Casey Files: Casey Files:

This week in 'The Room'

David Galland

International

Speculator

written Apr 4, 2008

posted Apr 8, 2008

Welcome to "The Room"

The subscribers-only home page of Casey

Research.

Dear Readers,

This week finds me writing

from Room 2218 of the infamous Jekyll Island Club. The hotel's

adjective comes from a secret meeting held here in 1910 involving

some of America's most powerful men. Here's an official history

of that seminal event...

Soon after the 1907 panic,

Congress formed the National Monetary Commission to review banking

policies in the United States. The committee, chaired by Senator

Nelson W. Aldrich of Rhode Island, toured Europe and collected

data on the various banking methods being incorporated. Using

this information as a base, in November of 1910 Senator Aldrich

invited several bankers and economic scholars to attend a conference

on Jekyll Island. While meeting under the ruse of a duck-shooting

excursion, the financial experts were in reality hunting for

a way to restructure America's banking system and eliminate the

possibility of future economic panics.

The 1910 "duck hunt"

on Jekyll Island included Senator Nelson Aldrich, his personal

secretary Arthur Shelton, former Harvard University professor

of economics Dr. A. Piatt Andrew, J.P. Morgan & Co. partner

Henry P. Davison, National City Bank president Frank A. Vanderlip

and Kuhn, Loeb, and Co. partner Paul M. Warburg. From the start

the group proceeded covertly. They began by shunning the use

of their last names and met quietly at Aldrich's private railway

car in New Jersey. In 1916, B. C. Forbes discussed the Jekyll

conference in his book Men Who Are Making America and illuminates,

"To this day these financiers are Frank and Harry and Paul

[and Piatt] to one another and the late Senator remained 'Nelson'

to them until his death. Later [following the Jekyll conference],

Benjamin Strong, Jr., was called into frequent consultation and

he joined the 'First-Name Club' as 'Ben.'"

And so it was that the Fed,

that blight upon the U.S. dollar and instrument of unlimited

government power, was born. Some of you, learning in last week's

missive that Doug and I were heading to this place, wrote strong

words condemning the place as if it had a life of its own. Like,

perhaps, the set piece of one of those classic horror films.

But writing from the perspective

of an instant expert (as I have only been here three days now),

the hotel is grandiose and very pleasant in a Southern manor

sort of way. The food is excellent, the amenities are plentiful

and the weather far more agreeable than that gripping my hometown

in the Northeast. I would, however, caution you to avoid the

place in summer; in addition to high heat, the bugs are reputed

to be both fierce and relentless. Even now, in early spring,

the truth of that reputation is confirmed by the occasional no-see-um

enjoying a snack at my personal expense.

Apparently, the old club had

fallen into disrepair after World War II, when the money men

that founded the place, including J.P. Morgan himself, stopped

coming here in favor of the more refined holiday resorts of Europe.

Such disrepair, in fact, that it was closed for four decades

before eventually limping back into existence as a 4H camp and,

some have said, even a flop house. Thanks to a substantial infusion

of cash from the state of Georgia, or, more correctly, the taxpayers

of Georgia, the club and its grounds have been restored to their

former state of glory and are now very much up to code.

But why are Doug and I here?

As much as I wish it was pure holidaying, or even plotting to

replace the Fed system and returning to one that is actually

based on something more tangible than political whim, we are

here at the invitation from a friendly competitor, Porter Stansberry,

to attend his annual editors conference.

It has been an interesting

experience because Stansberry tends to focus on investment areas

we tend to avoid. That said, there is a solid contrarian streak

that flows through the organization, such as the one that has

some editors talking about homebuilders being a good buy just

now.

Homebuilders? Surely you jest,

I thought to myself as I listened to the presentation. But then,

Steve Sjuggerud, editor of the highly popular and widely read

Daily Wealth, discussed how, in a typical housing collapse, the

shares in the homebuilders will go down by as much as 75% to

90%, a level that would make it seem hard to get hurt. But the

more important thing is that when they rebound from those depressed

levels, they can go up by as much as 300% to 500%.

