| |||

Gold’s Advantage Over Bitcoin in 2024Clif Droke Bitcoin continues to outperform gold and most other financial assets (including stocks) so far this year, but the shiny yellow metal has a key advantage over crypto in that it’s poised to continue strengthening even if the “everything rally” should fail. For reasons I’ll explain here, gold should enjoy a smoother, less obstacle-laden year compared with the currently white-hot crypto and other risk assets. There’s no denying bitcoin’s supremacy over precious metals in terms of percentage gain so far into 2024. For comparison purposes, the Grayscale Bitcoin Trust (GBTC), which many market watchers use as a crypto sector proxy, is up 60% in the year to date while the GraniteShares Gold Trust (BAR)—my preferred gold tracker—is up just 6% and most silver ETFs are barely higher on a YTD basis. Bitcoin’s popularity since last October’s broad market bottom has been more a function of the crypto’s use as a speculative medium to leverage a bullish financial market backdrop and less the result of defensive mindedness. This point is integral to establishing why gold should continue to perform well in the coming months regardless of what economic or geopolitical turmoil may descend upon the financial market, while bitcoin may (or may not) continue outperforming—again, depending on the political and economic climate. In order to bolster this assertion, let’s start by taking a cursory look at the past few years. Year 2017 is what many consider to be a pivotal year in the development of bitcoin’s status as a mainstream investment. In what was categorically a bullish year for equities from start to finish, 2017 was also correspondingly bullish for bitcoin, while being a mixed year for gold. Although the metal finished that year with a respectable 13% gain, there was considerably more volatility for gold than for cryptos. For instance, gold prices fell 10% during the pivotal September-to-December months that year—a time when many stocks were going parabolic. Bitcoin, by contrast, soared by over 1,000% that year and went linear during the September-December blow-off period. However, bitcoin was down sharply during the latter half of December while gold conspicuously rallied at a time when investors became widely concerned that stocks were vulnerable to a crash. This established one of the earliest instances of the inverse relationship between the two assets. There were several other examples of this tendency for bitcoin to rally during times of heightened financial market enthusiasm while gold underperformed. And by contrast, there have been plenty of instances where gold outperformed during times of increased broad market volatility while bitcoin faltered. A few notable examples will suffice:

Yet despite the evidence in recent years that bitcoin’s fortune is more closely tied to that of the equity market than gold’s, a growing number of analysts believe bitcoin is on its way to replacing gold as the premier safe-haven for investors. However, the evidence we’ve examined is clear: gold still offers an edge over crypto as a safety asset. That said, I maintain that bitcoin’s current strength is more a function of investors’ ongoing speculative fervor, while gold’s strength is mainly the result of hedging against what looks to be the early stages of a potential speculative bubble for equities (among other concerns). And to that end, bitcoin’s progression can be used as a useful leading indicator for the future direction of the S&P 500 Index. Consider the following chart comparing bitcoins trajectory (green line) with that of the S&P (red line) over the last seven years. As you can see, bitcoin tends to lead the stock market—sometimes with a lead time of several months—at pivotal turning points. This occurred in the years where the S&P suffered a sharp panic or correction, including 2018, 2020 and 2023. (As an aside, bitcoin prices can also lead the S&P higher, though more commonly it behaves as more of a coincident indicator, moving in sympathy with stocks after a major decline.)

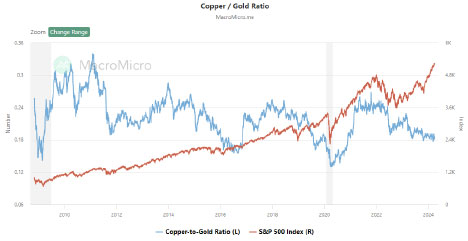

Source: Santiment.net With this background in mind, if bitcoin prices were to stall out and begin declining from here, it would carry a potentially ominous implication for equities. It’s not a concern right now, however, as both bitcoin and the S&P are still trending higher in tandem. Thus, there’s currently no need for alarm among equity and crypto investors. For gold, a key comparison is its relationship versus the copper price. The copper-to-gold ratio is arguably one of the most important technical indicators for divining what might lay ahead for gold. More exactly, the copper/gold ratio is used as a leading indicator for 10-year Treasury yields and, by extension, for the Fed fund rates. The thinking behind this indicator is that a falling copper/gold ratio points to where future interest rates are likely headed (as weaker copper prices suggest a softening economy—in turn often necessitating lower interest rates). And as gold prices are interest rate-sensitive, a falling copper/gold ratio often precedes higher gold prices (and vice-versa). In the last several years since the 2008 credit crisis, whenever the copper/gold ratio has fallen to the 0.18 level or lower, gold prices have performed extremely well in the months that follow. The latest instance of this occurring was shortly before gold prices took flight last October, and again in February.

Source: MacroMicro.me As of this writing in late March, the copper/gold ratio is still hovering at 0.18, which strongly suggests the yellow metal isn’t in imminent danger of falling prey to the bears. The currently low copper/gold ratio further points to the likelihood that the Fed will lower interest rates in the coming months, which is typically bullish for gold. What’s more, gold should be able to continue benefiting from persistent worries over the geopolitical outlook: Israel versus Palestine, a potential NATO versus Russia showdown, plus other geostrategic hotspots. Economic worries—namely rising consumer prices and the potential for a recession ahead of a what is sure to be a contentious U.S. presidential election—are also helping to bolster gold’s safety profile vis-à-vis bitcoin and other risk assets. For these reasons, gold should be able to remain stable while maintaining its upward trajectory for the remainder of 2024, which cannot necessarily be said for stocks and bitcoin. This conclusion should hold true regardless of what happens on the geopolitical front, as investors are likely treating gold as an insurance policy to be held until this year’s potential obstacles have been successfully overcome. ### Clif Droke About the author: Clif Droke is a veteran gold market analyst and published author. He can be contacted at clifdroke@protonmail.com |