Casey Files:

This week in 'The Room'

Doug Casey

International

Speculator

written Apr 18, 2008

posted Apr 22, 2008

Welcome to "The Room"

The subscribers-only home page of Casey

Research.

Dear Readers,

I am running quite late this

sunny New England morning. But I have a good excuse: my wife

has left me.

Well, it's not all that dramatic...

it is just that she has hived off for Europe for a ten-day gallivant

with friends, leaving me in sole charge of the children, pets

and sundry household duties. Survival under such circumstances

has required me to rethink standard operating procedures. First

and foremost, rather than rolling out of the sack at a leisurely

7:00 am in order to make it to school by 8:00 am, the kids are

now rousted awake at 6:30 am. Under my new regime, all forms

of maternal cosseting have been vanquished. Instead, following

the required morning absolutions, they find themselves, sleeves

rolled up, feeding and walking the menagerie, setting and clearing

plates, helping to prepare meals and dashing brooms this way

and that.

Then it's off to the playground

for a solid course of healthful chasing after a basketball before

the school bell rings.

All in all, I'm quite proud

of how well I am managing to whip this place into shape. A self-satisfaction

that slipped into the morning call with my wife yesterday. After

listening silently as I related how I have whipped the place

into good order, she commented, a bit coolly, it seemed to me,

"Very nice, dear. Now when I get home, perhaps you could

remember this new routine of yours and stick with it versus,

say, sitting about over a nice cup of coffee while reading the

morning news on your computer."

I have long believed that pride

cometh before the fall and suspect that, provided I am not ousted

in a coup by the grumbling natives before my wife returns home

next week, I shall find myself hoist by my own petard following

her return.

But to the extent that my service

as Mr. Mom has undeniably disrupted my schedule this week, I

am going to have to get right to it. While I am never sure where

my wanderings will take me, I suspect this will be a fairly eclectic

issue.

The Energy Picture

Yesterday I had a long and

interesting conversation with Jeffrey Brown, the petroleum geologist

who spoke so authoritatively on the topic of peak oil at our

Scottsdale Summit. As it was only recently that I touched on

Brown's studies of the Export Land Model in this column, I won't

go into a lot more detail today. But I did want to share the

gist of a couple of comments that he made which stuck in my mind.

On the topic of those who dismiss

the peak oil believers as kooks, he said something to the effect

of, "It is, in my view, ironic that some people believe

peak oil theorists are delusional. That's because it is the height

of delusion to think that we can treat a finite substance, oil,

as if it is available in infinite quantities. It is not."

He also commented that, as

is reflected in the $115 price, things are going in the wrong

direction, and fast. As he put it, even the most determined pessimist

couldn't have foreseen even a few years ago that things would

get this bad, this fast.

Where does he see the price

going from here?

"I think we are going

to see a geometric progression in oil prices: $50, $100, $200,

$400. It's just a question of how short the periods are between

doublings."

He went on to discuss that

it now looks as if global crude production peaked in 2005. Since

that time, the production of total liquids has been basically

flat. And, per comments reported here a few weeks ago, his model

shows that Mexico, on any given day the 3rd largest source for

imported oil into the U.S., will stop exporting oil in 2014...

at the latest.

There was much more to our conversation, which I recorded and

will work up into a longer article soon. Meanwhile, you can read

a research paper on the topic of the Export Land Model by following

this link.

Peak oil is not about running

out of fuel. It is about running out of cheap fuel. Unless and

until there is a serious technological advancement (see the Kurzweil

article at the end of this column for one promising area), this

is a trend you can make your friend... versus letting it kick

you around each time you visit the petrol pump or pay the electricity

bills.

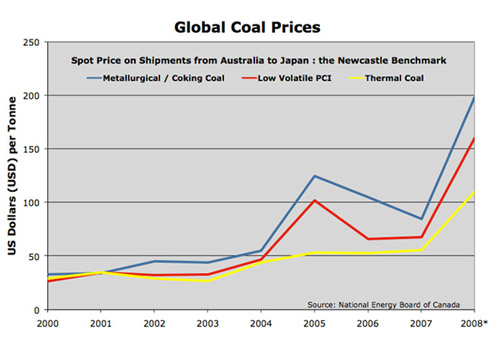

While we are on the topic of

energy, here's a brief look at what's going on in coal, the world's

third most important mass energy source (after oil and gas) from

Chris Gilpin of our Energy Research team...