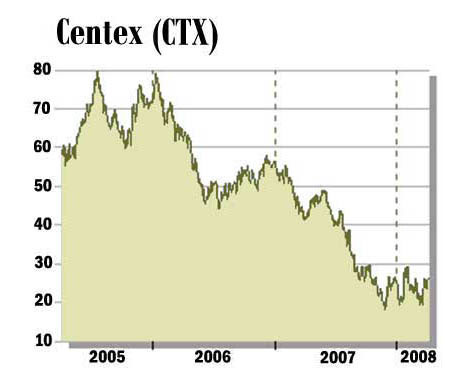

Consulting the ever-reliable

stock research tool on the CaseyResearch.com website, I find

that Steve has a point. Centex (CTX),

which is shown in the chart below and will be mentioned later,

is off by about 68%.

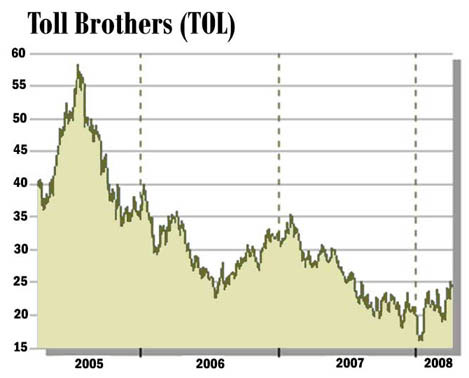

And the following chart is

from another of the nation's largest builders, Toll Brothers

(TOL), which is off from about $57 to $24... a loss of about

58%.

While I personally am of the

belief that the real estate that underlies these companies has

a long way to go before touching bottom... a topic we'll return

to momentarily, it is hard to argue with Steve's basic premise

that, at some point, the home builders sell at such a steep discount

that there is pretty much only one way they can move: up.

It is a classic contrarian

play and one to watch for. When the blood-letting has these stocks

down by 80% or more, which I think we'll see, you can assume

that pretty much anyone who is going to sell will have sold,

which, for the speculative minded, is the time to buy. Then sit

back and wait for the next upswing. It may take quite awhile

for the payoff, but provided the companies have the financial

ability to avoid bankruptcy - a matter for further and serious

investigation - in time the upswing will come and provide a big

payday.

The Trillion-Dollar Sure Thing

After falling as low as $887

earlier in the week, gold has come quickly back to $907 as I

write in the wee hours of Friday morning. Why the fall? Sometimes

it is hard to divine the minds of humankind, so I'm not really

sure. Misplaced optimism? Profit taking?

Even so, gold showed its spine,

returning quickly to the $900 level, a level which, as we have

recently discussed in this missive, may be the new base for the

yellow metal... a level below which people intuit that gold is

"cheap." Which it is.

Why? Because it is the U.S.

dollar that most people use when assessing the value of gold.

And the U.S. dollar is being increasingly put at risk by the

growing list of bailouts that are hastily engineered by the government

and all its various apparatchiks. During a phone call the other

day, our own Bud Conrad started tallying up all the money that

the government has applied or committed to the unfolding crisis

so far. The sum is now closing in on one trillion dollars.

Does that number concern you?

Does it surprise you? Does it make you, mouth agape, stumble

toward the nearest barkeep, your hand waving in a frantic attempt

to capture his attention so that he might provide a restorative?

I suspect not.

Thanks to our being inoculated

with a steady dose of large numbers, a number as huge as a trillion

probably only softly touches your individual consciousness. The

way, perhaps, that an acquaintance in this gentle clime might

helpfully brush a fallen magnolia blossom from the shoulder of

your white linen suit.

The impact should, however,

register more like a solid slap across your ruddy jowls delivered

by a southern belle after an imprudent remark encouraged by one

too many mint juleps.

