Investment Indicators from

Peter George issue #65

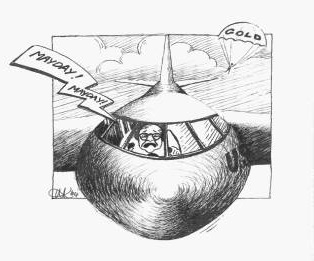

US flying on empty

Time for a 'Golden Parachute' part

1

Peter George

December 16, 2004

."..If my people, who

are called by my name,

Will humble themselves and pray and seek my face

And turn from their wicked ways,

Then I will hear from heaven and will forgive their sin,

And will heal their land."

2 Chronicles chapter 7, verses 13 & 14

SUMMARY

It is ironic to reflect that

the man who penned: 'Gold and Economic Freedom' as an article

of monetary faith in 1966, should find himself presiding over

the 'nerve centre' of the FIAT money system - particularly at

a time when the nation's economic freedom is on brink of being

severely curtailed by circumstance.

The clearest evidence of the

US flying on empty is the accelerating slide of the dollar. The

underlying cause has been the nation's relentless pursuit of

monetary and credit policies in direct opposition to those its

Fed Chairman so boldly espoused in his original article of 1966.

The tragedy is that responsibility for the coming crisis lies

largely with the Chairman himself, due to errors of policy committed

under his watch. One cannot escape the fact that he has been

steering the US engine of debt for 17 years, ever since August

11, 1987.

This report attempts to analyze

the state of the US economy. It presents some conventional forecasts

- based on past experience - as to what could happen if events

proceed unchecked. It considers the two most likely scenarios

of depression and hyper-inflation, depending on the strategies

chosen. Finally, it proffers a radical third alternative, one

which ought to be far less painful than going down the road of

depression but simultaneously has the ability to avoid the currency

destruction implicit in the hyper-inflation option. It lays a

foundation for gradually returning to financial discipline, balanced

budgets, and sound money - but in ways which retain the dollar's

role as major 'reserve currency.'

Implementation needs to be

rapid to halt the accelerating process of destruction already

underway - a process which will otherwise dethrone the dollar,

forfeiting its role to a politically unstable EURO ruled by increasingly

'godless' Europeans. A group of erstwhile Christian nations that

can exclude a man from office because of his expression of Christian

faith in action - his opposition to 'gay' marriage - can never

be trusted to sustain a sound monetary unit requiring strict

adherence to a code of mutually agreed principles. European Union

commitment to the Maastricht Treaty espousing financial discipline

is already honoured only in the breach by the EU's dominant members,

France, Germany and Italy. It goes to show that when push comes

to shove, Europe has no respect for principle - neither in morals

nor in finance. Those who believe the EURO can fulfill its role

as a reliable store of value for any length of time are in for

a disappointment. Investors will be jumping from the frying pan

into the fire. The rate can probably rise from $1,34 to $1,80

over the next 18 months but long before those levels are reached

the European Central Bank will be printing EURO's for all they

are worth, in an attempt to stem the tide.

The course of action we propose

requires a bold unilateral step of faith from President Bush

- in terms of restoring the dollar's role as a long term stable

store of value. To take the step, Bush will need to draw on the

unique experience of Alan Greenspan. The Fed Chief will have

to dump his long love affair with FIAT money and return to the

beliefs and principles of his youth. Without such a move, prospects

for US markets look bleak, as does the outlook for the standard

of living of the average American.

Only a Bush could do what is

proposed. Only a Greenspan could help him do it. Bush has the

moral courage to act. Greenspan has the experience to implement.

What we propose is the re-introduction of a working Gold Standard.

The keys are METHOD and PRICE. We discuss them in our conclusion.

The main body of the report will demonstrate that no other solution

can work without incurring untold global economic damage and

leaving America vulnerable to the accusation of having acted

dishonestly towards her creditors. There is a better way for

the US to pay her debts.

1. Greenspan's reputation in

the balance

Despite the eulogies of politicians who don't understand what

Greenspan has done, there are some in the financial world who

do. Their assessment of the Fed chief's overall performance since

1987 has been far less flattering. In the words of critic Doug

Henwood, Editor of Left Business Observer:

"He has lurched from

crisis to crisis - I don't know who could have been worse. He

turned McChesney-Martin's dictum around. Instead of taking the

punch bowl away, Greenspan was SPIKING it."

