle modeling system may be pointing to much higher prices over the next few weeks and months for the US majors. Based purely on technical analysis is that these external factors, trade issues, debt issues, election issues and others, may eventually be settled and the core economic fundamentals of the US and global economies could drive future price moves. This YM (DJIA) Daily chart shows an Adaptive Dynamic Learning (ADL) price modeling system and the result of an analysis from near the recent peak. You can see from the DASHED lines on this chart that the ADL predictive modeling system identified the recent downturn in price and may be indicating a dramatic upside price reversal over the next 10+ days. This leads us to believe that the YM, ES, Transportation stocks and Small Caps may rally over the next few days/weeks to attempt new price highs. (Click on images to enlarge) Esignal.com This Daily NQ chart with the ADL price modeling system results shown points to a different series of price events for the tech heavy NASDAQ. This chart shows that price could rotate between 7200~7400 of the next 3~5 days, then possibly settle near the 7400 level for a period of at least 7~10 days with some-little volatility. This analysis shows the NQ may stall near the 7400 level as capital shifts to small caps, DOW and S&P related equities over the next 3~5+ weeks. Esignal.com This recent 240-minute ES chart shows the recent price channel breakout in the ES that coincided with the upside price move we are referring to. This price channel breakout, as well as the newly attempted high price peak, may illustrate the desire for the US markets to drive upward while the global markets continue to rotate and contract because of debt issues and uncertainty. As mentioned in our earlier research, I believe a massive capital shift may be taking place where the US markets are becoming a global safe-haven for foreign investors and foreign capital as the US equities markets are rocketing higher on a strong US economy, strong earnings and stock buybacks. This capital shift could continue for at least another 6+ months. Esignal.com Lastly, I wanted to illustrate the cycle predictive modeling system and how precious metals as a basket will likely react to the continued global fear and market contractions. Metals have, for the past few months, been trading within a congested range that has flummoxed Gold-Bugs. They've seen this credit/debt/uncertainty issue unfold across the globe, yet metals have yet to show any real upside breakout. We are calling this the “Rope-A-Dope” setup in the metals markets. This is what we believe is a larger “wash-out” low price rotation that is designed to flush out the weaker longs before price appreciation really begins over the next 6~12 months. Smart traders will find this an opportunity to “buy more” or leverage into their existing positions. We are hoping and expecting that the metals will continue to bias upward over the next few months waiting for the shoe to drop that sends metals rocketing higher. At this point, it is looking like China may be that “shoe”. Esignal.com Happy Investing! ### Kal Kotecha Junior Gold Report is a website dedicated to informing the public about gold, silver, and metal companies. For Junior Gold Report's FREE newsletter, please visit the website. Kal Kotecha MBA is the editor and founder of the Junior Gold Report, a publication about small cap mining stocks that is read and enjoyed by thousands of investors. He was the editor and creator of the Moly/Gold Report, which focused on critical analyses and open journalism of companies profiting from the precious metals sector. The scope of his current activities include worldwide onsite analyses and reporting of developing companies. Kal has previously held leadership positions with many junior mining companies. After completing his MBA in Finance in 2007, Kal completed his PhD in Business Administration in January 2016. His thesis was on the Affective Heuristics of the 2008 stock market crash. He also lectures Economics at the University of Waterloo and Niagara College where he was voted Professor of the Year 2013/2014. |