Coal's Comeback

It wasn't too long ago - just

2006 actually - that coal had been written off as an old, dirty

fuel that had no place in the 21st century's energy equation.

What a difference a year makes...

* Values for 2008 are preliminary reported numbers subject to

revision

The prejudices against coal

were largely based on allegiances to the idea that actions taken

to prevent global warming - such as carbon controls - would crush

the coal industry. It turns out that the practicality of a simple-to-extract,

easy-to-ship fuel like coal outweighed these wishy-washy ideals,

and the international coal market went into overdrive.

The price paid for a particular

type of coal varies considerably, according to moisture, ash,

sulfur, calorific value, and the availability of user-specified

grades at their time of need. Australia is the main supplier

of coal to some of the world's biggest importers - namely Japan,

Korea, and Taiwan - and the price for thermal coal at its Newcastle

port has become a global benchmark.

The Newcastle benchmark doubled

for all grades of coal in 2007, and spiked to dizzying heights

in the early part of 2008 when heavy rains forced the closure

of several major coal mines in Australia. Thermal coal at Newcastle

went for as much as US$129, and has now pulled back slightly

as the flooded mines have been drained and resumed operations,

but the price remains well over US$100.

Coal is no longer the stealth

play that it was in 2007, but there are still opportunities to

be had. One area to keep an eye on are U.S. coal prices, which

remained dormant through much of 2007, but are waking up in 2008,

influenced no doubt by coal's international resurgence.

[Ed. Note: If energy

is not yet part of your portfolio, you are out of sync with one

of the most important trends in generations. At the risk of seeming

boastful, I think the new and improved Casey Energy Speculator

is, by an order of magnitude, the most comprehensive service

available for investors looking to keep closely in touch with

everything now going on in energy and, more importantly, the

best ways to profit. You don't need to take our word for it,

though, click

here for details on our 3-month, 100% money-back guarantee.]

So, How Are Things Going?

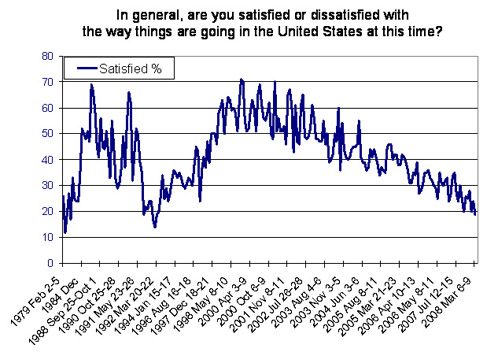

Bud Conrad dropped me an email

with the following chart reflecting a recent survey on the level

of satisfaction felt by the citizenry as to how things are going

in the U.S. While I suspect the trend expressed in the chart

has more to do with a general dissatisfaction in the level of

personal largess transferred to the respondents by Uncle Sam,

this sort of Jimmy Carter level of dissatisfaction won't go unnoticed

by the politicians.

In fact, I'll go on record

here and now that we are on the verge of seeing a New Deal announced.

It won't happen this year, but almost immediately after President

Obama takes power. I will bet that, trying to draft off the heuristic

connotations of that phrase, Obama will even use the term "New

Deal." But, in the same way that a Hollywood movie producer

names his movie sequels, it will likely be called the "New

Deal II"" which will then be used to excuse all manner

of re-jiggering of, well, everything. You heard it here first"

Here's a Trading Idea...

I have an idea that is very

risky, but potentially very profitable. Starting with one of

the biggest trends of the day, soaring food prices, we should

ask ourselves how we can profit.

The obvious is to buy food

commodities.

But there may be a better play.

Namely, only a drooling idiot can be supportive of bio-fuels

at this point.

Even the greenest of greens

must have come to the realization at this point what a huge screw-up

this has been.

The play, therefore, is to

figure out what market is going to be most affected by the government

pulling the plug on bio-fuel subsidies... and play that angle.

Everything being equal, the

dolts that conceived this moronic idea in the first place could

be expected to stubbornly remain with it for years to come. But

everything is not equal. Instead, we now have all sorts of reports

by quasi- and supra-state organizations pointing the finger at

bio-fuel as a major factor in the rising food prices. We will

soon have photos of starving children underscoring the damage

caused by this latest example of government miscalculation.

Most importantly, we have a

change in the presidency coming. That allows whomever is next

to cancel the subsidies and blame it all on Bush and his cronies.

The only question in my mind

is, what's the best way to play this?