Henwood concludes with a comment

on Greenspan's easy-money policies:

."..a recipe for future

disaster- ... hard to deflate a bubble gently"

In his latest fortnightly economic

tour de force, The Privateer's Bill Buckler was even less restrained.

What led up to his scathing attack was the way in which Greenspan

unburdened himself in an address to bankers in Frankfurt on November

19, prior to the start of the recent G20 meeting in Berlin. First

look at what Greenspan himself said:

"It seems persuasive

that, given the size of the US current account deficit, a DIMINISHED

APPETITE for adding to US Dollar balances must occur at some

point....International investors will eventually ADJUST their

accumulation of Dollar assets or, alternatively, seek HIGHER

Dollar returns to offset...risk, elevating the COST of financing

the US current account deficit and rendering it increasingly

less tenable."

The Privateer commented as

follows:

"Greenspan has now

joined the chorus of concern... that US current account deficits

are simply unviable. But current account deficits don't just

happen, they are CAUSED. They are caused by artificially lowered

internal rates of interest which generate in their turn much

higher rates of borrowing and debts. Then, as this new stream

of BORROWED PURCHASING POWER joins existing quantities

of cash and deposits in banks, it leads to increased CONSUMPTION

followed by climbing IMPORTS. The trade balance swings into deficit,

followed by EXTERNAL DEBTS piling ever higher."

"The wonder of it all

is that Greenspan now stands forth in Frankfurt and identifies

the assured OUTCOME of precisely the monetary and credit policies

which he himself has been the initiator and sustainer of for

so long!"

"How Greenspan will

be greeted when he returns to the USA is anybody's guess."

"If there is justice

- then based on Patriot Acts 1 and 11 - he ought to be arrested

as a financial terrorist."

"Greenspan has, by

deceit, placed the US in a position where the credit expansions

he originated have left the US exposed to a "debt maelstrom"

which can arrive anytime the rest of the world decides not to

lend."

Having deserted the discipline

of his first love, gold, for the deceptive allure of serving

the monied elite, the Fed Chairman can learn from Shakespeare.

It may help him understand the cause of his current difficulties:

"He

who sups with the devil must needs have a long spoon." Greenspan deliberately befriended

the Bankers. He exchanged his belief in sound money for a key

role in extending the tentacles of their fraudulent FIAT money

system. In fact he once boasted:

"I look forward to

being Fed Chairman and printing my way out of the next Kondratieff

winter."

His wish was granted. He was

appointed to the position on August 11, 1987. What followed two

months later was not his fault, he inherited it, but the way

he dealt with it set a pattern which has given us the mess we

find ourselves in today. On October 19, a date that subsequently

became known as 'Black Monday,' the Dow fell 22%. This was the

greatest loss Wall Street had ever suffered in a single day.

There were two acknowledged causes:

One was legislation which passed

the House Ways & Means Committee on October 15, 1987, eliminating

the deductibility of interest on debt used for corporate takeovers.

The offending provision was later removed.

The other - which brings us

closer to the events of last week - was the announcement of a

large trade deficit on October 14, 1987, which led Treasury

Secretary James Baker to suggest the need for a FALL in the dollar

on foreign exchange markets. Fears of a lower dollar led foreigners

to pull out of dollar-denominated assets, causing a sharp rise

in interest rates, which in turn hammered stock prices.

2. Greenspan and the crash of

'87

It is not the specific CAUSES of each crisis which concern us

so much as the countervailing measures adopted by the Fed under

the guiding hand of Greenspan and his predecessors. What makes

our discussion controversial is that on each and every

occasion when the Fed has intervened - both before '87 and since

- most of those in politics or the financial world have only

had praise for the successful strategies repeatedly adopted to

prevent financial melt-downs. A particular case in point was

Greenspan's rapid re-liquification of the financial markets in

the days following the crash of '87. His actions were so successful

that within 24 months markets had completely recovered. It is

however the cumulative long term costs of each and every

intervention which plagues us today as the required 'fix' balloons.

