|

|||

Doing God’s WorkBy Ton Coumans The divine power of fiat currency In 1966, at the height of Beatle mania, John Lennon made the rather callous remark that the Beatles were more popular than Jesus Christ. This evoked a wave of revulsion and violent protests throughout the US and many other countries. Beatles concerts were cancelled and their records were publicly burned in a show of protest. When contemporary entertainers, no matter how popular, place themselves in one category with a prophet and the founder of a religion they can expect sparks to fly. This makes it all the more surprising that hardly an eyebrow was raised when the CEO of Goldman Sachs, Lloyd Blankfein, confided to a journalist of the Sunday Times that he is in fact “doing God’s work”. Think about it; the CEO of a bank proclaims that it is God’s work when he sells dubious mortgage backed securities to his clients, while at the same time shorting these very products. Where is the indignation? Where is the revulsion? And yet in a curious way Blankfein’s statement could indeed be accurate.

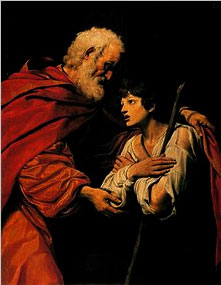

The Return of the Prodigal Son, Leonello Spada, Louvre, Paris In the parable of the lost son, scholars interpret the father as doing God’s work; forgiving sins and allowing the prodigal son to pursue a life of virtue once again. If you are familiar with the parable you may wish to skip the next four paragraphs. The parable of the lost son is simple in it’s narrative but allows us to test our sense of fairness and our ability to forgive and forget and be free to move on to better things. The setting in biblical times is one of a father of upper class standing and two sons, neither of which feels a particularly deep fondness of their father. The elder son accepts that life is not perfect and makes himself useful in the family business. The younger son decides to break out of his situation and convinces his father to given him a considerable advance on his future inheritance. He then makes of with the money and basically squanders it in short time on a prodigal lifestyle. When he has burned through his resources he falls into deep poverty and misery which brings him to ponder the choices he has made in his life. He thinks in envy to the simple hired hands his father employed and he eventually sees no other possibility than to make his way back home to beg his father to hire him as a day worker. On his arrival at home his father calls for a great celebration to rejoice the return of the lost son. The calf is slaughtered and the lost son is rehabilitated and given clothing and a ring. Scholars interpret this as the father doing God’s work; forgiving sins and allowing the son to pursue a life of virtue once again. However the elder son feels rejected and treated unfairly. He questions his father why the calf is slaughtered for the prodigal son when he himself, after all his diligent work, has not even been allowed a mere goat to celebrate with his friends. The father counters by stating that “all my possessions already belong to you”. But that the return this day of a lost son calls for a special celebration. A child that was lost to a life of sin has returned to live a life of virtue. The parable does not expand on how this difference op opinion is resolved. Did the West squander the inheritance? Looking back from 2011, is it accurate to conclude that the West, starting sometime in the eighties, progressively adopted the lifestyle of the prodigal son? Since the eighties more and more factories, productive assets and whole industries moved to Asia. The West no longer produces textiles, consumer electronics and many other items found at retail stores in any significant quantities. These items are imported in bulk from Asia with all the negative consequences for the trade balance. Equally, the energy resources of the West are in decline requiring oil and other energy sources to be imported from abroad with further negative consequences for the trade deficit. And yet the West has continued to live the good life, increasing energy use and expanding consumption in the face of declining domestic production and saving. The West has only been able to keep the party going by running up debt levels, private and public, often based on asset bubbles and financial shenanigans. Does this constitute an immoral state of affairs, comparable to the life of the prodigal son? At the very least it can be called shameful for one generation to pas on the debts of its consumption on to the next generation. The simultaneous decline of production and expansion of consumption based on ever more debt seems to have reached some kind of limit of late. We find ourselves now in a miserable position, unable to take on more debt and unable to reduce our trade and budget deficits. We truly are in dire straits with authorities at the IMF warning that a complete financial meltdown is a real possibility. We find ourselves pondering the unwise choices we have collectively made, much as the prodigal son did. There are no easy choices and all ways