Animas Resources Ltd.

Talent and Luck

Kevin Graham

Dec 11, 2007

I was invited to attend the

first-ever site tour of Animas' Santa Gertrudis gold deposits

and exploration lands. With no obligation, this invitation was

extended with the potential for an independent and objective

review of the project from an investor perspective. No consideration

exchanged hands. None was promised. None was expected. I am not,

at the time of writing, a shareholder of the Company, though

this may soon change.

At noon on December 5th, I

met up with Jeff Phillips (the brains behind the creation of

this Company/project), Greg McKelvey (geologist, President and

CEO), and Marina Trasolini (geologist, Lawrence Roulston's Resource

Opportunities) at the airport in Phoenix. We traveled to Rio

Rico, Arizona (near the Mexican border) for an overview briefing

on the Company that evening. Also attending the briefing were

John Wilson (geologist, VP Exploration), John Reynolds (geologist

and geophysicist, consultant), and Odin (Odie) Christensen (geologist,

advisor).

Next morning (December 6th),

we crossed the border, heading south to Magdalena, where we met

with Bob Moriarty for breakfast, and then on to the property.

Meeting us on site was Alberto Navarro (geologist). The day was

spent touring the property, visiting a number of formerly mined

pits, reviewing geologic maps, and grappling with the scope of

the project. That evening, we returned to the hotel at Magdalena

for dinner and the opportunity for more 'getting to know you'

conversation.

The People

I begin with the people running

the show because I think and feel that this is the most important

consideration in looking at any organization. Frankly speaking,

a company could be sitting on Fort Knox, but if I didn't feel

that the team leading the charge was both competent and trustworthy,

it wouldn't see a penny of my investment dollars.

Jeff Phillips appears to be living out one of the

main themes from Jim Collins' excellent book, Good to Great.

Collins postulated that one of the key foundations for building

a great company is to ensure first that you have the right people

'on the bus' before deciding which direction to drive. Working

with Greg McKelvey, Phillips has created a core team of staff,

consultants, directors, and advisors. I will highlight here only

those whom I have met. Detailed descriptions of others can be

found at:

http://www.animasresources.com/s/Management.asp

and

http://www.animasresources.com/s/AdvisoryBoard.asp

Phillips' background is in

corporate finance, marketing, and communications (including work

with Metallica Resources, Ultra Petroleum, Silver Standard Resources,

Strathmore Uranium, Penaco Energy, Guyana Goldfields, and Boron

Chemicals). Essentially, he's the dealmaker who conceived and

created the Company. He's also one of the Company's largest shareholders.

Greg McKelvey is the President and CEO. McKelvey

brings over 40 years of experience in both exploration (including

discovery) and mining, including postings with Newmont, Homestake,

Kennecott, and as VP Exploration Latin America for Phelps Dodge,

one of the former operators of a major section in the Animas

property. He sees his role as guiding the strategic development

and tactical implementation of exploration efforts. Given the

scope of the project, maintaining focus for the Company will

be a significant factor in determining whether or not that path

leads to success. Both in our discussion in transit (four hours

from Phoenix to Magdalena) and during the formal presentation,

McKelvey stressed the need for what he called a balanced 40/40/20

strategy. This strategy is comprised of three major components:

to rapidly extend known resources (40%), to discover additional

resources along strike and under post mineral cover (40%) and

to develop and test new ideas (20%), including deeper targets.

McKelvey

John Wilson is VP Exploration. Wilson brings more

than 35 years of experience around the world in all of: exploration

(including discovery), resource definition, and mine development.

Wilson led the overview presentation, and provided a clear and

concise understanding of the potential of this project. Not a

desk jockey, he'd be happier if he never left the field.

John Reynolds is a consulting geologist/geophysicist

with more than 35 years of direct related experience. He has

worked around the world, leading successful geophysics programs

for numerous mining companies. This includes working on the current

property for 18 months for Phelps Dodge. His role is that of

counterpart in the field to Wilson, leading efforts to compile

and understand existing data, as well as collecting new data

in the targeting of new resources.

Alberto Navarro is a consulting geologist who has

worked on the property for many years, bringing historical context

to the effort. We did not converse much, as my facility with

the Spanish language is more than 30 years into a stage of rust.

