Casey Files:

This week in 'The Room'

Doug Casey

International

Speculator

written Feb 29, 2008

posted Mar 3, 2008

Welcome to "The Room"

The subscribers-only home page of Casey Research.

February 29, 2008

Dear Readers,

It's getting to the point where

even the most determined optimist is having a hard time finding

a good reason to roll out of bed.

Among just the smattering of

news that crossed the lens this week...

- Producer prices rose 7.4 percent

in January from a year ago, coming on the heels of the news last

week that the Comedic Politicized Inflation (CPI) index has risen

over the last 12 months at the highest year-over-year rate in

decades.

X

- The National Association of

Purchasing Management's business barometer has fallen to the

lowest level since 2001, beginning to reflect a knock-on slowdown

in consumer spending.

X

- And, according to the U.S.

Commerce Department today, what modest growth in spending there

is, is now coming from inflation and not from confident consumers

mobbing local electronics shops to load up on the latest and

greatest.

X

- On that latter point, consumer

confidence in the U.S. is reliably reported to have grabbed its

chest and slumped to the ground, or at least to levels last seen

only in 1992.

And no wonder, given that housing

prices, the single most important component of the net worth

of so many people, are crashing; in December they fell by the

most on record, off 9.1% from the year before.

(During a cross-country ski

slog over the weekend, a friend who is a housing contractor by

trade told me he has not seen a slowdown like this in his 20

years in the business. He knows of only one new house on the

flight path to be built in these parts. The property holder has

six different contractors scraping it out in a bidding war to

get the job, assuring that the victor ultimately receives as

a reward a dry and meatless bone at best.)

If the housing sector slowdown

with its rising foreclosures and defaults isn't enough to keep

our optimist abed, he would have to do no more than flick on

the morning news to learn of soaring food prices, a crashing

dollar and a tumbling stock market.

No sooner had a trembling hand

secured a double dose of Advil, topped off with a cold compress,

when he would hear a report of hundreds of millions and maybe

even billions of dollars worth of new and unexpected losses being

suffered by municipalities, banks, and sundry financial institutions

on purportedly "safe" instruments concocted in earlier,

more positive times. This week, for instance, we hear that the

supposedly invincible Goldman Sachs may take it in the chops

for as much as $11 billion due to "variable interest entities,"

a form of conduit, our faltering optimist learns as he falls

back on his pillow in a fatalistic swoon, that holds close to

$800 billion in assets, some significant percentage of which

are now considered suspect.

At this point, the only folks

able to view the unfolding carnage with any casualness are the

super-rich for whom almost any conceivable loss would still leave

them the requisite funds to live like the royalty of old... and

the relatively small handful who've been smart enough to have

moved assets out of harm's way and into gold and other commodities

early on (a group that I continue to hope includes you, with

the help of our various services).

Interestingly, this week it

was revealed that the California Public Employees' Retirement

System can be counted among the few that have been seeing the

nature of the unfolding crisis in the right light, and has at

least begun to act appropriately. Calpers, according to Bloomberg...

...the largest U.S. pension

fund, may increase its commodities investments 16-fold to $7.2

billion through 2010 as raw materials prices surge to records.

Calpers, which has about $240

billion in assets, agreed at a Feb. 19 board meeting to hold

between 0.5 percent and 3 percent of its assets in commodities,

spokesman Clark McKinley said. The Sacramento, California-based

fund last year put $450 million into commodities, its first such

investment.

The agreement is the fruit

of Chief Investment Officer Russell Read's efforts since joining

in 2006 to boost returns by shifting funds into raw materials

and markets such as China and India. Oil has soared above $100

a barrel, wheat breached $13 a bushel for the first time, and

gold and platinum climbed to the highest ever since Calpers began

investing in commodities.

"We plan on ramping up

the program by hiring additional staff," McKinley said by

phone yesterday. "We are excited about commodities, which

have performed exceptionally well for us."

To which we say, welcome aboard!

Better late than never, so hats off to the obviously competent

Mr. Read.

Of course, as the pension funds, like the hedge funds, mutual

funds and institutional funds in general tend to run in packs,

this news can only help solidify the base under our current favorite

investments.

Listen and you can almost hear

the chat around the polished-wood-encased water coolers strategically

positioned around finely appointed office pension managers' offices

worldwide.

"Did you hear, Calpers

got into commodities last year?"

"Yeah, smart buggers.

And here we are with our bonuses slashed -- slashed, I say! --

to only $2 million, just because we invested in AAA bonds!"

"Well, if commodities

are good enough for Calpers, who are we to argue, eh?"

"Race you to the trading

desk!"

