|

|||

A World at War! What Does it Mean Today?David Chapman The 20th century was a century of wars. But then so were all the other centuries. The 21st century is so far no different. Trying to estimate the number killed in wars during the 20th century is nigh on impossible. It is estimated that upwards of 250 million were killed in military combat, civilian collateral, democide or deliberate famines. But it could be more. There were wars in every year of the 20th century and there have been wars every year so far in the 21st century. The USA has been involved in a war of some sort every year since its founding by revolution in 1775. War is profitable. The world spends an estimated $1.7 trillion annually on military expenditures. The USA leads the way with expenditures of about $650 billion but some believe it could be as high $1 trillion. The global arms trade is estimated at over $500 billion but there is a lack of comprehensive data. Seven of the globes top ten exporters of arms are US companies. The USA is the world's largest arms exporter followed closely by Russia, Germany, France and China. According to the Stockholm International Peace Research Institute the 6th largest exporter is Ukraine. That was a surprise. The big wars such as WW1 and WW2 involve the major powers. Many of the smaller wars also involve the major powers but usually indirectly (proxy wars). Wars are economic in nature. Wars can impact stock markets especially the large wars involving the major powers. Many wars are short-term in nature and have only a modest if any impact on markets and changes following the war are localized. Other wars may be more substantial but still have little overall impact on markets. Then there are wars that permanently change the world leaving not only the world a different place but the investing world a different place as well. Such was the case with both WW1 and WW2. Going into WW1 the global superpower was Great Britain and the British Pound was the world's reserve currency. The world economy was quite globalized. Some believe it took until the 1980's to regain on an inflation adjusted basis the levels of pre-WW1 global integration. Prior to WW1, many believed it would never happen as war could never pay. There were more significant benefits to be had from peace. Europe was complicated prior to WW1and different economists and historians have different theories as to its causes. Germany was a rising economic powerhouse and by 1910, its GDP was beginning to surpass that of Britain. It is said that when a rising power begins to rival the ruling power the tensions that arise are called the "Thucydides' Trap". Thucydides was a Greek historian who wrote the history of the Peloponnesian Wars between Athens and Sparta. The rising power of Athens threatened the hegemony of Sparta leading to the wars. While the US had by the time of WW1 become the world's largest economy they did not threaten the hegemony of Great Britain as the US was still largely contained within itself building "manifest destiny" and continuing its westward march. On the other hand, Britain was being challenged on numerous fronts and on numerous continents by the rising economic powerhouse of Germany. Countries formed treaties - Britain with France and Russia: Germany with the Austrian-Hungarian Empire and Italy. Rising nationalism in the Balkans and a sliding Ottoman Empire further contributed to the potential for a clash. Brinkmanship occurred and Europe went to war not realizing the devastation it would cause to their economies and their people. The war was a stalemate until the US entered the war in 1917 tipping the scales.

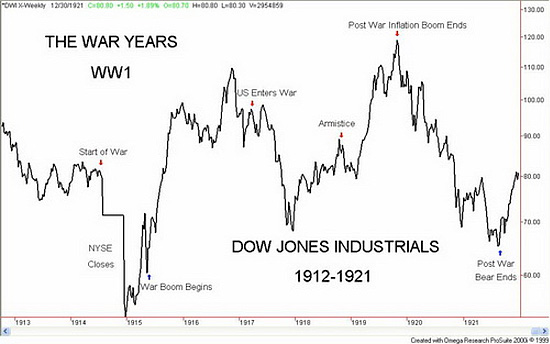

Charts created using Omega TradeStation 2000i. Chart data supplied by Dial Data The stock markets were a see-saw affair during WW1. When war broke out the NYSE closed fearing a wave of selling from Europe. The stock market fell bottoming when it re-opened in late 2014. The market recovered and by mid-1915 or so the war boom got underway in the US because US corporations were benefitting substantially from the war. The boom essentially lasted until the US entered the war in April 1917. What followed was a devastating bear market although it did not fall as deep as the 1914 market. As the tide shifted in favour of the allies the market began a recovery. But it took until after the November Armistice for the post-inflationary war boom to get underway. The inflation boom ended when the Fed tightened and the bubble burst resulting in a bear market that took the markets below the lows of 1917 by 1921. WW2 is considered by many to be WW1 the sequel although it expanded to the Pacific theatre and the death toll, particularly civilians was considerably higher. Yes, the war was different but many of combatants especially the major powers were the same. WW2 may not have happened if it hadn't been for the mistakes of the Treaty of Versailles. WW2 followed on the heels of the Great Depression. The Great Depression was characterized by a stock market crash, structural weakness in the economy, overproduction, and an unequal distribution of wealth, trade wars, currency wars and an international debt crisis that resulted in sovereign defaults. If these characteristics sound familiar, they are as most are present today.