But a trillion-dollar bailout,

just like a three-trillion-dollar war - or more correctly, in

addition to a three-trillion-dollar war -- carries with it consequences.

As an old and wise friend of mine now in his twilight repose

in Portugal likes to ungrammatically say, "There ain't no

such thing as a free lunch." And he's right, mostly.

A basic tenet of economics

has it correctly that if you flood the market with a large supply

of anything, the value of each successive unit must fall. Money

is no different, and monetary inflation will, as sure as day

precedes night, result in price inflation. And you don't need

me to tell you that the cost of pretty much everything at this

point is going up.

While the sort of price inflation

that eventually stirs the masses to action is still ahead of

us, there is little question at this point that it is inevitable.

Therefore, betting that interest rates will rise as lenders demand

compensation for the anticipated erosion in the value of their

money between the time it is lent and the time it is returned

to them, is as close to a sure thing - even a free lunch -- as

you can imagine.

In the past I have mentioned

those fairly rare occasions where Doug Casey, our illustrious

chairman and resident guru here at Casey Research, gets a certain

look in his eye and speaks with a certain tone in his voice that

indicates that he is issuing forth, oracle-like, a forecast that

invariably comes true. His view on the inevitability of interest

rates rising strongly over the next few years is delivered with

that same force of conviction. In fact, he is on the record,

as recently as yesterday morning, saying it is the single most

powerful trend he sees just now.

Personally, I have placed my

bets on that particular outcome and you might want to consider

doing so as well.

One of the

best ways to do so is with properly organized EuroDollar puts.

If you are a subscriber of the International Speculator

and want to re-read our write-up on that investment strategy,

simply access the March 2008 issue from the archives.

If you are not yet a subscriber

to the International Speculator, sign up today with our

3-month, 100% satisfaction money-back guarantee. Click here to

learn more and sign up now.

(There is a reason that this

publication is now in its 28th year, but me telling you and seeing

for yourself - without risk - are two different things.)

China on the Brink?

At our recent Scottsdale Crisis

& Opportunity Summit, I had an exchange with one of our many

interesting subscribers. In the interest of his privacy, and

because of where he calls home, I will call him only CG. He is

an international entrepreneur whose latest venture has led him

to take up residence in China for some time now.

In Scottsdale he told me that

he had translated some recent observations I had made in this

weekly column on the topic of China for his Chinese wife. His

wife, as he relayed it, said something to the effect of, "He

is exactly right. How does he know this?"

While it is always flattering

to have one's opinion thought worthy by those in the know, what

I found most interesting, and why I share this story here, is

that my comments were about the potential for civil unrest in

China. Not to be repetitious, but I think the topic important

enough to repeat the paragraphs which CG's wife found so revealing...

here they are:

After all, while many of the

world's economic observers fawn over China's remarkable progress,

the facts are simple. (a) The U.S. already has the infrastructure

in place that China is now trying to build; (b) China is run

by a cadre of corrupt communist comrades, not exactly a model

ripe for emulation by a thinking person; (c) they have over a

billion mouths to feed. Which is to say, any setbacks that cause

the aspirations of its large public to be disappointed could

result in social unrest and worse. (The rocketing cost of rice,

up almost 100% over the last year, may be a catalyst for such

unrest.)

Adding to the discomfort about

the potential consequences of social unrest, one only needs to

glance casually into the cupboard to find tightly packed examples

of the culture's apparent disdain for steadily beating hearts.

Reaching into said cupboard,

we pick up Barbara Tuchman's excellent Stillwell and the American

Experience in China to read her accounts of General "Vinegar

Joe" Stillwell's arrival in that country in the support

of Chiang Kai-Shek, as despicable a two-legged creature ever

to have wandered onto the human stage. In between other duties,

Joe had to restrain himself, and his men, from opening fire on

officers of Mr. Kai-Shek's nationalist army that would routinely

punish the loss of even so much as a single lice-ridden blanket

by a foot soldier with summary execution.

