FREE CALL OPTION ON URANIUMAlf Field Why be interested in uranium in the first place? The doyen of investment letter writers, Jim Dines, has proclaimed that uranium is in a long-term bull market and has been recommending accumulation of uranium shares.

Dines states that: "It is not our place to decide whether nuclear power is good or bad, especially since oil reserves will be used up in this century and there is no replacement in sight yet. At the end of last year there were 441 nuclear reactors in operation worldwide, with another 34 under construction. Six new reactors began commercial production in 2002 throughout the world, (three in China, two in South Korea and one in Japan), with construction having begun on six reactors in India and four in South Korea. Six units that had been mothballed in Canada are expected to return to service, with more units coming from Finland, Russia, Ukraine, Romania, Brazil, and Bulgaria. China and India have made clear that they intend to commit more resources to nuclear-generated electricity." The price of uranium has doubled from $7 to $15.50 per pound over the past year. There is obviously a shortfall in the supply of uranium. Dines talks of the "coming uranium melt-up" and makes the following points:

I have not been able to check Jim Dines' assertions but I have no reason to doubt them. Logic suggests that he is right on the button and that the prospect is for a long-term bull run in uranium. What is obvious is that uranium supplies that are either available now, or that can come on stream in the next few years, will command premium valuations. The premier uranium stock is Cameco Corp (CCJ), which has risen from a low of US$20 in April 2003 to a recent price of US$60. At the current price of US$45, Cameco has a market capitalisation of about US$2.5billion. Other smaller companies with connections to uranium have seen their share prices soar, (but are not yet recommended by The Dines Letter). The hunt is on for other uranium companies that may have been overlooked. This is where Aflease comes in. Recently Aflease made the following corporate announcement:

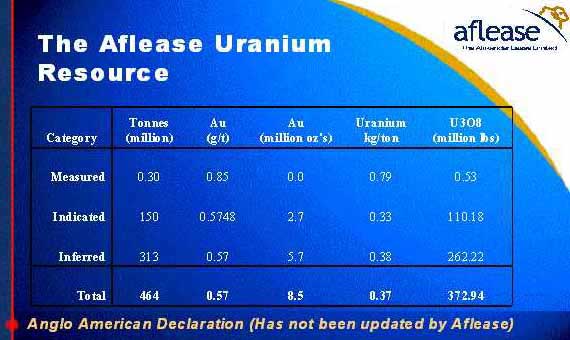

A feasibility study on the Aflease uranium resources is being conducted by Dr Charles Kingsley (Geologist) and Dawie Viljoen (Metallurgist). The first feedback in the form of an updated Resource model, plant costs and clarification of the uranium market is expected within a couple of months. What is interesting is that the Dominion Reefs and Rietkuil deposits are well-known, having been explored and partially mined in the past by Anglo American. Considerable information about these deposits is available from old Anglo American records. The Dominion Reefs and Rietkuil Resource Statement as determined by Anglo American many years ago is set out below:The resource is huge. Some 464m tons containing 372m lbs of uranium plus 8.5m oz of low grade gold as a by-product. It is nearly 55% of South Africa's total uranium resources and is an important deposit in a world context. Anglo American Declaration of Dominion Reefs and Rietkuil Resources now owned by Aflease:

