|

Gold stocks at the "rim"

of the bowl

Clif Droke

February 26, 2004

After a scary $12 decline in

the gold price on Wednesday, Feb. 25, many traders and investors

are wondering if the recent fall in gold will translate into

an equally precipitous drop in the actively traded gold stocks.

A reader writes concerning

the gold/gold stock market,

"I would point out that

the gold stocks as a group tend to anticipate the movement in

gold. Therefore, as gold reached $430 soon after the new year,

gold stocks refused to confirm the new high. Then it is telling

that gold tanked in less than 6 days of the new high.

"Now, the reverse is happening.

On Friday, as gold reached the low in the new year at around

$397-8, the gold stocks as a group refused to confirm the low.

The last time when gold was near this level around late January,

gold stocks were about 4% lower!

"If the price of gold

would break the support and go down from here, Friday (Feb. 20)

would have been the perfect opportunity for gold stocks to go

down big. But that did not happen. Friday is usually the ugliest

day of the week for gold stocks. Judging from the percentage

decline point of view, on Friday gold's decline of -2.91% compared

to gold stocks' decline percentages (HUI -3.28%, XAU -2.68%,

GOX -2.24%) is also telling. Last time when gold dropped to this

level, the decline in the gold stocks was quite a bit larger."

"Even your favorite gold

stock indicator, FCX is doing very well. The last time when gold

was at this level, FCX was priced at around $36, and Friday at

around $41... FCX is also a major copper producer, and copper

was at an 8-year high last Thursday."

Very insightful comments and

much appreciated. So is the gold stock correction over? Let's

take a look at a leading blue-chip gold stock to try and get

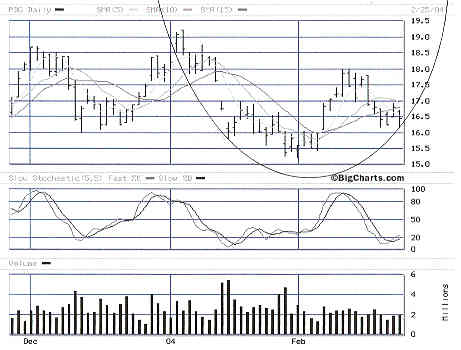

some insight. Below is the daily chart of Placer Dome (PDG).

Notice the potentially bullish parabolic bowl in this chart.

PDG precisely tested the outer "rim" of the bowl on

Wednesday, Feb. 25. The test of the rim was successful, but we

must wait to see follow-through on Thursday to see if this will

bowl will remain unbroken. Considering the bullish crossover

signal in the stochastic indicator for PDG on Wednesday I believe

the chances favor this bowl remaining intact. A breakout above

$17 will signal that the bowl is alive and well and that should

usher in a re-test of this month's previous high.

Along these lines, another

reader wrote to me the other day with the following observation:

"I've just drawn a parabola

on the 8-year chart of the HUI index and noticed that we may

touch the side of the bowl in a couple of months. My question

is, will this be the time to unload in a big way if the chart

breaks decisively through the side?"

My answer is that a breakdown

of the bowl would obviously be a bearish development, but we

aren't there yet so as long as the bowl remains intact we must

consider the dominant trend to be still up.

Clif Droke

February 26, 2004

eMail: clif@clifdroke.com

You might want

to buy Clif Droke's Junior Mining Stock Report for February $14 Clif

Droke

321gold Inc

|