>

An Opportunity to SufferDavid Chuhran The other day I was exiting a store as two elderly ladies were entering. They had cleared the outer door and were approaching the inner door. Even though my arms were full, I managed to quickly grab the inner door in time to hold it for them. They both happily thanked me as they passed and I smiled as I told them, "You're welcome." At the same time an ~18 year old was exiting, so I naturally extended her the same courtesy even though I was about to lose control of one of my bags. As she silently passed I followed her to the outer door, but arrived in time only to have it slam in my face. I fumbled with my bags to grab the door handle and made my own exit. As I walked to my car, I noticed her get into a new BMW 525i. I assumed it was hers, because I doubt her Mom or Dad would hang fuzzy dice from the rear view mirror. She sped off while talking on her cell phone and almost ran over an elderly gentleman in a crosswalk. I drove home shaking my head in disgust. I've observed incidents like this time and time again and I've come to the conclusion that this generation of budding young adults has lost touch. My grandparents (God rest all their souls) were born in the early 1900's and were also "budding young adults" when they had to face the Great Depression. Those years of suffering hardened them in many ways and taught them lessons that can only be fully appreciated if they're experienced first hand. Nevertheless, they did their best to pass them down to their children and grandchildren and my own parents continued to reinforce those lessons throughout my upbringing. My maternal Grandfather was a character. He loved to lecture and would begin his lesson of the week whether you were ready or not and whether you wanted it or not. The lessons are timeless pieces of wisdom that he distilled down into simple, easy-to-understand thoughts. For example: -Never date anyone you wouldn't marry. -No roommates, no partners. -Only liars and braggers talk numbers and most are liars. -Never lend money to friends or family unless you can afford the gift. -Always consider the worst case scenario, its acceptability, and its probability of occurrence. Those tidbits of wisdom have stuck with me my whole life and there are many more. They are simply stated, yet complex, multi-faceted concepts. I'll leave them for you to ponder. Those mostly one way conversations were painful at times, but at some point, and I'm not sure when, I realized I was on the receiving end of great wisdom and I began patiently listening. To my surprise, patient listeners were rewarded with a $20 bill (until my then future wife showed up earning the $20 while I got a $5). I learned patience and the art of listening, both great lessons by themselves. As a survivor of the Great Depression, my Grandfather had a distrust of banks. He realized their necessity, but still kept a strong box full of cash in the basement. He also had a distain for the growth and overreach of our government; however, he was a victim of their successful brainwashing. He counted on Social Security to supplement his Chrysler retirement. I'm not sure that he was fully aware of the socialistic noose FDR placed around our future generations' financial neck. He also never spoke of Gold. Since FDR was successful in confiscating and outlawing private ownership of Gold, out of sight was out of mind and that's exactly where the government power brokers wanted the "barbarous relic" to be. My Grandfather was one of the smartest men I've ever known. My bet is if he was fully aware of FDR's manipulations, he would've been an opponent of "Socialist" Security and a strong proponent of Gold. Both of these travesties are among the many things that make FDR stand out in my mind as probably our worst President ever. "Socialist" Security was a cop out, a burden shift, a politically expedient solution to avoid further pain at the expense of future generations. It was a failure to put peroxide on their paper cut likely resulting in amputation of our gangrenous limb. "Socialist" Security is responsible for changing the mindset of all subsequent generations. Most everyone has used it to supplement their retirement calculations assuming it's guaranteed, and why not? Workers pay their whole life and in the end expect the same benefits they were promised. The problem is that in its present form it's a financially bankrupt plan, born of a morally bankrupt idea, and signed into law by an ethically bankrupt man. Our citizens have been brainwashed into over consuming now at the expense of saving for their futures. The future will find many under prepared for retirement. "Socialist" Security will likely be reserved for only those whose defined benefit retirement plans completely collapse or those who render their 401k's valueless by investing in overvalued bubble stocks. It will turn into retirement welfare on a reduced scale and I expect no benefit from my ~50 years of contributions when I'm eligible in 2022. So, I plan for the future accordingly. Over consumption is obvious when you hear the occasional mention of our ballooning trade deficit, but how can that coexist with rising unemployment? I recognize the slight employment gains of late, but the recent numbers baffle me. We added only 1,000 jobs in December when we were expecting well over 100,000 new jobs, but the unemployment rate dropped 0.2 to 5.7% because 309,000 people quit looking. It's this sort of spin that makes all government numbers suspect. In light of all this, I was very interested to see if people were really still buying at the same rate? I took a look to see for myself and here's what I found:

This chart compares the Unemployment Rate (left scale/red line) and Personal Consumption (right scale/blue line). All it takes is a glance to realize that both have risen simultaneously. How can that possibly be? An increasing number of people were losing their jobs, yet we were still buying with conviction and at an ever increasing rate. This was our third consecutive year of rising total unemployment with over 3 million more workers unemployed since 2000. Of those losing their jobs, just over 1 million became unemployed since the recession officially ended and our robust recovery began in late 2001. Recovery? Robust? Look at the rise in the unemployment rate in early 2003. I would expect a flattening or reversal of personal consumption, but instead there's an upward pivot. No wonder our trade deficit is out of control and increasing at an unsustainable rate. So, how are we paying for this (robust recovery)?