As far as I know, no one else

is looking at this angle just now... which leaves the opportunity

wide open.

I ran this idea by options

and futures expert Steve Belmont, a partner with the RMB Group

(RMBgroup.com). Here's his response:

The answer to your e-mail is

simple. 1) Buy call spreads on sugar. 2) Buy relatively cheap

out-of-the money puts on soybeans, corn and rice. I believe this

is the next big trade in terms of reward to risk on the board,

despite what all "fundamentals" say -- partially for

the very reasons you mentioned, partially because of what I saw

in Bud's charts. Everything looks the same -- all at the top

of the parabola.

Nobody is taking this approach,

just like nobody I knew thought interest rates could rise. The

thinking has demand from China and India, etc. making it "different

this time." Whenever I hear that, I get suspicious. Full

disclosure: I own puts in corn and soybeans and am looking to

buy puts on rice.

While Steve's strategy is certainly

contrarian just now, primarily because you risk being too early,

the general idea that bio-fuel subsidies will end is, I believe,

a good one. What are your thoughts? Drop me a line at david@caseyresearch.com.

[Note: Note Steve's

mention of interest rates, a call that we featured recently in

the International Speculator and that I mentioned last week.

A couple of weeks ago, I bought EuroDollar puts - a strategy

recommended by Steve and his team - and am happy to report my

position has almost doubled already. Both Doug Casey and Bud

Conrad are on record as saying that playing rising interest rates

may be the single best move you can make today. This, and other

crisis strategies, will continue to be closely followed in our

flagship International

Speculator.]

On the Topic of Interest Rates

Not sure if you caught this

story, but the Wall Street Journal ran a piece this week questioning

whether or not the widely used LIBOR was actually valid, or if

it was being manipulated by the banks to downplay what they are

really paying for short-term money. You can read the full article

by clicking

here.

But here's the nub of the problem,

according to the WSJ:

The concern: Some banks don't

want to report the high rates they're paying for short-term loans

because they don't want to tip off the market that they're desperate

for cash. The Libor system depends on banks to tell the truth

about their borrowing rates. Fibbing by banks could mean that

millions of borrowers around the world are paying artificially

low rates on their loans. That's good for borrowers, but could

be very bad for the banks and other financial institutions that

lend to them.

In this market, at this time,

you have to be on guard against, well, just about everything.

People are desperately hoping that the banks will stop performing

like broken Whack-A-Moles, taking it on the head over and over.

But we are nowhere near out of the woods at this point.

President Obama?

Above, and in other editions

of this weekly missive in the past, I have expressed the view

that it will likely be President Obama who next sets his heels

on the Resolute desk in the Oval Office (the desk, a gift from

Queen Vic herself back in 1880, was built from the remains of

the British frigate HMS Resolute).

This week one of you wrote

to say, "Not so fast, I think you are jumping the gun on

Obama."

For entertainment purposes

only, I will risk offending the politically sensitive by sharing

why it is that I think Obama will be the next prez.

Here's my calculation at this

point. Despite the contention by many in the Democratic party

that Hillary's stubborn refusal to get out of the race is hurting

Obama's chances in the general contest this fall, I think the

opposite is true. In fact, every day she stays in the race improves

Obama's chances.

That's because Hillary's attack

dogs are turning up every possible stone trying to get the dirt

needed to bury Obama. Provided he can prevail (and at this point

it is almost a statistical certainty he will), then the Clintonistas'

constant attacks will serve to inoculate him in the public mind

against these very same charges, should the Republicans later

try to dredge them up ahead of the November vote.

Put another way, everyone will

have heard all the bad stuff available about Obama and so will

mentally relegate it to yesterday's news. Further, he will have

had the opportunity to practice the messaging that will best

allow him to dodge whatever charges the Clintonistas raise.

Meanwhile, back at Sunny Acres,

McCain is enjoying a nice long holiday. But once the contest

between Hil and Bama is settled, that holiday will come to an

abrupt end and the massive dossier compiled by the Democrats

on his many faults will be unleashed... just in time to do the

most damage ahead of the final contest.

While some of what McCain will

face when the general election kicks off in earnest did briefly

surface during the Republican contest, that was pre-school for

what is coming. He has, if you credit the fairly credible reports,

alienated a lot of people with his temper, people that won't

mind a little payback. Then there was the fact that he was caught

with his hand in the proverbial cookie jar with that whole Keating

S&L scandal, his rendition of Bomb, Bomb, Bomb Iran (seemed

funny at the time, but I have to believe it won't play well in

a 60-second attack ad aired over and over). And then there was

the whole cozying-up-to-the-lobbyists thing and his apparent

confusion over the key players in Iraq and Afghanistan, etc.,

etc.

