Investment Indicators from

Peter George

Nuclear Revolution - in

the making

Peter George

November 4, 2004

"Do not conform any longer

to the pattern of this world, But be transformed by the renewing

of your mind." -Romans chapter 12, verse 2

SUMMARY

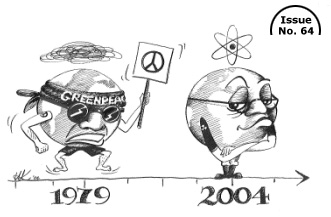

Gold Bugs are used to a world of conspiracy - banks and governments

fighting to deflect the relentless forces of speculators and

the market. Despite feeling at home in such an environment, the

writer was surprised at the web of intrigue and confused emotions

battling for supremacy in the field of nuclear science, some

determined to damn its role in the field of energy. Even today,

when the man in the street confronts the concept of 'atomic power,'

he often thinks first of bombs and radiation. He can largely

thank the 'Greens' and their political cousins in the 'Anti-War

Brigade' for most of these distorted perceptions. In a fit of

blind zeal the 'Greens' were set to ditch baby and bath water

both. It was not always that way.

By the end of the seventies the nuclear option was gaining ground

everywhere. The US had 100 Nuclear reactors in operation, 20

under construction and 100 more planned. The world had successfully

constructed over 400 in total: then came 'Three Mile Island"

(1979) and Chernobyl (1986). Most of the US '20' were halted.

Those on the drawing board got cancelled. TMI was an American

phenomenon. The world largely ignored it and waited for Chernobyl.

The 'Greens' and their 'fellow-travelers' blew a minor glitch

at TMI out of all proportion. Later, they and others totally

misrepresented the true extent of 'fall-out' from Chernobyl (1986).

On the back of both they sowed a wind of invective against anything

nuclear which succeeded in gutting it as an energy source for

the next quarter century. The process was aided and abetted by

a 20-year downtrend in oil and commodity prices. This helped

defer decisions by skewing the economic risk from nuclear, to

less complicated fossil fuels like oil, coal and more recently,

liquid natural gas.

A quarter century later, thanks to the misguided efforts of the

'Greens,' the world looks set to reap a double whirlwind - a

crisis in oil and gas supplies, coupled with a menace in 'global

warming.' The former could see oil prices spike ten-fold in a

decade. The latter could spawn increasingly nasty side-effects,

ranging from 'acid rain' and radically changing weather patterns,

to melting perma-frost and sharply rising sea levels. If at some

point in the future every identifiable 'Green' is punched black

and blue by an angry world, it would be no more than their just

deserts. They have been fighting the wrong war. Well-known 'Green'

James Lovelock, of Mother Earth 'Gaia' fame, has repented. We

discuss his views below.

Professor John McCarthy, ex-Director of 'Artificial Intelligence

Research' at Stanford, spent much of his life studying the modes

of reasoning required for intelligent behaviour. He summed up

political opposition to nuclear as follows:

"The counterculture generation is passing through the peak

of its political powernext generations seem to be more RATIONAL

about nuclear energy and many other issues. Therefore the US

is likely to resume building reactors before being driven to

it by other countries getting economic advantages."

When politics and phobias fight markets, markets invariably win.

The two-edged crisis in oil and energy will resolve itself in

similar fashion. The market will determine our choices. First

there's not enough easily-accessible oil and gas. Second, what's

left is destroying our planet. Few will take heed of the damage

until dollars and cents combine with the effects of global warming

to give us all a fright.

When the US was confronted in March 2001, with international

pressure to comply with the requirements of the Kyoto Treaty,

rolling back consumption of carbonaceous fuels like oil, coal,

and gas, to combat the 'Greenhouse' effects of global warming,

Bush was blunt in his refusal to give a blank cheque promise

of compliance:

"We'll be working with our allies to reduce greenhouse gasses.

But I will not accept a plan that will harm our economy and hurt

American workers."

Drawn up in Kyoto, Japan, in 1997, the accord initially called

for industrialized nations to cut greenhouse emissions 8% below

1990 levels, but gave them 'til 2012 to reach respective targets.

To become effective the agreement required ratification by countries

responsible for at least 55% of carbon emissions in 1990. The

US was then producing 36% of the total, but with only 6% of total

population, making it far and away the biggest polluter. US rejection

was a real setback but Bush did not act in isolation. Two years

earlier the Senate had voted unanimously, by 95-0, to reject

Kyoto unless China and other rapidly developing countries were

also required to join. Despite current protestations to the contrary,

Senators Kerry and Kennedy both voted WITH the majority, and

AGAINST Kyoto!

