Investment Indicators from

Peter George

Greenspan's

Ducks take flight Greenspan's

Ducks take flight

Peter George

Trinity Holdings

posted September 2, 2004

"I will destroy the wisdom

of the wise"

--I Corinthians chapter 1, verse 19

1. IRAQI WAR DUCK - Death knell of US Empire

2. THE OIL DUCK - rampant bull takes hold

3. THE DOW DUCK - heading for the precipice

4. THE DOLLAR DUCK - forced into FIAT folly

5. THE BOND DUCK - heading for the hills in

fright

SUMMARY

Time was when the 'Honourable Fed Chairman' spoke in measured

tones that markets moved. No more. Having recently had his tenure

extended for another term, Greenspan could be forgiven for wishing

he'd turned the offer down. Things are beginning to fall apart.

The centre cannot hold. It used to be that the old man was miraculously

able to keep 'all

his ducks in a row,' even though the promise of food never

materialized. The magic is fading. In rapid succession the ducks

are giving up and taking flight.

First it was the Iraqi War Duck as the situation spiraled out

of control. He was naturally followed by the Oil Duck as the

price accelerated to new highs. Last week the Dow Duck flapped

his wings with increasing consternation as growth prospects faded.

The Dollar Duck bobbed in concert as the July trade deficit hit

an all-time peak of $56billion. Only the Bond Duck looked set

to stay, having scooted to the far end of the lake to hide under

a bush. He's been conned into a false sense of security and will

soon get a wake-up call when he sees the Dollar Duck has dumped

him and fled.

They will all be gone by dawn. Then comes a Golden Sunrise.

1. IRAQI WAR DUCK

- Death knell of US Empire

If the war situation in IRAQ continues to worsen over a protracted

period of time, it could negatively affect US interests across

a broad political and economic front, eventually turning the

Middle East into a no-go area for US business. It could prove

to be the last straw in a dangerous buildup of threatening situations,

triggering a landslide collapse in the dollar and US markets,

and a long term surge in oil and gold prices. If allowed to deteriorate

sufficiently, it could spell the beginning of the end for the

erstwhile dominant position of the US. To date the only dividend

has been the incarceration of Saddam.

Comparisons with Rome

In the early days of Christianity the Apostle Paul instilled

fear in the hearts of his jailors by reminding them of his rights

as a Roman citizen:

"They beat us publicly

without a trialand threw us into prison. Now they want to get

rid of us quietly? No! Let them come themselves and escort us

out.When the officers and magistrates heard that Paul and Silas

were Roman Citizens, they were alarmed. They came to appease

them and escorted them from prison."

Despite holding sway for hundreds

of years, the fall of Rome was relatively swift, once the center

became rotten and the cash ran out. Romans themselves were no

longer prepared to fight and risk their lives for Empire. Employing

men from the tribes they conquered to do the dirty work, they

themselves opted for a life of luxury. Then, as finances began

to crumble, the Roman mint began to debase the currency. Once

Caesar lost control of the outermost reaches of Empire, he was

forced to 'pull back' his troops. The process marked the beginning

of the end. In due course the barbarian hordes overran Rome.

Comparisons with Britain

In the heyday of British Empire, an attack on an Englishman anywhere

in the world was guaranteed to incur the full wrath of the British

Navy. The policy of internationally -enforced protection for

British citizens gave birth to a patriotic song: 'Rule Britannia,

Britannia rules the waves.'

On the rare occasions when they beat the Springboks, some British

rugby fans still sing it today.

But the writer remembers journeying overland in 1962, after a

three year stint at Oxford University in England. He was returning

to South Africa. On the way he and his co-driver diverted for

a day and a half to climb Mount Kilimanjaro in Kenya. Half way

up they met a party of marooned sailors from the British Navy.

All were suffering from altitude sickness. As South Africans

from Johannesburg the writer and his friend were used to living

at 6,000 feet. Like the writer and his friend, the Brits were

returning home. Foreign Secretary Enoch Powell had recently shut

down their navy base in Aden. The country could no longer afford

the trappings of Empire. In this respect all international ventures

always end the same way. They have done so in the past and they

will do so in the future. The cost of policing and 'keeping the

peace' eventually outruns the benefits of exploitation. In this

context the word 'exploitation' is not even used in a pejorative

sense, but returns to it's original meaning: 'to cash in on or

make the most of.'

'Decline and Fall' of US Empire

This brings us to the US and the problems they are experiencing

in IRAQ. Ever since the end of the Second World War, American

power and influence has been in the ascendancy but the foundations

were laid a half century earlier. Wave upon wave of immigration

brought new blood, ideas and energy. More often than not, as

the British withdrew, they were replaced with American troops.

In rapid succession US business began to vie for a slice of the

pie in erstwhile British colonies. As the history books will

confirm, 'trade follows the flag.'

Now 'the flag' is becoming increasingly expensive to carry while

the payoff in trade is diminishing. IRAQ is an excellent case

in point. The writer watched a panel of experts over the weekend.

One was Pat Buchanan. The other was a woman and editor of the

Washington Post. They were discussing the pros and cons of present

policies in IRAQ. Buchanan strenuously defended the IRAQI government

decision to attack the centers of rebellion in the holy Moslem

cities of Faluja and Najaf - the first predominantly Sunni, the

second Shiite. He said unless the uprising was ruthlessly stopped

in its tracks IRAQ would become ungovernable. The lady member

of the panel vociferously protested, predicting Government and

US actions would alienate the entire Moslem world. There is no

easy answer. Whatever the true reasons for American intervention

in IRAQ, the pipeline carrying exports of crude to the West,

is more often closed than open and the price of oil reflects

it.

