|

|||

|

Doug Casey Welcome to "The Room" - Freebie of The subscribers-only home page of Casey Research. Dear Fellow Global Adventurers, This past week I came across worthy comments from Dr. Marc Faber of the Gloom, Boom & Doom Report in which he comments that, by continuing to cut interest rates, Bernanke will eventually "destroy the U.S. dollar." If Bloomberg is reporting accurately, and I see no immediate reason in this case to doubt them, Dr. Faber also said...

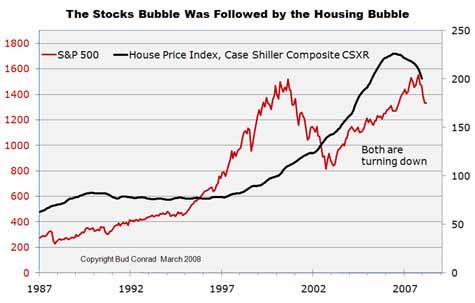

We share Dr. Faber's sentiments on the outlook for the dollar. And his thoughts on how to solve the many challenges facing the U.S. economy resonate with us here at Casey Research, as well. The fly in this otherwise pleasant and lightly scented ointment, however, is that - thanks to the nature of democracy and even humanity's shared psychology - Bernanke is powerless to take Marc up on his common-sense recommendation. In my opinion, the Fed is left with no course of action but to destroy the dollar. I say that due to the mechanical aspects of Marc's suggestion. You see, in order for the government to stimulate capital investment and capital formation, it would have to greatly reduce the weight of its own dead hand on businesses and individuals. There is a saying that capital flows to where it is best treated, the veracity of which can be proven by considering that on the order of 25% of the world's construction cranes are currently deployed in Dubai. And that city has no real resources of its own; it's located in the most geopolitically unstable corner of the globe, and has a physical climate that is measured only in terms of hot, really hot, and even hotter. Properly restructured, the U.S. could, at the risk of sounding nationalistic, kick Dubai's butt. And China's as well. After all, while many of the world's economic observers fawn over China's remarkable progress, the facts are simple. (a) The U.S. already has the infrastructure in place that China is now trying to build; (b) China is run by a cadre of corrupt communist comrades, not exactly a model ripe for emulation by a thinking person; (c) they have over a billion mouths to feed. Which is to say, any setbacks that cause the aspirations of its large public to be disappointed could result in social unrest and worse. (The rocketing cost of rice, up almost 100% over the last year, may be a catalyst for such unrest.) Adding to the discomfort about the potential consequences of social unrest, one only needs to glance casually into the cupboard to find tightly packed examples of the culture's apparent disdain for steadily beating hearts. Reaching into said cupboard, we pick up Barbara Tuchman's excellent Stillwell and the American Experience in China to read her accounts of General "Vinegar Joe" Stillwell's arrival in that country in the support of Chiang Kai-Shek, as despicable a two-legged creature ever to have wandered onto the human stage. In between other duties, Joe had to restrain himself, and his men, from opening fire on officers of Mr. Kai-Shek's nationalist army that would routinely punish the loss of even so much as a single lice-ridden blanket by a foot soldier with summary execution. But as degraded as Chiang and his fellows were, they were nothing compared to the big guy himself. Based on readings on the topic, confirmed with an airplane seat consultation with an academic who had made the study of such things his life's work, Chairman Mao was reliably responsible for the unnatural deaths of over 50,000,000 of his fellow countrymen. I digress. Returning to my theme, the U.S. has everything it needs to be more than competitive on the global stage. All that needs fixing, really, is to eliminate the single largest obstacle to capital formation, the heavy weight of government. To be metaphoric, it is hard enough to successfully climb the mountain of capitalist endeavor - having to do it with a large sack of rocks weighing on your spine greatly reduces the odds of success. There are many ways that this reduction in the weight of government could be accomplished. A well-timed nuclear backpack going off in the nation's capital pops to mind. But such a solution would only be temporary and would lead, unquestionably, to a Hydra-like regeneration of even more and bigger government in its place. No, the far better approach would be to put the institution on a strict regime. To treat the government the way a heartless physical fitness coach might, whose lunch money is entirely dependent on his client losing all but the essential ratio of body fat. Personally, I can see no better way of getting right down to it than by anchoring spending by reinstituting a gold standard, then tossing out the entire tax code in favor of a level tax of 10%. (With the amount of wealth that would be created, forgiving even that burden for the true unfortunates would be of no fiscal consequence.) In addition to providing a welcoming home for capital, among the many other advantages of making these moves, would be; (a) the elimination of the Fed. With no need to "manage" the currency, their disastrous reign over the world's money supply would come to a quick end; (b) the elimination of the horrible waste and costs associated with tax preparation, estimated to be a minimum of $150 billion a year, before taking into account all the personal time and worries that go into the current process; and (c) the government would be forced to be far more selective in its pursuits and to curb its unceasing expansion plans. Making a necessarily loose calculation and using the current economy for same, a gold standard and flat tax together would require