Who knows, maybe Obama's folks

will borrow Hillary's 3:00 am ad and repurpose it against McCain.

"It's 3:00 am in the morning, who do you want answering

the phone?" Cut to John McCain thrashing, confused, for

the telephone. "Who the hell's calling at this time of the

damn morning! And who am I anyway?" (Sorry, McCain fans,

I just couldn't help myself.)

And so his holiday will come

to a screeching halt, just in time for the popular vote.

That's how I read it and, if

I can find the right counterparty, how I'll bet on it. At least,

if I win, I'll have some small head start on the higher tax bill

Obama's perfect world will require.

Another Casey First

A couple of weeks back, I took

the unusual step of posting an ad from a friend and subscriber

looking for the ideal mate. (The early response, she has informed

me, has been quite good... with a fuller report due any day.)

Another subscriber with whom

I stay in fairly regular correspondence mentioned in passing

that he was temporarily in the ranks of the unemployed. As I

have always enjoyed our correspondence - Clifton is a very knowledgeable

amateur historian - I suggested that if we could help a friend

find a mate, we could help a mate find a job. After all, what

are phyles for if not to help when help is needed. In any event,

I suggested he write up an ad for himself. Which he did, and

which follows...

David and I have something

in common other than precious metals. Both his stepfather and

my father served in the CBI Theater during WWII. His was in the

air as an Ace, mine drove the Burma Road.

I thank David and the Casey

gang for allowing me to use this forum. I'm relatively new to

the Casey family, but not so to precious metals, thanks to my

dad.

I'm looking for an opportunity.

My resume includes a lot of positions, since I did a career change

from sales and sales management into accounting (MBA, CPA), and

I've walked away from more than one unethical situation. Most

recently I've been in the homebuilding/land development arena,

but am open to a different industry.

An avocational writer, I have

written numerous short stories and novels. My interests include

the card game Skat, coins, books, guns, dogs, comic books and

red zinfandel. I am a Vietnam Era Veteran having served as an

MP in the US Army.

I would prefer to telecommute

from Northern Alabama with occasional travel as necessary, but

am open to relocating for the right opportunity.

If you can assist me with either

a traditional accounting/finance role or an amalgamation across

my interests, or if you are an agent or editor looking for new

blood, please contact me.

Q&A

As usual, I received a number

of letters from readers this week. Here's a couple I thought

you might find interesting.

Hi David,

Thank you for your thought-provoking,

funny letters. As a new subscriber, I'm trying to wrap my head

around a few issues raised in the April 11 issue of "In

the Room." My first question is technical, the second historical/philosophical.

Doug Casey writes, "If

the money supply is stable and one commodity goes up a lot, the

price of others must drop -- the general price level, in terms

of dollars, stays the same." What is the relationship between

the effect of currency inflation on commodity prices, and the

effect of the cycle of supply and demand (and the resulting state

of the infrastructure) of each individual commodity?

More philosophically, in reference

to your discussion about the housing bailout, you champion the

virtues of free-market capitalism. I have to be the devil's advocate

here, for no one else is. Isn't it free-market capitalism, unrestrained

by governmental oversight, that makes sweatshops possible? Notice

that when regulation tightened in this country, working conditions

improved, wages went up, and the "free market" hightailed

it to the Third World, where anything went, and despite occasional

boycotts, still goes -- at least as compared to labor standards

here.

Wasn't it a lack of preventive,

regulatory oversight that allowed the housing crisis to brew

and erupt? The "free market" wasn't so free after all,

even to those who preyed on ignorant and marginally solvent borrowers

-- and who then, attempting to "spread" (hide and pass

on) the risk, sliced and diced these shaky loans into pieces

too small to recognize, thus giving new meaning to "death

by a thousand cuts."

No matter how wonderful, everything

has its dark side, an unrestrained market as well as governmental

regulation.

Yours truly,

Linda

Given my time restraints, I

asked our own Terry Coxon, a senior editor who works on the International

Speculator and BIG

GOLD, to respond. For those of you who are unfamiliar with

Terry, he was Harry Browne's partner and editor for years and,

among other accomplishments, founded the Permanent Portfolio

Fund. Here's his response..