The cost of war

If war is pursued with total commitment, the financial implications

for the US are downright threatening. They have neither the men

nor materials to finish the job. To date the cost has been in

excess of $130billion - excluding interest on the additional

debt. There are those who are convinced the US could get bogged

down in IRAQ for a decade at an annual cost escalating rapidly

towards $200billion. At this level it will be directly responsible

for up to a third of next year's total projected budget deficit

of $600billion. Having recently announced major troop withdrawals

from other bases world wide, the US military have cast the dice

for the option of intensified war. Without the ability to rotate

troops in the field, even the current level of strength is unsustainable.

The cost of victory

If by some miracle the US wins, their influence in the greater

Middle East will have been irretrievably damaged. A rising groundswell

of hatred amongst Moslems could make it more and more dangerous

for Americans to continue doing business there. In this event

the reliability of the nation's oil supplies will deteriorate

even further than at present. Not surprisingly it is rumored

that, for the next three years, 10% of all US aid to Africa will

go towards building a deep water harbor off the small island

of Sao Tome. The resort lies off the coast of West Africa, opposite

Gabon, and could produce one day produce oil reserves which dwarf

those of most other countries in Africa.

The cost of defeat

If, instead of standing its ground, the US pulls out of IRAQ

with undue haste, it runs the risk of permitting unbridled chaos

and mayhem. The IRAQ adventure would then go down in the history

books as one of America's worst ever foreign policy catastrophes.

US power and influence would suffer an insurmountable reverse,

substantially undermining America's ability to keep the peace

and influence international events. This in turn could lead to

a major sell-off in US bonds as America's long term credibility

fell under serious question.

Justifying IRAQI intervention

Contrary to most commentators, who with the benefit of hindsight

violently condemn US intervention in IRAQ, we support the English

philosopher who penned the following:

"For

Evil to prosper, all that need happen is for Good Men to do nothing."

There are times in history

when the ruling Super Power has an obligation to exercise that

power in the interests of securing peace and justice. These are

the times when evil men need to be stopped in their tracks. Saddam

Hussein was one of those men but this was not one of those times.

The constraint of available finance ruled it out.

"Suppose one of you

wants to build a tower. Would he not first sit down and estimate

the cost to see if he has enough money to complete it? For if

he lays the foundation and is not able to finish it, everyone

who sees it will ridicule him, saying, 'This fellow began to

build and was not able to finish.'" (Luke chapter 14, verses

28 - 30).

Having foolishly decided to

go the war route, clearly the attempt to justify intervention

on the pretext of the supposed existence of 'Weapons of Mass

Destruction' was either a gross error of judgment or a carefully

concocted scheme to deceive. With the benefit of hindsight, having

ignored the risks of a major financial overrun, it would have

been better to have ignored the UN and justified their actions

solely on the basis of the murderous past and continuing policies

of the Dictator Saddam.

A further complication was that through some of his earlier escapades

- particularly those conducted against IRAN - Hussein had secretly

been supported by the US. Once they decided to abandon him and settle accounts,

they should at least have done their sums and counted the likely

cost before going in.

Even their ability to exploit IRAQI oil has been a gross failure.

Far from being able to increase production, rising levels of

sabotage have with increasing frequency literally turned off

the taps. Short of a miracle there seems no way out. This is

one Duck that Greenspan can no longer wish away and the knock-on

effect is becoming intolerable.

2. THE OIL DUCK

- rampant bull takes hold

The US political elite has for many years held substantial direct

and indirect interests in the oil industry, going back to the

days when John D. Rockefeller controlled the Standard Oil Trust

and most of the oil industry. The Sherman Antitrust Act forced

the nominal dissolution of the Standard Oil monopoly in 1911,

but in reality the oil monster simply became hydra-headed, spreading

into banking, financial services and other major industries in

which the same shareholders continued to dominate. Those holding

the reins ensure that the US government keeps a watchful eye

and tight control over oil, particularly the relationship between

international prices and the up and down stream sharing of profits.

In return the powers that be attempt to maintain a delicate balance

between the interests of the oil cartel and US consumers. Despite

regular predictions by successive Presidents, that the US would

accelerate local production, and tame demand with conservation,

the exact opposite has happened.

Since the seventies, US dependence on imported oil has risen

from 25% to 50% and in the next twenty years is forecast to reach

70%. Having failed to develop alternative solutions, the US faces

a crisis. Simply trying to keep the price of oil steady and 'low'

has in itself a key objective for successive US Administrations

seeking to protect the national interest. Unfortunately, any

form of market interference, apart from yielding very temporary

short term benefits, actually distorts the forces of supply and

demand. It skews the equilibrium price and always carries an

ultimate long term cost.

Evidence of interference

The first IRAQ war in 1990 was allegedly caused when the US sought

to protect Kuwait and Saudi Arabia from a Saddam takeover. But

we need to go back a little. What triggered the IRAQI Dictator's

outburst of anger? If one recalls some of the press articles

of those years, the rationale is interesting. Oil prices were

languishing in the mid-twenties. OPEC had agreed to impose a

reduced production quota on its members. The intention was to

squeeze the price back up to $30. Under rumored pressure from

the US, Kuwait deliberately exceeded her quota to sabotage OPEC

objectives. Saddam was furious and decided to teach Kuwait a

lesson. There were also allegations at the time that the Kuwaiti's

were tapping into IRAQI oil fields by drilling 'obliquely' near

their common border. When Saddam proceeded to threaten Saudi

as well, the US panicked and stepped in to defend both kingdoms.

Prior to doing so they needed to insulate the dollar against

speculative attack. The US was in no position to finance a war

on her own. The dollar would have wilted. To protect the currency

- and as a condition of their providing military assistance -

the US instructed the Saudis to dump their gold stocks. At the

same time they rallied the main oil consuming nations and persuaded

them to share the financial costs of paying for US troops. At

the end of the day it is reckoned the US made a tidy profit.

Unfortunately, without similar wide-ranging support today, the

US can no longer afford unilateral action. The man who pays the

piper calls the tune; when he refuses to pay, the music has to

stop.