Fast forward to 2004 and China has leapt up the rankings to become

the world's second biggest consumer of oil. In the medium term

their demand could double again so, in retrospect, the US was

entitled to dig in its heels until compliance with Kyoto became

more widespread.

Today the Bush plan to fight greenhouse gasses calls for investment

in Hydrogen and other alternative sources of energy, together

with financial incentives to encourage their use. But hydrogen

is not in itself an 'energy source.' Furthermore, it can only

be produced economically - and in the spirit of Kyoto - as a

by-product of nuclear power. There is no point in burning oil,

coal or gas, to generate hydrogen.

In pursuance of their revised strategy, the US Department of

Energy a year ago commissioned a study by the University of Chicago

to investigate the economic factors affecting the future of nuclear

power. That report was only completed in August 2004. It made

ultra low projections about the likely future course of oil and

gas prices, totally ignoring the theory of 'PEAK OIL' discussed

in this report. Conversely, it made quite high estimates for

long term interest rates, and required returns on equity. Both

decisions selectively disadvantaged the capital intensive nature

of nuclear reactors. Despite these distortions, the study fully

assured the competitiveness of nuclear power.

CONCLUSION

The above summary is designed to demonstrate a principle. If

market forces require it, then 'Greens' or 'no Greens,' nuclear

will return to fashion. The appointed time for its restoration

is close. We intend to demonstrate why the case is far more compelling

than the tame conclusions of the Chicago report would indicate.

Those who position investments appropriately can make excellent

profits as events unfold, both in the short term and the long,

depending on the sector. As with all markets, they discount the

future. For major new producers of Uranium and certain leading

edge technologies in the field of Reactor Design, the rewards

could be exciting. We briefly mention our top two recommendations

below, but they are discussed in greater detail in the body of

the report. In the case of Uranium, the short-term outlook is

very strong. Not only is underlying demand set to ratchet up

sharply in the years ahead, but stockpiles of highly-enriched

weapons-grade uranium - and other non-mined sources - are depleting

fast. Simply to close the current gap, production will need to

double in the short term from 85m lbs a year to 170m. If the

oil crisis worsens, nuclear will be the main beneficiary. If

'Greenhouse' fears mount, nuclear is the only realistic way out.

Once the world's brightest and best are let off the leash and

enticed to re-enter the world of nuclear research, plants will

get simpler, design margins safer, fuel enrichment cheaper, licensing

quicker and construction times shorter.

In 1979, following the shock of Three Mile Island, uranium prices

peaked at $43 a lb. In the absence of this extraneous event,

uranium may well have continued to rise in step with other commodities,

peaking a year later at $50 a lb. That would have coincided with

Brent oil notching its then all-time high of $40 a barrel, and

gold a record of $850 an ounce.

Twenty four years down the track, Brent leads the pack. The price

has surpassed its previous high. At time of writing it had breached

the $50 level for the first time ever. Our initial short-term

'point and figure' target is $54. Nymex 'Light Sweet Crude' is

there already. (NYMEX is short for New York Metal Exchange).

Some commentators predict Brent could reach $60 in 9 months and

$80 in 24 months. No doubt there will be the odd gut-wrenching

correction on the way - as we saw in copper recently - but the

trend will remain intact.

In response to these multiple pressures, the uranium price will

undoubtedly play catch-up. Within 24 months it could equal and

surpass oil. Longer term both can DOUBLE - $100 a barrel for

oil and possibly $125/lb for uranium. Only then would they be

back to where oil was in REAL terms in 1980 and where uranium

might have been were it not for Three Mile Island. The short-term

logic in favour of selecting uranium stocks as top pick in the

energy sector, is therefore overwhelming. The metal starts from

a much lower base than oil - being $20 /lb instead of Brent's

$50 a barrel - yet on past performance the two should at least

rank pari passu.

If a cascade of bursting debt bubbles causes the dollar to tank

50% over the remainder of the decade, nominal dollar values for

oil and uranium could conceivably even RE-DOUBLE. (The 50% figure

was a forecast made by The Economist scarcely a year ago. It

is no more than the strict measure required to restore the US

trade deficit back to surplus - currently running over 5,6% of

GDP).

TWO SPECIFIC RECOMMENDATIONS

Based on the above summary and conclusion, we have two specific

investment recommendations to make. Clearly no action should

be taken until you have passed them across the desk of your personal

investment advisor, for a careful 'yea' or a 'nay.'

1. AFLEASE - Gold and Uranium Producer of Promise

The first is a simple gold/uranium play, but with the emphasis

on uranium. As a South African, the writer spent part of his

career in finance as a stockbroker in Johannesburg, the other

as a bond trader in Cape Town. But his most exciting four year

stint took place in between the two moves, from 1983 to 1987,

whilst Executive Chairman of junior gold miner Wit Nigel.