Pile on in, we shout enthusiastically,

daydreaming about selling our appreciated resource stocks to

the stampeding herd a ways down the road.

But that, fellow travelers,

is about the only golden lining to be found in the chaos now

gripping the world. And while a good investment brings a warmth

not unlike a crackling fire and a hot toddy on a cold day, the

toddy loses much of its flavor when one considers the impact

that the unfolding crisis will have on our less well-prepared

friends, family and fellow countrymen (and women, as the case

may be).

Commenting on the news in an

email exchange from New Zealand this morning, Doug Casey had

this to say...

"My own feeling is that

by the time this cycle is over, people are going to be shocked

by how high gold goes. But it will be a sideshow compared to

the circus the Greater Depression will put on."

Unfortunately, however, the

news for the unprepared gets much, much worse. There are two

areas that I would like to comment on in a bit more depth, starting

with Bernanke's testimony.

Bernanke Pushes the Button

Yesterday, while engaged in

my periodic physical exertions, or more specifically, while I

was clinging to the handles of a medieval masochistic device

sternly labeled the "Stair Master" down at the local

facility for such things, I managed to snake out a finger to

the television monitor to tune into Chairman Ben's testimony

in front the House Financial Services Committee.

It was, I noticed when the

camera pulled back from Bernanke's oddly detached countenance,

a sparsely attended affair. In fact, it seemed to my sweat-filled

eyes as if there were no more than five or so members of elected

officialdom in the gilded chamber.

(But, hey, why should members

of Congress be interested in anything to do with the economy?

It's not like there's anything going on these days. Whether or

not Roger Clemens is doping - now THAT is worth packing the chambers

for!)

In all seriousness, however,

Bernanke's testimony yesterday was far more important than most

people understand, least of all those now doing "service"

in government. Far be it from me to be critical of the pandering

class, but I was appalled at how unbelievably, well, stupid the

questions were that were pushed toward Bernanke by the handful

of Congressmorons who bothered skipping the brunch put on by

the American Lawyers Association down the hall in order to question

Bernanke.

Bernanke's testimony was important

because in it he made it abundantly clear that the Fed - and

by extension the U.S. government - was coming down firmly on

the side of inflation.

Those of you who have been

with us for any length of time know that we have been calling

for things to arrive at a location loosely identified as "between

a rock and a hard place." It has been our consistent belief

that the Fed would inevitably be forced to make a decision between

letting the economy collapse under the weight of its many debts

and obligations, or letting the dollar collapse by shifting into

default mode trying to inflate the country out of trouble.

The specific quote from Bernanke's

testimony you want to pay attention to was this...

"The Federal Open Market

Committee will be carefully evaluating incoming information bearing

on the economic outlook and will act in a timely manner as needed

to support growth and to provide adequate insurance against downside

risks."

Note the lack of reference

to run-away-inflation that is already making itself known here,

there and everywhere.

The news that the Fed is again

opting for inflation, while coming as no surprise to us, caught

the gold bears flat-footed by sending gold sharply higher, to

over $970 as I write.

Speaking from an entirely personal

basis, I am, of course, cheered by the rise in gold, thanks to

a long-held position in a gold ETF and a portfolio stuffed to

the gills with the higher-quality gold exploration and energy

stocks of the sort followed in our International

Speculator and Casey

Energy Speculator services. But there is a real risk arising...

a true tipping point... that I am not so sure I'll be happy to

see.

While there are many factors

that might push the economy over the edge, the one to watch closely

now are the foreign holders of the U.S. dollar. As we have mentioned

more than once, the amount of U.S. dollars in the hands of foreign

holders is at historic levels. In fact, the level of holdings,

estimated at as much as $16 trillion, is unprecedented by an

order of magnitude.

At this point in the game,

we would expect to see wealthy foreign individuals cashing in

their dollars for all manner of alternatives, including other

currencies, tangible property and, of course, gold and other

tangible assets. Given the price of tangibles at this point,

that trend is likely well underway.

Diversification out of the

dollar by institutional holders is likely also underway. But

after that, if pushed to it, will come the big kahunas: the foreign

governments and their many trillions.

Up until this point, that they

have been reluctant sellers can be understood in much the same

way you can understand the concept of Mutually Assured Destruction

when discussing the pros and cons of launching nuclear strikes

against your similarly armed adversaries. At what point, however,

do the foreign governments come to the conclusion that the other

side has already "pushed the button"?

Watching Ben Bernanke, there

is a reasonable chance, were I a foreign holder, that I might

come to the conclusion that he has done the equivalent of just

that.