More evidence of interference

Apart from the need to sever Saddam's links to sponsored terrorism,

there are those who believe the second IRAQ war, started in March

of last year, was largely otherwise motivated. They say it was

driven by US efforts to secure control of the country's vast

untapped oil stocks and increase the rate of pumping in line

with the size of the underground resource. Clearly, if this were

the case, the outcome to date has had exactly the opposite effect

to that intended. Looking back over the last twenty five years,

one wonders whether a less intrusive approach by the US may not

have given normal market forces a better chance to satisfy long

term customer requirements. Higher average prices over the past

two decades could have stimulated new production, encouraged

the timely development of alternative energy sources such as

nuclear, and promoted consistent conservation. Gas-guzzling SUV's

would then have been still-born and a far greater proportion

of electrical energy would today have been sourced from nuclear

stations - if not they at least would have been under construction.

Current oil prices are 'real' cheap

When Nixon abandoned 'gold convertibility' in 1971 he unleashed

a long term collapse of the purchasing power of the dollar and

a ten year boom in commodity prices. Oil rose from $3 a barrel

in 1971 to $40 by 1980, gold from $35 to a peak of $850. When

the press of today therefore issues panic statements to the effect

that oil, in its current range of between $45 and $50, is breaking

multi-year highs, they are nominally correct. But if they suggest

latest prices are going to ruin the world economy, they are mouthing

nonsense. They need to reduce today's prices to their 'real'

level, to make them comparable with previous peaks, or raise

future target prices to adjust for historic inflation from 1980

to 2004. They should do this before hitting the panic button.

For the same reason, to assume that current prices, in themselves,

can dramatically slow the US economy is not necessarily correct.

Real pain will only come when prices enter a far higher range.

In fact,

we believe the US recovery is terminating already, but for totally

different reasons and we will discuss them later when dealing

with the Dow Duck.

What is a 'fair' price for oil?

If we allow for 25 years of erosion of dollar purchasing power,

then the equivalent of the 1980 highs for oil and gold, in today's

'money,' would respectively

be $100 a barrel for oil - up from $40 - and $2125 an ounce for

gold - up from $850. If the current commodity boom extends for

another 7 to 10 years, and inflation sinks to zero, that is where

prices will head. But if central banks continue to insist on

staving off a threatened world debt collapse, by artificially

lowering short term interest rates and printing money, inflation

could spike up rapidly, as FIAT currencies begin to collapse.

Inflation averages of 6% per annum for the next nine years could

respectively drive the long term 'target' prices of oil and gold

to $200 a barrel for oil and over $4000 an ounce for gold. How

reliable are these relationships between oil and gold?

Relationship between oil and gold

Way back in 2000, GATA contributing economist Adam Hamilton,

proclaimed to a skeptical audience that commodity prices were

entering a major new long term bull. In a highly revealing combined

chart, he singled out oil and gold. He showed that over the entire

period from 1965 to 2003 the relationship between the two had

averaged 15,4 to 1. In other words, with oil at $50, gold should

be $770. Between their respective 1980 highs and today, the average

actually increased to 17,5. That would put gold at $875. This

is probably a truer reflection because from 1965 to 1971, gold

was artificially pegged at $35.

But Hamilton pointed out there had also been times when gold

outpaced its 17,5 ratio by a standard deviation of 1. This elevated

the average to 20. Oil at $50 could conceivably then put gold

at $1,000. So with oil at $200 as above, we would get $4,000

for gold.

This is out of the park. If one accepts the US has played games

in the oil market, it is nothing to what they have been doing

in the gold market. There have undoubtedly been identifiable

occasions in the recent past when the US Treasury was using derivative

structures to exert downward pressure on oil prices, but these

interventions amount to chicken feed compared to the lengths

to which they have gone to suppress the price of gold.

Could inflation take off as we assume above? Let's see what the

'bankers' have planned.

Council on Foreign Relations Project - 1998

In a speech delivered on March 21, 2003, respected GATA member

Frank Veneroso referred to efforts he had made to investigate

the lengths to which the Fed would consider going in the future,

in order to stave off deflation:

"We have not been surprised

by recent willingness of Fed governors to openly discuss unconventional

measures. Our first recognition of the willingness of the Fed

to break with central bank orthodoxy to support an overvalued

stock market occurred when we discovered the Council on Foreign

Relations (CFR) exercise on financial war games designed to prevent

a tech led collapse in the U.S. stock market.

This CFR project apparently began in 1998. It involved 70 odd

important persons from the corporate sector, Wall Street and

banking, government, academia, the military and national security,

and the major international institutions. Only half of the participants

were made public. The exercise involved central bankers and Treasury

officials who where not named. Fed Chairman Greenspan presided

over one of their key get togethers. The objective of this project

was to consider policy responses to contain a tech led decline

in the stock market so as to avert a crash in the overall stock

market, the dollar, and perhaps the economy. Such an extensive

exercise at such a high level suggested that the U.S. Fed and

Treasury recognized the potential for a disastrous stock market

collapse. We were most struck by the open discussion of radical

and unconventional measures to contain any stock market decline."

Some time after the CFR's secret

back-door planning exercise in 1998, Veneroso had sight of Fed

staff papers which indicated a willingness to adopt some of these

same 'unconventional measures' it became necessary to contain

damage from the unwinding of any future US stock market bubble

- or any other asset-type bubbles for that matter, such as property.

We now fast-forward to Veneroso's comments on Ben Bernanke's

infamous speech of November 2002.

"In late 2002, the

failure of US consumption to rise strongly, despite massive cuts

in short term interest rates and record re-financing of housing

mortgages at ultra low rates, convinced the Fed that the traditional

mechanism of monetary policy was no longer operative."

He was referring to Fed Governor

Bernanke's speech to the National Economist Club in Washington

on November 21, 2002.

Bernanke began with a statement which brooked no argument:

"The

conclusion that deflation is always reversible under a FIAT money

system follows from basic economic reasoning."

