Stocks: What to Make of the Day-Trading Frenzy Stocks: What to Make of the Day-Trading Frenzy

Bob Stokes

Elliott Wave International

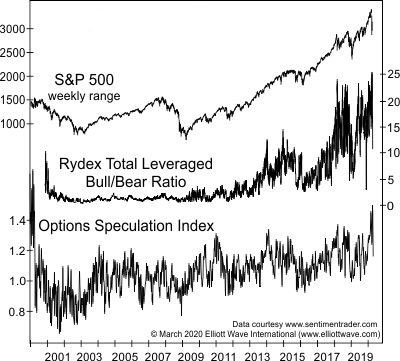

Posted May 31, 2020 Day trading - it's back. As you'll probably recall, day trading became so popular during the late 1990s that some market participants were selling their homes to raise the funds to participate. It didn't end well. After peaking in March 2000, the NASDAQ went on to lose 78% of its value. Yet, even after the dot.com bust, day trading never went away. There was a marked resurgence in the months leading up to the 2007 stock market top. But, even then, day trading activity was not as intense as it was around the time of the dot.com bubble. However, the wild speculation that was taking place around the time of the February 2020 top did call to mind the 1990s. The March Elliott Wave Financial Forecast, a monthly publication which covers major U.S. financial markets, the economy and cultural trends, showed this chart and said:

The middle graph in this chart shows that investors' amazing willingness to bet on stocks with borrowed money lasted right through the top of the bull market. … The bottom graph shows when SentimenTrader.com's Options Speculation Index jumped to 1.5, its highest total in 20 years. That index divides the total number of bullish transactions (call buying and put selling) by the total number of bearish transactions (put buying and call selling). … For anyone who wondered about where the small day traders who made the 1990s so wild went, meet the 2020 version. Did the February / March market meltdown make the day traders go away? Hardly. Here's a May 22 excerpt from Barron's: Day Trading Has Replaced Sports Betting as America's Pastime. Day trading among individual investors has taken off. A full-blown retail mania has taken hold in buying and selling small lots of stocks and options. … Many Americans used their coronavirus stimulus checks to trade stocks. So, no, day traders are as hopeful as ever. Even a market meltdown that saw the S&P 500 drop nearly 35% in just a month or so was not enough to scare them off. This speaks to the extreme level of optimism that is now in play and correlates with the stock market's Elliott wave pattern. As the book, Elliott Wave Principle: Key to Market Behavior, notes: The progression of mass emotions from pessimism to optimism and back again tends to follow a similar path each time around, producing similar circumstances at corresponding points in the wave structure. Learn more about the Wave Principle by reading the entire online version of Elliott Wave Principle: Key to Market Behavior. You can gain instant access, 100% free. All that's required is a free Club EWI membership. Simply follow this link to get started: Elliott Wave Principle: Key to Market Behavior, free access. ### May 27, 2020

Bob Stokes

Elliott Wave International

website: www.elliottwave.com This article was syndicated by Elliott Wave International and was originally published under the headline Stocks: What to Make of the Day-Trading Frenzy. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world. © 2020 Elliott Wave International 321gold Ltd

|