Regardless, the pressure is

growing daily on the economies of the Middle East and Asia, which

have to date helpfully reinvested the money they have received

in exchange for their goods into U.S. Treasury securities. And,

by doing so, effectively imported our inflation back home. Even

if they wish to continue avoiding the nuclear option, they will

at some point be forced to it by the U.S. pursuing a monetary

policy one could correctly term "Everyone for themselves!"

Make no mistake that once the

tipping point is reached -- and if the Fed makes yet another

steep cut at its next meeting on March 18, that could do it --

then things have the potential to shift from crisis to catastrophe

almost overnight.

What impact would a true collapse

in the dollar have on the global economy? It is a topic we'll

continue to poke at here and in our various publications. But

for now, keep your eyes wide open and your head down.

I'll touch on the second serious

development this week, but the lunch bell has just rung, so I'm

going to pass the baton over to Bud Conrad, who has sent over

a couple of items he thought you'd find of interest...

Bud on Bernanke

In alarming testimony to the

House Financial Services Committee, this week Fed Chairman Ben

Bernanke declared: "We have a problem ... the spreads between

the Treasury rates and lending rates are widening, and our policy

is essentially, in some cases, just offsetting the widening of

the spreads, which are associated with signs of illiquidity."

I said at the Denver Summit,

and since in articles, to watch out when the Fed cuts and long-term

rates don't drop.

It means that the rate-cutting

process of printing money to buy Treasuries in an attempt to

provide liquidity to lower rates is failing. The confidence in

the ability of Bernanke, or anyone else, to stop the collapse

is lost when people become aware that printing money makes it

worth less. The Fed action becomes the fear, rather than the

solution. At this point further cuts won't help the economy,

because long-term and riskier rates will reflect that loss of

confidence.

(Ed. Note: Bud Conrad recently

gave a wide-ranging interview

for the Gold Report on where the economy, gold, energy, food

and interest rates may be headed.)

A Trip Down Memory Lane

Our own Terry Coxon sent along

a link to a video of Richard Nixon announcing

the end of gold convertibility, pointing out that I would especially

enjoy the reference to "international speculators."

The canceling of convertibility

was, of course, a seminal event as it left the world with a pure

fiat monetary system, an experiment which has subsequently resulted

in the steady deterioration of all paper currencies, among other

ill effects (including unchecked growth in government, thanks

to the removal of any real obstacles to spending).

Will the whole house of cards

implodes some day, forcing a return to a gold standard or some

other system that forces fiscal restraint? If I was a betting

man, I would place large sums that the answer is "yes"...

it is inevitable.

In fact, the collapse may have

already begun.

Energy Chart of the Week

By Chris Gilpin, Contributing

Editor, Casey

Energy Speculator

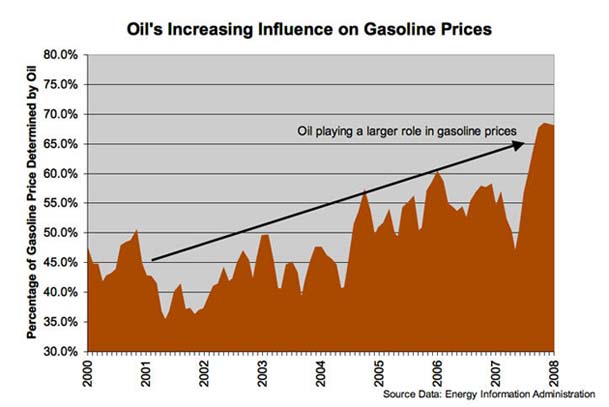

Gasoline prices are comprised

of several costs: transportation of oil (usual from some distant

corner of the globe), refining costs and profits, more transportation

of gasoline (to get it from the refinery to the gas station),

taxes from every level of government, and the cost of buying

the crude it all started from. This last cost has mounted, and

now oil prices hold a greater and greater influence over gasoline

prices.

In 2004, oil prices rose 50%

from $30 to $45 roughly, and this created a corresponding 26%

rise in gasoline prices. In other words, gasoline prices increased

half as fast as oil prices did.

As oil prices have risen, the

oil cost of gasoline has begun to dwarf all other components.

Now when oil prices go up, it will cause a much steeper rise

in gas prices. If oil were to make another 50% jump from $100

to $150 - which we think is quite possible in the next year or

two - gasoline prices would rise at a rate closer to 35%. The

U.S. average for regular-grade gasoline hovers around 310 cents

per gallon right now with oil near $100; a 35% increase would

lift it to 419 cents per gallon.