Half way through the writer's stormy tenure as Chairman, the

company made a public offer for a minimum 25% stake in a gold-uranium

producer called AFLEASE, then controlled 65% by Anglo's Vaal

Reefs gold mine. Today that company, with a much-expanded capital

base, sits on a uranium resource estimated by Anglo to amount

to 330m lbs. That would make it approximately 60% the size of

Canadian heavyweight CAMECO. AFLEASE also has two small, but

proven shallow gold reserves - and a potentially much larger

gold resource which has yet to be properly drilled but could

ultimately contain in excess of 10m ounces of gold. A 'reserve'

is a deposit which has been properly established. A resource

is far less certain.

In total Aflease controls approximately 60% of South Africa's

easily- available uranium. Grades should initially average close

to 1kg a ton (2,2 lbs). A third of projected uranium revenue

will come from gold which co-exists in the same deposit, at an

average recovered grade of 1gm/ton. Much of the resource lies

at or close to surface. The other three gold deposits are quite

separate and have nothing to do with the above gold as a by-product

of uranium.

The company recently raised R200m ($33m) via a share swap with

Randgold & Exploration. A portion of the funds will be used

to complete a 'pre-feasibility study' of the uranium deposit.

It should take 6-9 months from start to finish. In the late 70's

and early 80's the giant Anglo American Corporation sank 240

boreholes on the uranium prospect. These ranged from surface

down to 2000 meters. To put it bluntly, the deposit has been

drilled as thoroughly as a Swiss 'Emmentaler' cheese.

Seventy of the cores are still available for re-assaying to enable

the information to become SAMREC compliant. In the old days of

South African mining, exploration of the 'Main Gold Reef' - or

even the 'Merensky' Platinum reef - was relatively predictable.

Less than a dozen good borehole results were all one needed to

prove up a viable mine because it was simply an 'extension' of

an existing reef. Imagine having 240 drill holes in a single

large deposit! All thanks to Anglo thoroughness.

Subject to the pre-feasibility study producing no unpleasant

surprises, the company will approach one of a handful of potential

customers with a view to establishing an initial mega mine capable

of producing up to 6m lbs a year. 2m would come from a 'soft

start' short-term opencast proposition, taking a year or so at

most to bring on stream. The mega mine would take four years

to establish and would have a minimum 25-year life.

Most of the initial finance for the above mine would come from

the customer. Mining and treatment costs are expected to average

less than $15/lb. If the uranium price is trading over $30/lb

by August next year - currently $20/lb - we have a very sound

proposition on our hands. If the spot price hits our more realistic

target of $45/lb, we have ourselves a veritable humdinger of

a project - despite our long-term bullish projections for the

Rand, currently trading above R6/$.

We enclose a far more detailed analysis in the main body of this

report, but it is only available to SUBSCRIBERS. The Company's

CEO is currently on an overseas 'roadshow,' visiting potential

investors in the UK, Switzerland, Canada, the US, and Japan.

Japanese gold group Jipangu already holds 20m shares and has

recently appointed a second director to the Board.

In the long term, should the pre-feasibility pan out as hoped,

and should the market warrant, AFLEASE could one day open THREE

mega mines producing a total of 12m lbs a year. This would place

them in the same league as CAMECO with their current production

of 20m. Although AFLEASE has nowhere near the high grades of

CAMECO, it will operate in a far kinder environment. When account

is taken of its by-product revenue from gold, the company will

enjoy surprisingly low costs in relation to it's the price of

uranium.

The company has a present issued capital of less than 325million

shares. The ruling price at time of writing was R2,10/share equivalent

to US 35cents. We believe that at around R2,50 ( US 40cents)

- it would be possible to pick up between 20m and 30m shares

in sizeable blocks. The total investment would amount to less

than $15m. Should any of our readers be interested, they may

contact us via our web site, www.investmentindicators.com.

On July 27 of this year, we recommended the stock at R1, (US

16 cents) in a special report entitled: ENERGY UNLIMITED - AFLEASE

and URANIUM. It has since doubled off a low base. We believe

that by July of next year, with the 'pre-feasibility' complete

and uranium at $30, the shares could be trading at R7 ($1,16).

By the end of next year, 14 months down the line, with spot uranium

probably up at $45/lb and gold at $600 an ounce, these shares

could well be trading between five and six times current levels.

That would put them between R10 and R12/share, equivalent to

US $1,80 each.

2. SOUTH AFRICA'S 'REVOLUTIONARY REACTOR'

Investment recommendation number two is even more interesting.

