| |||

This past week in goldJack Chan

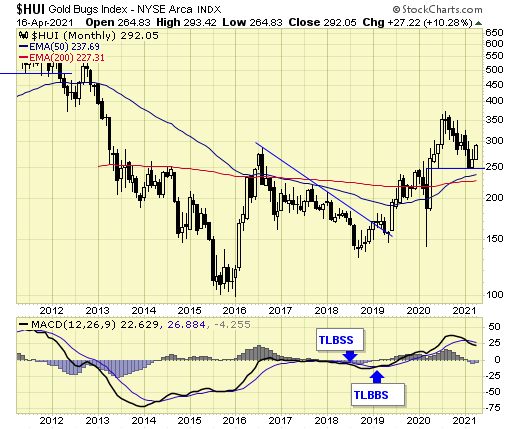

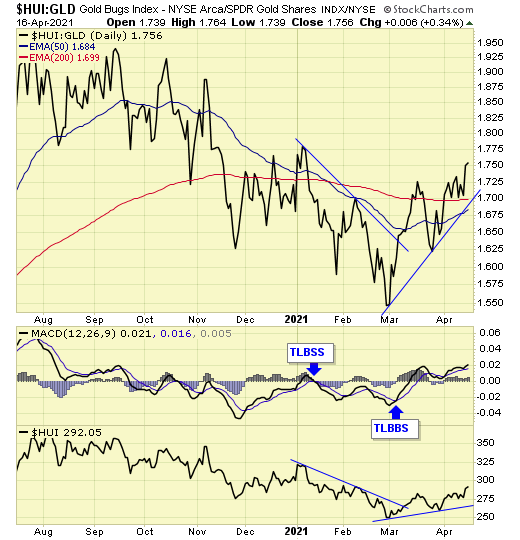

Gold sector as represented by $HUI is on a long-term BUY signal.

Short-term is on BUY signal.

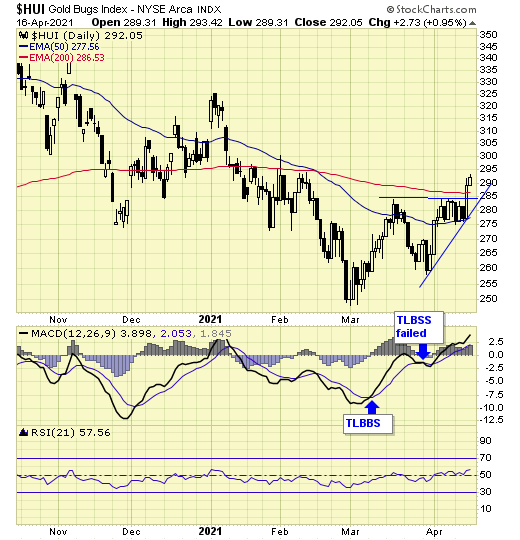

COT data is supportive for overall higher gold prices.

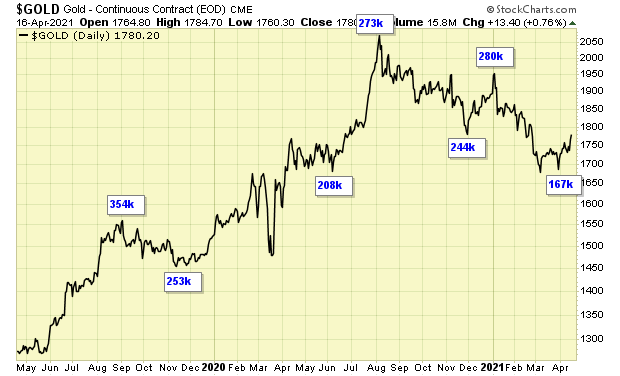

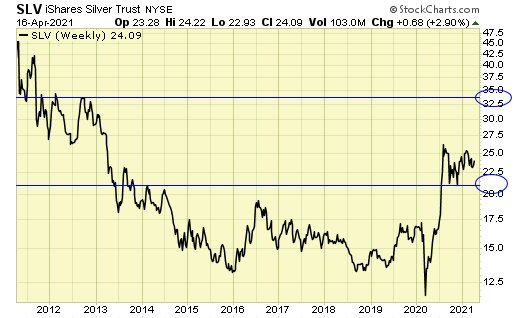

COT data is supportive for overall higher silver prices.

Our ratio is on buy signal.

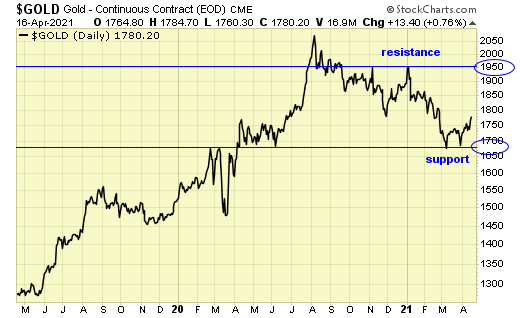

Gold has found major support, and has resistance at 1950.

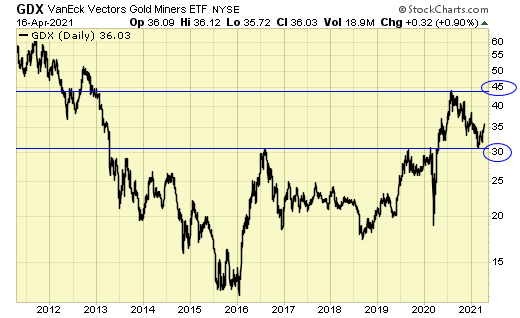

GDX has also found support, and has resistance at 45.

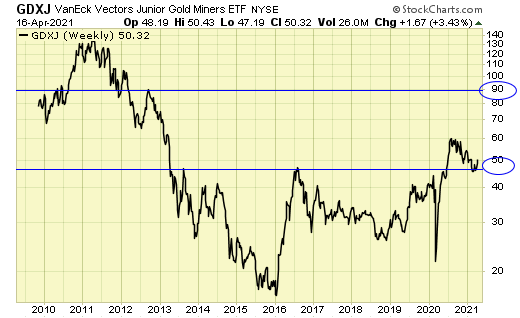

GDXJ is bouncing from major support, and has resistance at 90.

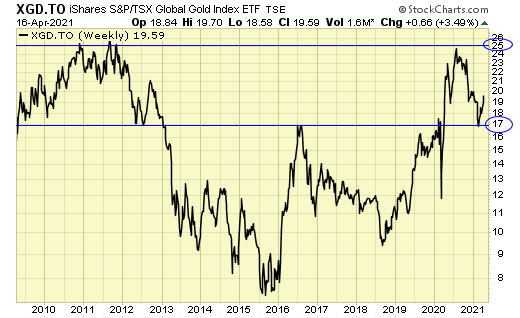

XGD rallied sharply from support, has resistance at 25.

SLV also found support, and has resistance at 33. Summary Long-term – on BUY signal. ### Apr 16, 2021 Disclosure: We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion. We also provide coverage to the major indexes and oil sector. Jack Chan: Is the editor of simply profits at www.simplyprofits.org, established in 2006. Jack bought his first mining stock, Hoko exploration in 1979, and has been active in the markets for the past 40 years. Technical analysis has helped him filtering out the noise and focusing on the when, and leave the why to the fundamental analysts. His proprietary trading models have enabled him to identify the Nasdaq top in 2000, the new gold bull market in 2001, the stock market top in 2007, and the US dollar bottom in 2011, and most recently, overweighing in bonds over stocks in 2019 before COVID19 became a household name. In his spare time, Jack is an avid golfer and tennis player, and volunteers his time coaching and lecturing at local clubs and universities. |