Meltdown dead ahead?

David Chapman

October 25, 2004

We are always surprised at the complacency of the bulls in the

face of mounting evidence that may have got it wrong. Indeed

we have listened endlessly recently to forecasts of how we have

now survived through the worst month (September) and that traditionally

markets often bottom in October (although sometimes as late as

November) and then take off in the traditional late fall and

Santa Claus rally. They might still be right but that doesn't

mean they may not get a good Hallowe'en scare first.

But complacency is what we have seen of late with the VIX at

record lows while the indices were not even at the highs seen

earlier in the year. Even recent sentiment numbers in the mid

to high 50's and even low 60's suggests that the market was once

again becoming overly confident. Of late the economic numbers

while certainly not in the depressing range have been below expectations

(see leading indicators). And job cut announcements just keep

on coming the most recent from General Motors.

Grant you not all the job cuts with GM are in the US but still

when you realize that thousands of job cuts have been announced

recently beyond GM then there is a growing problem. The high

tech sector in particular has seen very high job cuts of late

with no particular up tick in new hiring. And it is being born

out by the recent employment numbers where the non-farm payrolls

came in sharply below expectations plus revisions to the downside

in previous months. Couple this with the generally rising trend

in the weekly claims report and someone somewhere is going to

realize that the economic recovery is not all its cracked up

to be. Is there a saving grace on the jobs front? It has been

suggested that the underground economy is where the jobs are

and is also behind why the retail sales numbers still look good.

But the underground economy aside job losses are just a part

of the growing problem. The recent trade numbers came in at a

deficit of $54 billion the second highest on record. We are on

track for a $600 billion dollar deficit for the year or roughly

5.5% of GDP. In 1987 we had a stock market crash when the trade

deficit hit 4% of GDP. So is this a problem? Well it is easy

to rationalize away the deficit and say it doesn't matter because

it is just a recycling of goods and dollars. Asia (China) supplies

the goods to satisfy the demand for goods in the US and then

recycles its dollars right back to the US to finance the deficits.

Trouble with that picture is that not necessarily do all of the

dollars come right back into America. Nor does it always come

back in the form of just financing the debt through the purchase

of Treasury Bills and Treasury bonds and notes and/or the bonds

and paper of US corporations and agencies. Some of it is used

to purchase other US assets including buying other companies

and real estate. And some it is going to buy assets in other

countries. An example of that is the takeover attempt being made

by the Chinese state owned MinMetals to buy Noranda Inc. (NRD-TSX)

the giant Canadian zinc, nickel and copper, producer. China with

its insatiable demand for metals needs to secure its own supply.

And they have indicated it won't stop at Noranda.

To add to the deficits the recent budget deficit numbers came

at over $400 billion or approaching 4% of GDP. Still low by some

standards (Japan's is around 8%) but we are reminded that the

only G7 member to run a surplus is Canada. The US budget deficit

in percentage terms to GDP is not yet as bad as it was in the

late 80's, early 90's under Reagan and Bush Sr. But in listening

to the recent Presidential debates there seems little hope that

no matter who gets in that it is not about to come down any time

soon and indeed could get a lot worse especially given the growth

rate under Bush Jr.

We are reminded that all US debt including future social security

requirements is now well in excess of 3 to 1 to GDP an unprecedented

number not even seen during the Great Depression. Even taking

the more conservative numbers seen in the Federal Reserves Flow

of Funds the number is roughly 2 to 1 to GDP but that number

excludes future social security requirements. We wonder how the

over leveraged economy will end especially for the overleveraged

consumer. The consumer stands at the highest levels ever for

debt to income of 125:100. In Australia a recent Economist

article said that there consumer debt/income ratio was over

160:100. Seems that there are others that are even more profligate.

Oil (and natural gas) prices just keep ticking higher. Higher

oil prices act like a tax on the economy not dissimilar to a

hike in interest rates. The impact of higher oil prices can be

delayed similar to interest rates. But oil is an essential in

many consumer products besides automobiles. The world faces both

a demand and a supply problem with growing demand, no new major

sources coming on stream and threats to supplies due to attacks

in the Middle East where 65% of all of the world's oil resources

lie. Plentiful and more expensive sources of oil are available

but many of them are in extremely environmentally sensitive areas,

deep in the ocean or expensive to produce (Canadian oil sands,

Venezuelan shale fields).