Phillips and McKelvey stressed

their feeling of a need to ensure that Animas has at its disposal

a wealth of expertise and connections in the form of a carefully

selected Advisory Board. This group includes specialists in corporate

finance, business development, mining engineering, geologic exploration,

marketing, and mining law. On this last count, one of these advisors

was a co-writer of current mining laws in Mexico, and has recently

served as an advisor to the government in amendments to these

laws. Clearly, Phillips is doing his best to cover all the important

bases.

Odie Christensen is an active member of the Advisory

Board who, in his own words, plans on becoming even more involved.

Christensen's involvement in this project is better understood

with reference to the Behre Dolbear report, commissioned by another

former operator of the property in 1997. See the link at:

http://www.animasresources.com/i/pdf/BehreDolbearonSGCarlinPotential.pdf [BIG file]

In a nutshell, this report

was tasked with evaluating the potential for the Santa Gertrudis

deposit to contain deep Carlin-type gold mineralization. Carlin-type

mineralization means low-grade, high tonnage, with a host of

associative characteristics, including: structure; alteration;

geophysics; geochemistry; mineralization; and soil geochemistry.

Without going into great detail, their conclusion was that this

potential was very strong. Carlin-type mineralization refers

to Newmont's Carlin Trend in Nevada, advanced in the 1980s by

a team led by none other than Odie Christensen. When he arrived

on the scene, the project had identified some 300,000 ounces

of gold. By the time he left, that figure had been raised to

more than 20 million ounces. As Exploration Manager, he was instrumental

in transforming the Carlin Trend from a single mine into the

largest gold district in the United States. For the skeptics

who might suggest that his presence at Carlin was merely coincidental

with this transformation, his next appointment was as Newmont's

Chief Geologist, Worldwide. An impressive member to have on your

team, I say. To the point in question, I heard Christensen say

on more than one occasion during the site tour that this "sure

looks like a Carlin-type deposit."

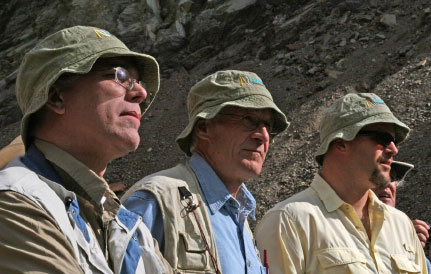

Christensen, Wilson,

Phillips, Moriarty, and McKelvey

History of the Property

To call this a 'property' would

be a misnomer. The folks at Animas term it a 'district' and rightly

so. This district is a consolidation of properties formerly controlled

by as many as ten different companies at one time. The largest

of these was formerly under the Phelps Dodge umbrella. The collection

of properties has just been expanded to include in total approximately

630 square kilometers of land, all of which is described as 'prospective'.

There are hundreds of kilometers of roads already built. Bonus:

the road that leads to the property stops at the property. As

a result, the chances for cross-border hanky panky traveling

through the area are slim to nil. Power, water, and workers have

been available in past on this property, and are expected to

pose no great challenges to the project on a go forward basis.

One of 22 previously

mined pits

The total cost of acquisitions

is estimated at about $5 million. To find the district, open

Google Earth. Set the Tools/Options to Universal Transverse Mercator.

Find the coordinates 543000 mE and 3388000 mN. Most of the black

spots you will find there represent the water table at the bottom

of previously mined pits. The rectangular black spots are heap

leach pads, left by prior operators.

Since this past summer, data

has been gathered from a variety of sources, now being fed into

a computer model that will be a prime source of guidance for

drilling activity, set to begin in the New Year. The enormity

of this task is reflected in the following description of available

data: 1,017 reverse circulation drill holes, totaling 98,620

meters; 225 diamond drill holes totaling 21,122 meters; 34,000

rock samples; and 21,000 soil samples. Moreover, 55% of the district

is covered by a soil geochemical survey. In today's dollars,

the value of this data would be in the tens of millions of dollars.

In other words, while Animas Resources is only five months old,

this early stage explorer is already well advanced by a wealth

of information now being modeled for the first time using previously

unavailable computer techniques. District-wide data, sourced

from different property acquisitions, offer synergy in consolidation,

pointing to potential for resource extension (along trending

structures) much larger than offered by piecemeal consideration.