Bernanke failed to point out

the ultimate destruction which would follow if the above FIAT

policies were actually implemented. He then went on to tell a

parable about an alchemist who discovered how to turn base metals

into gold. Trust a purveyor of dishonest money to choose an example

which points to the mythical destruction of the FIAT system's

greatest enemy, gold! In your dreams Ben!

Bernanke concluded with his now infamous statement of future

Fed intent to counter the threat of deflation. May it be a warning

to international investors foolish or naïve enough to harbor

the faintest hope that the long term value of the US dollar can

retain any sort of meaningful buying power, or that current low

yields on long term US government bonds are anywhere near sustainable

in the years ahead. We think yields will treble, but more of

that when we come to discuss why the Bond Duck is set to take

flight. Meantime, here is Ben's recipe for prosperity:

"US dollars have value

only to the extent that they are strictly limited in supply.

But the US government has a technology called a printing press

(or its electronic equivalent), that allows it to produce as

many dollars as it wishes at essentially no cost. By increasing

the number of dollars in circulation, the US government can reduce

the value of the dollar in terms of goods and services, which

is equivalent to raising the prices of those goods and services

in dollars."

To complete the nightmare,

be assured that many consider Ben Bernanke to be Chairman Greenspan's

most likely successor. It is Fed- inspired statements like the

above which virtually guarantee that commodity prices are set

to defy gravity. That is why oil was recently nudging $50 a barrel

and why, despite lagging, gold is set for a catch-up. Just as

the US Administration's schemes to control oil have come to naught,

ultimately, and much sooner than expected, the gold conspiracy

will implode as well. The latest US ploy to crush oil was an

announcement that IRAQI oil was back at full production and that

in addition, the US was planning to release oil from the Strategic

Stockpile. One day later the IRAQI pipeline was attacked again

and, as for the so-called stockpile, who knows how much is there

and whether they dare release it?

Before the gold conspiracy implodes, there are one or two building

blocks which first need to fall in place. We discuss them below.

3. THE DOW DUCK

- heading for the precipice

In his speech to economists at the end of 2002, Governor Bernanke

openly advocated Fed operations to prevent a bursting of future

asset bubbles. He had in mind open-handed monetization. Clearly

something was needed over and above simple monetary policy if

Bernanke and his boss were to realize their shared dream of eliminating

the cycles of boom and bust, both in markets and the economy.

It was King Canute who, in olden times, demonstrated to an adoring

audience the futility of opposing trends. He placed his throne

on the sea shore - just above the water line - as the tide was

turning. He commanded the sea not to wet his feet. His words

went unheard. Bernanke and his ilk are in for a similar experience.

The difference is that Canute was under no illusions whereas

Bernanke is in dreamland.

Fed intervention by way of a drastic reduction in rates did little

to stem the equity slide from early 2000 to late 2002. Instead,

what they did was generate an even bigger bubble in housing. Today Bernanke knows full well that

a collapse here will be an entirely different kettle of fish

and all he has done is jump from the frying pan into the fire.

Here is why: In 1997, in the US economy, equity and housing made

roughly equal contributions to household net worth. Seven years

later, thanks to Greenspan's rate cuts, the real estate component

had grown a huge 80%, massively outstripping equities, themselves

up a mere 15%.

The equity component crashed 41% from $12, 2 trillion at the

end of 1999, to $7,1 trillion by the end of 2002. By March 2004

it had recovered to only $9, 1 trillion. Housing meanwhile went

beserk:

"accelerating real

estate values kept household net worth largely moving forward

during one of the greatest equity bear markets in decades."

(Author unknown).

To sustain the housing bubble

going forward will now require keeping the bond bubble intact.

Both will pop if the dollar bubble deflates further. The dollar

will definitely implode if the Dow sniffs the return of a long

term bear, a slide which takes out previous lows.

Return of the 'bear'

US markets bottomed in October 2002, European markets only in

March 2003. After enjoying major rallies for the past year and

a bit, all spent the first quarter of 2004 topping out. Between

then and now, led by the NASDAQ, all have since given major long

term 'sell signals.' Let

us explain. Market direction is all about trends and moving averages.

When a market breaks below its 200 day moving average, it generally

signals a long term change of trend. If a market stays down long

enough for its 100 day moving average to turn down, and in turn

break below the 200 day, it draws a line in the sand. Very rarely

will a market then rally above the crossover point before beginning

a major new slide which takes out previous lows.

In the past two months, starting with the NASDAQ, but followed

by the Dow, Europe and Japan, all major equity indices have largely

met the above criteria, as a prelude to re-entering the next

phase of continuing long term bear markets. All these markets

will in due course go lower - much lower than the investing public

presently anticipates.

We will focus on the Dow - See chart below.

The initial breach of the 22-year old bull market, what we describe

as Leg 1, took the Dow down from its all-time high of 11,700

on January 17, 2000, to an intra-day low of 7,200, two years

and nine months later, on October 10, 2002. In the following

16 months the Dow enjoyed an extended rally, pushing up 50% to

10,700 by February 20, 2004. It has been working its way down

ever since.

On August 3, (the writer's

62nd birthday, what a present!) the Dow's 100 day moving average

broke below its 200 day, at an intersection point of 10,246.

Thirteen days later, on August 16, the Dow cracked to an intra-day

low of less than 9800 - a level last seen some eight months ago

in December 2003.

The Dow is currently enjoying what could be a final rally back

to the 'intersection point' of 10,246, before slipping off a

precipice. First stop might be a short breather at 9,000, followed

by a re-test

of the October 2002 low of 7,200.

In a recent letter, Jay Taylor's charting friend, Roger Wiegand,

suggested we could revisit this level as early as October. In

retrospect we would simply have had a two year respite from the

bear. After retracing our way to 7,200, it's probably down again

- big time - to the lower channel at 5,500. One would hesitate

to put a time on it, but probably by end 2005, as gold is roaring

up from $400 to $850. What a switch! More of that later.

