CHARTWORKS - OCTOBER 11, 2005 CHARTWORKS - OCTOBER 11, 2005

Gold Short

term risk $460... two-month potential $542

Technical observations of RossClark@shaw.ca

Bob Hoye

Institutional Advisors

posted Oct 14, 2005

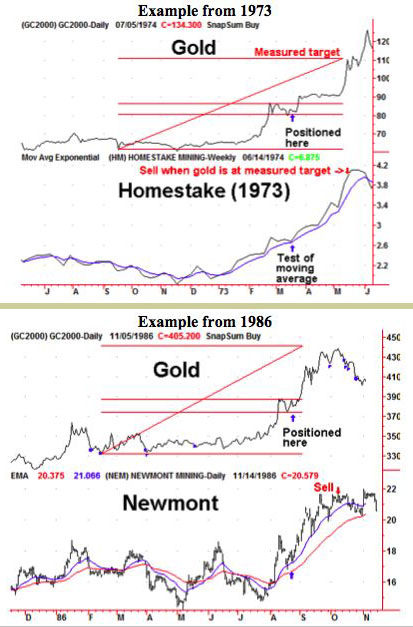

The US gold price staged a

triangular consolidation pattern through mid summer. The first

attempt to breakout was thwarted in August as prices retreated

below the breakout ($440) and tested $430. The subsequent rally

has managed to achieve new multi-year highs. This type of breakout

following a consolidation of seven-months or more has occurred

only once in each of the past three decades. The following charts

display each example together with the pre-eminent gold miner

of the day.

Once the bullion price manages

to make new highs the correction must hold above the old high

(✓) at which time the mining

stock makes a successful kiss of its rising 20-day exponential

moving average (✓). The key

point here is that this pullback to test the breakout in gold

becomes a measuring point for the ensuing rally. Based upon the

previous three examples, from the initial bottom ($412.90, Feb

8th), the current pullback ($463, Sept 23rd) should be at 38%

of the total rally. This calculation provides a target of

$542. While the bullion price may achieve a marginally higher

high, traders should sell the mining stocks once this target

is reached.

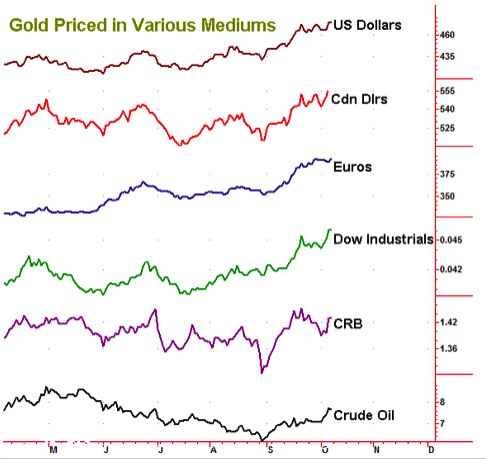

Gold Priced in Various Mediums

The gold trend has been up

for the past month whether it is priced in US Dollars, Euros,

Canadian Dollars, CRB Index, Crude Oil, the Dow Industrials or

S&P. This is the sign of a true bull market.

The breakout in the Euro-Gold

price at €350 in June and successful test in July has resulted

in a rally to €394, approaching our minimum target of €400.

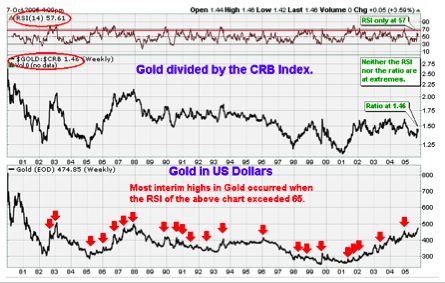

The Gold/Crude Oil ratio and

the Gold/CRB ratio are coming off multi-year lows. The following

chart displays the Gold/CRB ratio, Gold in US Dollars and the

RSI of the ratio. Interim highs in the bullion have been concurrent

with RSI readings over 65. Even though this has been an excellent

rally, we are only into a neutral territory with lots of room

before becoming overbought.