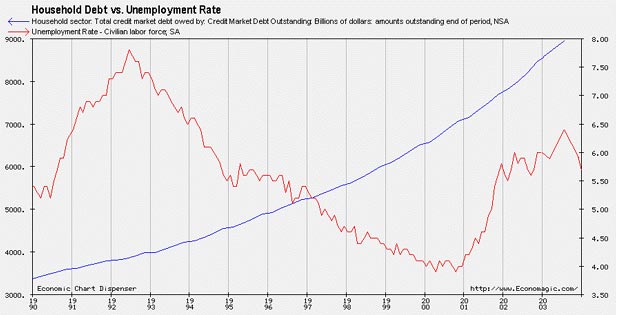

This chart compares Household Debt (left scale/blue line) to the Unemployment Rate (right scale/red line). Wow! I would say a good portion of that over consumption was paid for with borrowed money and the blue debt line looks somewhat parabolic. As unemployment was rising from late 2000, so was the amount we borrowed to sustain our consumption. Notice that since 1995, our outstanding household debt has nearly doubled. This borrowing, through the multiplier effect, has been a major contributor to the doubling of M3 over that same period. This is unsustainable and will likely suffer a sharp trend reversal at some point in the not to distant future triggering a corresponding contraction in M3. However, while the unemployment trend is climbing, I would expect some increase in borrowing as people move to cover their short term expenses while searching for new jobs. I was curious to see if there were other factors influencing consumption. So, I decided to see what people were doing with their savings and what I found was astonishing.

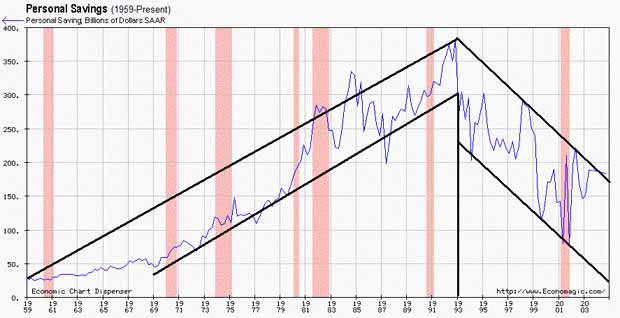

This chart shows Personal Savings since 1959. The first third of the chart would represent my parents, who were born in 1935-36, and their "second hand" generation alone. The trend is stable and steady as they demonstrated the lesson of saving learned from their parent's direct, "first hand" Depression Era experiences. The middle third brings on the early Baby Boomers whose parents were children during the Great Depression. That means they learned their lessons "third hand" from their grandparents through their parents. Notice how the volatility increased, but the trend remained intact. As a tail end Baby Boomer, I can't take responsibility for helping the continuation of the uptrend to its peak, because I wasn't a saver right out of college. I think this is common. Regardless, even throughout the recessions (pink shaded areas) they all demonstrated a commitment and resolve to saving throughout the uptrend. Notice the topping and trend reversal. My parents were retiring around this time and the bulk of saving was now left to the "third hand" Baby Boomers. Lesson dilution was likely a partial cause of the reversal as savings were used to sustain the upward trend in consumption. That dilution was brought on and supported by the belief that 401k's would generate +20% returns forever. That wealth effect was also fueled by overvalued homes that left the "third hand" feeling "rich" absolving them of any responsibility to save for the future. After all, their cash-out refi appraisal was tops in the neighborhood. It became, "Sure, we can afford that; there's plenty of money for the future. The stock market is up and my house has doubled in value in the last 5 years!" The consequence, however, was an increase in M2 velocity throughout the late '90's as those "at rest" savings were withdrawn and squandered. This resulted in an increase in economic activity that expanded the aggregate money supply. Notice the recent test of the top of the downtrend channel. M2 velocity has been slowing since 2000 and this may add further weight to the evidence suggesting a possible move toward M3 contraction. The downtrend also coincides with the entry of the "third hand" Baby Boomers' children into college or the work force. Those "fourth hand" children, who think Gold is only used for Rapper medallions, observed their parents spending habits and they needed---no, expected---new cars, computers, clothes, etc. I have to ask: Absent any significant change in the status quo, what trend do you think the saving habits of our "fourth hand," "budding young adults" will take? Unfortunately, most "first hand" experience is gone now and the lessons have ceased, faded, or fallen on deaf ears. It all became clear to me. We've turned into a "What's my monthly payment?" society where we don't care how much things really cost. Artificially low interest rates, easy money, and a belief that Social Security really is secure have been the catalysts that triggered our willingness to take on increasing amounts of debt while sacrificing our future savings to sustain addiction to an ever increasing amount of consumption. This cannot last. History will repeat and the lessons will be relearned. When I was a "budding young adult" I asked my Dad, he's the smartest man I've ever known, why I had to work hard labor jobs (like pouring concrete) when he could've just given me the money for a new car or paid for my college. His answer represents the greatest lesson of my life, he said: "I never wanted to deny you your opportunity to suffer." It was simple, straightforward, and brutally honest. Through suffering you didn't take things for granted, you learned to work hard and appreciate what you had, and most of all, you learned to live within your means while saving for the future. Based on my observations of these "budding young adults," whose parents both work to pay for their new car, clothes, and college education, it looks like they'll soon have their opportunity to suffer. As the gusty winter winds begin to howl, I now understand Kondratiev. The "fourth hand" becomes the "first hand" to future generations. Furthermore, rather than being viewed as a problem that requires confiscation, outlawing, and active suppression, in this wave Gold rises as the solution. David Chuhran Copyright ©2004 David Chuhran. All Rights Reserved |