Casey Files: Casey Files:

Why Strawberries Are Not

Money

Balancing Risk in a Time of Crisis

By David Galland,

BIG

GOLD, Managing Director

Casey Research

Dec 20, 2007

As

you have probably heard, Federal Reserve Chairman Ben Bernanke

has gone on record stating that, if the need arose, the Fed would

print dollars by the helicopter load to smooth over a collapse

in the 25-year borrow-and-spend bubble, a collapse that is now

underway. As

you have probably heard, Federal Reserve Chairman Ben Bernanke

has gone on record stating that, if the need arose, the Fed would

print dollars by the helicopter load to smooth over a collapse

in the 25-year borrow-and-spend bubble, a collapse that is now

underway.

Putting Bernanke's words into

action, since early August of 2007, the Fed has stepped up to

the plate with tens of billions of dollars. On November 15 alone,

the Fed injected almost $50 billion into the banking system,

the largest single-day cash infusion since 9/11.

Then, on December 12, the Fed

announced that it would open the spigots by providing lending

$28 billion created out of nowhere to the nation's banks in exchange

for a "wide variety of collateral."

In other words, the Fed will

accept as collateral even the very same toxic waste paper now

bedeviling the financial system.

And that's just one of many

ways that the government is scrambling to keep the house of cards

from falling. For instance, there are 12 Federal Home Loan Banks

(FHLBs) whose job it is to serve as "lenders of last resort"

by making cash available to banks and other financial institutions.

In the third quarter of 2007

alone, FHLB loans skyrocketed to a record $746.2 billion, nearly

18 times the yearly average between 2003-2006.

That alone should tip you off

to how serious the government considers the current credit crisis

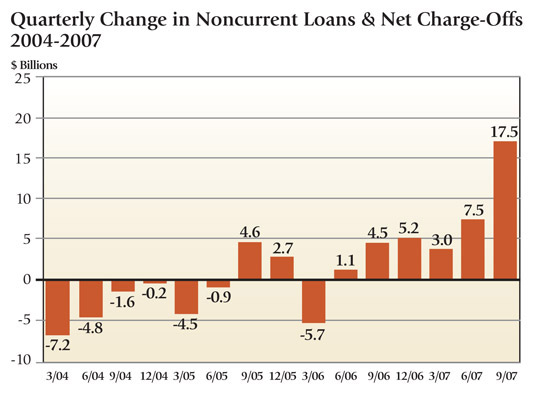

to be. And no wonder. The following chart shows the steeply worsening

increase in non-performing bank loans and outright charge-offs.

Faced with the very real threat

of a deep recession caused by a freeze-up in credit, falling

home values and soaring loan defaults, the Fed is left with a

rock-and-a-hard-place decision. Hold tight and let the economy

fall... hard. Or, open the money spigots wide in an attempt to

maintain liquidity in the markets, sacrificing the dollar in

the process.

Given two untenable choices,

it is our view that the government will continue on the path

of a loose monetary policy, the implications of which are not

hard to figure out.

Sticking with the helicopter

metaphor for a moment longer, creating billions of new dollars

out of thin air to smooth over a litany of problems caused by

decades of irresponsible debt creation is analogous to a helicopter

trying to put out a raging forest fire by dropping tank loads

of gasoline.

In other words, the "solution"

is more of the same. It is only making the situation worse.

The result is simply this:

as more and more dollars are created and injected into the economy,

the purchasing power of all the dollars in circulation comes

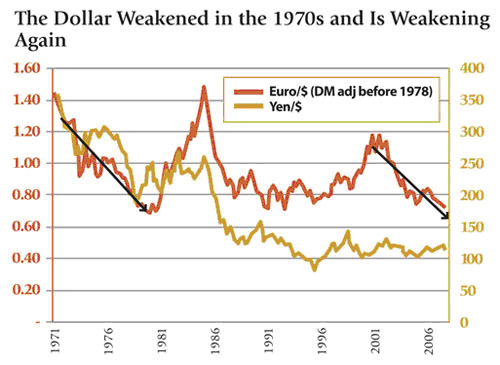

under pressure. It's called inflation. The last time we saw anything

like what we are seeing today was in the 1970s. Here's a snapshot

of the dollar against foreign currencies, then and now. The parallels

are eye-opening.

You don't need me to tell you

that, regardless of what the Fed would like you to think, inflation

is already a problem. Yesterday I paid $3.10 for a gallon

of gas, $7.50 each for movie tickets, and just shy of $30 for

two cheese Stromboli's following the show.

Since March 2002, the U.S.

Dollar Index, which measures the value of the dollar against

a basket of six major currencies, has fallen 35.3%. The downtrend

in the U.S. dollar is far from over.

Balancing Risk

Once you've identified the

problem, identifying how to balance the risk to your portfolio

is easy. In times of inflation, people turn to tangible "stuff."

Viewed in that context, it is perfectly understandable why oil,

gold and other commodities have been moving higher.

And, just as the U.S. dollar

has farther to fall, so do the commodities have farther to rise.

On that point, JPMorgan went on record a few days ago with their

forecast that of all the commodities, they expect precious metals

to be the strongest in 2008... followed by agricultural products,

base metals and energy.

We think JPMorgan has it right,

and that of all the possible portfolio diversifications you can

make today in an attempt to protect your overall portfolio and

to profit over the coming year, few will serve you better than

gold.

But Isn't Gold

a Relic? But Isn't Gold

a Relic?

The younger generation of money

managers know little about gold. They know about structured investments

such as those that are now failing left and right, but they don't

know about gold.

Rather, they sneer that gold

is a barbaric metal, an artifact from yesteryear.

