Investment Scoring & Timing

Newsletter

More Charts! Metals &

US Stocks

Michael Kilbach

Jun 1, 2007

The editorial we published

last week incorporated long term charts for gold, silver and

the Dow Jones Index with a twenty seven year support line. This

week we expand on that same line of thought.

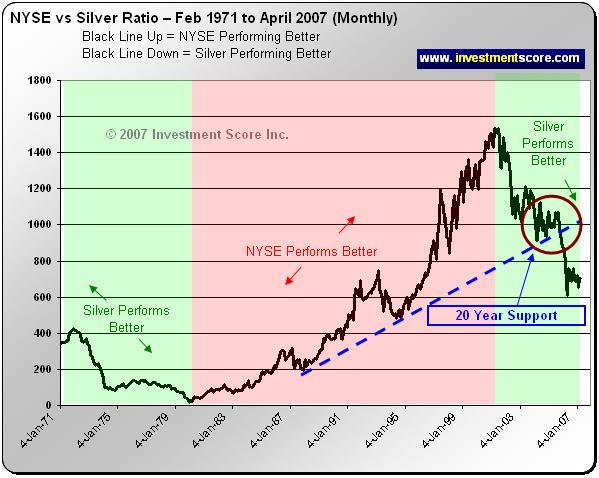

In the above charts you will

notice:

1) Dividing two markets together

to create a ratio helps us determine which market is outperforming

the other market. For example, in the chart above, when the black

line heads higher, the NYSE is outperforming Silver and when

the black line heads lower Silver is outperforming the NYSE.

2) We used several US stock

markets to give an overall picture of what is generally happening

to US stocks when compared directly to silver and gold. Or conversely,

what is happening to silver and gold in comparison to US stock

markets.

3) Each chart has a very long

term support line of about 27 years. In technical analysis support

lines are important as they usually represent key areas of support

and resistance. When the price of a market approaches a support

line it will regularly cause a market to pause or bounce higher.

This support line represents a "line in the sand" where

investors are ready to buy back a market as it hits this key

psychological barrier and possible opportunity to make money.

Often support lines are reached after long, aggressive price

declines are ready for a key point to either rest or bounce off

of it. We believe markets do not move in a straight line and

therefore key turning points such as support lines are often

used for counter rallies.

Also, as a general rule, the

longer the line of support has been in place the more significance

it carries. For example, a support line that has been in place

for a few days is much less important than a support line that

has been in place for a few years or in this case decades.

Additionally, in technical

analysis, once a key support line has been broken that same line

now becomes a line of resistance. What was once an invisible

floor and barrier to the downside now becomes a ceiling and barrier

to the upside. Once a support line is clearly broken the trend

usually continues lower and the new resistance is not easily

broken to the upside.

You may be wondering if these

markets are landing on a key line of support that has existed

for 27 years, why wouldn't these ratios bounce off of this support

and start a new prolonged advance.

In the financial markets anything

can happen. We think that the ratios will likely bounce off of

these key lines of support. In fact you will notice that many

of them have already bounced a few times along the line of support.

But we believe that investing is about probabilities. Based on

our observations of historical major market movements we have

devised a set of guidelines to assist us in our investment decisions.

We believe major market trends are like large swinging pendulums

with huge momentum as massive amounts of capital flow from one

asset class to another. In our opinion one major market trend

will not end until an extreme is met in the direction traveled.

You will notice the major trend from about 1980 to 2000 was for

US stocks to outperform commodities. We now believe that major

trend has reversed and will accelerate when these twenty seven

year support lines are breached.

To help illustrate other key

lines of support we have provided a second set of charts.

In the above set of charts

you will notice:

1) In most of the charts the

falling ratios paused on the key twenty year support lines. Notice

how many of them bounced for many months as the psychological

barrier held as support for the declining ratio? The support

line was a resistance area but not a launch pad for a new major

advance.

2) In most cases once the support

line is clearly broken that line becomes resistance and the ratio

does not break back through to the upside.

3) The same question asked

about the twenty seven year support line could be asked in regards

to this twenty year support line. If a support line has been

in place for twenty years why wouldn't that line of support hold

and provide a base for a new US equities advance? History now

tells us that the twenty year line of support was merely a place

of rest or support to slow down the ratios decent before it headed

lower to the twenty seven year support lines.

From a very short term perspective,

a stronger stock market with softer, performing commodities is

not a shock to us. After a great start to what we think is a

major commodities bull market, we expect periodic slow downs,

pull backs and breaks. We recognize that markets do not move

in a straight line and expect corrections when market sentiment

and enthusiasm gets overheated. When we keep the big picture

in perspective, our investment decisions become easier and less

stressful. When we look at the long term trends, the day to day

price movements become nearly irrelevant. In the short term we

may be experiencing a strong stock market with weaker commodities,

but in the big picture the trend is clear in our opinion. We

expect the twenty seven year support lines to be breached and

once this occurs, we expect commodities to advance quickly. This

is why we have been positioning ourselves in silver investments.

At www.investmentscore.com

we always keep the big picture in perspective. We do not try

to pick exact tops and exact bottoms of a particular equity or

market. Instead we look at the big picture and use our custom

built timing charts to generally average into the market during

times of pessimism and out of the markets during times of enthusiasm.

We first try to locate major bull markets and identify opportunities

to enter those markets on intermediate pull backs. We use our

timing charts to help us identify the end of this commodities

bull market and then when appropriate enter the next potential

major bull market. You may receive access to our timing charts

by visiting our website and subscribing to our newsletter. Or

you may subscribe to our free newsletter and read free commentary

about our opinion on the markets at www.investmentscore.com.

May 31, 2007

Michael Kilbach

email: mkilbach&investmentscore.com

website: www.investmentscore.com

Disclaimer/Disclosure: Disclaimer/Disclosure:

No content

provided as part of the Investment Score Inc. information constitutes

a recommendation that any particular security, portfolio of securities,

transaction or investment strategy is suitable for any specific

person. None of the information providers, including the staff

of Investment Score Inc. or their affiliates will advise you personally

concerning the nature, potential, value or suitability or any

particular security, portfolio of securities, transaction, investment

strategy or other matter. Investment Score Inc. its officers,

directors, employees, affiliates, suppliers, advertisers and agents

may or may not own precious metals investments at any given time.

To the extent any of the content published as part of the Investment

Score Inc. information may be deemed to be investment advice,

such information is impersonal and not tailored to the investment

needs of any specific person. Investment Score Inc. does not claim

any of the information provided is complete, absolute and/or exact.

Investment Score

Inc. its officers, directors, employees, affiliates, suppliers,

advertisers and agents are not qualified investment advisers.

It is recommended investors conduct their own due diligence on

any investment including seeking professional advice from a certified

investment adviser before entering into any transaction. The performance

data is supplied by sources believed to be reliable, that the

calculations herein are made using such data, and that such calculations

are not guaranteed by these sources, the information providers,

or any other person or entity, and may not be complete. From time

to time, reference may be made in our information materials to

prior articles and opinions we have provided. These references

may be selective, may reference only a portion of an article or

recommendation, and are likely not to be current. As markets change

continuously, previously provided information and data may no

be current and should not be relied upon.

321gold Ltd

|