.

|

|||

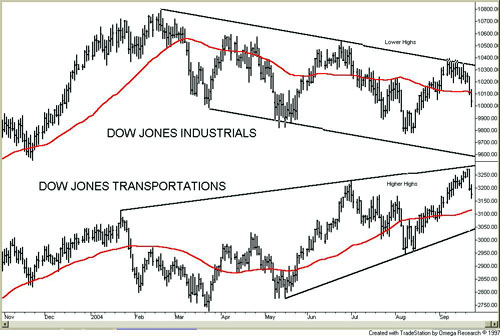

On the edge?David Chapman On Wednesday September 22, 2004 the major indices (DJI, S&P 500) had their biggest moves in weeks. The fact that it should come to the downside should have been no surprise given the up move witnessed since the lows in mid-August and the numerous negative divergences that were showing up. That the drop should also have come on the same day that President Bush spoke to the United Nations giving them a speech more suited for a Republican Convention citing how strong the economy is and how Iraq is on the road to peace and democracy can only be termed as rather ironic. Indeed the economy seems to be starting to head off in the opposite direction despite months, even years of the most stimulative monetary conditions we have ever seen in our 30 plus years in markets. Numerous other pundits have gone over the events of the past few days but they are worth repeating. Indeed it wasn't so much the economic news that sent the markets reeling but the spate of negative news coming out on companies that seemed to be everywhere in the economy. A quick summary is in order. Wendy's slashed profit outlook because of rising beef costs and closing stores in 5 states because of all the recent hurricanes. Thank goodness for Wendy's that Tim Horton's here in Canada remains very profitable and allowed them to maintain at least some semblance of profits. In the financial sector both Bear Stearns and Morgan Stanley saw their profits fall reflecting lower trading income. And the SEC is finally discovering Fannie Mae that their accounting is anything but clean. Fannie Mae stock promptly plunged over $5. Fed-Ex said their profits will lag. They gulped and fell over $3. Cisco Systems was downgraded. General Motors said they were slashing jobs in Europe. And Twinkies (Interstate Bakeries) declared bankruptcy. You can't even keep junk food up. All of this followed Colgate and the airlines Delta and US Air who are struggling to stay out of bankruptcy. And as if that wasn't enough it seems that the disruptions from Hurricane Ivan on the oil sector might be worse than expected. Crude oil inventories that were expected to fall between 5 to 8 million barrels fell according to the Energy Department 9.1 million barrels and the American Petroleum Institute had them even worse falling 12.9 million barrels. In a world hungry for oil this was not good news and oil soared over $48 per barrel. We have had long-term targets of $55 to $58 and we now appear to be on our way to those targets. We continue to hold longer term targets of over $70 and we may be there sooner than we expect. Offsetting the rising prices due to the hurricane disruptions is word that the US may release supplies from strategic reserves. And following on the heels of the negative profit picture came news on Thursday that Leading Economic Indicators fell for the third consecutive month. Earlier in the week while housing starts came in about expected, building permits fell by 5% indicating that future-housing activity may finally be slowing. Unemployment claims were also higher than expected reflecting what may be the a growing problem particularly in Florida and other hard hit hurricane states where many have lost their jobs because the business they were working for have been hit hard. While the Federal Reserve raised the funds rate by 25 basis points for the third consecutive time as expected the big question on everyone's mind will now be whether that will be the last of the rate hikes. Given that all of this negative news is coming on the heels of very stimulative monetary conditions we wonder if that the US economy might finally be moving into the Japan phase where even virtually zero interest rates failed to lift them for years. US Treasury Bonds that were rallying to new highs earlier in the week finally reversed and were heading into negative territory for the week. Technically numerous divergences were being seen in the markets that have been building for the past few weeks. Negative divergences were seen between the VIX Volatility Indicator and the S&P 500 where the VIX made new lows and the S&P 500 was below its former highs. This told us that the market was becoming very complacent even as we failed to make new highs. Second we had a major divergence between the Dow Jones Industrials (DJI) and the Dow Jones Transportations (DJT) (Dow Theory). Dow Theory says that the averages must confirm each other and here we have the DJI turning down at a significant zone of resistance at a lower high while the DJT made new highs. Noted bear guru Richard Russell pointed this divergence out in a recent column and as well noted that not only has this happened once but it also occurred at the June highs giving us two major divergences on these key averages.

