|

|||

Joe Average Conducts Due DiligenceKevin Graham

In my best Opie Taylor voice, I say, "Gee whillickers, Pa". Absolutely nothing out of the ordinary qualifies me to conduct due diligence at any level beyond your typical bloke on the street. I am Joe Average. As I've often been known to say, "Aw shucks! I'm just an English major with a calculator." A year ago, I couldn't have told you that Au was short for gold and Cu for copper. Nor could I have told you how a porphyry was different from a vein. Nor could I have explained the significance of oxidation to grades of copper near the surface, nor the best range of temperature for precipitation of gold. In short, the closest I had come to gold mining in Indonesia was an investment mistake I'd made about ten years ago. Fortunately for me, that relatively small purchase was after the price plummetted from $200 to $2. I still have that one on my portfolio, just to offer a daily reminder of what can happen when I let my arrogance, my greed, and my laziness get between me and prosperity. So how did I get from knowing absolutely nothing about Southern Arc Minerals in mid-May of this year to a personal invitation for my first-ever site visit from the Company's President, John Proust? Perhaps more importantly, what have I learned since mid-May, both about Southern Arc (SA) and about due diligence? The simple answer to the first question is that I just love to ask questions. The more questions I ask, the more questions I discover yet to be asked. But, and this is key with this unending litany of questions comes focus and clarity. Call it my version of infill drilling (yet another term I'd never heard of six months ago). If anything qualifies me to conduct due diligence, this is it - asking questions that lead to more questions. I ask questions because I mostly operate in the second Knowledge Quadrant; that is, I don't know, but I know that I don't know (for more on the topic, click here. SA first came on my radar screen in mid-May on a momentum scan I'd conducted on StockCharts.com. With some modest success using this tool, I was prepared to place small amounts of money into stocks that had experienced significant price gains on new volume, followed by textbook Fibonacci retracement. Between May 6th and 16th, SA fit the bill perfectly, rising from $0.62 to $1.65 (on new volume), and checking back to $1.23 before again climbing. I was in for what might be a few days, I thought. Having bought, I did a little background reading on SA and learned that there may be more to this one than a simple pump and dump momentum play. The more I read, the more I liked. The more I liked, the more I read. Before long, I was building a file of scribbled notes and collected articles on any and every subject that touched on the business of this Company. I should say that, while investing is a hobby for me, I do feel a duty to my family to keep a close eye on this hobby. I'm regularly amazed to find people on the BullBoards who appear to spend as much time deciding between a Big Mac and a Quarter Pounder as they do on their choices in investment. It's not unusual to have a poster come on the Board, announcing that they've just bought a particular stock, and then to ask "Is this a good investment?" If you're a trader, you don't really care. If you're an investor, this is a question you should have asked yesterday. Well, by June 19th, my file had grown quite thick. Then Omar Boulden wrote an article appearing on 321gold.com. It was a Case Study on Due Diligence. Of interest, the illustrative case was Southern Arc. An excellent piece this was, pushing me into overdrive in my mission to better understand my investment. Every day, it seemed, I was posting another question on the SA BullBoard. Over time, I started to post my own ideas, asking for others to poke holes in what I was seeing. Knowing little, I had no interest in convincing others of my opinion. I sought the truth, and do even now. If someone can convince me that my investment in this Company is imprudent, I'll be gone in a flash. So far, my confidence in SA only grows stronger. It gets a little scary sometimes, when you keep asking and asking, and no one seems able to come up with a convincing argument against. There are lots of arguments on the SA Board, and I've tried to capture them in my own online 'book' (link). I am constantly clearing the table, and freshly asking the question, "what's wrong with this picture? Are you just fooling yourself?" Question the source always, I say, especially when it's you. Treat every piece of information (and its source) in much the same fashion as you consider every other driver on the road; namely, that it's out to get you if you don't take proper care. Eventually and inevitably, I came to the conclusion that I needed to simplify things. The world is already too complicated. Keep it simple, stupid (KISS). Perfect decisions are ever elusive. In the absence of perfect decisions, I must ask and answer, "What are the key areas which I must understand? These include the geology, the find, the politics, the business opportunity, and the people running the show. By mid August, I was pretty comfortable with my understanding of these areas, with the biggest of holes tied to the geology. But I was far from finished in asking questions. In any event, I can only conclude that John Proust cottoned to my method, and decided to invite me to join the site tour in the hopes of carrying a better informed understanding of this opportunity back to the SA BullBoard. On the first morning of the first day on Lombok, I warned him that I had come prepared with more than 50 questions for him and his team. His answer was simply, "bring it on." So I did. By the way, the answers to all of these questions are posted on the Southern Arc BullBoard. Q46: Roughly what proportion of shares/warrants is in what you might term "friendly hands"? A46: "Fifty per cent by about twenty-five people." (John Proust) That explains immediately why John doesn't fear a hostile takeover. Someone from the Board had earlier asked the Company whether or not it had considered a Shareholder Rights Plan. The answer was that it had not been seen as necessary. I now understood why. Upon reflection, I think Proust's answer may also point to a partial explanation for my being invited on the site tour. My sense had always been that the BullBoard was of little material value to anyone other than those on the Board. The numbers and the dollars had to be so small as to bear no impact on the big picture of Southern Arc's performance on the market. Only in the past few days have I come to decide that this, indeed, may not be so. With a fully diluted share count of just 66.9 million, and fully one-half in known 'friendly hands', who clearly weren't selling, that left a relatively small float of potentially active stock. Personally knowing the holdings of what amounts to no more than a dozen members of the SA BullBoard, it doesn't take long to figure out that a significant portion of the shares beyond the 'friendly 25' is held by folks who frequent the Board. This said, then, it behoves the Company both to understand what people on the Board think, feel, and say, and to make an effort to ensure that the Board has a full and accurate understanding of its investment opportunity. I should point out that the Southern Arc website is among the best I've ever seen for providing clear, up-to-date information on Company activities. This goes as far as providing such detail that you could go on Google Earth and add pushpins to identify the locations of drill holes, within one-tenth of a metre. I know this because I've done it, as have others. Moreover, the Company's Vice President Project Management (Robert Vidoni) has proven to be a rare and ready resource for many on the Board, taking phone calls and answering emails in great detail. This Company is exemplary in its transparency. Transparency is a mark in the 'win' column in my book. At the same time, SA is (at times) painful in its efforts NOT to appear promotional (pun intended on the NOT reference, by the way). Sometimes clinically written News Releases have left the market wondering what's actually there. An inattentive reader could easily miss the steak for the lack of sizzle. This is, in my estimation, a reflection of its President who insists that the Company stand on its merits, rather than on a 'huff and puff' public relations effort. While we're on the subject of John Proust, it's worth mentioning that, at last count, he holds or is exposed to more than 8 million shares and he's still buying, hundreds of thousands of shares in recent months and at market. Q50: Much has been made of your regular recent purchases at market. Suggestions are that you are both trying to support the share price, and to accumulate shares. How do you answer these suggestions? A50: "I'm accumulating shares when the opportunity arises. People often ask me, 'how much is enough?' My answer is, 'I'll let you know when I get there.'" I have a close personal friend who has bought 100,000 shares of SA in the past month. When I asked why, his answer was simply, "insider