Why the Dow is so fragile - the 'fundamentals'

The US is a classic case of an economy drowning in debt. Like

an 'energizer bunny' playing a drum - the action slows as the

battery dies. As a frog expires without warning in water brought

slowly to the boil, so a child watching the bunny is surprised

and crestfallen when the toy goes dead. US investors will be

similarly traumatized when their economy unexpectedly lurches

to a halt. It will be in defiance of authoritative prognostications

to the contrary but the reasons will be plain. Consumers are

totally tapped out, increasingly nervous, and wishing they had

saved when they had the opportunity.

'The Privateer' exposed Greenspan's propaganda as follows:

"The global economy

is slowing fastboth the Bush Administration and ...the Fed know

this and are watching it with increasing dread..one more quarter

at the current rate of deceleration and Japan's economy could

also be back in recessionyet in two days of testimony to Congress,

Greenspan assured the world that the June 'soft spot' was temporary

and there was 'nothing to fear'the rise in oil was 'only transitory'He

painted the rosiest of scenarios in the expectation that no one

would dare to refute him."

Since then every financial

statistic has painted him a liar. Investors were stunned when

the July jobs figure crashed from an expected 228,000, to an

actual 32,000. Dr Kurt Richebacher, former Chief Economist of

Dresdner Bank, was not surprised at all. After carefully analyzing

the fabulous job stats put out by the Bureau of Labor he discovered

that of the 1 million new jobs supposedly created in the 3 month

period March-May, virtually two thirds had come from a new statistical computer

model!

Richebacher summarized the US problem in an interview with Philip

Coggan of the London Financial Times:

"Inflating asset prices,

propelled by a limitless supply of credit at Fed-orchestrated

rock-bottom interest rates, created a deceptive recovery through

a protracted borrowing and spending binge."

Coggan says Richebacher believes

that once the stimuli are withdrawn the bubbles will burst -

thanks to a massive

sell-off in bonds.

The withdrawal of the 'job creation' façade is the first

stimulus to fade from the scene.

As evidence of deceptive recovery begins to manifest, it will

be increasingly difficult to justify share prices priced on the

basis of 22 x average earnings. They would compare with long

term averages of as low as 13, falling to beneath single figures

in recession. On the basis of overblown p/e ratios alone, the

Dow can halve. If foreign funds take fright and begin to exit

US markets, the dollar will tank as well. This will eventually

cause investor malaise to spread. It will finally begin to deter

the long suffering offshore buyers of US bonds. Once the debt

bubble starts to burst and Americans are forced to rely on internally-generated

savings, rates will rise dramatically. Corporate earnings will

fall sharply - they could even halve. Then the slide in the Dow

will intensify. An ultimate target of 2,000 and lower would not

be out of the question over the next three years.

We think the Dow crash will precede the crash in the dollar and

US bonds. Official US spokesmen are already attributing slowing

growth to rising oil. Because oil prices are low in real terms,

we consider this to be a distortion of the truth.

4. THE DOLLAR

DUCK - forced into FIAT folly

As we turn attention to prospects for the dollar, we feel like

a traveler in the desert, struggling to distinguish between the

ever-present mirage at the horizon, projected by the Fed, and

the deteriorating reality experienced on the ground. On the rare

occasions when the stats have not been processed through a government

filter, we are subjected to unadulterated 'Fed-speak' such as

below:

"The rest of the world

loves investing and lending money to America and will continue

to do so ad infinitum, regardless of the ballooning size of the

'twin deficits' on budget and trade."

The second tells a picture

of a nation drowning in debt, gutted of manufacturing capacity,

rapidly alienating a hostile world of lenders, driving perilously

close to a sign reading: "End of the Road."

The war in IRAQ and the dollar

On the face of it the IRAQI war duck is demanding an ever bigger

share of an escalating US budget deficit. Both are out of control.

If the economy slows further, prompting the Dow to slide, tax

receipts will shrink as corporate profits sag in face of recession

or worse. Yet the Administration has been determined to prosecute

the war at almost any cost. Are there other considerations which

can affect the dollar even more than a deteriorating budget deficit,

should the war be lost? It would appear so. An extract from Bill

Murphy's Lemetropolecafe Midas column of August 24, referred

to a recent article in the Asian Times by Pepe Escobar, who wrote

the following:

"From an American perspective, the need to control IRAQ's

oil is deeply intertwined with the defense of the dollar. The

strength of the dollar is guaranteed above all by a secret agreement signed

between the US and Saudi Arabia in the 1970's that all OPEC oil

sales be denominated in dollars.

Saddam Hussein started selling IRAQI oil in Euro's (and making

a handsome profit) in November 2000 - and that's another crucial

reason for the IRAQI invasion. Many OPEC countries, not to mention

Russia, have openly flirted with the idea of trading their oil

in Euros. (OPEC is made up of Algeria, Indonesia, Iran, Iraq,

Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab

Emirates, and Venezuela)." It seems the Americans are fighting

a rearguard action to retain oil sales in dollars. It is a practice

which adds considerably to dollar strength because so many nations

are forced to keep their 'working capital' in dollars. That is

why Saddam had to be taught a lesson to prevent others from copying

his example. The problem is the ramifications of intensifying

the war, run the risk of alienating far more nations than just

IRAQ.

As James Turk recently set out in 'Goldmoney:'

"It seems clear that

OPEC and the other oil exporters are already pricing crude oil

in Euros."

The US trade deficit and

the 'strong' dollar policy

In an effort to retain OPEC's policy of trading oil in dollars,

some US Treasury Secretaries have deemed it important to maintain

a 'strong dollar policy.'