Between 1991 and 2000, previous

operators mined 564,000 ounces of gold (with an average grade

of 2.13 grams per tonne) from an historic (non-compliant) resource

estimate of some 1,280,000 ounces. This means that historic estimates

would leave 720,000 (non-compliant) ounces still on the property.

Of the total district, gold was produced from 22 open pits in

an area of 72 square kilometers, or just 11.4% of the total land

area.

Campbell Resources, the last

major operator in the district, had acquired its portion of the

property from Phelps Dodge in 1995 for $10 million. Campbell

ceased operations in 2000, resulting from gold prices falling

to under $300/ounce.

An Expanded Paradigm

As intimated above, efforts

going forward, in part, will be targeted at fleshing out the

potential for this district to offer a multi-million ounce Carlin-type

deposit. Geologists on the scene described the ore bodies at

surface to be showing very little erosion. Suggested by this

is that already mined ore may represent just the beginning, with

potential for more ore and even better grades at depth. With

very little past production and exploration below 300 meters,

a Carlin-type deposit (to depths of 1,000+ meters) remains to

be tested and proven.

As a bonus, all mineralization

is seen as post major structure on the property. This means that

'following the bread crumbs,' as it were, will be much easier,

and much more predictable than would otherwise be the case.

Of significance, the framework

of past exploration and production was restricted to oxide-based

mineralization. This was because the only extraction method then

under consideration for this property was heap leaching. For

a backgrounder on heap leaching, see the links:

http://www.rthiel.com/Heap_Leaching-GRI_Dec03.pdf

and

http://www.bullion.org.za/MiningEducation/Gold.htm#science

This process offers lower relative

capital and operating cost in comparison to other methods, but

is restricted (without adding another intermediary stage) to

oxide ore. While a heap leach production facility (if I heard

correctly) could cost as little as $20 million to build, the

process is not nearly as effective as other, more expensive,

extraction methods. The gold now sitting in the tailing dumps

for the 22 mined pits at Santa Gertrudis could range to 50% of

the original contained metal. These tailing dumps may re-enter

the picture at some future date, either in newer technology heap

leach processing or in some other, larger more sophisticated

facility.

The property adjacent to a

number of mined pits is covered by 20-30 meters of post-mineralization

gravel. Much of this area (of many square kilometers) remains

untouched by exploration. John Reynolds means to extend efforts

meaningfully into this area in the immediate future, seeing no

reason to believe that mineralization stops with the arrival

of this gravel. The potential, he says, is huge, yet remains

to be proven.

Reynolds and Christensen

Because of the mindset to extract

gold using the low cost heap leach method, whenever sulphide

ore was encountered, exploration by prior operators stopped.

Animas, however, views this property/district through a much

wider angle lens. In all fairness to prior operators, the rising

price of gold allows Animas to do so. Sulphide ore is not seen

as an impediment but as a valued resource. With the Carlin-type

target in mind, identified a full decade ago by a former operator,

Animas sees its potential as entirely open, both in lateral extent

and at depth.

The upside potential for this

project is significant. As an investor, though, one should always

be asking the question, "What's my downside risk?"

Here's what I see as the worst-case scenario. Animas is

an exploration company, not a producer. The clear objective of

this Company is to take the resource definition to a level where

a larger operator (perhaps on a joint venture basis) can take

it to full realization of its potential. As exploration activities

ensue, however, this big picture objective (in the worst-case

scenario) may slip further from reach, perhaps only on a delayed

basis, but out of reach nonetheless. For a relatively low end

capital investment, and within a year from the start date, Animas

could put the heap leach model back into action, producing 60,000

ounces per year. Back in 2000, one site targeted to be mined

(but abandoned when the price of gold dropped below $300) had

been estimated to contain 125,000 ounces of gold. That site alone,

within two years of production, could both pay for its capital

cost, and generate new cash flow in the range of double its current

market capitalization, hence funding future exploration activities.

From a risk reduction viewpoint, that's not a bad Plan B. Keep

in mind that the Company has inherited an historic resource estimate

(non-compliant) of some 720,000 ounces.

As I see it, the greatest challenge

facing this Company may be the size and scope of the district

and what it offers for exploration. To get 'permission' from

the market to take this project to the next stage, Animas must

find and remain focused on the best bet target(s). It would be

far too easy to become enamored with too many targets. Greg McKelvey

recognizes this as key to his success as the project leader.