3. US Flying on empty

Collective central bank interventions, like the Plaza Accord

of 1985, have had very mixed benefits and we discuss them in

detail. It is necessary to still the growing clamour for yet

another joint agreement, leading to yet another devaluation of

the dollar. The most powerful advocate of this strategy has cleverly

- and only very recently - been Greenspan himself as he openly

PREDICTED what he wanted to see happen. His co-conspirator was

- and still is - President Bush, as he unrepentantly pursues

the 'borrow and spend' policies he and his administration devised

to counter the crash of 2001.

We strongly disagree with the

strategies both of them colluded to implement, but the flaws

only become apparent when the results of Fed intervention are

studied collectively, in retrospect, and over an extended period

of time. By doing this, can we count the true cost of intervention.

It will help us allocate responsibility for the problems the

US faces today. It may assist us in suggesting a way out of the

current economic impasse. What is undeniable is that the US economy

is maxed out and flying on empty. All categories

of debt have been pushed to the limit - internal, external, private

and public. Thanks to the low interest strategies of the Fed,

the US middle class has mortgaged itself to the hilt - either

by 'trading up' or 'extracting equity.' In the process house

prices have ratcheted to an unsustainable peak.

If the dollar slide gathers

momentum it could conceivably lead to a panic collapse in the

international value of the currency. US bond prices will eventually

follow as foreign central bank support slowly wanes. Long term

interest rates will then DOUBLE from 5% to 10%. Mortgage rates

will move in step. The housing bubble will burst. Retail sales

will fall off sharply. The US could face depression which will

then spread to her trading partners as their biggest market wilts

and shrinks to a shadow of its present size.

4. The FIAT alternative leads

to hyperinflation

In the recent past concerted currency intervention by Asian central

banks served to lend artificial support to both the dollar and

US debt markets. We discussed this extensively in an earlier

report we wrote on March 12, 2004, entitled:

"Currencies

in 'FIAT Folly' - face Abyss of destruction." (Subscribers are welcome to

access all previous reports.)

In a recent article Bill Gross

of PIMCO called the actions of Asian central banks a 'Faustian

Bargain.' By artificially supporting the dollar and US bonds

at the expense of their own currencies - printing Yen and other

currencies to buy dollars - they were effectively subsidizing

their exports to US markets. Without such intervention, American

consumers would either buy something cheaper - or nothing at

all. Asian central banks get left holding a swelling stock of

increasingly worthless dollars, but down the line there is likely

to be a more damaging and dangerous result.

Although the printing of Yen

in small quantities inflicts minimal damage while Japan is experiencing

deflation, large-scale printing would have dire consequences.

In a fruitless and vain attempt to hold up the currency of a

country far larger than hers, Japan would eventually jeopardize

her long term bond market, causing prices to fall and yields

to rise. This would create far greater damage in the banking

and pension sectors, than a slide in the NIKKEI due to a slowing

economy.

Yield on the 10 year Japanese

Government Bond peaked at 9% in 1990, fell to half a percent

in 2003, but has since risen to 1,45%. In so doing, it has broken

a 14 year down trend line. This suggests that in the next few

years Japanese bond yields could rebound sharply, in line with

rising yields in the US. Ultimately they look to bounce right

back up to their previous peak of 9%. That would decimate the

asset values of Japanese bank stocks.

The above is an example of

how sustained currency support operations by America's trading

partners will simply transfer the American malaise to those countries

that intervene. The end result will be the destruction of the

FIAT money system through a spreading and accelerating process

of inflation which finally goes 'hyper.'

5. Facing the pain of reality

The South African Sunday Times of November 28, carried an article

on the US economy headed:

"When

the US sneezes, the rest of the world catches a cold." It contained a quote from Scott

Campbell of Optimal Fund Management:

"The US dollar can

tank to smithereens and the current account problem will not

disappear. The twin deficits in the US - budget and trade - are

a consequence of living beyond one's means for some time, and

the only way to fix the problem is through some belt tightening.

The US economy badly needs a RECESSION to reduce import demand,

and bring consumer credit back into line."