buying that's the best sign of all". Q25: What's holding share price down? A25: "Short-term traders." Steadily, shares are transferring into stronger hands. This process will continue and stabilize, allowing share price to rise on the merits of the Company's performance. (John Proust) The tight concentration of non-trading shares leaves the Company exposed to the volatility of traders, some of whom are regular posters on the BullBoard. As I see it, those who trade as little as 10% of their holdings, and publicly predict downswings in share price, are shooting themselves in the head. They may be able to trade that 10% into 12% or 15%, insofar as they also convince others that the share price is sure to fall to a particular Fib retracement level. Meanwhile, their core holding of 90% is going nowhere. Already, these folk are having a tough time re-collecting their trading shares, with very low daily volume and wide spreads in the bid and ask. Secondly, the tight concentration of non-trading shares leaves little available for institutional buyers. Institutional buying is a key to demand that drives share price up. It normally precedes any involvement by a major mining company in joint venture discussions. In SA's case, it's the other way around. Volume is so low that no institution could find a half million shares if they tried. Well, they could, but it would likely cost them $10 per share to get to the finish line. "But hold on there Sergeant Carter," I say. We're getting the cart before the horse. Let's take a look at what's in the ground. Exactly what is Southern Arc? Well, the Company is an exploration focused group, looking to take to exploitation deposits of at least one million ounces of gold. So what have they got and where? Taking a wide angle view, if you look on a map of Indonesia, you will see along the south an arc of islands formed by volcanic activity. This is the 'southern arc'. Indonesia is the fourth largest area of mineralization in the world, due to this formation. SA presently has seven properties of interest on three islands. Within each of these seven properties there are varying numbers of prospects, with a total number of about thirty-five. Already, perhaps six or seven prospects of high interest have been identified. A number of these would be actively under development, were it not for the 'elephant' deposit currently being modeled on Lombok Island. This elephant is the Selodong (pronounced Slow-dong) prospect, located in the southern portion of West Lombok. Currently the focus of Company energies, Selodong is located one island to the west of Sumbawa, home of Newmont's Batu Hijau. For reference, Batu Hijau (clearly visible on Google Earth) is the ninth largest copper/gold porphyry deposit in the world, and second in the region only to Grasberg. To cut to the chase, and while it's early to judge, Selodong has the very real potential to leave Batu Hijau choking in its dust. Of interest, Selodong was formerly a property under exploration by Newmont, who had spent (in today's dollars) approximately $30 million in drilling and sampling there. Faced with a 'use it or lose it' ultimatum from the Indonesian government before it had a clear picture of Selodong, Newmont opted to focus on developing Batu Hijau, and relinquished the block of property including the Selodong prospect. SA immediately picked it up, along with all the drilling and sampling data, striking a deal with Newmont for a 2% NSR and the first right of refusal on any joint venture opportunity. Not a bad price, I say. To date, SA has identified (with the help of the Australian consulting firm, GRS) 15 porphyry targets within the Selodong prospect, now under hot pursuit. Now would be a good time to shed a little light on porphyries, as differentiated from veins. Veins are like streaks of water across a window pane, relatively inconsistent in formation. Porphyries are like big blobs bubbling up from below the surface. If you can picture the shape of an upright light bulb, consistent and predictable in shape, rising up to near the surface, you've got it. These formations rarely appear in isolation. At Batu Hijau, two of these have been identified so far. Mineralized porphyry deposits offer lower grades than veins but they're close to the surface, all in one place, very inexpensive to mine (open-pit), and humongous in size. Q30: How deep do these kinds of porphyry formations normally run? A30: It would be common to see this kind of formation run to depths of 1,000 metres or more (Mike Andrews, Ph.D. Geologist, Director of SA - see his bio here.

