|

|||

Gold at 50% of current market priceAlf Field It is possible to buy gold lodged in the Perth Mint for 50% of the current market price. I will show you how this is possible, but first some background information. Some years ago a couple of smart geologists found a large high grade gold deposit north west of Kalgoorlie. They did a joint venture with a large American mining company to mine the property. The US company owned 51% of the deposit and was responsible for operating the mine. The remaining 49% was held by two companies associated with the geologists and they received their proportionate shares of the production each year. Let’s call them company A and company B. The 49% of the JV was shared 75% to A and 25% to B. The mine was very profitable and over the years these two companies sold only a portion of the gold that they received each year. They sold enough gold to cover expenses, repay debt and have enough profit left to pay some tax to the Government. The balance of the gold they left on deposit at the Perth Mint. The result is that each year these two companies increased the quantities of gold that they held at the Perth Mint. The situation at 30 June 2014 for each of these two companies is set out below. These are from notes to their published balance sheets at that date. From Note 10 in company A’s balance sheet: Gold on hand at 30 June 2014 has a net realisable value of $169,489,965 (2013: $145,653,325) measured at spot rate. Gold in transit had a net realisable value of $2,327,412 (2013: $1,620,212) measured at spot rate. Spot rate for the year was $1,393.11 (2013: $1,303.32). Thus company A’s gold stock is worth $171m and it appears that they added 10,000 oz. to the stockpile from current production. $171m is equal to $3.40 per share for company A. It is quoted on the ASX at about $2.96, a discount of 12% to its gold holdings alone. That is quite juicy, but company B is better. From Note 11 in company B’s balance sheet: Gold on hand at 30 June 2014 has a net realisable value of $37,432,313 (2013: $35,701,527) measured at spot rate of $1,393.11 (2013: $1,303.00). Thus company B’s gold stock is worth $37.4m which equates to 62c per share for company B which has recently traded on the ASX at about 56c. This is a discount of about 10% to its direct gold holdings. In addition, company B owns 26% of company A. Thus B owns an indirect 26% share of A’s $171m of gold. This equals $44.6m, or 74c per B share. If we add B’s direct holding of 62c worth of gold to its indirect holding of 74c per share we get $1.36 per B share of gold held at the Perth Mint. Company B is extraordinarily tightly held but there is some volume on offer in the 65c to 68c range. Thus a purchase of shares in company B at these levels equates to a 50% discount to the gold that they hold directly and indirectly at the Perth Mint. Apart for the gold that they own, these two companies have just won what geologists might describe as a mining lottery. The 51% of the joint venture owned by the American mining company, which was originally Placer Dome and subsequently Barrick, has recently been sold to a local Australian company, Northern Star (NST on the ASX) for $75m. This looks like a bargain because NST in recent drilling has found a new deposit in a new section called Pegasus which is high grade. It can be accessed from existing workings and processed through the existing plant. For the NST announcement click here. The basic news was that the JORC resource at Pegasus had doubled to 763,000oz at a grade of 11.4gpt. Development of Pegasus is well advanced with access gained via the decline at the adjacent Rubicon mine. Capital cost of bringing Pegasus into production will be a mere $10m. Production will start in early 2015, ramping up to 100,000ozpa by July 2015. Half of this will be for NST with the remainder shared between companies A and B. That will increase annual production to 125,000ozpa for companies A and B, split 75% -25%. The NST MD had the following to say: “Pegasus is one of the best high grade gold discoveries in Australia in the past 10 years. It is every gold miner’s ideal scenario – a deposit rapidly approaching 1.0m ounces at a grade of +10gmpt located immediately adjacent to an existing operation.” This should push the value of 51% of the JV up from the $75m paid by NST to a much higher value. No doubt companies A and B will be salting away even more gold in the Perth mint once their share of gold from Pegasus starts flowing. In addition, company A owns 44% of company B, thus consolidating the ownership between the 2 companies in the hands of the directors once other common shareholders are taken into account. If we assume that A and B’s combined 49% holding in the JV with NST is worth say $100m compared to the $75m that was paid for 51%, we can calculate the following values for the two companies;