Most recent figures indicate

a trade deficit running at $665billion a year, equivalent to

6% of GDP. The budget deficit is running at an annualized rate

of almost the same - $630billion - equivalent to 5,7% of GDP.

Ruthlessly trimming the budget deficit would go a long way to

curbing the trade deficit, without dramatically trashing the

dollar. However, if budget pain is not on the table for discussion,

the dollar is being set up for a major fall.

6. Refusing to face the pain

Greenspan and Bush currently have a totally different strategy

from Scott-Campbell's. Although Greenspan admits it is important

that BOTH deficits be cut, conceding that cutting the budget

deficit would help reduce the trade deficit, he went on to warn

that:

"Inducing recession

to suppress consumption would not be constructive."

In sympathy with this attitude,

and a day prior to Greenspan's routing of the dollar on November

19, the US Congress aligned itself with the Fed Chief's 'soft

option' approach, by RAISING the federal debt limit $800billion

to $8,18trillion, thereby automatically REJECTING restrictions

on both tax cuts and spending,

Economist Robert Brusca of

the UN's FAO Economics division saw right through Greenspan's

DOUBLETALK. He said Greenspan is NOT warning about the consequences

of a weak dollar - to the contrary:

"If anything Greenspan

is afraid that the dollar will not get WEAK ENOUGH, and as a

result the US current account deficit could stay too large for

too long...while Greenspan voiced support for closing the budget

deficit, it's really the CURRENT ACCOUNT deficit that worries

him more. And one way to close the current account deficit is

to see the DOLLAR DROP even further compared to other major currencies."

Brusca went on:

"A call to shrink the

US current account deficit - as long as we conclude it is NOT

a call for RECESSION in the US - is also a call for STRONGER

GROWTH abroad AND for a weaker dollar."

In other words it places blame

and the burden of change on America's trading partners - more

so than on the US itself.

7. Why the strategy for a weaker

dollar won't work

Following the PLAZA Accord of 1985, France, Germany, Japan and

the UK agreed to assist the US to effect a substantial devaluation

of the US dollar in order to bring the US trade deficit back

under control. At that stage it was running at 3% of GDP. Over

the next three years the dollar exchange rate declined by an

average of 50% against the currencies of the countries in the

Accord. By 1991, five years after the Accord, the trade deficit

had been completely eliminated and replaced with a small surplus,

but the unseen costs were substantial. Two years into the slide,

the deflationary effects on world trade triggered the crash of

'87. Two years later, despite a sharp and sustained bounce back

in Western markets, the Japanese NIKKEI collapsed, forcing the

nation into a 14 year recession from which it has yet to recover.

The position the US finds itself

in today is more serious than 1985. On June 22 of this year,

The Economist published an article entitled:

"How

to slay America's monster trade gap" The writer mentioned how hard

it would be for the US to close the now MUCH HIGHER trade gap

without causing substantial pain - not just to herself, but to

her trading partners, most of whom would struggle to find alternative

markets as US demand is curbed by the rising cost of imports.

Because the American market is so dominant, its loss implies

a substantial drop in overall sales for trading partners whose

currencies appreciate. The deflationary impact of these influences

will in turn have a knock-on effect on the US, making it difficult

for the latter to maintain exports - let alone increase them.

The article referred to a study

by economists at the OECD who reckon that to narrow the deficit

by TWO percentage points by the end of the decade - six years

out - will require the dollar to LOSE 25% of its current value

by the end of 2004. The article was written in June. Since then

the dollar index has fallen 7,8% and the EURO 10,2% - still nowhere

near sufficient to turn the situation around. Even so, the OECD

prescription only looks to trim the deficit by 2% of GDP. The

problem is that latest figures place the deficit closer to 6%,

if the latest quarterly figure of $166 billion is annualized

to $664,8 billion.

On October 28 the Economist

followed up its June 22 article with an update entitled:

After interviewing Stephen

Roach, chief economist at Morgan Stanley, The Economist wrote

the following:

"In the three years

from 1985, the dollar fell by 50% against the other main currencies.

Inflation and bond yields rose and, in October 1987, the stock

market crashed. America's current-account deficit is now almost

twice as big as it was then, so the total fall in the dollar

- and the FALL-OUT in other financial markets - could well be

larger. The WOLF is licking his lips."

