| |||

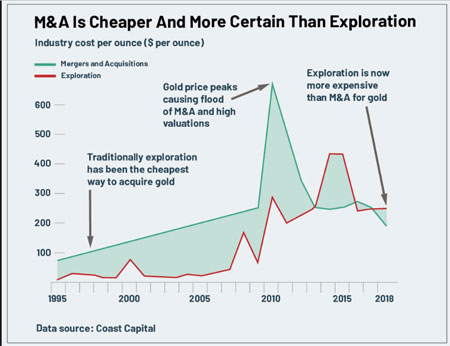

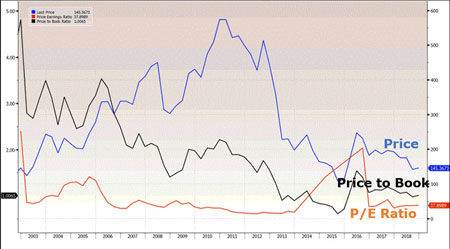

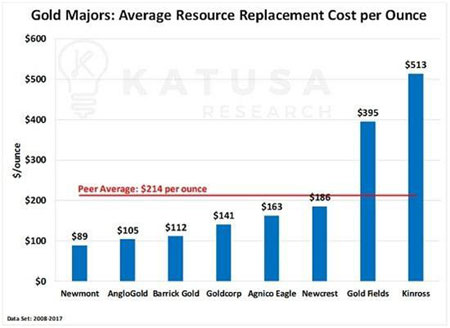

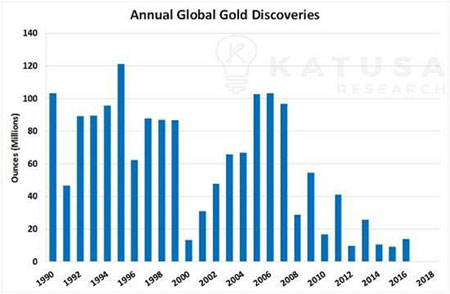

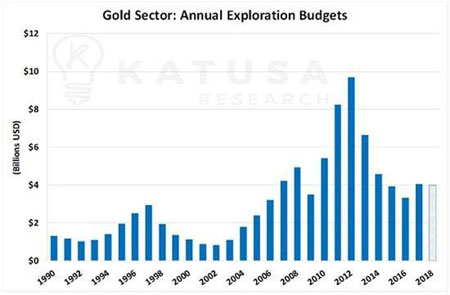

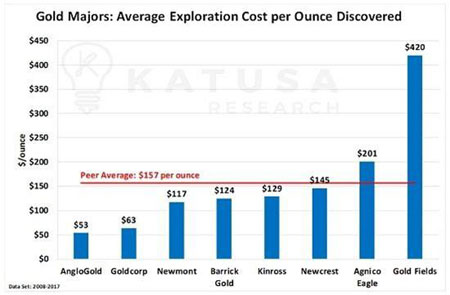

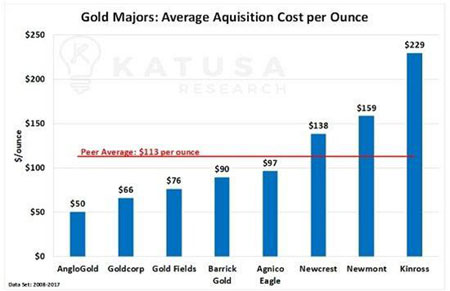

Buy or merge rather than work?Olivier Crottaz It is by forging that one becomes a blacksmith, says the maxim. In the mining sector today it is (currently) no longer the case. Why? Because drilling, discovering, developing is more expensive (or less profitable) than capturing undervalued assets. Indeed, the fall of mining stocks offers incredible opportunities for those who have 1) means 2) an asset also under valued to add for synergies / cost savings 3) courage. Acquisition costs are now lower than exploration costs. The last time this case appeared, it was in 2015 ... follow my eyes: Today, even more than in 2015, the mining P/E is very attractive. Knowing now that buying or merging is a better deal than drilling, at what price should ounces be bought? Large companies face significant costs to replace their ounces ($214 average) Because discoveries are increasingly rare and difficult to find. Discovery budgets are down since the peak of 2012. The costs of discovered ounces remain high. In conclusion, the cost of acquiring ounces remains better than drilling. As you can see, the graphs above cover periods from 2008 to 2017. With the significant increase in gold since June 2019, the mining companies will announce profits for the third quarter, increase their cash and recover courage to embark on acquisitions/mergers. Source of graphics: https://www.kitco.com/news/2018-10-08/Short-Sellers-Beware-Gold-Must-Go-Higher-Edelson-Institute.html (October 2018) ### Oct 9, 2019 |