This balancing act for staged growth will be pivotal, as the

Company progressively earns enough rope by which to hang itself,

striving all the while not to do so. Nature of the beast.

Country Risk

In an unrelated Behre Dolbear

report (2006) (see the link: http://ratcliffephotos.free.fr/kamoto/CountryRankings2006.pdf),

Mexico was tied for 4th in a ranking of 25 countries for risk

in mining investment, behind only Australia, Canada, and the

U.S.A. This low level of country risk, in the general case, coupled

with pre-existing mining activity on the Santa Gertrudis property

suggest that, while nothing is airtight, this element is on the

periphery of the radar screen. Nonetheless, the appointment to

the Advisory Board of a fellow who co-drafted Mexico's current

mining laws indicates that Animas takes nothing for granted.

Plans for Near-term Activity

- Mine Development Associates

(Reno) has been engaged to work on future resource estimates

- Major Drilling of Mexico (subsidiary

of Major Drilling Group International) has been contracted for

a program to drill 8,000-10,000 meters, beginning in early 2008.

One drilling rig is scheduled to arrive in January, another in

March. This said, McKelvey insists that the drilling program

will be driven by data (of which there is much), not the other

way around. At the same time, drill rigs are not plentiful in

supply, so the Company may bite the bullet and acquire rigs as

they become available, whether or not the timing is perfect from

a data-driven perspective. Assay results will lag drill hole

completion by about six weeks. Waiting time, with just a couple

of drills turning, will create some slowdown in using results

to guide subsequent drilling. Not great, but par for the course

in this part of the world

- Hire two new geologists in

the New Year. Geologists are a scarce resource these days. This

shortage will continue to be a challenge in the immediate future

- Finish refurbishment of residential

facilities at the base camp in preparation for the upcoming drilling

program. Looks pretty much done already. Paint on the exterior

of the main buildings was being applied during our site visit

- The hope is for an NI43-101

Technical Report by the end of the first quarter of 2008, but

a shortage in those qualified to write such a report may push

this into a May-June 2008 time frame

- Complete infill drilling to

elevate the resources as necessary

- The current budget for 2008

of $2.5 million is likely to be raised, with new available funding.

The next 18 months of operations is covered by current resources.

Bonus Program Tied to Performance

in the Business of the Company

While officers of the Company

are shareholders, they are not 'huge' shareholders. Their opportunity

to earn significant shareholdings, however, is not insignificant.

Rather than a 'willy-nilly' share granting program, Animas has

constructed a bonus program that rewards officers of the Company

when they place the Company in a position to reward shareholders

at large. Their bonus plan is tied to defined resources. One

million shares will be granted when 1.6 million ounces of 43-101

compliant resource has been achieved. Another one million shares

will be granted when 2.7 million ounces of 43-101 compliant resource

has been achieved. Were I a shareholder in this Company, with

current outstanding shares of less than 22 million, and a market

capitalization of just $27 million (with a hope to quadruple

that to $100 million before the end of 2008), I'd be pleased

to share the inevitable rewards of such a program. With completion

of the current financing, the Company will hold greater than

$7 million in cash. This should provide a good kick-start in

efforts to bring the management team (and shareholders at large)

one step closer to sharing in the bonus program.

Graham, Christensen,

and Phillips

Animas Resources has acquired

a huge exploration opportunity at a significant discount, and

possessing what I see as minimal downside risk, if managed well.

Considering the historic resource, the caliber of the team in

place, and the exploration potential of this district the market

capitalization of just $27 million sounds to me like opportunity

knocking. With a share price of $1.25, opportunity knocks loudly.

Buying at a discount what someone

else has created at great expense has always been a good business

practice. Looking at such a project through a newer, wider, and

deeper lens, and utilizing technology tools not previously available,

offers great potential to the talented and the lucky. The Animas

team is clearly talented. As for the lucky, what's that old saying?

Luck is the place where preparation meets opportunity. As always,

time judges all. This writer is neither a licensed financial

analyst nor a geologist. Please do your own due diligence.

Kevin Graham

email: kevin@lookoutmanagement.com

Animas Resources website

Please click here to rate this

report: http://survey.corplink.com/LMI/ARSVR2007.aspx?E475H6OE

321gold Ltd

|