Linda:

1. Commodities and inflation.

The initial effect of an increase in the rate of monetary inflation

(an increase in the growth rate of the money supply) is to lower

interest rates. This tilts the demand for goods in general toward

capital goods (long-lived assets, such as buildings and machinery)

and away from short-lived, consumable goods (such as socks and

toothpaste). That's why the recent run-up in housing prices outstripped

the rise in consumer prices.

Among commodities, the earliest

to be affected by an increase in the rate of monetary inflation

will be commodities associated with the production of capital

goods -- such as lumber and metals. Consumable commodities, such

as foodstuffs, will lag behind and then later catch up. This

closely matches what we've seen over the last few years -- the

monetary inflation that pushed short-term interest rates down

to 1% and produced a boom in housing construction also set off

a rise in the prices of metals, but only more recently has fueled

a rise in the prices of wheat, rice and other foods.

2. Sweatshops. Milton Friedman

remarked that if his parents hadn't worked in sweatshops in Chicago,

he would never have gotten an education. What could he have been

thinking?

If by sweatshops you mean people

working in rough conditions for low wages, it is possible for

determined, energetic government action to change matters. The

government can, for example, require that every workplace maintain

a temperature of 80 degrees or less. And it can prohibit paying

any employee less than a certain wage rate. Sounds nice. But

the effect on employees ranges from bad to catastrophic -- because

the cost an employer is willing to incur for a person's labor

is limited unbendingly by the value that labor adds to output.

Air conditioning and other

workplace amenities (even fans) come with a cost, which is a

cost of maintaining an employee. It is inescapable that if the

government requires such amenities, then it imposes such costs

-- which reduce the wages the employer is willing to pay. The

employees might like the air conditioning, but the fact that

it is installed only by government mandate is proof that the

employees would prefer sweat and higher wages.

The effect of minimum wage

laws is even worse. Name any minimum wage rate and there are

people whose labor doesn't add that much value per hour. So no

one will hire them. In the U.S., these victims of government

are generally teenagers, who tend to be short on the education,

reliability and work experience that make labor productive and

valuable. Some of them never get their first job, and with time

they become chronically unemployed and eventually unemployable.

Not even slavery is as effective at keeping the poor poor as

vigorously enforced minimum wage laws.

Outside the U.S., measures

to shut down sweatshops would have even worse effects. The children

sewing clothes in Bangladesh only get 50 cents per hour because

that is about what they add to the value of the factory's output.

Requiring a minimum wage of 75 cents per hour would destroy their

jobs and leave them earning nothing. Some would die. An effective

boycott would be just as cruel. Boycott the clothes they make

because you don't like the terms of their employment and you

boycott their opportunity to live.

Terry

In Defense of Marx

I also received the following

email message, in response to my less than flattering description

of Karl Marx last week.

David

Based on your following statement:

"Thus wrote Karl Marx,

by reliable accounts a penniless, unpopular, slovenly loser throughout

the entirety of his miserable existence. Yet, avoiding any deep

contemplation, the masses gravitated to his slogan, resulting

in hundreds of millions of deaths and untold misery that carries

forward even to this day."

It's clear that you are an

absolute cretin. Marx's slogan is a fabulous one, and any civilized

culture would do well to aspire to it.

But being a bourgeois imbecile,

it's no wonder you deride it. As for Marx being responsible for

millions of deaths, uh, no, I think you'll find that those responsible

were people with names like Stalin, and Mao, who distorted Marx

for their own ghastly purposes. Now grow up or shut up!

Ross

At 53 years old, I suspect

the whole "grow up" thing is simply not going to happen.

And I don't really feel compelled to shut up, either. So I will

comment, albeit briefly, that while Marx didn't actually pull

the trigger on the uncountable millions who have died based on

his fine-sounding ideas, he might as well have.

That's because the slogan that popped to his mind one day, and

which you are so deeply fond of, "From each according to

his abilities, to each according to his needs" contains

within it a clear and implicit promise of coercion and even violence.

Any platitude, even Marx's,

might be used by an individual as a reminder to act in a certain

way toward their fellow man. But when it is adopted as government

policy, which was clearly Marx's desire and goal, it becomes

an entirely different thing altogether.

Simply (as a "bourgeois

imbecile," I am capable of no complex thoughts), what happens

if I, as the individual in Marx's equation who is able to produce

more, am unwilling to give of my bounty to others unable to produce

more?