forward include taking pain. Will we come to the same conclusion as the prodigal son and decide to find our way back to a virtuous state of affairs in which we live within our means as citizens, balance the government budget and assure that imports are in balance with exports? This, in itself, will be an enormous challenge for many western countries to achieve should their citizens join hands to pursue this route. Low interest rates and relaxed lending standards send the wrong signals to the economy that resulted in misallocation of resources on a massive scale. Spain and Ireland build far too many houses, France hired too many civil servants and Germany has too many factories. Undoing these imbalances will have far reaching consequences. Many of us have become so accustomed to the good life that we feel it is our right, rather than our achievement to live in luxury. Re-adjusting will be painful. But assuming we do come to our senses, as the prodigal son did, and eventually after many years of restructuring reach a situation in which we live within our means, we will still have that enormous debt we have accumulated over the last decades to pay off. That will be a burden so great as to potentially keep us in depression for a generation or more. The forgiving father that did not require his prodigal son to repay the money he had squandered is a luxury the West does not have. Or do we? All debts are denominated in currency units and the Federal Reserve and other central banks can create currency units (money) in any quantity they wish, often referred to as the money printing press. They can, technically, buy as many government bonds as they wish and then literally tear up the document relieving the debtor of their requirement to repay. With some creativity any debt circulating in society can be voided in this way. Throwing money from helicopters, pondered by Bernanke, comes to mind. The FED indeed has the power to deliver us from the consequences of our bad choices and frivolous lifestyle and also free future generations from having to live enslaved to the debt we acquired. Is this what Lloyd Blankfein was referring to when he stated he was doing God’s work? Is this the divine power of fiat currency, which allows grave mistakes to be excused, without excessive depressions, misery and outright famine? What is not to like about fiat currency when considering this? To bring this into perspective let us consider the case of Ireland. Ireland was enticed into a housing boom by the low interest rates of Euro-land. They build too many houses and government debt in general got out of hand. House prices have come done by as much as 60% from their bubble levels leaving banks undercapitalized with massive bad loan portfolios. However, the Irish are well through the denial phase and on their way to taking the hard measures necessary to cut out accesses, attract new business and generally balance their affairs. Given this, is it not reasonable for the ECB to gradually buy up the bad loans to recapitalize the banks and buy government bonds to relieve future generations of Irish from and unbearable debt burden? Many believe that printing money by the central banks will lead to automatic hyperinflationary misery but this is not necessarily the case. Consider that the total federal debt stands at $14.8 trillion dollars (October 2012) and we are not experiencing hyperinflation. Two years ago the debt stood at around $12.3 trillion dollars and there also was no hyperinflation. The Federal Reserve currently holds just under $2 trillion in US government bonds on their balance sheet. Were the FED to relieve the US government from ever re-paying that debt, effectively tearing up the document, the real economy would not notice, and it would not be inflationary. But the debt would be reduced by almost $2 trillion. Several counties such as Germany and the Netherlands have managed their affairs responsibly over the years, much as the elder son in the parable that had that stayed with his father and lived within his means. Is it fair to these countries that Ireland is “let off the hook”? It will not cost the Dutch and German tax payers any money, contrary to popular belief, since the relief will come in the form of printed money by the ECB. But their consent is needed and the question is, are these countries ready to forgive and move on in the case of Ireland? Would it be in their best interest to let Ireland off the hook, even if it feels unfair? Many point out that it was fiat currency in the first place that got us into this mess, and that it is an insult to attribute divine characteristics to the concept of fiat currency. I can only agree wholeheartedly. Which brings me to wonder why the father in the parable gave his son the money in the first place. He should have known that it would only get him into trouble and misfortune. And along the same line, why did the Spanish Court in 1492 give a foolhardy adventurer three ships to sail to the west, when everybody knew they would fall off the earth? Is it just the manner of things? The