And they're right.

While gold doesn't go up in

a straight line - no investment does - it has been considered

real money since about 4,000 B.C. Compare that track record against

that of government-issued paper currencies. Actually, there is

no comparison.

Given the historical record,

it's hard to argue with the adage that all paper money continually

falls in value, just at varying rates of speed.

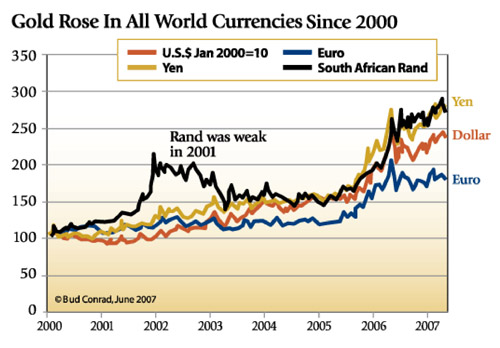

And, since 2002, that is exactly

what has been happening. In fact, while the next chart shows

just four currencies, over the last six years gold has risen

in all the world's currencies. As you can see, the price rose

more in yen, because the yen has been weaker than the dollar;

and it rose less in euros because that currency has been stronger

than the dollar.

Bottom line: for the last 6

years, gold has been a better investment than paper currencies.

We can expect this trend to continue and to accelerate.

A minute ago, I mentioned that

since March 2002, the U.S. dollar has fallen by 35.3% against

a basket of six major foreign currencies. Well, over that same

period gold has risen by 181% against the dollar. (And the HUI

Index of large cap gold stocks, the sector you want to play in

to get more bang for your buck, has risen 367% over that same

period.)

But why is it that gold is

still considered a store of value after all these millennia?

Why is it that record numbers of investors - private and institutional

- are beginning to turn to more modern forms of gold, including

gold ETFs and, of course, the shares of established gold mining

companies?

For the answer to that question,

I defer to none other than Aristotle who, in the fourth century

BC, explained why gold is money...

To serve well as money, an

object must be:

- durable, which is why we don't

use strawberries as money;

- divisible, which is why artwork

isn't practical;

- convenient, which is why lead

isn't very good;

- consistent, which rules out

real estate;

- and useful in itself, which

is why paper is such a weak choice.

Of all the 92 naturally occurring

elements, none fits the requirements better than gold. No one

ordained that it should be money; it grew into that role through

the practical decisions of millions of people over thousands

of years.

Not to pick a fight with Aristotle,

there's another essential characteristic I'll add to the list.

For an object to serve well as money, it must be difficult to

produce - otherwise, a growing supply of the object will undermine

its value. Gold is again the standout. Adding to gold reserves

requires a massive expenditure of labor and capital to find it

and dig the stuff out of the ground.

So difficult is it to produce,

all the gold ever mined would fit into a cube roughly 25 meters

on a side -- and that's something no politician or banker can

ever change. How different from paper money, and even more different

from the deposits the Federal Reserve regularly creates just

by running electrons (there are plenty of them, and they don't

cost much) through a computer.

The "Inflation Factor"

Key for gold is how little

supply is added in a year -- only about 80 million ounces ($62

billion worth at today's prices). That amounts to a gross "inflation"

rate for gold of 1.6% per year, compared to the existing supply

of approximately 5 billion ounces. And gold's net inflation rate

is actually a little less than that, since some amount of metal

disappears every year in uses that are not fully recoverable.

Competing forms of money -

the U.S. dollar, for example - typically increase at an annual

rate of 10% or more (in some years and in some places, much,

much more)... and have been doing so for decades. Per the above,

as we head into 2008, we see the increase in the supply of U.S.

dollars ratcheting up well above the norm.

With the supply of paper money

growing so fast and the supply of gold growing hardly at all,

gold now represents just a tiny percentage of the hundreds of

trillions of dollars worth of paper money in the world's financial

system.

Given the easy-going creation

of money by politicians trying to paper over today's problems

and yesterday's expensive promises - don't forget that 76 million

baby boomers are now beginning to enter their retirement years,

triggering a demand for trillions of dollars in Social Security

and Medicare entitlements -- every minute a few more people become

uncomfortable with the thought that everything they own is just

paper. That's when they become potential gold buyers.

What might happen to gold prices

if this process were to accelerate or if there were a general

shift in attitudes about paper money?

The total market value of all

publicly traded stocks is about $50 trillion. If just 5% of that

total value shifted toward gold - which could happen with just

a modest uptick in worries about paper currencies -- $2.5 trillion

would flow into gold. At today's prices, that would buy all the

gold in the central banks three times over. In fact, it would

buy three-quarters of all the gold in the world, including wedding

rings, gold teeth and the contents of the Saudi Princes' vaults.

Of course, such a thing wouldn't

happen at "today's prices." Instead, the price of gold

would leap, perhaps by a factor of two or much more, to accommodate

the increased demand.

In the final analysis, if you

have not already done so, it's time to begin getting acquainted

with gold and gold stocks as a portfolio asset.

###

David Galland

is the managing director of Casey Research, LLC. For over 27

years, the Casey organization has been providing unbiased research

to self-directed investors looking to profit from developing

trends. If you're interested in learning more about gold, gold

stocks, gold mutual funds and gold ETFs, check out BIG

GOLD,

Casey Research's unique publication designed for investors looking

to cautiously diversify into gold.

For a limited

time, a full 12-month subscription to BIG GOLD is just $79, plus

you'll receive the special report 3 Prudent Ways to Profit

from the New Bull Market in Gold. Learn

more now, click here.

Doug Casey

Casey Archives

321gold Ltd

|