In other words, a 50% devaluation

is nowhere near ENOUGH, even given that it has already fallen

almost 10%!

8. The problem of China

Official US policy repeatedly urges the need for a substantial

REVALUATION of the Chinese Yuan in order to reduce ballooning

Chinese exports to the US market. Some recommend a Yuan up-move

of as much as 40%. Many US domestic manufacturing industries

have been gutted by Chinese competition. Quite recently my wife

went shopping for her grandchildren. Chinese 'Barbie Dolls' sell

for less than 15% of the cost of an American 'original.' How

can the US compete?

Understandably there is a groundswell

of rising protectionism. Many US industries have re-located their

plants to China to take advantage of labour rates which don't

even bear talking about. Unfortunately a Yuan revaluation causes

more problems than it solves.

First of all, China is running

an OVERALL trade deficit, but admittedly not a large one. Although

her surplus with the US constitutes between 20% and 25% of the

US total of $665 billion, it gets dissipated financing imports

of food, raw materials, metals and crude oil. In fact the Chinese

economic miracle has been largely responsible for booming commodity

prices despite a GDP which is only 3,5% of the world total.

While Americans may rue

the rate at which Chinese increasingly swap bikes for motorized

transport, thereby developing an insatiable thirst for oil, the

flow-through benefit down the supply chain is substantial as

third world exports of commodities take off skywards. They are

beginning to enjoy a measure of economic blessing for the first

time in 20 years - this is certainly true of South Africa, the

continent's 'commodity treasure chest' - hence the strong Rand.

The last thing they wish to see is the Chinese Tiger shot at

dawn.

Secondly, the Chinese are reading

their economic history books. The first PLAZA Accord, in 1985,

ruined Japan and drove her into a 14 year deflationary recession.

China needs similar treatment like a hole in the head. She still

has 200m unemployed. They are being absorbed into the economy

at a rate of 14m a year. She desperately needs a further decade

of growth.

Thirdly, 65% of Chinese exports

source from foreign-owned factories answering to shareholders

in the US and Japan. To that extent, even marketing strategies

are out of her ambit. China simply supplies cut price labour

and an environment free of the health, pension, and insurance

costs which burden manufacturers in the West. China's central

bank Deputy Governor Li Rougo described the extent of the wage

disparity as follows:

"The appreciation of

the Yuan will not solve the problems of unemployment in the US

because the cost of labour in China is only 3% that of US labour.

They should give up textiles, shoe-making and even agriculture....

They should concentrate on sectors like aerospace ....sell those

things to us ...we would spend billions.... We could easily balance

the trade."

The fourth problem with a Yuan

revaluation is that for various reasons, 50% of Chinese loans

are deemed shaky and worse. Raising interest rates or revaluing

the Yuan could trigger widespread defaults in the banking sector.

In the first instance debt-laden customers would finally sink

under the weight of rising rates. In the second, a revaluation

could spark a run on deposits as money flees the country.

In an article entitled:

"Follies

of fiddling with the Yuan" Henry C.K. Liu, Chairman of

New York-based Liu Investment Group, put it this way:

"With every passing

day more market watchers join the ranks of those predicting a

looming crisis in the US financial system due to excessive debt,

particularly external debt. This danger cannot possibly be defused

by China, regardless of the monetary policy she adopts. The dismal

record of Fed monetary policies which induced the crashes of

1987, 1994, 1997, and 2000, discounts the value of US advice

for Chinese economic and monetary policy....China's growth has

largely been led by GROWING processing and assembly operations

in China for re-export, operated by TRANSNATIONAL corporations

mainly to DEMOLISH the hard-won gains of labour movements in

the capitalistic West."

As a passionate believer in

free markets, my own comment would be:

"What is wrong with

international investors locating plants where labour costs are

lowest? When critics exercise the right to call for tenders for

capital construction projects, they insist on keenest prices.

Why can't investor's do the same in the area of labour costs?

Chinese Premier Wen bluntly

told US Treasury Secretary John Snow that the dollar crisis is

America' s problem, not China's. He could have added that America

needs to start living within her means before trying to pass

the buck and blame trading partners like China. Wen well knows

that a sharp appreciation of the Yuan will drive China back into

deflation.