But as degraded as Chiang and

his fellows were, they were nothing compared to the big guy himself.

Based on readings on the topic, confirmed with an airplane seat

consultation with an academic who had made the study of such

things his life's work, Chairman Mao was reliably responsible

for the unnatural deaths of over 50,000,000 of his fellow countrymen.

To disabuse you of the notion

that China has reached a level of permanent stability, I would

like to share with you a YouTube video that our own Louis James

brought to my attention. While I have only watched part 1 of

the 8 parts available (I plan on ordering the full documentary),

it's enough to give you a better sense of the place than you'll

get from the mainstream media.

The documentary is called The

Tank Man and it is quite moving. View

it here.

One of the consequences of

a sense of unsettledness in that populous nation will almost

certainly be a move to stash away more gold, something they can

do more easily these days, thanks to a liberalization of gold

ownership that began in 2005.

How You Trade: The Casey Broker Survey

Recently we conducted a fairly

comprehensive survey of how you, our highly valued and much appreciated

subscribers, traded the resource stocks. Do you favor online

brokers or the full-service variety? Do those of you domiciled

in the U.S. buy on Canadian markets or over-the-counter? Who

are your favorite brokers? What are the best ways to save on

commissions? All these questions and more were addressed in the

survey, the results of which you can read by clicking

here.

[pdf]

We would also like to thank

those of you who took the time to take the survey... it offers

a valuable look at an important topic.

My Mother's House - Continued

Jim Turk of GoldMoney.com likes

to view the economy and markets, using as his lens grams of gold,

as opposed to the U.S. dollar, a fiction at this point. Apparently

a regular reader of these weekly ramblings, he weighed in on

the recent discussion of the current value of my mother's childhood

home, a photo of which she sent along since my first posting

on the topic. Here are Jim's comments:

Here's another way of looking

at the price of your mother's childhood home in Mont Clair, New

Jersey, which you note was purchased in 1929 for $45,000, sold

below that price almost 20 years later, and now valued by Zillow.com at $1.24 million.

Your comment that "the actual current value of the property

is likely closer to twice that value" because it was subdivided

into a number of lots is a pretty good estimate when viewed in

terms of real money.

The dollar in 1929 was defined

as 23.222 grains of gold, which meant that one ounce could be

exchanged for $20.67. So that 1929 price was really 2,177.1 ounces.

Gold today is trading around $930, which means the adjusted purchase

price of your mother's house, allowing for inflation and other

debasement of the dollar, is $2,024,703. It's not quite double

the Zillow.com estimate, but that could be because gold is still

relatively undervalued notwithstanding its rise in price the

past several years.

In any case, this example explains

why gold is money -- gold communicates value very effectively

over long periods of time, making it the ideal money for economic

calculation.

Regards

Jim Turk

(www.goldmoney.com)

While on the topic of real

estate, I'd like to share another email from one of our subscribers,

Frank, on a topic that I think you'll find of interest. As you'll

see, he touches on some recent transactions made by Centex, the

homebuilder mentioned earlier.

I am a subscriber to Big Gold

and International Speculator.

I am a real estate developer

based in Sacramento, CA and doing business throughout Northern

California. If you use this information, please do not use my

last name.

In the Sacramento and surrounding

area MLS, 51% of all listings are REO or short sale. 61% of all

actual transactions are REO or short sale. With a bulge of ARM

resets through July, the existing resale market should be soft

for the next fifteen months anyway.

The real blood bath is bulk

residential lots, both paper lots and finished lots. The privately

held builders are mostly headed to bankruptcy. Of the big residential,

privately held developers in my area, literally perhaps two survive

and all the rest go down. When I meet with a residential developer

who wants to "fire-sale" lots, there is no possibility

for a transaction because in most cases the debt exceeds the

land value. Which brings up the lenders. The lenders are not

foreclosing yet. Why? Are they not being leaned on by the regulators

yet? The attitude from the lenders so far is denial that they

have problems. Other banks have problems but not them..

