|

|||

There are signs of life in the beaten-down junior mining sectorClif Droke

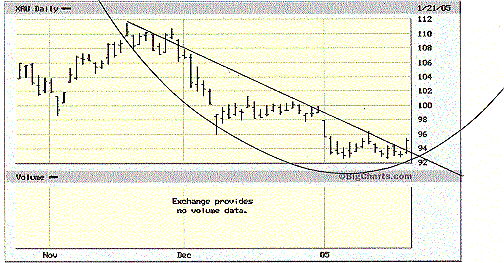

JMSR snippet Below is an extract from Clif Droke's latest Junior Mining Stock Report Yes, there are signs of life among some of the beaten-down junior mining stocks, which have undergone a painful correction in recent months from last year's highs. This is reflected somewhat in the broader market measures of the XAU and HUI indices, but also among individual junior mining equities covered in the stock section below. Keep in mind that the real action often doesn't begin in the junior mining sector until spring, but there are sometimes some spirited technical rallies that have happened historically in the February-March time frame. Speaking of the XAU gold/silver stock index, it has certainly had it rough in recent weeks even as the broad market was making higher highs in late 2004. The XAU drifted from its recent closing high of approximately 110 to a low near 92. The past couple of weeks, however, have witnessed a bottoming process and an attempt at gathering strength for an oversold rally, the first real rally since the November-January decline. The XAU index closed up over 2% on Friday at 95.06 and more importantly above its 15-day moving average to send an immediate-term buy signal. The XAU also broke out above a 2-month downtrend line. The close above the 15-day MA is bullish; however, this doesn't guarantee the XAU will ride straight up since the 15-day MA is still trending lower. It may take a few days to reverse the trend of this moving average, yet even during this phase the XAU should at least have enough buoyancy to keep it afloat above its recent lows. The next important test for the index will be the 30-day moving average, which currently intersects the 96.50 area. I believe this level will be tested and overcome. Lots more follows for subscribers, you can subscribe to the Junior Mining Stock Report here.

--Clif Droke

|