What is disconcerting concerning oil prices is listening to a

large number of analysts that view the current rise as merely

temporary and when this passes oil prices will fall back to the

$30 to $35 range especially with the lifting of such temporary

disruptions as the Gulf of Mexico stoppages due to the hurricanes.

Offsetting this is bullish sentiment numbers for oil as high

as 77% suggesting that there are very few bears out there.

But with a falling US$ another reason oil prices are moving higher

(along with numerous other commodity prices) is to compensate

producers for their declining purchasing power. The US$ has started

what looks like another leg down with minimum targets projected

down to major support at 80 on the US$ Index. Longer-term targets

project down to the 60/65 levels with some analysts projecting

down to 50.

For a number of months now we have consistently maintained targets

for oil to rise to the $55 to $58 range. We are now at the bottom

of that range. It is very possible that we could hit another

temporary high here. But as quickly as we hit the zone and staged

a reversal oil prices oil has reversed right back to the upside

again and is threatening new highs. What could be the unexpected

in this oil bull market with many expecting lower prices, is

that it will surprise instead to the upside.

Amongst those soft-pedalling the rising oil prices is Alan Greenspan

who insists that prices are nowhere near high enough to inflict

the kind of damage caused by the 1970's oil crisis. Of course

Mr. Greenspan is correct in that oil prices are nowhere near

the inflation-adjusted prices of the 1970's, which would have

to rise to $80 or higher to attain those levels. But these kinds

of statements are whistling in the dark unless Mr. Greenspan

knows that prices will never reach those lofty levels. In Iraq

there have been numerous attacks and shutdowns on the oil pipelines

during the ongoing war. What if an attack occurred on the Saudi

pipelines?

But if a lower dollar, higher oil prices and job cuts are not

enough to roil the markets the insurance scandal may what tips

it over the edge. Since the bubble tech market of the late nineties

burst the markets have dealt with numerous scandals including

Enron, WorldCom and plus others in the investment banking and

mutual fund industry. The latest target of Eliot Spitzer the

New York attorney-general is been civil charges against Marsh

& McLennan the world's biggest insurance broker. The scandal

also appears to go beyond Marsh and could soon envelope numerous

companies.

If there is one thing this scandal has accomplished is that it

has pushed the Fannie Mae scandal into the background. It may

be that it is in the background only because it takes so long

to try and figure these things out. It may yet rear its ugly

head and slam the markets not to say the potential for trouble

in the US real estate market given Fannie Mae's pre-eminent position

as American's biggest mortgage lender. But it could get worse.

We are hearing rumours that the next major investigation is going

to be in the Derivatives game. Could J.P. Morgan Chase the world's

biggest holder of derivatives an area we have long suspected

as being rife with problems be far behind being dragged into

an accounting scandal?

And lest we forget to mention the Fed is slowly raising interest

rates with at least two more hikes already priced into the futures

markets. Rising interest rates raise the possibility of cutting

off the cheap supply of money that has fuelled the markets for

the past few years especially for home mortgages. And long rates

could rise as well as we were intrigued when Goldman Sachs one

of the world's most pre-eminent investment banking companies

announced that investors should reduce their bond holdings for

the US from 25% to 10%. That's nothing they said to get out of

Canadian bonds altogether.

Finally there is the uncertainty of the election. This campaign

has made previous bitter, polarized negative campaigns look like

a walk in the park. The level of rhetoric has risen to atrocious

levels on both sides. The campaign is rife with personal attacks,

lawsuits especially concerning touch screen voting machines with

no paper trail and a history of computer glitches (and as an

aside the largest manufacturer Diebold is a major contributor

to the Republican party), and charges of fraud and deceit as

vicious attempts are being made to keep or prevent key voting

constituencies from voting or off of the voting lists. The polls

are too close to call and we may wind up like we did in 2000

with a hung jury for weeks on end and lawsuits and legal action

flying in every direction.