Although large sections of these deposits are relatively low grade, there must be pay shoots with higher-grade uranium and gold. This is inferred from the fact that previous mining produced grades in the region of 1kg (2.2lbs) per ton. The deposits are reputed to be shallow, from the surface to 500 feet deep, suggesting that mining costs will be low. These assumptions were further confirmed by an interview with Neal Froneman, CEO of Aflease, published on the Mineweb web site on 14 January 2004, as follows: "Details for the proposed operation are sketchy, but Froneman estimates the uranium mine could process as much as 4.8 million tons of ore a year - that's twice the size of the gold operation at Klerksdorp. If grades were consistent with the earlier mining operations - about 1kg/ton - Aflease could produce as much as 4,800 tons of uranium a year (approximately 10.6m lbs). Froneman said Aflease would aim to mine the deposit at R40/t, process the ore at a cost of R40/t and keep overheads down to R15/t. At those costs and the current uranium price of $15/lb, Aflease could make a cash operating margin of $23,560/ton of uranium. If it manages to produce the 4,800 tons of uranium each year, Aflease could turn an annual cash operating profit of US$113 million. That number could improve still further if gold by-product credits are factored into the equation. Froneman also said Aflease would also look to produce 153,600 ounces of gold each year as a by-product of the operation, assuming it could get grades of 1 g/t". (My emphasis.) If the gold by-product production turned a profit of say $200 per ounce, this would add in excess of $30m per annum to the above profit figure of $113m for uranium, making a total operating profit of $143m per annum. This figure would need to be reduced by corporate overheads, amortisation, financing charges and taxation. If we believe that uranium is in a bull market, then the price will not remain at $15.50 per lb. I believe that the price will rise to at least $30 per lb within 2 years. At that price, the prospective Aflease uranium profits would increase by 10.6m x $15 = $159m. Add the original profit figure of $143m above and we get a figure of over $300m per annum for operating profits from the uranium operation. These figures must obviously be regarded as "back of the envelope" informal calculations until the feasibility study currently being undertaken has been completed. They do, however, give a glimpse of what management is hoping to achieve. These prospective profit figures are subject to significant fluctuations depending on a number of variables, not least of which is the ZAR/US$ exchange rate. In the Mineweb interview Froneman indicated that the cost to restore the mine would be of the order of R100m (US$14m) with initial production commencing in 2 year's time but ramping up to the 4,800 tons of uranium level over a further 2 years. The old Anglo American shaft was apparently built to the normal high specifications of Anglo American and should require minimal cost to restore to full capacity.

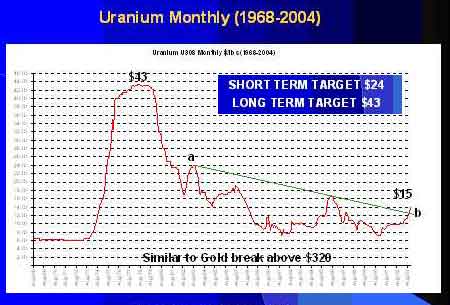

The graph on the previous page depicts the uranium price over the past 36 years. An upside break above $16 will trigger a technical buy signal for uranium with a short-term target of $24. Once $24 has been exceeded, there is no resistance until $43 per lb is reached. The following graph reveals the supply/demand figures for uranium together with the uranium price over a similar period.

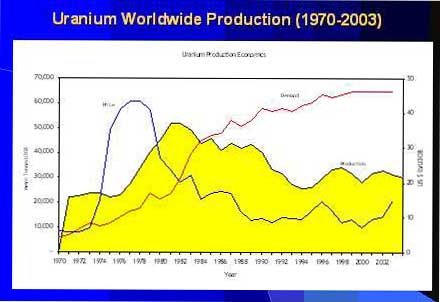

The obvious question that flows from this graph is the why the huge discrepancy (shortfall) between supply and demand has not caused the uranium price to rise more dramatically until now. The answer is that large inventories of uranium were built up by the USA and Russia during the Cold War for defence purposes. Following the end of the Cold War and with nuclear disarmament, there was no need to maintain these stockpiles. These stocks were gradually filtered into the private market as fuel for nuclear power plants. This additional supply caused the free market price for uranium to plunge until it reached its low point of $7 per lb in 2000. Uranium producing mines that were no longer viable closed down causing the decline in uranium production depicted above. The huge supply deficit depicted in the above graph is now impacting the market price for uranium because the Cold War stockpiles have largely been exhausted. This is what James Dines has been referring to. When one factors in future demand likely to emanate from China and other Asian countries, it is reasonable to forecast uranium prices in excess of $43 per lb within a few years. Aflease as a Uranium Call OptionAflease has 236m shares in issue (211m + 25m for Kalgold still to be issued). AFKDY traded on Nasdaq at US37c on 3rd February 2004, giving the company a market capitalisation of US$87m. This is about 3.5% of Cameco's market capitalisation of US$2.5 billion.