More than a year ago, David

O'Rear, Chief Economist of the Hong Kong Chamber of Commerce

summed up calls for a Yuan revaluation as follows:

"If Japan's mature

financial institutions and exporting corporations were devastated

by the aftermath of the first PLAZA Accord, imagine what would

happen to China's far less developed banks and other financial

sector companies. The implications for Hong Kong are severe as

well."

The 1999 economics Nobel laureate

Robert Mundell attended a conference in Beijing this year. He

said:

"Never before has there

been a case where international monetary authorities have tried

to pressure a country with an INCONVERTIBLE currency to appreciate

its currency. China should NOT appreciate or devalue the Yuan

in the foreseeable future. Appreciation or floating of the Yuan

...would have important consequences for growth and STABILITY

in China and Asia."

In concluding the section on

China, we quote from a short article by Michael Darda, Chief

Economist of Polyeconomics, an economic forecasting firm in New

Jersey. It was headed:

"A

Ruinous Dollar Policy" "The Fed is fixated

on the current account deficit. This has led them to imply the

dollar should fall....Those advocating a weak dollar to redirect

trade flows do not have history on their side. While a depreciating

currency is assumed to boost exports and shut off demand for

imports, this is only the FIRST EFFECT. Eventually a weak currency

invites INFLATION, which neutralizes the effect of the lower

exchange rate.....Persistent currency depreciation has NEVER

brought lasting prosperity to any government in the history of

the world. If the dollar continues to depreciate, it will bring

higher inflation, higher interest rates, lower real growth rates,

and a reduced standard of living for most wage earners."

Darda ended by urging Greenspan

to focus his attention on his own area of responsibility, the

creation of EXCESS supplies of money. This is Key number one.

The second was pinpointed by author Richard Duncan in his book

entitled:

'The Coming

Dollar Crisis' Duncan highlighted what he

considered to be the greatest danger to the world economy - the

curtailing of American demand for imports. He predicted

that as the dollar crash proceeds, the US trade deficit will

eventually shrink. If the bond market collapses simultaneously,

the process could accelerate out of control. Americans will literally

stop buying products from overseas. This will instantly remove

a huge source of global demand from the world economic equation.

UNLESS REPLACED, Duncan says we face the likelihood of an acute

global depression.

Unfortunately the SOLUTION

he proposes comes from fairyland. He would have the international

community pressure emerging market nations to raise wage rates

by an average of 25%. He says this will give a balancing boost

to world demand. Try telling that to the Chinese and Indians

while their unemployed still number in the hundreds of millions!

The strategy won't get off first base. The ultra low wages of

workers in China and India will rise as and when the situation

demands. Right now it does not.

But we draw attention to Duncan's

key phrase "UNLESS REPLACED." We will address it in

our conclusion.

9. Biggest Danger for US market

- crashing bonds, rising rates

Top US economist Fred Bergsten - a well-entrenched 'establishment'

figure - forecast a 'financial quagmire' unless Bush took steps

to tackle the deficit problem. But he never told him HOW to do

it. All he did was repeat the warnings of others:

"A sharp US dollar

fall is possible in the next six to twelve months, and US interest

rates could go to DOUBLE DIGITS."

Until the Presidential election

was out of the way, dollar and bond bears were confused and out-maneuvered

by the stubborn refusal of bond prices to crack and rates on

the 10 year and 30 year bonds to rise. Bill Gross of PIMCO gave

the reason why their forecasts came to nothing. He said that

until Japan and China began to lose their appetite for recycling

dollar surpluses into the US bond market, the bigger the trade

deficit became, the greater the degree of support for US bonds.

In fact he maintained that Asian buying actually pushed rates

DOWN.

Following Greenspan's bearish

forecast on the dollar and US bond rates, there was an immediate

and overwhelming market turnaround. Asian support began to fade

and long term bond charts began to give clear SELL signals with

rates breaking sharply upwards.

10. CONCLUSION

The conclusion of our analysis is simple and stark. Last time

the US trade gap hit crisis point was in 1985 when it reached

3% of GDP. At that stage it required a 50% devaluation of the

dollar over a three year period. This successfully but painfully

brought the trade deficit back into small surplus after six years.