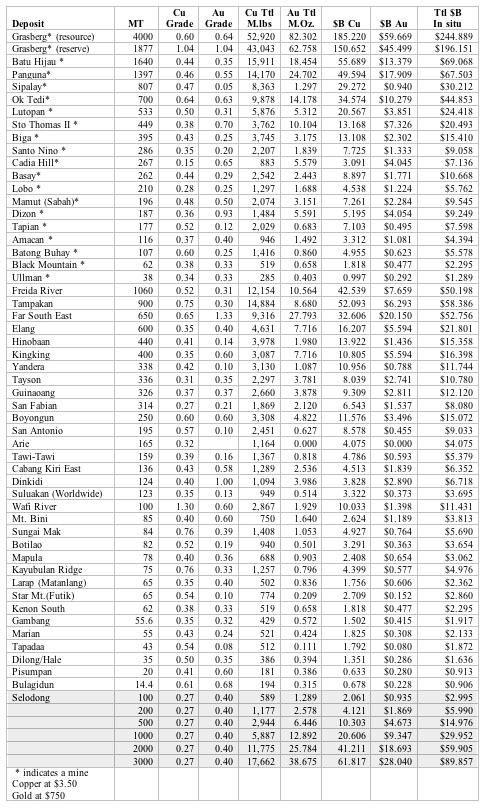

Q4: Of the 15 porphyry targets, how many do you see as reasonably hoped to be connected? A4: "Between 10 and 14". (either Hamish Campbell, Vice President Exploration or Mike Andrews, Director, geologists both). The Company has now begun deep drilling on the third of these porphyry targets. Newmont had already drilled into six of these targets, providing further guidance to SA activities. The most recent News Release announced that the current model shows two of these targets as connected, over a north-south span of some 1,000 metres. It is believed that this may extend another 500 metres southward to include the first target, Montong Botek, into which three deep dill holes have already been completed. Of the first five reported holes, mineralization has been reported at an average total intersect of 417.17 metres, with a weighted average grade of .27 % Cu and .40 gpt Au. If the 1,500 metre north-south aspect of the model holds, with an estimated east-west band of some 280 metres, considering only the depth of holes drilled (rather than the potential 1,000 metres), and using the weighted average specific density factor of 2.67, we're looking at reasonable hope for 467,814,438 tonnes of ore. At current weighted average grades, that would translate into 2.755 billion pounds of copper and 6.033 million ounces of gold. Do the math. That's $14,017,673,160. Remember that this is near surface deposit (with mineralization beginning no deeper than 33.8 metres, and as little as 2.0 metres, for any of the first five major holes), and that it's concentrated in ridges of hills. Very little lateral waste rock. Very cheap to mine. Remember also that we're talking here about just 3 of 15 porphyry targets so far. Consider now that the Montong Botek target (not yet claimed to be connected to the other two) showed a drill hole with a sub-intersect of 105.0 metres, showing gold at 1.04 gpt and copper at 0.60%. A further 600 metres to the north, the Blongas II target showed a drill hole with a sub-intersect of 102.25 metres, showing gold at 1.05 gpt and copper at 0.50%. Coincidence. Not likely. Now you may say that this is just me smokin' wacky-tabacky or daydreaming, but consider the following, and consider it knowing that this is a Company erring on the side of conservatism in every word it utters. Q42: What do you see the likely tonnes processed per year at Selodong? A42: "Perhaps 200,000 per day, over 15-20 years." (John Proust or Hamish Campbell or Mike Andrews) Now, this is one of those answers you get and don't follow up on, for fear that someone will retract it. It's like a child getting unexpected permission to do something, and then asking, "Are you sure?" You just run with it. Paolo Rigoni, a fellow Board member (and 321gold.com contributor) has punched this 1.09 billion tonnes of ore (at just 15 years of mine life) into his IRR spreadsheet. With a $1 billion capital expenditure, we find a Net Present Value of $7.2 Billion and an internal rate of return of greater than 97%. Q32: If estimates of up to 3 billion tonnes at $35/tonne are accurate for Selodong, that would be $600 per share at 40% of in situ. What am I missing here? A32: "If you can get 10%, run to the bank with it." (Bob Bishop). I guess that means $150 per share. (Joe Average) These guys know that they already have a viable deposit. Q1: What's the minimum in necessary ore to justify an economically feasible mine at Selodong? A1: "100 million tonnes" (porphyry) at copper/gold "grades of .35/.45". (John Proust) The table, below, is a re-jig of one sourced from Garwin et al. from Econ. Geol. 2005, showing porphyry deposits in southeast Asia, along with grades of copper and gold, and in situ value. You'll note that I've added a number of scenarios for Selodong at the bottom of this table. Personally, I am convinced that there's more than 500 million tonnes of ore among just the three connected sites, and confident that this will ultimately prove up to well beyond 1 billion tonnes. Of course, time alone will judge.  