| |||

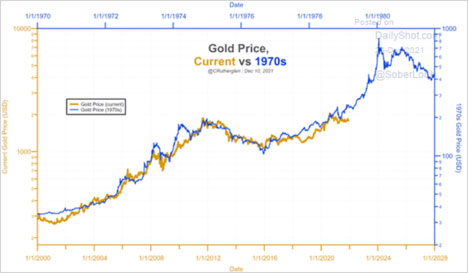

Perspective on Today’s Gold MarketGeorge Lyttle Now that the tax loss season is nearly over, it’s time to take another look at the gold market. I have previously pointed out that sentiment towards precious metals is at a record low level historically. Consequently, we are at a time to look at other types of analysis to see if we can find good possible investment candidates. This chart was recently sent to me by a good friend. Do you see what I see?

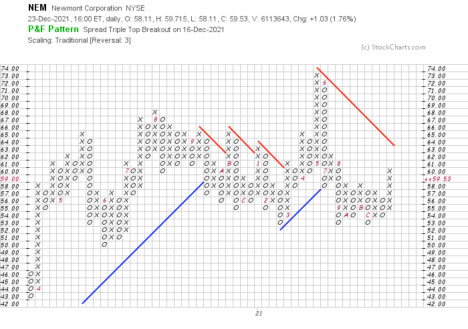

W.D. Gann in his courses clearly states that human nature does not change, neither does its pattern. Gold, since the start of this century, seems to be following very closely to the pattern formed 50 years before. It looks like the next three years could be very good for gold holders as long as this continues. While we are dealing with Gann analysis, information provided by Gann Global Financial is informative. It appears that both the Gann 60 and 90-year cycles had significant bottoms on March 16, 2020. If these cycles hold true, the 90-year cycle is due to experience a significant acceleration starting in June, and the 60-year cycle in August. The question now is: What would be a good speculation to consider? A scan for the most profitable P&F patterns yields two good candidates, Franco-Nevada and Newmont Mining. This would be a good place to start. (Click on image to enlarge) (Click on image to enlarge)

In my courses, I try to emphasise that one analysis alone doesn’t really provide the full scope of what investor’s should know in order to both reduce their risks, and maximize the odds for successful speculation. ### Dec 27, 2021 Disclaimer: This contents represents the opinions of George Lyttle. Nothing contained herein is intended as investment advice, or recommendations for specific investment decisions, and you should not rely on it as such. George Lyttle is no longer a registered investment advisor. Information and analysis above are derived from sources, and using methods believed to be reliable, but George Lyttle cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis, and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions. |