The chart of the Nasdaq price of AFKDY reveals the panic sell off that took place in mid December when the company decided to moth-ball its open pit operation and CIL plant. The shares dived from around 70c to a panic low of 25c before recovering. At their current level of 37c there is obviously no froth in this market. Cameco is a uranium producing mining company with high-grade uranium reserves. Cameco has other important assets including a holding in Bruce Power (which is an electricity producing utility) plus some gold assets. Cameco's attributable uranium resources are of the order of 450m lbs and annual production is about 18m lbs. Aflease is a small gold mining and exploration company in South Africa. Its gold mining assets are arguably worth more than the current market capitalisation of the company. If this proposition is accepted, the uranium assets of Aflease come free. The Aflease situation is complicated by the fact that the company needs a capital injection of the order of US$40m to complete its various new gold mining and exploration projects. (Uranium will be funded independently.) This will result in some dilution of equity depending on how the new capital is raised. Allowing for full dilution, this would push the market capitalisation of Aflease from $87m to US$127m. This compares favourably with the informal operating profit calculations of up to $300m per annum as set out above for the uranium section only. The recent decline in the share price of Aflease is probably related to uncertainty about how the company will raise the necessary finance to remain viable and to complete its various projects. Considering the huge potential profitability of both the uranium and the new gold mining projects of the company, it is unthinkable that the major shareholders will not ensure that Aflease is adequately funded. Failure to do so would invite an unwelcome take over bid. Call options are all about rapidly increasing value once the strike price has been exceeded. On this basis Cameco is already "in the money". That means that it is already profitable. The Aflease uranium deposits are probably partly "in the money" and partly "out of the money" at current uranium prices. We will only have definitive information about this when the feasibility study is completed. It will also require time and capital to bring the deposits into production again. Once the uranium price has moved up to the point where both the Cameco and Aflease resources are "in the money" (which should happen in a uranium bull market), one can compare relative increases in the in situ value of their resources and then compare these with their respective company market capitalisations. At the point where both deposits are "in the money", a $10 increase in the uranium price will increase the value of uranium in situ by $4.5billion for Cameco and by $3.7billion for Aflease. Compare these figures with the current market capitalisations of $2.5 billion for Cameco and only $127m (fully diluted) for Aflease. The much bigger "bang for your uranium buck" in Aflease becomes immediately apparent. This is a very crude comparison. Discounted net present values would be a better way to compare these stocks, but until a great deal more information is available from Aflease, such calculations cannot be done. Call options are high risk/high reward investments and Aflease is a similar high risk/high reward investment. It should be approached on that basis. Alf Field PS. An interview with Jim Sinclair that discusses uranium and Afrikander Lease was recently published on the Moneyweb/Mineweb web site. The important portion of the interview is reproduced below. Jim Sinclair makes the important point that historic stockpiles of uranium have been used and that the market in uranium is reverting to a more normal commodity type situation with supply falling short of demand, hence a bullish situation for the uranium price. MONEYWEB: Jim, just to close off with, a year ago you were also very bullish on platinum, on the platinum price - and that has also justified your confidence in it. Do you see that continuing to rise? JIM SINCLAIR: Platinum is like any other of a more minor metal, very much driven by the supply and demand factors. And platinum has had a number on it of approximately $1100. It would become, I believe, fully priced up into that area, basically more on the supply and demand side. But let me add another one to you right now. Uranium, believe it or not. And I would suggest that in the next three years the US purchase of enriched uranium is now being processed, and that basic purchase at the end of the cold war is what put the mines on hold. Now real supply and demand will enter the picture, and demand looks better than supply. MONEYWEB: So you've got to start thinking about a little stock in South Africa called Afrikander Lease, which has got huge uranium assets. JIM SINCLAIR: You do, certainly you do and for myself, uranium properties that had merit would be something that I would be interested in. MONEYWEB: Jim, as far as uranium is concerned, why is there now this interest in uranium? What information has come to light that has got people excited about it? JIM SINCLAIR: That we have processed almost all of the purchase. Part of ending the cold war was buying the enriched uranium, and part of the buying the enriched uranium was to process it. And if you've got enriched uranium and you're processing it, what is the mine off-take? And when mine off-take drops, what happens to the economics of the mine operation and to production? And the answer is that it contracts. Then when the item which caused that contraction is exhausted, real supply and demand comes back into the mining operation and, as the mining people listening know, you don't just crank up a mine on any product at the whim of a demand. It takes time and process. So, between cranking up the supply to meet the demand, prices rise. Thank God commodities are simple. Thank God commodities rarely go to zero. MONEYWEB: Jim Sinclair, US's Mr Gold - and there might be hope yet for Afrikander Lease. Disclosure

and Disclaimer Statement: In the interest of full disclosure, the author

advises that he is not a disinterested party in that he has a

personal investment in Aflease shares. The author's objective

in writing this article is to interest potential investors in

this company to the point that they are encouraged to conduct

their own further diligent research. Neither the information

nor the opinions expressed should be construed as a solicitation

to buy or sell this or any stock, currency or commodity. Investors

are recommended to obtain the advice of a qualified investment

advisor before entering into any transactions. The author has

neither been paid nor received any other inducement to write

this article. |