father did not “bet the farm” on the outcome when he facilitated his son to break away. The father new the business would carry on even if his son were to fail. We collectively seem to allow strong convictions in society and in individuals to run their course, judge the outcome and retain what has a lasting quality. Bad outcomes are treated as a lesson. Is this the process of progress in general? Greenspan’s “irrational exuberance” speech comes to mind. Possibly he wanted to signal in 1996 that the FED was anticipating that the economic party was getting a little too wild and that it might be time to take the punch bowl away by raising rates. But the reaction was so strong and so negative that he buckled. Society in that time was hell bent on “going for it”, as was the prodigal son. Would not Greenspan have been replaced, had he stood his ground? Just as the father in the parable, Greenspan let it happen, possibly reassuring himself that he was not betting the farm on the outcome and that the Fed had the printing press ready for when society came back to its senses. No system or organization run by mortals is fail-safe. It is even said that any system run by people is doomed to fail in one way or another. So too, a system of money creation, managed by a mere hand full of mortals is bound to at least err on occasion. All fiat currencies in history have returned to their intrinsic value of zero. Will this time be any different? The power to create money is so profound that the risk of the care takers being corrupted, even with the best intensions in mind, is just too great to endure. The outlandish salaries and bonuses being paid on Wall Street only serve to underwrite this. I would be more convinced that Lloyd Blankfein was doing God’s work if he would indeed be doing it “pro Deo”. As of recent years there is more talk of basing the global money system on gold. Precious metals of course are not managed by mortals, have been trusted for thousands of years and are incorruptible. Trade deficits and budget deficits can not be extended indefinitely because the gold will run out at some point. The gold based money system has a build in mechanism to counter imbalances before they get out of hand and there is no room for shenanigans. This mechanism has been absent in our current fiat money system over the last three decades and is the source of the imbalances. But will precious metals based money bring out the best in humanity? Is it able to allow mankind to exploit disruptive ideas and technologies quickly? Is it flexible enough to ensure that able body men and productive assets do not fall idle in turbulent times? Case in point is that if the US government would not run the food stamps program, food producing assets would fall idle forcing even more lay offs while 45 million citizens would go hungry. Continuing the program would not be possible in a gold based system because the gold will run out at some point. Gold is very unforgiving. There is no limit to man’s capacity for folly. But there is equally no limit to man’s capacity to forgive as the parable of the prodigal son displays. Should not our money system mimic this in some way, without of course overtly inviting folly? The way forward from here is not at all clear. The most benign outcome would be that countries follow Irelands example and return to a balanced state of affairs and the central banks pardon the debts incurred in the crazy years. But it could be too late for that scenario as it seems the people are rising up and ready for revolution. The Tea Party movement as well as the Occupy Wall Street gang are convincing in their passion if not confused in their message. However, as Bill Bonner brilliantly points out in the Daily Reckoning; “beneath the fantasies is a hard truth: the current system no longer works for them”. I project that eventually these movements will figure out that what they really want is a seat on the Board of Governors of the Federal Reserve. Then they will acquire the divine power to determine who will be at the receiving end of the money creation scheme. That is most likely the moment when the rest of us will want to hold gold and have a vegetable garden. ### Ton Coumans Ton Coumans holds a Masters degree in Mechanical Engineering and has pursued a life long philosophical study of systems, human and otherwise. The subject of interest is how individuals come to cooperate in the form of communities and societies that develop a common identity, set of beliefs, moral codes and expectations for the future. As such, societies are regarded as living organisms of a higher moral relevance than its basic building block, the single individual. As a living organism, societies seek to grow, expand and thrive in general, whilst competing and cooperating with other societies. The challenge is to assess the state of affairs in a society and compare this to the general beliefs and expectations of that society. When significant discrepancies occur the object is to anticipate how the tension will be resolved and invest accordingly. |