There may be any number of

reasons why I might not want to hand over goods I have earned,

or shoulder extra work so that others less able may live more

comfortably. For instance, I might want to save money to start

a new business. Or, I may be concerned about the future and want

a little extra padding to assure my immediate family doesn't

have to go without. Or, I may simply enjoy the feeling of fine

Corinthian leather on my car seats.

But regardless of my reasons,

I may decide that, no thanks, I'd rather keep the fruits of my

labor all to my selfish self.

Leaving the government in Marx's

utopian world with only one option... coercion. They can forcibly

take the goods from me, or they can send me to a work camp. And

they can take away the controls of production, which was Marx's

proposed solution. But when they do, they will be taking away

the incentives to innovate and to produce, leading inevitably

(just check the history books for proof) to an economic meltdown.

Just as inevitably, the government - looking to protect itself

- then resorts to anything and everything to stay in power. Stalin

and Mao are not the exceptions in this form of government, but

the most likely consequences.

There is more to this discussion

than I have the time or the inclination to go into here. But

if you, Ross, have reached this stage of life still believing

in Marx and communism, then I'm betting you are still pondering

how Santa Claus manages to slide down your chimney each Christmas.

It's Official: I'm Out of Touch

I read this morning, as I watched

the stock market rise, that the reason for the rally has to do

with the fact that Citigroup's first-quarter revenue plunged

"only" 48 percent.

According to Bloomberg:

The New York-based firm's first-quarter

net loss of $5.11 billion, or $1.02 a share, compared with earnings

of $5.01 billion, or $1.01, a year earlier. Analysts estimated

the company would report a loss of $4.75 billion, according to

a survey compiled by Bloomberg.

So, a year-over-year swing,

in the wrong direction, of about $10 billion is good news? I

must be out of touch with the new reality, because I just don't

get it.

Apparently, however, the rationale for such ebullience - which

has the Dow up 197 points as I write - is because people are,

once again, seeing Citigroup's results as not quite as bad as

they could have been. This, apparently, signifies the beginning

of the end. And because things are going to improve, the Fed

can now be less aggressive in cutting rates... which has strengthened

the dollar, taking a (temporary) bite out of gold.

Now, one could comment endlessly

on these sorts of market movements. But I think it is a waste

of time. No question that traders will continue trying to spot

the patches of blue through the thick gray overcast. But this

storm, according to everything we see and reliably report on

in our various publications, is just getting rolling and before

you know it, lightning and hail the size of grapefruit will be

sending the equities market running for cover.

Inflation Watch

It is getting harder by the

day to keep up with all the negative inflation reports. The latest,

out of the UK, has it that the government there is waaaaaay understating

the real inflation rate. Specifically, that instead of it bouncing

along under the 3% rate, it is actually running closer to 15%,

based on a basket of items that the Daily Mail categorizes as

"must pay." You know, those annoying things like food

and fuel which governments like to leave out of their inflation

indicators. Here's the

story.

Meanwhile, Faith, one of your

fellow subscribers, sent along the following link to a YouTube

confrontation between Ron Paul and Fed Chairman Ben Bernanke.

While I would rank the caliber of most questions asked of Bernanke

by most Congressmen on a level with those that might be asked

by a grammar school social study class, Ron Paul gets into Bernanke

with both elbows. It is a very interesting exchange, stunning

almost. Check it out here.

Political Pandering

How low will a presidential

candidate stoop to pick up a vote? If you trust the evidence,

the answer is, pretty low. Among that evidence are the promises

of the Democrats that, if elected, they will change the current

regs so that union organizers will be able to unionize a company

based on a signed petition, versus the secret ballot that companies

can now insist on.

Now picture this. With the

secret ballot system, you step into a private booth and vote

to unionize, or not.

Under the proposed rule change,

George from down in the shop stands in front of you, toothpick

between his teeth, proffering you a sign-up sheet. "Here,

sign this," he says. So, what are you going to say? "No

thanks? I have noticed how so many of the unionized industries

have been destroyed and moved off-shore to be competitive."

I don't think so.

It reminds me of the close

friend of a former partner of mine who set up a vegetable stand

by the side of the LI Expressway. After a week or two, a guy

in a big caddy drives up and gets out. Toothpick between his

teeth, he says, "Looks like a nice business youse got here.