The cost was heavy. It led to the crash of '87 and caused the

collapse of the NIKKEI in '89. Today the trade deficit is pushing

towards to an annualized rate of 6% - DOUBLE the crisis level

reached in 1985. To make matters worse, 15% of total US imports

come from China who is in turn responsible for 23% of the total

US trade deficit of $650billion. They are refusing to be part

of the adjustment process.

This means that those countries

responsible for the remaining 85% of exports to the US are going

to have to bear the total burden - but from a far wider deviation

from the norm than the US encountered in 1985. Even a EURO rate

of $2,00 would be insufficient, as would a Yen rate of 52. Yet

the economic implications for both these countries would be catastrophic

at the currency levels specified. They would drive them into

depression. The average level of their exports to the US would

have to fall by 50% if Chinese exports continue unabated.

They will be forced to find

replacement markets or their own economies will be severely dented.

We are talking about a diversion of $670billion of fresh buying,

which has to come from somewhere. It simply isn't there.

Alternatively, there has to

be a compensatory increase in US EXPORTS to these same trading

partners and the rest of the world - but excluding China. Either

way, the required swing of trade in favour of the US will suck

$670billion of buying power out of the world economy. It will

be highly deflationary. Somehow or other, there has to be a compensatory

boost to international liquidity - preferably not by raising

debt.

In his book 'The Coming Dollar

Crisis' discussed at the end of section 8 above, Richard Duncan

highlighted a further dimension to the loss of buying power.

He predicted that as the dollar crash proceeds, it could trigger

panic foreign selling of US bonds. The process could accelerate

out of control if Americans literally stop buying products from

overseas. The figure of $670 billion could even be exceeded.

------------END OF PART 1------------

|

PART 2 of this report is headed:

"TIME FOR A GOLDEN

PARACHUTE"

It describes a method by means

of which the US could return the world to a working GOLD STANDARD.

It suggests various price levels for the various STAGES and the

hurdles which would have to be cleared in each case before one

could proceed from one stage to the next. It also discusses the

probability of each of the 3 scenarios - hyperinflation, dollar

devaluation or golden parachute and the investor's response.

Part 2 is only for SUBSCRIBERS.

We encourage you to access

it at Peter George's website with a view to becoming a

SUBSCRIBER. The address is:

www.investmentindicators.com

|

Peter George

tel: 021-700-4880

cell: 082-806-3147

Contact

DISCLAIMER

Readers are advised that the material contained herein is provided

for informational purposes only. The authors and publishers of

this letter are not acting as financial advisors in providing

the information contained in this publication. Subscribers should

not view this publication as offering personalized legal, tax,

accounting or investment related advice. Readers are urged

to consult an investment professional before making any decisions

affecting their finances.

Any statements contained in this publication are subject to change

in accordance with changes in circumstances and market conditions.

All forecasts and recommendations are based on the currently

held opinions and analysis of the authors and publishers. The

authors and publishers of this publication have taken every precaution

to provide the most accurate information possible. The information

and data have been obtained from sources believed to be reliable.

However, no representation or guarantee is made that the information

provided is complete or accurate. The reader accepts information

on the condition that errors or omissions shall not be made the

basis for any claim, demand or cause for action. Markets change

direction with consensus beliefs, which may change at any time

and without notice. Past results are not necessarily indicative

of future results.

The authors and publishers may or may not have a position in

the securities and/or options contained in this publication.

They may make purchases and/or sales of these securities from

time to time in the open market or otherwise. The authors of

articles or special reports contained herein may have been compensated

for their services in preparing such articles. Peter George Portfolios

(Pty) Ltd and/or its affiliates may receive compensation from

the featured company in exchange for the right to publish, reprint

and distribute this publication.

No statement of fact or opinion contained in this publication

constitutes a representation or solicitation for the purchase

or sale of securities or as a solicitation to buy or sell any

specific stock, futures or options contract mentioned in this

publication. Investors are advised to obtain the advice of

a qualified financial and investment advisor before entering

any financial transaction.

________________

321gold Inc

|