|

|||

Gold & the dollar range-bound in the near-termClif Droke

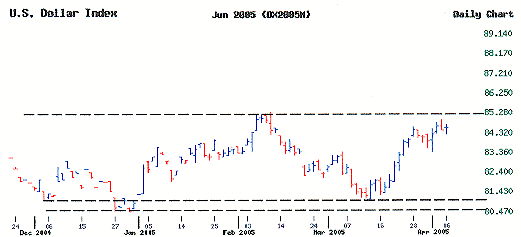

snippet Below is an extract from Clif Droke's Gold Strategies Review for Apr 2005 Gold and the U.S. dollar index have established near-term trading ranges as we've discussed in previous newsletters. This will afford traders the opportunity of making profitable short-term trades off the support and resistance parameters of the range, but as far as sustained intermediate-term moves we'll likely have our patience tested until later in the year when the dominant trends for both the dollar and gold should re-emerge. Last month we looked at the 10/20/30-week moving averages for the dollar index and noted that the 30-week MA was intersecting around the 85.00 level. It was stated, "What I can envision for the dollar index is a re-test of the recent pivotal low at the 80.50-81.50 area. If this benchmark zone holds up as support it will signal a resumption of the trading range environment that I wrote about in last month's newsletter. In other words, we'll need to carefully monitor the $450-$465 area in gold as a potential strong resistance and the 80.50-81.50 area as a potential strong support in the dollar." We got that successful test of the trading range floor support in the dollar and the buck subsequently turned up to test the higher end of its range near the aforesaid 85.00.

I further stated, "In terms of dollar resistance, the 30-week MA that intersects at the 85.00 area should keep the dollar confined during any rallies along the way in coming months. I believe that while the longer-term gold trend remains up and the dollar trend sideways-to-lower, the Fed and its allies will do all in their power to keep the price of gold from exploding upside this year as well as to keep the dollar from collapsing." This assessment of the near-term has so far proven to be true and the words and actions of the Fed so far this year confirm it. It is becoming abundantly clear that Year 2005 will be mostly used to stabilize a host of commodities, currencies, and interest rates in order to put the U.S. and global economies back on what the central banks consider an "even keel." Fundamentally, one thing that is keeping gold in a trading range is the propensity for central bank sells of gold. The latest headline from the London Financial Times states, "ECB joins list of gold sellers with disposal of 47 tonnes." The gold sales of the European Central Bank was the first disposal of any of its official reserves since its creation in 1999, the article stated. Also keeping gold in check is the recent announcement of the International Monetary Fund of possibly unloading some of its 3,217-ton store of yellow metal to finance debt relief for developing countries. But what about further on out... More follows for subscribers, you can subscribe to the Gold Strategies Review ($21) here. --Clif Droke |