Charts created using Omega TradeStation 2000i. Chart data supplied by Dial Data While the stock markets of WW1 were generally a seesaw affair, the stock markets of WW2 were characterized by a sharp down followed by a sharp up. From the onset of war in September 1939, the Dow Jones Industrials (DJI) generally followed a downward trajectory not bottoming until 1942 losing over 40%. When the tide of war began to shift, a rebound got underway in April 1942 and the stock market embarked on one of the great bull markets of all-time lasting until May 1946 gaining about 158%. The stock market ended in a post war mini-crash but the decline was a milder 25% for the DJI. The post war stock market slump lasted until 1949 before the market embarked on the bull market of 1949-1966. The DJI finally took out the 1929 high in 1954. The post WW2 world was quite different then the post WW1 world. The Great Powers divided up the world amongst themselves through the Treaty of Versailles following WW1. The treaty imposed huge reparations on Germany. The Ottoman Empire was divided up by the major powers, primarily Great Britain and France, with little regard to the tribes and people who inhabited the region. The country of Iraq, a country that did not exist before was created out of the Treaty of Versailles. Iraq was created by the British to encompass the oil fields of Kirkuk and Basra with little regard to the Kurdish, Sunni and Shiite tribes that inhabited the country. Similar changes were seen in Europe and less so in Asia. Many of the changes under the Treaty of Versailles came back to haunt the world prior to WW2 and some, particularly in the Mid-East haunt us today. The post WW2 world was a bipolar one with the US the dominant power on one side and the Soviet Union the dominant power on the other side. A bipolar world is easier to manage as the two powers effectively divide the world into their respective spheres of influence. The presence of nuclear weapons assured mutual destruction. Control of commodities to fuel the two empires was paramount. There was little or no challenge to each other and wars were either proxy ones or direct intervention by one power or the other (US in Vietnam, Soviet Union in Afghanistan as examples). With the collapse of the Soviet Union in 1990/1991 the world moved from a bipolar one to a unipolar one with the US as the dominant power. It was hailed as the "New World Order" and saw the emergence of the "Wolfowitz Doctrine" that stated as its first objective to prevent the re-emergence of a new rival. However, things have changed. The emergence of China as global economic and military power may now be creating the kind of conditions that were present prior to WW1 between Britain and Germany. There are estimates that the Chinese economy will surpass the US economy in the next decade. Since the financial collapse of 2008 China has led the way in calling for an end to US hegemony on the world and for a new reserve currency not dominated by the US$. The formation of the BRICS and their desire to create their own IMF and World Bank (two US dominated institutions) and end the use of the US$ for trade purposes. BRICS also wish to create an alternative payment system. Currently the global payment system is SWIFT dominated by the US$. An alternative SWIFT would bypass the US$. This is not a suggestion that the US$ is about to lose its global status. It serves the US too well as the US prints money and then exports their dollars around the world that allows the US to purchase goods from around the world and the excess of US$ buys their debt. But with threats from China and the BRICS vowing to conduct more business in their currencies it could cause a problem for the domination of the US$. The question is the current brinkmanship being seen in Ukraine vs. Russia and the East China Seas vs. China US$ related? If that were the case, it also highly unlikely that anyone would acknowledge that as a reason for current tensions. The US$'s share of global reserves has been falling and today it is currently around 60% vs. over 70% a decade ago. The financial collapse of 2008 has hastened this decline, and as noted, hastened the call for the end of US$ domination. Sanctions placed on Russia are a form of trade war. Sanctions on smaller economies such as Iraq, Iran and North Korea have little global impact. But Russia is the world's 8th largest economy and can bite back. Already it is biting as European stock markets have recently fallen sharply and Germany the dominant economy of the EU appears to be falling into a recession. Many in the EU are getting cold feet about the potential for further sanctions on Russia. Others are getting cold feet about US$ domination as well. A $9 billion fine imposed on BNP Paribas, France's largest bank, by US regulators in June 2014 because of its dealings with Iran, Sudan and Cuba was met with disbelief and comments questioning who does the US think they are to tell us who we can deal with. It also heightened the danger of holding US$ assets. The current brinkmanship has led to a military buildup by Russia along the border of Ukraine and a military buildup by NATO in NATO countries that surround Russia. There has also been a military buildup by the US in the East China Seas and by China who are claiming numerous islands as part of their territory. Japan is also involved in the conflict and they have been tossing off their post war aversion to the military and changing the rules of the game with regard to what military they can have. The danger is for a mistake. While the past is not repeated, it often rhymes. Few expected the carnage of WW1. The leaders of WW1 looked on the last European war as their point of reference. That was the Franco-Prussian war of 1870-1871. When the dust cleared on that war, Germany had won sealing German unification and ensuring the rise of German power. France faced internal problems and a revolution (the Paris Commune) that resulted in bloody suppression by the French army. Today the last war was the Cold War where the wars were either proxy wars or direct intervention by the two powers. During that period, China was largely inward looking but following the collapse of the Soviet Union China began to rise as both an economic and military power. Will the current conflicts result in a new Cold War? Or will the major powers miscalculate and plunge the world into yet another global war? The consensus is that it most likely will be the former. The real danger and the unexpected result is that it becomes the latter. The other danger is that the conflict as it deepens has some major unsettling surprises for investors irrespective of which direction the conflict takes. ### Aug 24, 2014 David Chapman: Disclosure Copyright 2014 All rights reserved David Chapman |