Whaddaya do wit your garbage?" "Oh, nothing much. It's

just a couple of garbage bags' worth that I toss in the trunk

of my car and take home." "Dat right. Well, you know

what? I think you could use a dumpster." "Really, it's

no trouble at all," my partner's friend replied. To which

his new acquaintance said, cracking his knuckles as he spoke,

"No, you don't understand. You NEED a dumpster. It will

be here in the morning. You just pay us rent for $500 a month

and everyone's good, right?"

But back to the present, while

I have nothing against unions, I understand enough about human

nature to understand what a fundamentally flawed idea it is to

force businesses to unionize based on a petition. The last thing

the U.S. needs at this point is yet more reasons to ship industry

overseas. One can only hope this is one of those situations where

the politicians are doing the only other thing they do better

than pandering... lying, in this case to the heads of the unions.

The Price of Gold

In my closing comments last

week, I wrote the following...

A final check of the numbers

as I prepare to put the tools to rest has it that gold is hovering

around the $926 level, while the DJIA is taking a hard shellacking,

down 223 points.

For entertainment purposes

only, I'm going to bet that gold is going to go over $950 in

the coming week. In fact, I'll go one step further, and say it

will peak at $953 for the high next week (as of noon next Friday,

April 18). If you want to get in on the game, send in a specific

guess of gold's high for the week (also by noon Friday). If you

are right, we'll comp you for a year of BIG GOLD... with a tie,

going to whoever sends in their prediction first. Drop me an

email with your prediction, and any other comments you have about

this week's edition, to David@caseyresearch.com.

The high for the week, using

intraday spot prices, rang in at $953.90... so I'd have to give

my crystal ball high marks. But I was outmaneuvered by Anne V.,

who actually nailed it right on the head, winning herself the

free one-year subscription to BIG GOLD. Here's her entry:

"David I think gold will

touch 953.9 next week. And I hope some of our gold juniors follow

suit!"

As for the juniors, the next

and most important trigger will be the next round of quarterly

reports issuing forth from the large producers. Those reports

will start coming out within a week or so, and will continue

into mid-May. If they are as positive as I think they will be,

the attention on the mining sector will ratchet up considerably.

Stay tuned, things are about to get interesting.

Miscellany

- A friend in need. Say what you will about Colombia,

they have had more than their share of turmoil and trauma. And

think what you will about the War on Drugs -- the Colombians,

at least to this casual observer, seemed to have jumped on the

team, supporting the U.S. effort to interdict supplies at the

source by, among other things, allowing U.S. soldiers to tromp

all over the place and engage in blanket dusting of crops using

various insecticides. I also have no doubts they paid close attention

to the admonitions of the U.S. government to build a diversified

economy. But when it came time to approve a new free trade agreement

with them, politics trumped and the Colombians were turned back

at the door. Not sure what message the rest of the world will

take away from this, but I think the bigger point to pay attention

to is that the trade barriers are only beginning to go up. And

not just in the U.S., but around the world. Not a good trend

if you ask me.

x

- Ascent of humankind - continued. Underscoring his optimistic view on

the world we live in - or soon will - our globetrotting chairman

sent along a link to an excellent article by Ray Kurzweil. Kurzweil,

who is well known and respected in the science community, points

to the exponential advances in computing power, and how that

same level of technological leap-frogging is now being applied

to other crucial fields as well. I have often commented to my

kids that their generation may live to 200 years of age. And

if you credit Kurzweil, the odds in favor of that happening are

improving daily. Here's a

link to the article.

x

- Crisis, what crisis? According to Bloomberg, "The

amount of distressed corporate bonds jumped to $206 billion April

11 from $4.4 billion in March 2007, according to a Merrill Lynch

& Co. index of bonds yielding at least 10 percentage points

more than Treasuries." Read those numbers again. $4 billion

to $206 billion in a year? Look for cover if you haven't already

found it.

And that is that for this week's

particularly rushed edition of The Room. I apologize for any

poorly worded or ungrammatical expressions, as at this point

I have the choice of doing another pass through what I have just

written, or picking the kids up from school.

As always, I greatly appreciate you taking the time to read this

weekly missive. As I sign off, the DJIA is up 234 points and

gold is trading at $916. Time to worry? Hardly. But it is time

to pick up the kids and so I will sign off for this week.

Until next week...

Sincerely,

David Galland

Managing Director

Casey Research, LLC.

###

Doug Casey

Casey Archives

321gold Ltd

|