the government to live with a budget of about $1.38 trillion per year, requiring a substantial reduction in the $3.1 trillion it is projected to burn up in 2008. But the reality would be not quite so stark, as the tax receipts would soar in the new economy as the world beat a path to set up to do business in the U.S. There's just one problem with that practical, though utopian, view. Which brings us back to the nature of democracy and the psychology of humankind. While the votetariat may talk a good game, when it comes right down to it, the majority is interested in seeing its favorite uncle not spend less but more. More on health care. More on fighting global warming (or cooling, whichever idea has the most traction at the moment). More on bailing out subprime borrowers and lenders alike. More on the social security net. More on FDA inspections, more on financial regulation, more on building bridges and more on commissions to study the drug habits of professional athletes. Some want more money for Homeland Security and war, others want more money for foreign aid to this or that country or to protect pygmy elephants as they meander through dark jungles on the other side of the world. Not very long ago, my own dear mother provided illumination on the topic when she told me that she, who had been a big Ron Paul supporter, had retracted her support after hearing him comment to the effect that he would, as she put it, "eliminate my Social Security." And there's something else. The Germans have a word, Schadenfreude, which loosely translated means taking pleasure at seeing others fail. The tightly linked obverse of that sentiment is that we take umbrage when someone succeeds a bit too much. Consider the indignation in some circles at Bush's "tax cuts for the rich"... tax cuts that will almost certainly fade away into the darkening horizon as the next administration comes to power. But tax cuts for the rich... or, more accurately, those who aspire to wealth and succeed in gaining same, is exactly what the country needs to power through the looming crisis. What the country doesn't need, really, is to keep depreciating the currency. What will it take for the average voter to wake up to the reality that the U.S. dollar has lost 81% of its value since its link to gold was cut in 1971? If things continue on the current flight path, which is pretty much headed straight at the ground, we may soon find out. The Right Way to Look at the U.S. Economy Today  In the lead article of our December 2006 International Speculator ("Users Guide to Fiscal Calamity", view archives) we pointed out that the 20-year bubble in financial assets was only temporarily and lightly deflated in 2000, as the Fed's money pumping shifted the asset bubble to the housing market. As a consequence, going into the current crisis, the long bubble was not only intact but larger than ever. In the wee hours this morning, in between arranging his shirts and socks for a 6:30 am departure for a look-around of China, our own Bud Conrad somehow found the time to throw together the chart above, updating the data on the asset bubble. If you step back from the chart, squint at it slightly, and use the power of your mind to add the two lines together, one representing equities, and the other housing... then mentally assign a net asset value to both... what you come up with is a clear road sign that the bubble still has a long way to go in a collapse, and that the collapse has begun. Confirming that point, as I was writing this, the news came across the screen that U.S. payrolls contracted again in February, the second month in a row, and the most in five years. Understandably, the stock market is again in a free fall. This is all but a continuum at this point. Yesterday, for instance, we learned that, collectively, the equity in American homes is now less than the debt owed on those homes. This is the first time this has ever occurred, or at least since the Fed started tracking that data in 1945. It is no wonder, therefore, that foreclosures and "walk-aways" are also breaking all the wrong records. Rushing about trying to keep the wall from collapsing on top of the economy, the Fed announced today that it will further ramp up the largely indiscriminate, cut-rate lending it is making available to the banks, indicating that any hopes for a more intelligent approach to sorting things out will go unfulfilled. Desperate Acts - Continued On the topic of desperate acts, in recent editions of these musings, I have pointed to attempts by the bureaucrats to maintain the status quo by paying off bank employees in tax havens for client lists, selling off state lotteries and closing parks, etc. On that general theme, this week provided additional examples: The first entry is from Jubak's Journal, which appears regularly, it seems, on MSNMoney.com...

While Mr. Jubak is to be thanked for bringing a little levity into the day, his indignation misses a key point. It's not as if they are actually betting with their own money. Even a complete wipe-out of the organization's remaining capital would be papered over with a quick press release that the government has had to step in and bail it out. People will shrug off the news, if they even notice it, as just another billion here, a billion there. Unlike them, I view these billions as just more bricks in an increasingly rotted and dangerously tipping wall. The second item comes from Bloomberg...

I love Bettye's unusual candor... no question where her loyalty rests. Destroy the county's credit rating? Blow off $184 million? No sweat. But cause any expense or discomfort to the county's employees, no way.