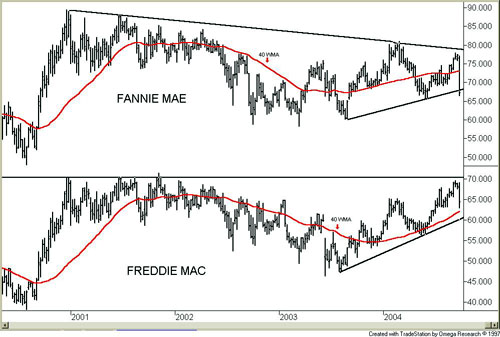

Russell in his columns also noted the major divergences the two major Dow indices displayed in 1973 when at that time it was the DJI making new highs while the DJT made lower highs. What followed was a devastating bear market that collapsed the indices to new lows in 1974. This divergence also showed up at the October 2002/March 2003 lows when it was the opposite with the DJI making a higher low in March 2003 with the DJT making a lower low. We should point out that Richard Russell, also known as "Super Bear" recently made Barron's once again predicting Dow 3000. Contrarian analysts of course were all over that one. A key to this market going forward could be the fate of Fannie Mae (FNM-NYSE) and its kissing cousin Freddie Mac (FRE-NYSE). The malfeasance, of which rumours persisted for months, could tip this market right over. Fannie Mae is a firm that has originated almost $4 trillion of mortgages in the US, almost 3 in every 4. The mortgage market cannot take too much of hike in interest rates. There is a very high volume of floating rate mortgages in some instances as high as 125% of market value. We also suspect that there could be considerable problems with mortgages with homes that were in the paths of the hurricanes depending on the extent of the damage and the We and numerous other analysts including The Economist have noted what we believe to be a bubble in the housing market fuelled by the easy monetary conditions that have persisted for the past few years. Problems at Fannie Mae could have disastrous effects on the mortgage market. As the "Daily Reckoning" (September 23, 2004) noted "a scandal at Fannie Mae could be the harbinger of a bust in the mortgage markets. Just as Enron spelled the end of the good times on Wall Street four short years ago". We echo that sentiment. Both Fannie and Freddie are upwards of 90% owned by the large institutions. Like a herd if the scandal spread and downgrades came from the rating agencies the stampede out of the stocks by the institutions would be almost uncontrollable. We are showing a weekly chart of Fannie and Freddie below. Both have been making what appear as broad topping patterns since 2001. Fannie appears to be now breaking down with minimum potential targets down to $35 to $38. For the moment at least Freddie is holding it's up trend lines but that may be fleeting.

We are important cross roads in the market. The recent weakness in the profit picture is not surprising nor is the mixed numbers for the economy. What is disconcerting is as we pointed out at the beginning is that this is coming after years of the most stimulative monetary conditions we have ever seen. We term it irresponsible and will at some point in time cause even deeper problems. When you push increasing amounts of money at a problem that no longer has any impact or the impact is muted is a clear slowing in the velocity of money. Couple these problems with the ongoing war in Iraq and to a lesser extent in Afghanistan plus threats being heard regularly against Iran and Syria and we have a war without end and a bottomless pit of spending. The current budget deficit is approaching $500 billion annually and it could get bigger. Income tax cuts are being perpetuated. We are now struck that the world could become even more dangerous as Russia is joining the US in announcing that it will do pre-emptive strikes anywhere, anytime. Russia has increased its military expenditures three fold over the past year or so. A recent Economist article (The end of the affair? September 25, 2004) is noting deteriorating relations with the West. Given the powerful interests (oil) of both superpowers in the Caucasus and Central Asia there are real possibilities of clashing interests. While it was the US military expenditures in the 1980's that spent the USSR into bankruptcy the shoe this time could be on the other foot. Our cycles are turning down

into October. Dates to keep an eye for possible lows are around

October 20. The trouble is determining how low we will go. If

this is a shallow pullback within the context of a new up leg

in the market as many bulls would have us believe we should not

take out 1080 on the S&P 500. The August lows were at 1060

and obviously that is a key area of support as well. Below that

we could fall to 1000 and 960. With oil prices rising and the

US Dollar threatening to break down we are not surprised to see

gold and gold stocks rising. We are we believe "on the edge"

and the next few weeks will determine whether we go over or find

another ledge of support. The opinions,

estimates and projections stated are those of David Chapman as

of the date hereof and are subject to change without notice.

David Chapman, as a registered representative of Union Securities

Ltd. makes every effort to ensure that the contents have been

compiled or derived from sources believed reliable and contain

information and opinions, which are accurate and complete. Neither

David Chapman nor Union Securities Ltd. take responsibility for

errors or omissions which may be contained therein, nor accept

responsibility for losses arising from any use or reliance on

this report or its contents. Neither the information nor any

opinion expressed constitutes a solicitation for the sale or

purchase of securities. Union Securities Ltd. may act as a financial

advisor and/or underwriter for certain of the corporations mentioned

and may receive remuneration from them. David Chapman and Union

Securities Ltd. and its respective officers or directors may

acquire from time to time the securities mentioned herein as

principal or agent. Union Securities Ltd. is an independent investment

dealer and is a member of the Toronto Stock Exchange, the Canadian

Venture Exchange, the Investment Dealers Association and the

Canadian Investor Protection Fund. |