Henry Rubin was one such under Clinton. The right to print dollars

at virtually no cost, and have the rest of the world accept them

as 'payment,' has been

such an amazing privilege, that the US has been prepared to go

to extraordinary lengths to protect it. Unfortunately it has

come at a very high cost and a glance at a long term chart of

the trade deficit versus the trade-weighted exchange rate of

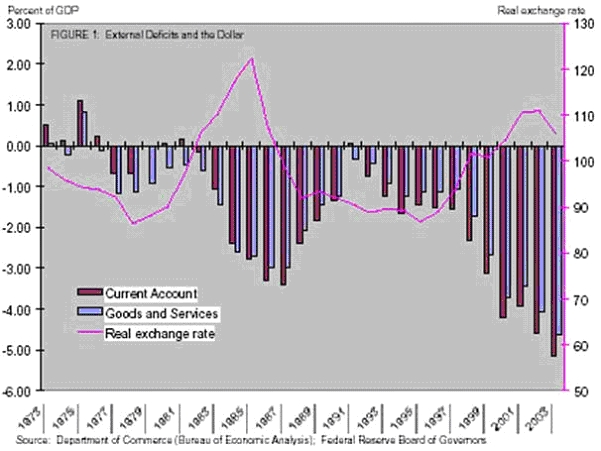

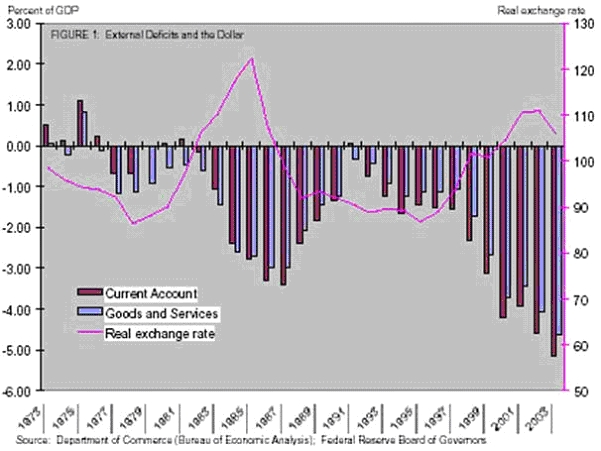

the dollar will explain why this has been so. See chart below:

Not since 1977 has the US run

a trade surplus of any size. When the US Fed hiked rates to 20%

plus in 1980 to break the bull market in gold, the dollar took

of. From 1981 to 1986 it rose nearly 40%. This caused the trade

deficit to explode. As rates were cut again and the dollar subsided,

the trade deficit briefly disappeared for a year in 1991, but

the surplus was marginal. Having roundly condemned the market's

'irrational exuberance' in the mid nineties, Greenspan withdrew

all caution and refused to comment as the Dow and NASDAQ surged

into the year 2000. Dollar strength followed. The trade deficit

plunged to new depths and despite a sharp fall in the value of

the dollar, it has not yet been sufficient to turn the tide.

The EURO rose 50% in less than two years, from $.86 in February

2002, to a peak of $1,29 in January 2004, before pulling back

to its current artificially low level of $1,20. Yet, so far it

has had no effect on the trade deficit.

The reason is most likely because years of dollar 'over-valuation'

have gutted US manufacturing industry, much of which has been

exported to China and India.

The ECONOMIST calculated a year ago that it would take a further 50% devaluation of the dollar merely

to swing the trade deficit back into surplus - let alone enable

the US to generate sufficient foreign exchange to pay of years

of accumulated international debts.

There is a second possible reason. Rising oil prices, combined

with falling domestic production, are together ensuring that

oil's contribution to the burgeoning trade deficit is growing

by the month. It is not yet hurting consumers but it is building

somewhat of an insoluble problem for the dollar. Even a further

devaluation cannot help that much. There is simply an absolute

limit to the amount of local oil production at all but stratospheric

prices.

Likely consequences of a major dollar fall

The problem with engineering a hefty devaluation as part of a

strategy to swing the trade deficit back into surplus is that

it would sow panic into the US bond market. A fifty percent devaluation

would require the dollar to fall 15% per annum for three years

in a row. US 30 bonds presently yield only 5%. Imagine a foreign

holder losing 15% of his capital, each year, for three years

in a row. A 5% return on his money would nowhere near compensate.

We will study the outcome we expect when considering the likely

behavior of the BOND DUCK in the next section.

5. THE BOND DUCK

- heading for the hills in fright

Changing the US way of

life

There are two alternative strategies to dollar devaluation. The

first requires effecting a radical change to the US way of life.

The second opens the door to allowing the adoption of Bernanke-type

policies of blatant monetization.

In discussing the path of discipline, we draw on figures appearing

in the latest Privateer but present them a little differently.

The July budget deficit widened from $54 billion to $69 billion.

The June trade deficit jumped to a record $56 billion from May's

$46 billion. The latest figures for each give a combined average

monthly twin deficit of $125 billion. On an annualized basis

that amounts to $1,500 billion. The latest estimate for US Gross

Domestic Product (GDP) is $11,600,000 billion or $11, 6 trillion.

The twin deficits account for 12, 9% of GDP.

That is HALF the problem. The other is that the US is also living

on internal credit to the tune of another 12%. Combining the

three items comes to an enormous 25% of GDP, which is currently

being borrowed into existence.

If one were counseling a spendthrift he would be told to start

living within his means. Cut what he cannot afford. Why should

it be different with nations? If one were dealing with minor

problem countries like Thailand or Argentina, they would simply

be told:

"Sorry boys, there

are no more loans. It's over. Get back into line."

It was the radical but respected

American economist, Dr. Ravi Batra, who in 1998 said:

'The US is just a big

version of Thailand.'

Imagine the extent of the internal

contraction the US would have to suffer if they overnight decided

- or were instructed - to stop the borrowing? It would cause

a 25% contraction of US GDP. The world can no longer afford to

lend the US 12,9% of its living standard, nor can the US itself

continue to pile up internal debts, most of which have come by

way of extracting maximum equity from the housing market.

