INSTITUTIONAL ADVISORS DECEMBER 20,

2007 INSTITUTIONAL ADVISORS DECEMBER 20,

2007

Tax Rip-Offs and a Remedy

for Reckless Central Banking

Bob Hoye

Institutional Advisors

posted Dec 27, 2007

One would have hoped that financial

rip-offs committed by medieval princes would have been permanently

shelved when liberal enlightenment ended the divine right of

kings.

Recent imperious announcements

by Messrs. Greenspan and Bernanke to use the "printing press"

to inflate anything they can should be considered startling only

in the resort to honesty. Euphemisms for currency depreciations

started with the original promoters of the Fed and the tout was

that a "flexible" currency would prevent serious financial

contractions.

Regrettably, since the doors

of the Fed were opened in 1914 there have been many financial

crises and the dollar has lost 95% of its purchasing power. Particularly

ironical is that since originally touted as an agent of stability,

financial volatility has increased and has continued to the remarkable

violence in the sub-prime sector, for example. This is a subset

of the lengthy experiment in artificial "investments"

otherwise known as derivatives.

On the very big picture, long-dated

rates in the senior currency have ranged from the low of 1.85%

in 1941 to the high of 15% in 1981. During the 200 years prior

to the chronic attempt to artificially lower interest rates,

the range was 2.25% to 6.00%.

Obviously, imposition of ambitious

policymaking has introduced extraordinary volatility, and in

a separate article we have pointed out that while the commodity

and financial markets have suffered many severe contractions,

the concept and practices of central banking have never been

corrected.

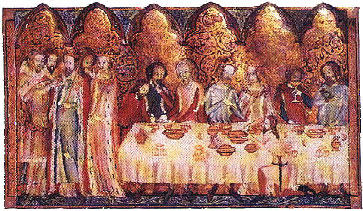

Nineteenth Century liberals,

so rational and principled in their views, could not have imagined

the greedy craft developed by many modern governments in confiscating

private wealth earned by productively working citizens. Are we

seeing medieval financial tyranny replicated by today's proponents

of the divine right of bureaucrats? A look at history provides

perspective, and, although outrageous when imposed, the passage

of time makes early examples of princely finance somewhat amusing:

The colourful Richard I (1189-1199)

sold property to finance his joining the crusade of Peter the

Hermit. Upon returning, he took it back on the pretense that

originally he had no right to sell it.

The infamous King John (prompted

the Magna Carta in 1215) introduced the clever plan of imprisoning

and ransoming the mistresses of priests, confident that the funds

he could not obtain from their greed he would from their lust.

Edward I (1272-1307) confiscated

money and silver or gold plate from monasteries and churches,

faked a voyage to the Holy Land and, in keeping the money, refused

to go.

Edward IV (1461-1483) was described

as the handsomest tax-gatherer in the country; and when he kissed

a widow because she gave him more than he expected, it is said

she doubled the amount in hopes of another kiss.

Henry VII (1485-1509) was fiscally

sound and approached wealthy families with two arguments. If

the household was not extravagant in expenditure, then he attacked

what they had saved by thrift; while if they lived extravagantly

they were considered opulent and could afford any exaction. Named

after his minister of finance, the ploy was called "Morton's

Fork".

A broader form of wealth confiscation

capable of tapping even the poor was accomplished by currency

debasement and extreme examples in ripping off everyone provoked

severe social disorder. No matter what method employed, financial

outrage prompted the evolution of parliament as a necessary means

of constraining fiscal ambitions of the governing classes.

The struggle between individual

freedom and authoritarian state proceeded until the late 1600s

when growing commercial wealth and political power in London

began to become influential with its financial common sense.

The specific event that formalized the victory over the ancient

status quo was the "Glorious Revolution" of 1688, which

maneuvered the pro-business and Protestant William of Orange

into the British Crown and displaced James II as the last absolutist

king. How refreshing this was is indicated by the oppressive

politics of his and his predecessor, Charles II. Starting with

the restoration of the monarchy with Charles in 1660, both kings

were bribed by France to change the culture of England - consistently

in an authoritarian direction. Scornful remarks by miffed establishment

were similar to those directed to the pro-business movement today.

No matter how imaginative or

despotic princely financing was, it can't compare with the long-

running compulsion to spend other people's money by today's bureaucrats

and politicians, virtually unrestrained by the checks and balances

of constitution or mainstream media.

But before expanding this point,

consideration should be given to the other event that formally

ended the old world, which was the beginning of modern finance

with the incorporation of the Bank of England in 1694. As history

shows, central banking is fine when disciplined by a convertible

currency and, when not, it becomes a tool of state ambition to

confiscate wealth though currency depreciation. That the dollar

has lost 95% of its value exceeds most princely devaluations

and, like those, has been no accident.

Indeed, recent Fed announcements

to "print money" could be an attempt to go for the

final 5%. While many outside central banking would consider this

as infinite folly, it is uncertain as to how long this endeavour

will maintain credulity in even academic circles. Regrettably,

modern financial agencies such as the Treasury or Federal Reserve

System have become as corruptible as their medieval counterparts.

Fortunately, history provides

some antidotes to governmental abuse of the productive sector.

Short of rebellion, the most effective of course has been to

force government and its financial agencies to be accountable

to the taxpayer. As for those who have wrecked the currency (also

a government responsibility), Dante, in his Inferno, reserves

a special place in hell for "false moneyers".

The Anglo-Saxon Chronicles

record something equivalent, albeit more temporal:

"1125 A.D. In this year

before Christmas King Henry sent from Normandy to England and

gave instructions that all moneyers ... be deprived of their

members ... Bishop Roger of Salisbury commanded them all to assemble

at Winchester by Christmas. When they came hither they were then

taken one by one, and each deprived of the right hand and the

testicles below. All this was done in twelve days between Christmas

and Epiphany, and was entirely justified because they had ruined

the whole country by the magnitude of their fraud which they

paid for in full."

-The Laud Chronicle (E)

Fortunately, history indicates

that the public will eventually figure out that no matter how

beguiling the claims about currency management and taxation are,

the gambit has been mainly to confiscate private savings. They

will then demand the return of sound money and accountable government.

###

-Bob Hoye

Institutional Advisors

email: bobhoye@institutionaladvisors.com

website: www.institutionaladvisors.com

Hoye Archives

The opinions

in this report are solely those of the author. The information

herein was obtained from various sources; however we do not guarantee

its accuracy or completeness. This research report is prepared

for general circulation and is circulated for general information

only. It does not have regard to the specific investment objectives,

financial situation and the particular needs of any specific person

who may receive this report. Investors should seek financial advice

regarding the appropriateness of investing in any securities or

investment strategies discussed or recommended in this report

and should understand that statements regarding future prospects

may not be realized.

Investors should note that income from such

securities, if any, may fluctuate and that each security's price

or value may rise or fall. Accordingly, investors may receive

back less than originally invested. Past performance is not necessarily

a guide to future performance. Neither the information nor any opinion expressed constitutes

an offer to buy or sell any securities or options or futures contracts.

Foreign currency rates of exchange may adversely affect the value,

price or income of any security or related investment mentioned

in this report. In addition, investors in securities such as ADRs,

whose values are influenced by the currency of the underlying

security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications.

321gold Ltd

|