The rogue factor in all these

calculations is refining capacity. Last spring, a spree of unplanned

refinery outages pushed gasoline prices higher when oil had retreated

to $60. By the time refining capacity came back online, oil was

marching to $100. By having one major cost replace the other,

gasoline prices have stayed between 280 and 310 cents per gallon

since April 2007.

This may have created a false

sense of security among motorists, who saw oil move up twenty

or thirty dollars without much of a corresponding rise in gasoline

prices. This spring refineries have scheduled their normal outages

to switch from winter to summer-grade gasoline, but how many

unplanned outages will occur? The U.S. oil-refining infrastructure

is outdated and badly in need of replacement, but permitting

a new refinery in the Lower 48 has proven to be a near impossible

task. It's reasonable to expect a growing number of unplanned

outages at refineries in the years ahead, and if any of these

correspond with another jump in oil prices, then prices at the

pump would roar to new heights.

As a motorist, it's all very

annoying. The best tactic is to hedge your rising fuel costs

with energy stocks that will benefit from higher oil prices -

or trade in your car for one of those Flintstone vehicles. But

I hear they can be rather hard on the feet.

[Ed. Note: If you are looking

to profit from energy, you owe it to yourself to check out the

Casey Energy Speculator. And it couldn't be easier, given that

subscriptions come with a 3-month, no-questions-asked, 100% money-back

guarantee. Check out the current profit-packed edition by clicking

here now.)

The Other Important News of the Week

Last week I pointed to the

breaking news Fitzroy MacLean of our Without

Borders publication tipped me to, about German intelligence

officers paying a Liechtenstein bank employee US$5.9 million

to steal a disk containing the names of all the German account

holders.

In writing this news up, I

posited that the Germans likely also got the account names of

non-Germans, "...giving the German government a very nice

trading card."

It didn't take long for my

intuition to be proved right, as it was announced this week that

the Germans were now cooperating with friendly governments around

the world so they, too, could corner tax miscreants.

Confirming the point, one of

our subscribers sent along a news item from New Zealand about

how that country's Internal Revenue Department is offering anyone

with an offshore account, especially of the Liechtenstein variety

to, in essence, come out with your hands up or else. If you are

a New Zealander with assets in the pilfered bank, I have no doubt

you are sweating bullets.

Here in the U.S. of A., the

Internal Revenue Service is also working hand in glove with the

Germans to hunt down the tax cheats.

This is a trend firmly in motion,

with serious implications.

First, now that executives

and even lower-level employees of banks in tax havens with the

right levels of access have seen the going market price for client

names, and that rather than being brought up on criminal charges

for breaking confidentiality agreements, they will be saluted

by officialdom around the world, there will be a rush to capitalize.

All that the person needs to do is to grab the list, download

the file, or whatever, and make it past the front door to collect

on the waiting riches.

In addition to the considerable

personal problems this will cause the account holders, it effectively

spells an end to the idea of financial privacy.

And that is an important battle

to be lost by anyone who values individual freedom. Look at it

this way, until recently countries knew that if they squeezed

too hard, money would begin slipping across the borders to undeclared

safety. With that escape route closed, they can now squeeze ever

harder.

Even so, human nature being

what it is, you can expect the same people - at least those not

in jail following the global witch hunt that will soon extend

to the Caymans, Andorra, or any other jurisdictions where the

bankers have been accommodative to privacy seekers - to look

for other ways of hiding wealth.

Of course, gold, diamonds and

other readily portable and fungible assets will find favor. Setting

the stage for the battle in the war of the state against the

individual: a new round of government confiscations of gold and

other such assets, "in the public interest."

I can't see this happening

imminently, and we should be able to see it coming, but the threat

that it could happen in the next decade, along with foreign exchange

controls and similar acts of desperation by the tax farmers,

is real.

Now let me be clear. I am not

in favor of tax cheating. Per the fresh example from Liechtenstein,

the risks are too high and, in my view, always have been. But

that doesn't mean that I can't lament the fact that the system

is moving closer and closer to the point where you won't be able

to enjoy any level of privacy in relation to your financial affairs.

Visa's $19 Billion IPO a Scam?

During the course of dinner

with a highly positioned financial services executive the other

night, he told me that Visa and MasterCard had lost a major lawsuit

related to hidden charges, and that it will cost them a lot of

money and force them to change their business in a number of

detrimental ways.

Almost immediately thereafter

I read that Visa was planning a $19 billion IPO. Coincidence,

I wondered?

Curious, I decided to dig a

bit. I hadn't gotten very far when I came across a very coherent

analysis

on the situation by Mish Shedlock.

Could the broader investment

community catch on to the true intent of the IPO, dooming it

and by doing so, maybe, lead to yet another giant stumbling?