A surprising African example of budgetary discipline

The writer is based in Cape Town at the southern most tip of

the African continent. Our country, South Africa, is still responsible

for 25% of the world's gold production. Some of our American

friends prematurely write us off and describe our ANC government

as 'pro-communist.' There

is no doubt many of its older members once were avowed communist

supporters when Russia was their main source of military support

and finance. It is hard to blame them. Yet there is also evidence

that Rockefeller gave the ANC R30m in 1985 - to assist them in

their efforts to fight a terrorist war against the White-controlled

'Apartheid' government of the National Party. At the time we

recall the EPG (European Parliamentary Group) visiting South

Africa in an urgent attempt to persuade the whites to accept

an immediate hand over of power to a black-controlled pro-communist

government. Fortunately South Africa's President at the time,

PW Botha, totally rejected their efforts.

Majority Rule by a black-controlled government only came 9 years

later in 1994. Communism had collapsed in 1991 so by the time

the ANC gained power their erstwhile friends had gone and the

entire system had been shown to be a total fraud.

With the demise of communism and the expansion of 'globalism,' countries that refuse to trade and

get efficient will fall off the log and starve. Erstwhile communists

have to learn about capitalism.

It is not just Black Africans who have to make this adjustment.

Americans need to study the past history of some of their own

political leaders. In 1969 as a Rhodes Scholar at Oxford University

in England, ex-President Clinton was violently protesting against

his country's participation in the Vietnam War. A year later

so was the Democrat's latest contender, John Kerry. Both were

well aware that some of their backers were out-and-out Marxists.

They were definitely not 'anti-war,'

they simply wanted North Vietnam to succeed in its takeover of

the South, and thanks to the efforts of men like Clinton and

Kerry the Communists won the war. Fortunately they have lost

the peace and Clinton and Kerry had to grow up. South Africa's

ANC is having to do the same. Talk to the beneficiaries of 'Black

Economic Empowerment' and 'Affirmative Action.' They think capitalism is wonderful - wouldn't

you?

We have taken this political detour in order to find an excuse

to quote from a recent article by the Chief Economist of South

Africa's largest 'parastatal.'

His name is Mandla Maleka and he works for ESKOM - otherwise

known as South Africa's 'Electricity Supply Commission.' He writes a regular column for South

Africa's biggest circulation daily newspaper, part of the ARGUS

Group. His latest article was headed:

"Save more, borrow

less, and grow the economy"

It was an excellent call to

fiscal prudence and financial discipline from one of South Africa's

top black business leaders. He ended with the following injunction

to his countrymen: "A saving nation combined with prudent

fiscal and monetary policy managers should be able to grow the

economy to levels sufficient to attract foreign direct investment

and create employment. So do your bit - slow down the appetite

for CREDIT and increase your SAVINGS."

US will likely choose the coward's way out

We doubt the US will listen to the wisdom of a little nation.

They are too far down the road to financial ruin.

Matching their current trade deficit of $56 billion for last

June was net foreign investment of $72 billion. An imminent crack

in the Dow could frighten off foreign investors, even cause them

to pull out in droves, reversing the inflow into an outflow.

The dollar would crash and the US would be forced to fund its

budget deficit from its own non-existent savings. Other things

being equal, that would tend to push rates up sharply, rapidly

puncturing the housing boom. The Fed would initially try to prevent

it happening. Bernanke would inevitably begin to monetize the

debt. The Fed would have to PRINT the money to buy the bonds

that investors were no longer prepared to subscribe for at current

low rates. Failing that, rates would have to rise very sharply.

As the printing began in earnest, dollar holders would begin

to jump ship and seek alternatives. Japan and China would be

left holding the baby.

Unless private holders harbored a collective death wish, they

would switch their dollars into a safer 'store of value' as quickly

as possible. It could be other currencies or gold and silver.

As the dollar slide accelerated, the pressure on other central

banks would mount. Most might try to slow the rate of collapse

by intervening - printing their own currencies to buy the dollar,

hoping to stem the rate of decline. In the process FIAT currencies

will collapse together. Soon enough, international investors

and savers will switch to gold. For more on this process readers

are encouraged to ask for copies of an earlier report we wrote

entitled: "Currencies in FIAT folly." It is

27 pages long.

Readers may recall that in our 'SUMMARY' we described how the

BOND DUCK had initially: "looked set to stay, having

scooted to the far end of the lake to hide under a bush. He's

been conned into a false sense of security and will soon get

a wake-up call when he sees the Dollar Duck has dumped him and

fled."

That is indeed how US bond rates have been behaving in face of

growing evidence of a slowdown in the US economy. There is little

sense of the dangers facing the dollar if fears of a slowdown

cause a sharp sell-off in the Dow. As we described above, a dollar

crash has serious consequences for off-shore holders of US bonds.

We therefore maintain that the current strength in US bonds is

merely a deceptive rally. We believe that from a technical perspective

the weekly chart contains a 'reverse head and shoulders' pattern.

Furthermore, if we look at a monthly 'arithmetic' chart of the

30 year bond, it will be clear that there is 'a long term

falling wedge formation' which has already broken out and

upwards. It is pointing towards a long term upside target for

the 30 year bond rate of 12% and higher. We therefore concur

with Dr. Kurt Richebacher's prediction that in due course there

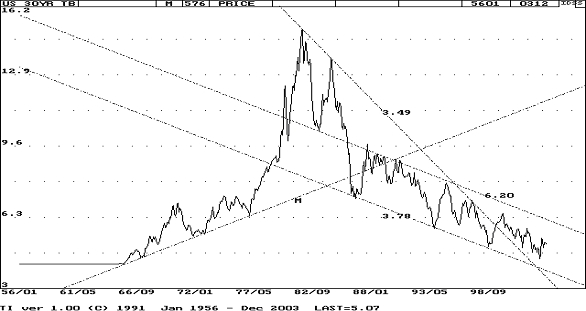

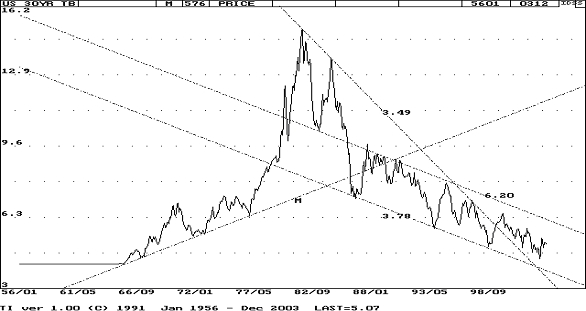

will be a 'massive sell-off in bonds.' See chartist, Daan Joubert's long term chart

below.