Some of the public builders

are starting to dump lots. 30 days ago, Centex sold approximately

880 paper lots that they had paid $60,000,000 for three years

ago and had spent an additional $10,000,000 in entitlements for

a total of $70,000,000. They sold these for $8,000,000. $70,000,000

to $8,000,000 in three years! Centex sold 97 finished lots on

Friday, March 28, for $27,000 per lot. The cost to finish these

lots was approximately $40.000 per lot, therefore the residual

land value is less than zero. 12 months ago, Centex had over

$900,000,000 in unrestricted cash. Today they have just over

$65,000,000. Do you see a trend? I think the residential market

starts to come back in California in 2-3 years. The public builders

run out of lots over the next 18-24 months and California keeps

growing and there is continual if diminished housing formation.

Additional bad news is that

the retail and office markets are starting to roll over now.

These foreclosures have not started but will soon and will lag

residential by 12 months or so. Office vacancies are rising and

the big box retailers and grocers have all pulled out of the

market.

In a follow-up email, I asked

the author of that email, "How are you going to manage?"

To which Frank responded:

Thanks for asking about me.

I have no bad projects, one that is underperforming has NO DEBT!

That is how you survive as a developer. Plus, having turned $250,000

into $1,500,000 over the last eight years, thanks to your investment

publications plus Richard Russell's Dow Theory Letters, I know

I will survive just fine.

I would keep one thing in mind,

just about everybody is bearish on the real estate market and

that is when it will eventually turn. I say the bottom is in

2009, not 5-10 years out, and then we will start a slow process

of recovery but from a much lower base.

I've said it before, and I'll

say it again. We have the best subscribers in the world.

Energy Chart of the Week

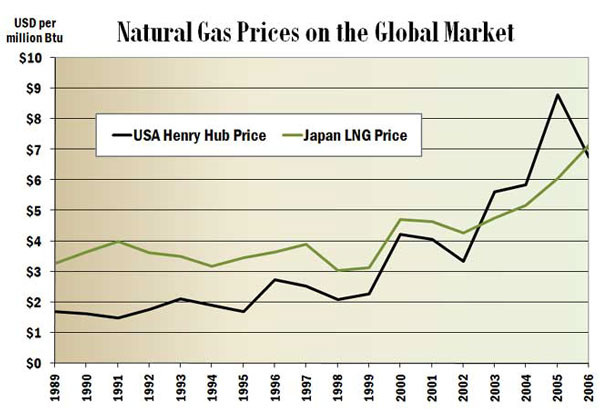

Natural gas markets used to

be regional and disconnected. Not so long ago, the gas price

in Europe bore little relation to the gas price in the United

States and vice versa.

Pipelines, even just fifteen

years ago, were the only way that natural gas, on a mass scale,

was transported. But not anymore...

The rapid growth of the liquefied

natural gas (LNG) business has transformed natural gas into a

global commodity. Nations like Japan now rely on LNG supertankers

for the fuel to meet a significant chunk of their energy needs.

LNG is linking together natural

gas markets from around the world. It's allowed the tiny Middle

Eastern nation of Qatar, which has the world's third largest

natural gas reserves (after Russia and Iran), to become an energy

superpower.

Generally, the higher associated

costs of LNG (liquefaction, transportation, regasification) have

meant that the LNG price has been higher than the U.S. domestic

price. This trend flipped between 2003 and 2006 due to a sudden

uptick in LNG supply followed by Hurricanes Rita and Katrina,

which wiped out production in the Gulf of Mexico and drove up

domestic prices.

In the last two years, we've

seen LNG prices rise higher than Henry Hub prices once again.