The Pebble Bed Modular Reactor (PBMR) is a South African development

based on German technology established in the 60's, 70's, and

80's, which the Germans dumped after the traumas of Chernobyl.

It promises to revolutionize the nuclear power industry over

the next decade with its inherent safety, cost-competitive small

unit size, and flexible operation. It has perfect application

to commercial-scale production of hydrogen - which Bush is pushing

for - plus desalination for areas short of potable water, and

normal electrical generation in lieu of oil, gas and coal. In

terms of cost, ease of operation and safety, it is 5 years ahead

of any other nuclear designs currently on the drawing boards.

It is genuine fourth generation technology but its biggest selling

point is its inherent safety. Those who understand nuclear plants

describe it as follows:

"It is a reactor whose safety is a matter of physics, not

operator skill or reinforced concrete."

The first prototype is due for completion by end 2008. If successful,

from 2015 onwards, 35% of all new power plants in the world could

be PBMRs - not nuclear plants, ALL plants.

The South African Government is shortly expected to announce

its full backing for the continuing development of this exciting

project. However, if, after the announcement, a multi-billionaire

foreign investor with youth on his side and a penchant for calculated

risk, is prepared to stump up $1,2billion, he could take a controlling

stake in the Pebble Bed project - on condition he undertakes

to keep assembly in South Africa. In 10 years time he could have

an organization valued at many times the size of his initial

investment. South Africa could be generating $25 billion and

more a year, from exports. For the foreign investor, it would

be like finding another NOKIA - 15 years ago, when the company

was still in the timber business.

In a Financial Times article on August 10, 2004 there

appeared the following description of the Pebble Bed:

"Looking further ahead,

a US-led consortium of 10 nations is planning fourth generation

reactors that could be deployed after 2015. The six reactor concepts

being studied by the consortium mark a REVOLUTIONARY change.

They would operate at high temperatures (500 - 1,000 degrees

centigrade) to maximize efficiency and minimize the output of

radioactive waste. This is too hot for a pressurized water circuit,

so they would use new coolants such as helium, molten lead or

molten salt. Conventional uranium fuel rods would be replaced

with another system such as South Africa's "Pebble Bed"

technology, in which fuel is encapsulated in spheres the size

of billiard balls."

If there is anyone out there

interested in the amazing potential of this project, and capable

of handling the financial challenge of $1,2billion, please contact

the writer.

N.B. Neither of the above two recommendations has merit

unless our primary analysis of the energy markets is correct.

Prospective investors should carefully assess our detailed reasons

for predicting a massive swing back to nuclear. At this point

the reader will only have had sight of our six page 'Summary

and Conclusion.'

The

full report is over 40 pages long explaining the nuclear and

broader energy markets as well as giving more detailed valuations

of Aflease and the Pebble Bed Reactor. We encourage you to access

it at Peter George's website with a view to becoming a SUBSCRIBER.

The address is:

www.investmentindicators.com |

Peter George

tel: 021-700-4880

cell: 082-806-3147

Contact

DISCLAIMER

Readers are advised that the material contained herein is provided

for informational purposes only. The authors and publishers of

this letter are not acting as financial advisors in providing

the information contained in this publication. Subscribers should

not view this publication as offering personalized legal, tax,

accounting or investment related advice. Readers are urged

to consult an investment professional before making any decisions

affecting their finances.

Any statements contained in this publication are subject to change

in accordance with changes in circumstances and market conditions.

All forecasts and recommendations are based on the currently

held opinions and analysis of the authors and publishers. The

authors and publishers of this publication have taken every precaution

to provide the most accurate information possible. The information

and data have been obtained from sources believed to be reliable.

However, no representation or guarantee is made that the information

provided is complete or accurate. The reader accepts information

on the condition that errors or omissions shall not be made the

basis for any claim, demand or cause for action. Markets change

direction with consensus beliefs, which may change at any time

and without notice. Past results are not necessarily indicative

of future results.

The authors and publishers may or may not have a position in

the securities and/or options contained in this publication.

They may make purchases and/or sales of these securities from

time to time in the open market or otherwise. The authors of

articles or special reports contained herein may have been compensated

for their services in preparing such articles. Peter George Portfolios

(Pty) Ltd and/or its affiliates may receive compensation from

the featured company in exchange for the right to publish, reprint

and distribute this publication.

No statement of fact or opinion contained in this publication

constitutes a representation or solicitation for the purchase

or sale of securities or as a solicitation to buy or sell any

specific stock, futures or options contract mentioned in this

publication. Investors are advised to obtain the advice of

a qualified financial and investment advisor before entering

any financial transaction.

________________

321gold Inc

|