While that remains an outside possibility, it is by no means

out of the question given the impact of the lost lawsuit, and

that the credit card companies are almost certain to be next

to feel the pain of consumer belt tightening.

I suspect most people wouldn't

be unhappy if the credit card companies took it in the neck.

On that theme, years ago I

interviewed a senior credit card company executive and over the

course of our meeting, I mentioned to him that I had recently

caught a charge for "lost credit card insurance" on

my bill. It was for something like $46 a year - for nothing,

as far as I could tell. Indignant, because I hadn't approved

the charge, I called the service center and no sooner were the

words of complaint out of my mouth than the representative said,

"No problem, sir. That charge will be removed." In

other words, no questions or pushback at all.

"Oh, that!" my new

acquaintance, the credit card executive, commented, a smirk on

his face. "That was the idea of the guy in the office next

to me. We were running behind on the quarterly numbers and he

came up with the idea to bump the revenue."

"You mean," I asked,

a somewhat stunned look on my face, "that you simply hit

all the credit cards with a $46 charge?" (And we're talking

about hundreds of thousands of accounts.)

"Yep. It was a big winner,

because most people don't look very hard at their bills."

"But that must be illegal,"

I said dismayed.

"Probably," he said

with a dismissive shrug.

He didn't get the job.

Of course, the flip side of

Visa running into trouble will be yet another form of credit

that gets tighter... and more costly.

Miscellany

- Lines of Lawyers. As predicted, lawyers armed with thick

briefcases and high-digit display calculators are increasingly

jostling each other in the long lines that are starting to form

at the doorsteps of the wounded financial service industry behemoths.

This week, HSH Nordbank, a German sector public bank (translation,

they have clout), announced it was going after UBS bank for "hundreds

of millions" in subprime losses. As the piling on grows,

we'll start to see the major bank failures that our own Bud Conrad

has been forecasting these past months. Followed, natch, by the

helicopters' worth of bailouts, courtesy of taxpayers.

X

- High-Stakes Shell Game. In a classic shell game, the banks

are trying to prop up the AAA ratings of the insurers standing

behind the hundreds of billions of dollars of toxic waste now

eating away at their portfolios. While cost effective -- $3 to

$5 billion is a lot cheaper than the carnage that will follow

a downgrade -- the odds are high that they'll invest the money,

the insurers will get downgraded anyway, costing them their investments

and the value of their portfolios. Unless, of course, the same

helicopters show up with yet more taxpayer largess to keep the

insurers intact. It would not surprise me in the slightest to

see, even, the de facto nationalization of a failing rating agency.

X

- In the "Remember,

We're All Only Human" Department ... I came across another anecdote about another

of the esteemed members of the judiciary, one Robert Somma, a

federal bankruptcy judge appointed by President Bush in 2004.

It appears he has stepped down from the bench after police found

that he had crashed his Mercedes into another car while drunk

and wearing a dress, fishnet stockings and heels, and carrying

a purse. "He's a highly respected member of the bar,"

said a fellow judge, "and remains so." I don't care

about his dress code, live and let live, I say... but next time,

take a cab.

X

- Look Before You Leap. There was news out this week that

Norilsk, the Russian mining giant, was ordering a fleet of super

icebreakers to take advantage of the melting of Arctic ice, opening

up new routes across the top of the world. Someone might want

to tell them not to place their deposit yet, because the Arctic

ice hasn't just re-formed, it's thicker than ever. Here's

the reference.

That's It for This Week

Major developments are afoot,

with the term "We live in interesting times" barely

covering it.

While we expect things to continue

in a similar vein, and to likely grow steadily worse for some

months and maybe even years to come, the best approach at this

point is to assure that you and your family come out okay.

It's like the warnings that

the flight attendants give during their briefings on the topic

of what one should do should yellow oxygen masks start falling

on your head while in flight. If you don't first take care of

yourself, before turning your attention to the less well positioned,

you could find yourself wiped out and of no use to anyone.

As I close my weekly musings,

I see that gold is solidly planted at $971, oil is parked over

$101 and the long-suffering DJIA is off yet another 295 points.

Wall Street types like to look

down their nose at people who invest in gold, silver and other

commodities... but they may have to revisit their prejudice,

given that the broader U.S. stock markets have been essentially

flat over the last 5 years... which means, adjusted for inflation,

their favorite sector has been a loser for half a decade now.

Decidedly not the case for the precious metals, energy and other

commodities.

Until next week, thanks for

reading...

David Galland

Managing Director

Casey Research, LLC.

###

Doug Casey

Casey Archives

321gold Ltd

|