Indonesia's state-owned Pertamina just negotiated a deal with

Japanese gas companies to sell LNG at over US$10/MMBtu until

2011. The Japanese are competing with Taiwan, South Korea, and

a fast-growing Chinese market, all of which are clamoring for

more LNG. When a minor earthquake took a Japanese nuclear power

plant offline, Japan had to scramble to pick LNG for its natural

gas-generated electricity, paying over US$20/MMBtu for some cargos,

proof that its deal with Pertamina is no stretch and might actually

look like a steal in a few years.

Another factor that few investors

realize is that LNG prices in Asia are tied to the Japan Crude

Cocktail, a benchmark for crude oil markets in the region. As

the dynamics of Peak Oil make themselves felt, LNG prices will

rise in tandem with oil prices.

Combine this with a growing

need for cleaner fuels, like natural gas, and it's clear that

the LNG market, and consequently LNG prices, are headed higher

for a long time to come.

[Note: Jeffrey Brown,

one of the faculty members at our Scottsdale Summit, is a petroleum

geologist. He gave a very compelling presentation on the concept

of the Export Land Model, which shows how declining production

combined with rising consumption can result in oil & gas

export countries rapidly reaching the point where they can no

longer export.

Among many interesting points

he made during his presentation, the most interesting was that,

based on current trends, Mexico will ship its last barrel

of oil to the U.S. in or around 2014... just 6 years from now.

This has, in my opinion, huge

implications. For one, Mexico is currently the second largest

source of oil for the U.S., so we will have to fight it out with

our international competitors to replace that oil. Secondly,

Mexico gets something like 65%

[Editor's note: corrected, 6.5%] of its GDP from its oil exports...

which means we could see some real trouble south of the border.

You can read some articles

by Jeffrey on the Export Land Model on EnergyBulletin.net, but

for ways to invest in this trend, there is no better source than

the Casey

Energy Speculator or, for the more active traders among you,

the Casey

Energy Confidential. The trend of higher oil prices is a

trend in motion that will stay in motion for years to come...

so getting positioned in the right plays now should pay off in

spades going forward.]

Miscellany

LAX Phyle. We have yet another brave individual

willing to help coordinate a get-together with other members

of the Casey "phyle" (yet-to-be-named)... this time

in Los Angeles. If you live in that area and would like to meet

up for a cup of coffee down at the corner store (or whatever

passes for same in a city of 3.8 million), drop Kristen a note

at phyle@caseyresearch.com and she'll help get you organized.

Just for laughs. Back in the old days,

I periodically used to have to suit up in coat and tie and wander

through the canyons of Wall Street and other haunts of Corporate

America where I would sit in endless meetings listening to oh-so

smart people wax forth on things like strategic planning and

"best practices."

It did not take me long, even

though I am a college drop-out, to ascertain that underneath

the suits were just human beings. Conversant in the latest nomenclature

and buzz words, yes, but human beings nonetheless. Someone kindly

forwarded me the following video, which is funny - especially

to those of you in the Southwest but on one level, it is a bit

close to the truth. Click here to

view.

Favorite headline of the week: "Some homes

worth less than their copper pipes"

And That, Dear Readers, Is That, for

This Week

I am now going to take advantage

of the weather and the good company to wander the local golf

links. I am fairly new to the sport, but enjoy learning it.

I usually close with a quick

check of the markets, but I started so early this morning in

order to rendezvous for the just-mentioned game of golf,

that the stock markets won't be open for another hour and a half.

Speaking of the stock market,

you may have wondered why I made no mention of the new "Paulson

Plan," but when you think of it, why bother? The final form

of same will only really arrive after many months and endless

political re-jiggering. In the end, the odds are good that the

plan, if there even is one, will bear little resemblance to the

current version being floated. Pay attention to the big trend,

and the rest of this stuff is just noise.

And with that, I take my leave

for a rare day of doing not much of anything at all.

David Galland

Managing Director

Casey

Research, LLC.

###

Casey Archives

321gold Ltd

|