Another chance for gold to

shine part 1

Clif Droke

Mar 7, 2005

After a ho-hum week of

trading last week, the price of gold closed the first week of

March at $433.60 While slightly below last week's close, gold

is back above its 20-week moving average and is about to meet

up with a rising wave of supply that should be able to carry

it back up toward the $445-$450 area before encountering strong

resistance.

This is good news for gold bulls as it will allow gold another

test of that pivotal high from earlier December before the 10-week

correction began. This is coming at a time when many major commodities

are experiencing parabolic-type blow-off moves to the upside

as the winds of inflation are stirring once again after a brief

hiatus.

The latest news headlines reveal much concern over the rising

specter of inflation, including a feature-length article in a

recent edition of Business Week entitled "Is that a whiff

of inflation?" In a rather dark tone, the editors state

in this article, "The forces that have held it back are

starting to move in another direction."

Another recent article appearing in the London Financial Times

asserts, "Inflation measure signals revival of price pressures."

This article expounds at length the fact that the Federal Reserve's

favorite measure of inflation has recently rekindled fears that

price pressures may have intensified at the start of the year.

Naturally, this is ex post facto (considering that the aforementioned

"measure" is only viewing what occurred earlier in

2004).

But the re-emergence of inflation concern in the major news headlines

is worth noting. This is especially true since most mainstream

publications have gone out of their way to paint a rosy picture

at the beginning of this year, complete with some of the most

ebullient economic headlines since the late 1990s. Why the sudden

about-face? This discussion will have to await another commentary.

For now suffice it to say that the perception, if not a measure

of reality, is that "inflation is back" right now.

And for that we have only to turn to the primary barometer of

inflation pressure, viz., the price of gold.

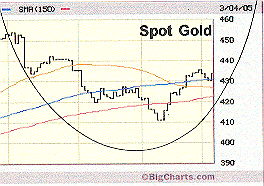

Now as you can see in the daily chart of spot gold,

the yellow metal is back above its 10-week, 20-week, and 30-week

moving averages. The upward curve of the parabolic bowl structure

in this chart reflects the increasing rate of change in momentum,

which is what should give rise to the re-test of the $445-$450

area in the immediate-term. Now as you can see in the daily chart of spot gold,

the yellow metal is back above its 10-week, 20-week, and 30-week

moving averages. The upward curve of the parabolic bowl structure

in this chart reflects the increasing rate of change in momentum,

which is what should give rise to the re-test of the $445-$450

area in the immediate-term.

A concern,

however, is that the 10-week MA is still downward-tilting, which

suggests that a battle with resistance lies ahead as gold moves

above $440 and closer to the $445-$450 target area. Also of concern

is the fact that gold's 10-week correction bottom at $410 was

to the right-of-center of the mid-point, or "vertex,"

of the parabolic bowl. This again could mean that the parabola

will "expire" once gold reaches the target area. We'll

know more as the target is reached.

--Clif Droke

Publishing Concepts

website: http://www.clifdroke.com/

email: clif@clifdroke.com

|

Clif Droke

is the editor of several subscription services including:

1) The Gold

Strategies Review,

a monthly forecast & analysis of gold and silver futures

and precious metals stocks. Published online. $200/yr.

2) The Durban

Roodepoort Deep (a.k.a. The DROOY Report) for traders,

published online every trading day.

Aimed at

serious day and short-term traders of Durban Deep and followers

of the XAU & HUI index. DROOY Subscribers are billed monthly

$50/month.

Two

week 'trial' subscriptions now available $25, here.

|

321gold Inc

|