You can also see that since

1987 the Gold/CRB ratio (currently 1.42) has found the 1.60 level

to be a significant support/resistance level. Once again we are

nowhere near that resistance.

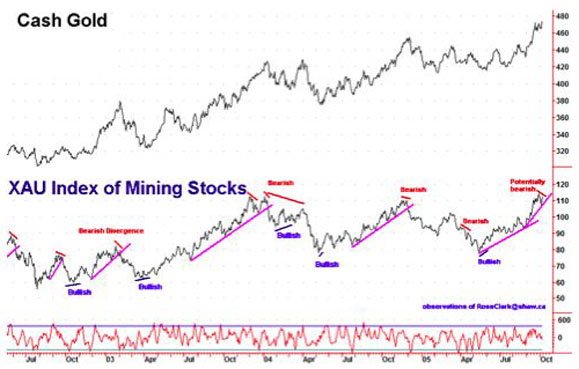

Senior Producers

The XAU and HUI mining stock

indices outperformed the bullion from the bottom in May through

the end of September. However, a bearish divergence has become

evident in the past ten days. If the divergence remains in place

and prices break the support line (currently 108 in the XAU)

a sell signal would be confirmed.

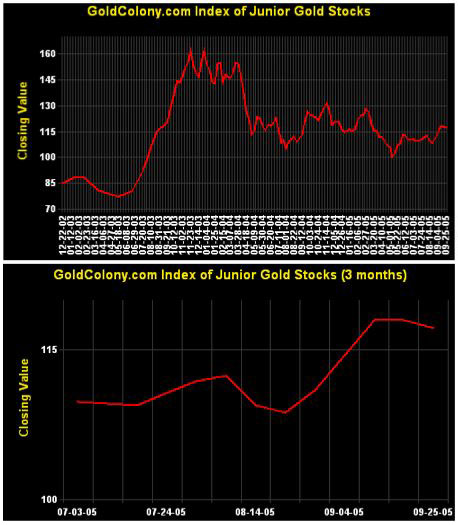

From the following chart you

can see how poorly the juniors have performed in the past 21

months. While they are up 20% since the May bottom they are still

a good 25% off the highs. If gold makes the run to $542 it should

do wonders for this group.

COT

The Commitment of Traders data

is back into dangerous territory once again. The commercials

are short a net 202,724 contracts. The non-commercials are long

a net 171,498 contracts. Both are at extreme levels dating back

to at least 1986. This makes prices vulnerable to any negative

news, but does not guarantee a break. Note that the runs of April

2002-May 2002, December 2002-February 2003, December 2003-January

2004 and October 2004-December 2004 occurred with extreme readings.

The best rallies in any market occur when the open interest is

rising together with the price. Such is the case right now.

Arrows denote signals from

the GoldWorks COT Model. In non-trending phases or when signals

are in the direction of the underlying trend the market reverses

quickly. However, following upside breakouts from consolidations

it generally takes seven to nine weeks of signals to reverse

the trend.

Bob Hoye

Institutional Advisors

E-mail bobhoye@institutionaladvisors.com

Website: www.institutionaladvisors.com

CHARTWORKS - OCTOBER

11, 2005

Hoye Archives

The opinions

in this report are solely those of the author. The information

herein was obtained from various sources; however we do not guarantee

its accuracy or completeness. This research report is prepared

for general circulation and is circulated for general information

only. It does not have regard to the specific investment objectives,

financial situation and the particular needs of any specific person

who may receive this report. Investors should seek financial advice

regarding the appropriateness of investing in any securities or

investment strategies discussed or recommended in this report

and should understand that statements regarding future prospects

may not be realized.

Investors should note that income from such

securities, if any, may fluctuate and that each security's price

or value may rise or fall. Accordingly, investors may receive

back less than originally invested. Past performance is not necessarily

a guide to future performance. Neither the information nor any opinion expressed constitutes

an offer to buy or sell any securities or options or futures contracts.

Foreign currency rates of exchange may adversely affect the value,

price or income of any security or related investment mentioned

in this report. In addition, investors in securities such as ADRs,

whose values are influenced by the currency of the underlying

security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications.

321gold Inc

|