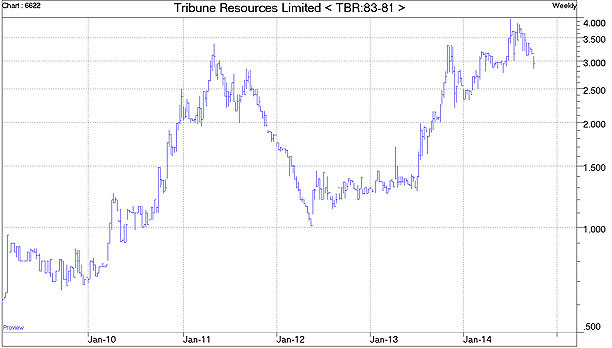

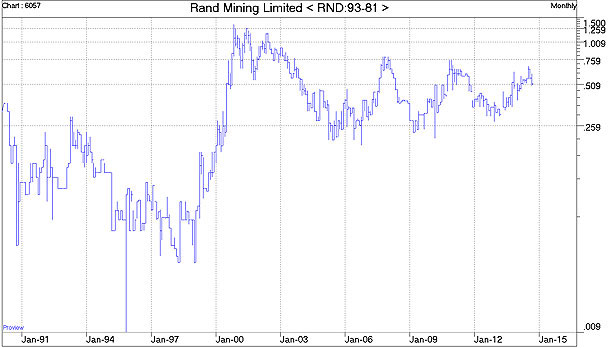

The valuation of the JV at $100m looks to be on the low side. When Pegasus is fully ramped up (probably F/Y 2016), the 49% share of JV production will be 125,000 oz. Assuming a possible profit margin of $600 per ounce at a A$1300 gold price and an all in sustaining cost of about $700 per oz, that would produce a pre-tax profit of $75m per annum (split $56m to A and $19m to B). If these companies do what they have done in the past, some of that gold will not be sold but will be added to their Perth Mint accumulations. Naturally you will want to know the names of these companies. Company A is Tribune Resources TBR and company B is Rand Mining RND. Both stock are quoted on the Australian Stock Exchange. Charts of their share prices are set out below:

By way of personal disclosure, I bought shares in these two companies about 18 months ago at about $1.35 for TBR and 43c for RND. TBR moved up quite nicely within a few months and I sold at various prices, the last being at $3.30. I have recently started acquiring TBR again once the value of the Pegasus deposit became apparent. I still have a decent holding of RND at 43c. I do not expect to be a seller of either share until their share prices approach the values calculated above. Why are these shares selling at such bargain prices? Marketability is a big problem. It is not easy to buy or sell in any large quantities. One has to be patient in accumulation and to sell into demand when it occurs, as I did last year with TBR. Secondly, enquiries in the market will elicit feedback that these companies are run by people of questionable character. That has bad connotations, suggesting that they are doing something illegal. There isn’t any evidence supporting that assertion. The problem is that the companies are opaque and don’t publicise themselves or their achievements. They don’t do presentations at symposiums or conferences. Shareholder communications are bland and without hype. Generally the bare minimum required by law is communicated. The directors don’t take phone calls or respond to emails. There is nothing illegal about that. Nor is withholding a portion of the gold production from the market and accumulating it in a stockpile. Some people would say that this is a smart move. They are simply putting surplus assets into gold and deferring payment of tax. One aspect that has been troubling some people is the fact that RND has an option to acquire tenements in Liberia where it is drilling for iron ore. If the option is exercised, RND will have to transfer 8m TBR shares and additional payments in the form of multi-million RND shares and options. The full details can be seen here. At first blush this looks alarming and anyone contemplating a purchase of RND (or TBR) will have to make a judgment call about this issue. My personal opinion is that this iron ore transaction is dead in the water. Apart from the recent decline in the iron ore price from US$130 to US$80, the company has done very limited drilling on the site and is still awaiting assay results from the early holes. A couple of months ago the Ebola virus emerged and Liberia has been badly impacted. RND has had to close down operations in Liberia and repatriate employees to the points from which they were employed. The Liberian government has closed down all mining operations, which may also include the assaying companies. A game changing event for TBR and RND has been the news of the rich Pegasus discovery and the impact that this will have on these companies over the next couple of years. In these circumstances, pursuing iron ore in Liberia makes no sense at all. Experts suggest that it will be several years before the Ebola outbreak can be brought under control, so nothing will be able to be accomplished in Liberia during that time frame. RND should abandon this iron ore project in Liberia. There would be sighs of relief from shareholders if this happened. Meanwhile NST (the 51% partner in the JV) became the third largest shareholder in RND during the past year with a holding of 4.8%. What does this imply? The bottom line seems to be that if you are sitting on a gold mine – as these guys literally are – then why not keep sitting there, like King Midas, putting more gold into the vault when it becomes available. Eventually they will have to find an exit mechanism. This may involve a takeover by someone (NST?), or the sale of the 49% of the JV followed by an in specie distribution of the assets owned by the companies. It will be fascinating to watch – and hopefully profitable as well. Patience may be required. |