CONCLUSION

After years of playing the magician, Greenspan has run out of

tricks. Returning to the scene we painted at the outset, the

'ducks he liked to keep in a row' are one by one taking

flight but the BOND DUCK is the most important and will likely

be the last to fly away. We predicted in our 'SUMMARY' at the

beginning:

"They

will all be gone by dawn. Then comes a Golden Sunrise"

Here is what we meant:

As the world's biggest borrower, the US is responsible for managing

the most significant financial instrument available to international

investors. It is the US bond market. In order to sustain its

attractiveness the US needs to ensure that the dollar fulfills

its role as a safe 'store of value.'

It further has to persuade lenders that US ability to service,

and eventually repay, ballooning international debts, is credibly

within the bounds of probability. We believe that a calm, cool,

assessment of the facts does not support such a conclusion. This

leads us to the following. If the world's most widely-used financial

instrument is close to unraveling, and, if in the process, most

other FIAT currencies could be dragged into pit with the dollar,

there is a near certainty that sooner rather than later a growing

proportion of world savers and investors will be struggling to

get through the doors of gold and silver. The days of governments

being able to purvey FIAT currencies and related bonds as honest

repositories of people's savings, is drawing to a close - albeit

not always obvious as the trends unfold.

Central banks have gone to great lengths to persuade the world

to trust in their FIAT currencies. The process has entailed a

simultaneous conspiracy to suppress the price of gold and denigrate

its properties as a 'safe haven.'

This has enabled governments to keep long term interest rates

at artificially low levels because the lower than normal gold

price signaled 'inflation under control - no need to worry -

we can keep printing.'

The extent of suppression of gold bears comparison with an old

Roman war machine called 'the catapult.' Having been pulled back to its maximum point

of compression, release will bring a violent surge.

As we were finishing this letter, John Embry and Andrew Hepburn

of Sprott Asset Management published a brilliant 66 page study

entitled:

"Not free, Not Fair:

The Long Term Manipulation of the Gold Price"

Sprott are well-known Canadian

Fund managers, controlling total funds in excess of $1,6billion,

invested mainly in gold, gold shares, and precious metals. John

Embry used to hold down a high-level position with the Canadian

branch of the Royal Bank of Scotland. The latter were suitably

embarrassed when Embry had the courage to come out and speak

the truth. He and Hepburn summarized their findings as follows:

"The more we investigated

the gold market, the more readily apparent it became that the

gold price appeared, in the POLITEST of terms to be 'managed.'

Despite that they went on to

say:

"We believe gold is

well-launched into a multi-year bull market for a number of strong

fundamental reasons. In fact we would go on to say that the fundamentals

may well be better today than they were in the seventies when

gold experienced a TWENTY-FOLD move in price."

They concluded with the following

forecast:

"The inevitable failure

of the latest attempt to influence the gold market will serve

to AMPLIFY the forthcoming rise in the gold price that is going

to occur anyway for very solid financial and geopolitical reasons."

In the longer term, drawing

a line through Sprott's guidelines, gold could ultimately rise

20-fold again, from last year's $350 to an eventual $8,500 in

9 years time. The Sprott report can be accessed at their website:

www.sprott.com.

Once the price breaks through the 'glass ceiling' of $430

imposed by the world's central banks, it will quickly move back

to $550, then on to its all-time previous high of $850 - last

seen in 1980. If one had to guess timing, one would look to the

metal soaring back to $850 by end - 2005. That is in 16 months

time. $500 could be on the cards by Christmas, or early next

year. Greenspan's ducks will soon be gone. Then the 'hunter'

will become the 'hunted.'

END

|

Peter George

will be launching a NEWSLETTER SUBSCRIPTION SERVICE within the

next 2 months.

If you would

like to be kept informed please email pgportfo@trinityholdings.co.za

|

Other articles by Peter George:

- Currencies in 'FIAT Folly'

- face Abyss of Destruction - March 12, 2004

- Strategy for R6/$, Buy Gold

NOT Dollars - July 12, 2004

- SA Gold Shares - Buy when

there's Blood - July 27, 2004

- Energy Unlimited - Aflease

and Uranium - July 27, 2004

Friday, August 27, 2004

Peter George

tel : 021-700-4880

cell: 082-806-3147

e-mail address : pgportfo@trinityholdings.co.za

website: Trinity

Holdings

Peter George turned 62 in August,

2004. Born in Natal, South Africa. Graduated with a BA (PPE)

- Politics, Philosophy, and Economics - at Oxford University,

England, followed by an MBA at the University of Cape Town. He

was a Member of the Johannesburg Stock Exchange from 1969-1981,

Chairman of Wit Nigel gold mine near Johannesburg, from 1983-1987,

and a Member of the South African Bond Exchange from 1993-1997.

He and his associates currently own an option to repurchase and

reopen the Wit Nigel gold mine. Today he writes a regular commentary

on world markets, currencies, and gold. He lives in the lovely

South African city of Cape Town. His reports are available via

e-mail or, by special arrangement, via surface mail - for the

elderly who are not yet 'computer literate.'

His e-mail address is : pgportfo@trinityholdings.co.za

________________

321gold Inc

|

![]()

Greenspan's

Ducks take flight

Greenspan's

Ducks take flight