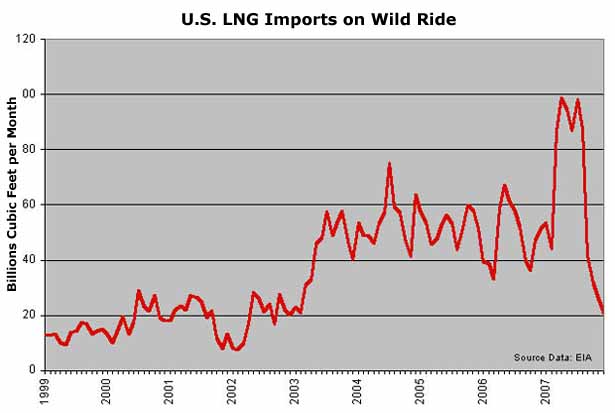

Last year showed both the promise, and the problem, with liquefied natural gas (LNG) imports to the United States.  The promise is that rising LNG imports will offset dwindling natural gas imports coming down the pipe from Canada. Alberta, especially, will consume a much greater proportion of its own natural gas production to extract and upgrade their massive tar sands resources. With an emerging global market in LNG, a drop-off in regional supply shouldn't matter, or so the conventional thinking goes. The problem is that the rest of the world is clambering for LNG as well - and they're willing to pay higher prices for it. In the first half of 2007, the U.S. was able to track down a number of cargos and imported a record amount of LNG. Then, a minor earthquake forced the Japanese to shut down a nuclear plant, and they had to rely on natural gas-fired power plants to make up the shortfall. In their desperation, Japan outbid nearly everyone for LNG cargos, and U.S. LNG imports plummeted. There was no sense in paying $12/MMBTU for LNG, when natural gas in North America cost nearly half that. There are five regasification terminals for LNG in the Lower 48 and lately two of them have been sitting idle. LNG imports are still very low in the beginning of 2008. Last year, LNG imports averaged 45 Bcf per month, but in the first two months of 2008, that's down to 21 Bcf per month. Discouraging news for consortiums working to build more of these very expensive and very controversial regasification LNG terminals. The wild fluctuations in LNG imports to the U.S. in 2007 demonstrated that until prices within North America go much higher, the U.S. will not participate in the global LNG market. The idea that LNG will flood the U.S. natural gas market with new supply and keep down prices is ludicrous. North American natural gas prices will rise - as they have been for the entire decade - until it makes economic sense to go out and compete with the likes of Japan, Spain and others for expensive LNG cargos. By keeping an eye on LNG prices, we can gauge where domestic prices are headed. LNG prices are, in that sense, a leading indicator of domestic natural gas prices - and, with the inevitable corrections along the way, they point to a future with natural gas prices of well over $10.

Bootstrapping It Were you to place the America of today on a scale with the America of yesteryear, there are a number of measures by which the current model would fall short. At least if I was the one doing the weighing. Consider, for instance, that in his time, which was the early 20th century, H.L. Mencken was, by a wide margin, the most popular newspaper columnist in the land. For those of you who haven't yet had the pleasure of reading his writings, I would suggest you run, not walk to the nearest book store to pick up a collection. My personal favorite is the Vintage Mencken as assembled by Alistair Cooke. Meanwhile, to tide you over, here are a couple of a multitude of his many quotable quotes...

There was another author from earlier times, one Horatio Alger, Jr., who was wildly popular in the 19th century based on his many dime story novels, mainly about scrappy lads who managed through honesty and hard work to fight their way out of poverty and into the proverbial mansion on a well-sited hill. (That he had a base predilection for the same scrappy lads failed to dent his popularity, it seems.) This comes to mind because of an article Doug Casey thought you might enjoy. It is the story of a young man with everything, who decides to test the American dream by dropping out of his usual society, ignoring his material advantages, and with just $25, to try and attain some modest level of financial stability. While some of you may be tempted, after reading the article, to catalogue the various reasons why the young man was a success, while others less fortunate at birth would be doomed to fail, I think the mere act of making that catalogue is wrong-headed. What the world needs these days, in my view, is a lot more of the "can do" attitude, and a whole lot less of the helpless victim mentality that so unprofitably grips the minds of such large swaths of current society. In any event, here's the story... Eye on Liechtenstein Kevin Brekke, our Switzerland-based editor, has been helping us keep an eye on the developments in Liechtenstein, a canary in the coal mine, as far as we are concerned, for the outlook for financial privacy. Here's his latest report...

And That's It for This Edition... It is an absolutely stunning day outside, and I swore to our production team that I would get this missive to them early, so I am going to line up both of those objectives and sign off now. But first, a couple of quick housekeeping announcements.

As is my custom, a quick check of the screen reveals that gold is hovering around $975, which is almost $200 higher than the average realized price of gold sold by Kinross Gold and other producers in producing their highly profitable Q407 financial results (to wit, the next quarterlies will only be better). I also see that the DJIA has broken fairly decisively below the 12,000 benchmark. It's going lower. Until next week... thank you very much for reading. David Galland ### Doug Casey

Casey Archives |