Okay, so how and when are we going to prove this deposit? Q16: Can you say when you expect infill drilling to commence and where? A16: It's early to say where, but as for timing, "possibly, but not likely before the Spring". (Hamish Campbell or Mike Andrews) Q17: When would you hope for a completed NI 43-101? A17: "Add six months to the previous answer." (Hamish Campbell or Mike Andrews) In Indonesia, development of a mining project involves something called a Contract of Work (CoW). This spells out the rights and obligations of both the government and the company. Q18: As for CoW negotiations, what can you say about the start and finish, and the process between the two? A18: (Answers come from one-on-one with Hamish early in the visit, and from his briefing on the final morning) There will be two CoWs. One for Sumbawa and one for Lombok. The one for Sumbawa is about to begin negotiations. 29 representatives from three levels of government have already been named, with three people named to represent SA. This process is expected to take between 3-4 months. (I think I heard that) this is the first new CoW to be negotiated in a decade, as an extension from the 7th generation version of CoWs (noting that there are majors also now pursuing the CoW negotiating process). This refers to different iterations of contracts, from their inception in the 1960s. It's being referred, then, as a 7+ generation CoW. Approximately 90% of the details of this contract are taken as a given, with the balance representing a 'tweaking' of the remaining details. A CoW, once signed, should be good for about 30 years. It was stressed that since these CoWs were initiated in the 1960s, the government has never (stress never) reneged on a contract. These contracts, for good or bad, protect the company (or the government) from changes in legislation. For example, if general mining taxes are changed after a CoW has been finalized, such a change (up or down) would not affect the CoW. The government negotiating team for the Lombok CoW (except for local representatives) will be comprised largely of the same people as for the Sumbawa CoW. The Lombok CoW negotiations are expected to begin in 4-6 weeks, and to catch up to and be signed at the same time upon completion with the Sumbawa CoW. One will determine the outcome of the other. It is important to note the importance of SA's socialization process here. The Company has taken great pains to ensure good relations with local communities in which it operates. Employment is rotated to include all surrounding communities, sharing in the opportunity for raised standards of living. The running of a well of water to a neighbouring village from an SA drill hole (that struck water) is a good example of the Company's sense of citizenship. As we traveled by truck through various villages and rural areas, we were roundly greeted by, 'Hi Mister' and smiles and waves. Others have not historically taken this need for local buy-in into account, and have paid the price, in varying degrees. Q19: How would you characterize the political risk and the general political environment, with respect to comparison countries? A19: (Answers come from conversations with each of John Proust, Hamish Campbell, and Mike Andrews, along with Hamish Campbell's final day briefing) The national government is stable, with two more years in its mandate. The president is eligible for two five-year terms, and is expected to be confirmed for his second term. Every country has political risk. Indonesia is no different. This said, the government is on record as supporting the development of mining in Indonesia, and is eager to move forward on this front. Like in any other country, there are nuances in how things happen, so cultural sensitivity is an obvious asset. Whereas other (major) mining firms have been refused exploration rights, and/or had the processes prolonged into several months before approvals have been granted, SA has enjoyed approvals regularly within days of application. Southern Arc is invested in Indonesia. The significance of this acculturation is not to be underestimated. Understanding how conservative the Southern Arc folks are in what they say and how they present what they've got here, I leave the final comment to geologist Mike Andrews. Q52: Can you keep a straight face and say that you have reason-based hope for Selodong to be one of if not the largest among copper/gold porphyry deposits in history? A52: (Here's where Mike Andrews hesitated for a moment, looked down at the drill core, then slowly raised his eyes across the table to mine, and unable to restrain a smile said) "Yes." (In other words, he couldn't keep a straight face. He then went on.) "Kevin, I'm just over the moon on Selodong over the moon. I'm over the moon on Selodong." With respect, Kevin Graham |