Given everything it is amazing the markets have held together.

But then it is an election year and in watching the market action

of late every plunge is met with buying to push it right back

up again and every piece of bad news is offset but even the slightest

good news as an excuse to rally. And all of this has taken place

on pitiful volume. A bull would observe that despite all these

recent problems of high oil prices, insurance company scandals,

slowing economic numbers, job losses, hurricanes, hung polls

and yes did we fail mention somewhere numerous profit results

somewhat below expectations that the market has been extremely

resilient. And did we forget to mention that terrorist alerts

remain at a high level and may intensify as we near the election.

So what are we to think? Will the markets melt down or will the

positive election cycles kick in and ride us into December and

then get the traditional Santa Claus rallies that will take us

onto new highs in 2005 where there has never been a down year

in a year ending 5? Or will the markets break down recognizing

the deteriorating economic situation, the growing scandals and

be pushed over the edge with a hung election ala 2000 and a possible

terrorist attack.

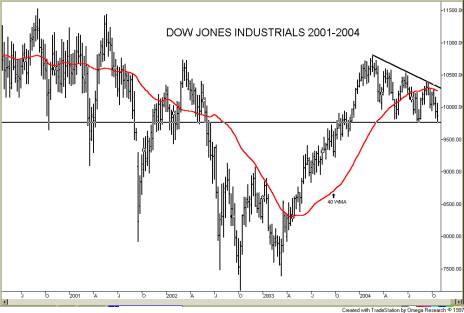

We favour the downside just because the markets have been so

complacent and the negative divergences are becoming unmistakable.

But then we can't rule out the upside either. The key levels

to watch for on the S&P 500 as we go forward are the 1080/1090

zone on the downside and 1020/1030 on the upside. Any breakdown

or breakout of these levels will lead us either to 960 or 1250.

As cycles analyst Michael Jenkins points out we have been dominated

in the first years of the new century by the 1930's cycle, which

for the most part we have followed reasonably faithfully. Of

course while 1933 was a huge up year so was 1935 following the

consolidation of 1934. We are showing that chart below. Note

that the cycles turn up into November until January and then

we correct into March before taking off for good.

The best hope for the bears is the Japanese 1990's cycle another

pattern we have been able to remarkably follow thus far. That

market topped in June 1994 (and we saw a high in mid June 2004

for our markets as well) but October saw only a minor high and

after a rally in December (Santa Claus rally?) we went off the

cliff straight down into July 1995.

We believe the growing negative news and high market complacency

will lead us into a meltdown dead ahead into 2005. Not what the

bulls would want at all. But until we break key levels on the

downside the bulls cannot be ruled out. We may be on the verge

of determining that direction.

October 21, 2004

David Chapman

Email: david@davidchapman.com

Note: Charts created using Omega TradeStation or SuperCharts.

Chart data supplied by Dial Data.

David

Chapman is a director of the Millennium Bullion Fund. David

Chapman is a director of the Millennium Bullion Fund.

The opinions,

estimates and projections stated are those of David Chapman as

of the date hereof and are subject to change without notice.

David Chapman, as a registered representative of Union Securities

Ltd. makes every effort to ensure that the contents have been

compiled or derived from sources believed reliable and contain

information and opinions, which are accurate and complete. Neither

David Chapman nor Union Securities Ltd. take responsibility for

errors or omissions which may be contained therein, nor accept

responsibility for losses arising from any use or reliance on

this report or its contents. Neither the information nor any

opinion expressed constitutes a solicitation for the sale or

purchase of securities. Union Securities Ltd. may act as a financial

advisor and/or underwriter for certain of the corporations mentioned

and may receive remuneration from them. David Chapman and Union

Securities Ltd. and its respective officers or directors may

acquire from time to time the securities mentioned herein as

principal or agent. Union Securities Ltd. is an independent investment

dealer and is a member of the Toronto Stock Exchange, the Canadian

Venture Exchange, the Investment Dealers Association and the

Canadian Investor Protection Fund.

________________

321gold Inc Miami USA

|